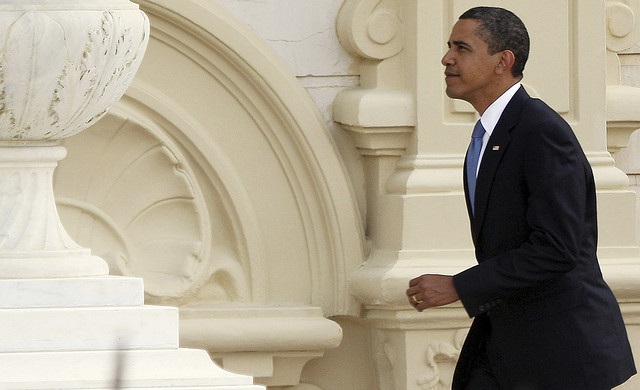

Whenever President Obama says Jobs you know bad news is on the way. He has spent hundreds of billions creating non Jobs while squeezing the private sector (which creates real jobs) ever harder. But the JOBS I refer to here is his JOBS act which allowed “emerging growth companies” to float in the US with far looser standards of corporate governance than is the norm. Roll up Manchester United (NYSE:MANU) which IPO’d today with a stock price of $14 valuing it at $2.33 billion. The whole float ( supported by all the usual sort of big name banks that bought you stocks like Facebook, Netflix, etc, etc) is a total joke.

I do not know where to start with this one. But let’s begin with a complicated share structure for a Cayman Islands based company which sees the new owners of 16.3 million shares actually only having an effective 1.3% stake in the voting rights. So the Glazer family (loathed by all Man U fans) still call all the shots, with that looser corporate governance which Obama is so keen on. But hey this is an emerging growth stock isn’t it? Er no.

So new shareholders cannot get to stop the Glazers running this like a personal fiefdom but at least they get dividends right? Er no. The Glazers themselves took out a $10 million dividend from the highly indebted club a few months ago but the prospectus makes it clear that there will be no dividends going forward. Shucks.

But at least the $233 million raised (net of grotesque Wall Street fees) goes to paying down Man U’s highly expensive £459 million debt? Er no. The Glazers are trousering $100 million the rest will nibble into that debt.

But at least the most expensive sports club in the world does not need to invest heavily in buying new players does it? Er no. This might not be appreciated Stateside but the English league title was last year won by Manchester City not Manchester United. They are not one and the same. City is bankrolled by a rich Arab. If Mr Abramovich wishes to write a few cheques then Chelsea FC could buy in younger talent and so unless Man United spends money it does not have then they might not even finish second in the UK league next year. A lack of success on the field is unlikely to boost revenues.

But at least Man United is consistently and increasingly profitable is it not? Er no. Revenues in the years to June 30th 2009 to 2011 were £278 million, £286 million and £331 million respectively. Operating profits were £125 million, £64.3 million and £63.5 million respectively. Post-tax profits were £5.3 million, minus £47 million and £13 million respectively.

But the rating is fair for such a powerful brand which is supported by 10% of the world’s population? Er no. That 10% number comes from the prospectus and includes all people who watched Man United play last year. So had my team (West Ham) played Man United then despite the fact that I wear claret and blue (not red) and sing “I’m forever blowing bubbles” not whatever the Man United fans sing while munching prawn sandwiches, I would count as a Man United supporter. Go figure. As for the rating? Shall we call it 111 times historic earnings? Bargain. Er not.

So if after tax profits might be not a lot this year, even if we add back non cash items like amortization of player contracts, will Man United generate enough cash to a) pay down debt and b) invest in the new players needed to start winning again and maintain the value of its brand? Er..no.

What about visibility of earnings – they are safe are they not? Er no. A few years of City winning all the silverware and an empty trophy cabinet at United is like to see the reds lose some of their glamour and fickle support. Man United has not always been successful. When I was 5 (1973) a goal from ex United star Dennis Law (by then playing for City) saw the red team relegated to division two. Kids at my school thought United were losers. They supported Leeds, Derby or Wolverhampton Wanderers (Wolves). I bet today my schoolmates and their sons support Man United. Diehard supporters always remain true (my club is useless but I do not care). But the fickle, who generate those revenues at the margin, from merchandising etc may drift if United do not start winning again.

Meanwhile the sex crazed morons who play professional soccer will demand ever higher wages and clubs must pay if they are to retain and attract talent. So visibility of earnings? Not great.

But at least there are no other risk factors to mention. Er no. Check the prospectus. I bring you only the highlights. If you are thick enough to buy this stock you are thick enough to play pro soccer.

Hot Features

Hot Features

Hi Tom

I read your article and was thoroughly enjoying it and was in full support of your views until the last sentance. I really wish I was thick enough to earn £100,000 a week because then I could happily “invest” £5000 in Man Utd.

Regards

Rob

Rob

Sadly being utterly thick is not the only pre-requisite for being a professional soccer player. Indeed there is always the odd player who is quite bright – FT reader Jonathan Spector for example.

Best wishes & thanks for saying you enjoyed article

Tom

Give a man a gun, and he may rob a bank…give a man a bank, and he will rob the world!