In the weeks running up to the budget sources close to the Treasury were keen to downplay today’s budget. Following the ‘omishambles’ budget of 2012 the Chancellor was said to be hoping for a period of comparatively calm waters and for 2013’s effort to pass without notice.

This perceived wisdom was soon swept away as the Chancellor unveiled a broad range of tax cuts and increased infrastructure spending. Budgets normally contain a surprise flourish to feed headlines and cheers from their party benches, but following a master class in press management the Chancellor proceeded to pull unexpected rabbits from hats the public galleries didn’t know he had in his possession.

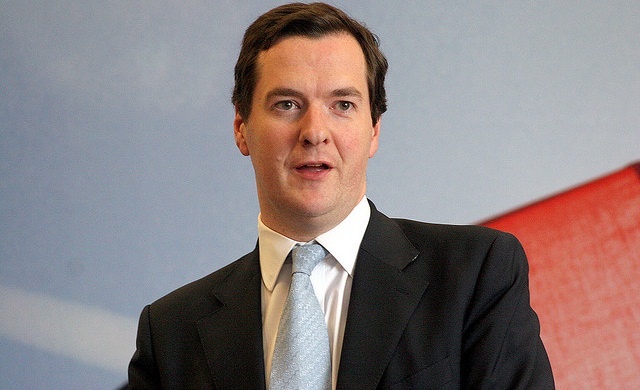

“It is a Budget for our aspiration nation”, said the Chancellor George Osborne as he stood to deliver his fourth since taking control of the country’s finances. Sounding like a Tory 2015 election slogan in the making Mr Osborne faced the challenge of trying to generate growth in a country with stagnant GDP figures, liquidity still not reaching small businesses and renewed crisis in the Eurozone.

Before the budget was signed-off by the Quad, comprising the Prime Minister, Chancellor and the Deputy Prime Minister and Chief Secretary to the Treasury, the LibDem leader and his party colleague Danny Alexander, Downing Street rebuked calls for increased borrowing and radical tax cuts with the Prime Minister and his Chancellor becoming increasingly wedded to the economic strategy unveiled in 2010.

The current state of the economy presented a grave backdrop for this year’s budget. Whilst unemployment has continued to fall the concurrent squeeze on living standards has not seen the boost the economy that improved jobs data would normally bring.

Along with the government’s austerity policy lacklustre GDP growth has become one of the staples of the British economy. Apart from a 1% blip thanks to the Olympics, the government have seen only marginal rises at best and at worst a recession.

But the OBR’s 0.6% growth forecast for 2013 will reassure many who fear that a triple-dip recession was on the way, but the OBR’s questionable record in accurately of predicating GDP leaves room to doubt whether we will close the year on an upwards trend.

Whilst Labour MPs heckled with delight as the Chancellor announced that the Office for Budget Responsibility have halved growth forecasts for 2014 down to 1.4%, but there will be many who will be glad that the task of rectifying the nation’s finances does not, as yet, fall on them.

This predicated growth will come in part due to £3bn of infrastructure spending during 2015/16 and a cut to Corporation tax from 28% to 21% from 2014, with a further cut to 20% in 2015.

The surprise abolition of stamp duty on AIM investments gained immediate approval from the City of London, with ADVFN CEO Clem Chambers arguing that “While Europe plans to put its boot on the neck of savers and investors the UK begins to clear away choking taxation on the roots of growth.

“Osborne is the first chancellor in memory to understand that taxes to the roots of the economy stunt growth. Cuts to stamp duty on AIM, UK’s listed growth company sector, demonstrates his vision and understanding that small positive changes to the roots of the economy lead to large positive outcomes”.

ADVFN’s Alternative Budget had highlighted the need for the Chancellor to cut taxes, including Corporation, to support businesses by allowing greater flexibility for them to grow and investment in hi-tech infrastructure and the Chancellor’s tax measures were met with initial approval from UK’s business sector.

A new tax regime to encourage investment in shale gas and fracking, with Mr Osborne arguing that it was “part of the future and we will make it happen”. The government is expected to publish new guidelines detailing how local communities will benefit from fracking and in doing so potentially establish a new source of income to boost regional spending.

There are though two figures which the Chancellor will wish to see dominate newspapers and broadcasts in the next few days; the deficit is predicated to have fallen by a third, 7.4% of GDP, by the end of this year and that the income tax threshold rising to £10,000 from April 2014.

A cherished policy of junior coalition partners, the Liberal Democrats, Tory MPs were clamouring to claim credit during the pre-budget session of Prime Minister’s Questions. LibDems have been even keener to argue that it came from the front-page of their 2010 manifesto and not the Tory’s, but with an election looming the political angle to budgets will only become more acute.

Demonstrating that, despite serious challenges, the UK economy has started to recover and that the government is acting to help those in work provide two strong positions for a government, or the two parties within the current coalition, to take to the electorate.

“We’re not out of the woods yet, but we’re getting there” may not be the greatest rally cry, but if the measures in today’s budget help the economy match, or better, the OBR’s growth forecasts then the government will have a strong argument that whilst it has been tough it has been necessary.

Hot Features

Hot Features