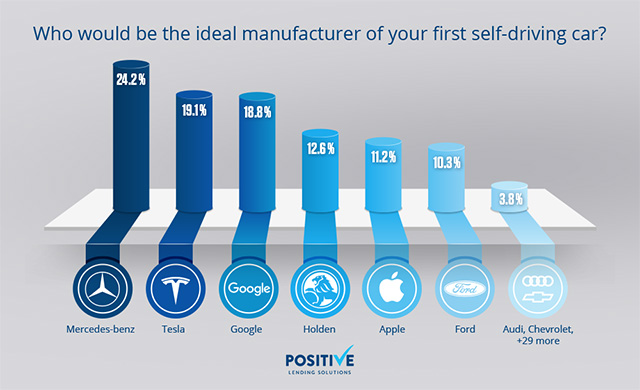

We recently asked 1,500 Australians ‘Who would be the ideal manufacturer of their first self-driving car?’, the results were surprising and may point to further disruption across industry sectors.

Overall, around a quarter of the respondents said Mercedes-Benz would be the ideal manufacturer, closely followed by Tesla and Google with just under 20%. While the mix of the top three is interesting, featuring a traditional car manufacturer (Mercedes-Benz), a tech company (Google), and one of the first companies to successfully do both (Tesla), it’s when we break down the findings into age brackets that the true story is told.

When we extracted the data from those who voted for each manufacturer, there was a clear divide between the younger, middle and older generations. For those in the 55-64 and 65+ age brackets, traditional car manufacturers such as Ford, Holden and Mercedes-Benz were the clear choice. Younger survey participants between 18-24 and 25-34 clearly chose Google as their manufacturer of choice, while Tesla was the preferred manufacturer for those aged 35-44 and 45-54. The only real anomaly in the findings was from those who chose Apple as the best manufacturer of the ideal driverless car. Apart from those who didn’t disclose their age, the 55-64 age group led the way.

There are a number of questions that come out of these findings that need to be answered to get a true understanding of their reasons:

- Are the older generations aware tech companies are venturing into the car manufacturing industry?

- Has Australia’s world-leading proliferation of car options diluted the younger generation’s respect for traditional car companies like Holden and Ford?

- Are the younger generation savvier when it comes to technological advances?

- Are the younger generations spending more time online and therefore have a wider breadth of knowledge on the latest trends?

- Do the older generations feel more confident putting their safety in the hands of long-term car manufacturers?

“The survey results are surprising and have allowed us to adapt our business in order to accommodate to the inevitable increase in driverless vehicles coming into the market”, said Tom Caesar from Positive Lending Solutions. In what most are describing as one of the biggest technological movements of all time, the ripple effects on businesses in supporting industries will be far and wide.

So who is right, the older or younger generations?

While no one can say for certain, the reality is they’re probably both right. The change currently underway in the car industry is of such enormous proportions, that manufacturers making the next generation of automobile will need to be at the cutting edge to survive.

With tech companies entering the car manufacturing industry, it’s forced traditional automakers into making vast improvements to both the efficient process of making the cars themselves, and the technological advancements they come with. The race for the first fully operational driverless car is on in earnest, and it won’t be too long before they go from design and development to reality.

Why are tech companies entering the car manufacturing industry?

There are several reasons, but they all come back to the same common theme…money. In 2014 the automotive industry was worth $US9 trillion dollars, with the connected car portion of that enormous figure coming in at $US400 billion. With this smaller figure still more than the Smartphone, PC and wearables market combined, it makes sense for tech companies to move into this space, especially when there is so much synergy between vehicles and technology.

Business Insider Intelligence has delved into the future of the car manufacturing industry, and their research has uncovered some interesting findings that explain why Apple and Google are muscling their way in. But the two main findings are:

- Cars with internet-connection hardware is growing at a rate 10 times faster than the overall car market, and by 2020 will be in 75% of the 92 million cars shipped globally.

- The amount of data that can be collected by carmakers and tech companies will rise considerably. This will enable car performance to be monitored, while updates and patches can be sent to cars remotely (much like Smartphone updates), saving money on recalls to repair a car’s software system.

