Texas headquartered Diamond Offshore Drilling has filed for bankruptcy with debts of more than $2.6bn (€2.36bn, £2.06bn), due to the “unprecedented” impact of an oil price war and the global coronavirus outbreak.

The collapse of the company comes 12 days after it missed an interest payment on $500m worth of bonds and said it was working with advisers on different options for its future.

In Chapter 11 filings lodged with Houston’s bankruptcy court, Diamond said conditions in its “highly competitive and cyclical industry” had “worsened precipitously in recent months”.

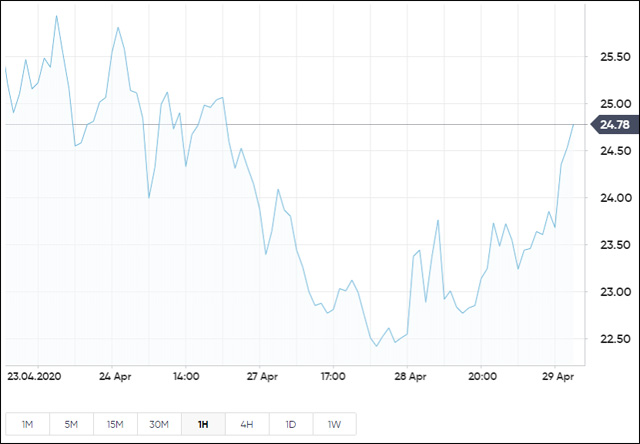

Oil contracts traded below zero for the first time in history on April 20, in response to the Russia and Opec price war and Covid-19’s crippling impact on the global economy.

Diamond said it had taken “various actions” to shore up its finances, including borrowing $400m under a revolving credit facility in March, but that Chapter 11 bankruptcy represented the best return to stakeholders.

Those stakeholders include NYSE-listed Loews Corporation, which owns 53 per cent of Diamond, 2,500 staff who work there, and bondholders who are owed more than $2bn.

Other oil and gas companies have also been feeling pressured including Whiting Petroleum Company, a Denver-based shale oil producer listed on the New York Stock Exchange which filed for Chapter 11 on April 24, 2020.

Diamond’s most recent accounts show that losses almost doubled to $357m last year, as its revenues fell about $100m to $980m.

Trade Brent Crude Oil Spot CFD

Hot Features

Hot Features