For Google, driverless cars opens up the possibility of people spending longer using their search engine or watching YouTube, both of which generate enormous amounts of money through paid advertising. Entering an industry that will open up the possibility of people spending more time online or using their Smartphones really is a no-brainer for tech companies like Google and Apple. A combination of enormous amounts of money and data collection will have any tech company salivating at the prospect of joining the automotive industry, which is why they’ve already spent several years in the development stage.

Should traditional carmakers and tech companies go it alone?

The question tech companies and car manufacturers have to ask themselves is, “should they go it alone or join forces”. Cars are not easy to build, nor are the technological advancements that are required to keep up the pace. The costs in setting up manufacturing plants; developing systems to sell, deliver and service the vehicles; and litigation when things go wrong are enormous. For example, in 2014 General Motors Co. forked out $US5.3 billion in fines, compensation and vehicle recalls to repair faulty ignition systems. Toyota Motor Corp. were fined $US1.2 billion for failing to report safety defects, while Volkswagen are currently awaiting the cost of their emissions scandal, with $US7.3 billion having been set aside so far.

Companies like Apple and Google have the deepest pockets imaginable, and the figures needed to start a car manufacturing business from scratch, and the ongoing costs, probably wouldn’t scare them too much. But the reason they are at the top of the food chain for revenue is because they are good at what they do. They are tech companies, not car manufacturers, which is why the likely path forward will be a coalition between tech companies and car manufacturers. They may feel it’s easier to revolutionise the automobile industry without ever having to manufacture a car.

Google spokeswoman Courtney Hohne has already suggested this is the likely way forward for the tech giant, despite the fact they’ve spent the past six years developing driverless cars.

“We have enormous respect for the expertise of the automotive industry and how big and complex a job it is to manufacture a vehicle. We’ll partner with many different companies to bring this technology into the world safely,” she said.

This collaborative strategy is in-line with how they currently operate anyway. After all, they may create the Android software that is in the majority of the world’s Smartphones, but they don’t make the phones themselves. Likewise, Apple outsources the manufacturing of it’s devices to companies in Asia, so the likelihood of them building and operating a manufacturing plant of their own is remote.

Who will team up with who?

That is the multibillion-dollar question. No-one knows who will join forces, and there aren’t any whispers coming out of either industry yet. However, there have been some interesting moves made already.

While many traditional car companies have invested heavily in technology for their range of vehicles, a few have set up their software development operations in California’s Silicone Valley, home of the world’s biggest tech companies including Apple and Google.

Jaguar Land Rover has a presence in Silicone Valley and has already formed close working relationships with leading tech players such as Intel and MIT AgeLab, while Ford has also opened a research centre there.

Meanwhile, many car manufacturers have spoken glowingly of tech companies joining the automotive industry.

“We see Apple and Google as welcome competition, the motorcar revolution needs new blood, it stimulates the creativity of our engineers,” said BMW UK spokesman Gavin Ward.

Chief Executive of Fiat, Sergio Marchionne said, “Whether it is the Google car or the Apple car, this notion we are seeing with autonomous driving and assisted driving is going to change the traditional nature of car making. The industry in general has to open up to disruptors, I think we have been late to the party.”

Cars are already heavily computerised, and the driver experience is shaped just as much by the technology in the car as the physical components. This means consumers will be more concerned about their relationship with the tech companies that make their driving experience so enjoyable, rather than the car companies who ‘just’ manufacture the vehicles. This is a worrying development for car manufacturers because it will relegate them to becoming just another cog in the supply chain, as opposed to the driver of the entire industry.

What next?

With car manufacturers setting up software research facilities in Silicone Valley and publicly claiming their delight at the emergence of Google, Apple and other newcomers such as Tesla, it looks like they are creating an environment where partnerships are inevitable. But it will be interesting to see who blinks first and makes the opening move to join forces. Will a car manufacturer seek out a tech company, or vice-versa? Has it already happened? If a car manufacturer makes the first move, does it diminish their negotiating power, and vice-versa? The extraordinary costs tech companies would bear should they build from scratch or take over a manufacturing plant, and the need for car manufacturers to have the most advanced technology in their vehicles to stay at the cutting edge of driverless car technology, suggests collaboration is going to happen. It’s not a matter of if, but when.

So while our older generations may be ignorant of the role tech companies are playing in the automotive industry, and the possible lack of understanding of how the automotive industry works by our younger generations, it seems they were both right when choosing who the ideal manufacturer of their first self-driving car should be.

Hot Features

Hot Features