Pay vs Performance Disclosure

|

12 Months Ended |

|

Dec. 31, 2024

USD ($)

|

Dec. 31, 2023

USD ($)

|

Dec. 31, 2022

USD ($)

|

Dec. 31, 2021

USD ($)

|

Dec. 31, 2020

USD ($)

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | VALUE OF INITIAL $100

FIXED INVESTMENT BASED ON: | | | | | | YEAR | | | SUMMARY

COMPENSATION TABLE TOTAL FOR

PRINCIPAL

EXECUTIVE

OFFICER

(PEO) | | | COMPENSATION

ACTUALLY

PAID TO

PEO | | | AVERAGE

SUMMARY

COMPENSATION TABLE TOTAL NON-PEO FOR

OTHER

NAMED

EXECUTIVE

OFFICERS

(NON-PEO NEOs)) | | | AVERAGE

COMPENSATION

ACTUALLY

PAID TO

NON-PEO NEOs | | | TOTAL

SHAREHOLDER

RETURN

(TSR) | | | TSR

OF PEER

GROUP | | | NET INCOME

(IN THOUSANDS) | | | COMPANY -

SELECTED

MEASURE-

ADJUSTED

RETURN ON

ASSETS | (a) | | | (b)1 | | | (c)2 | | | (d)3 | | | (e)4 | | | (f)5 | | | (g)6 | | | (h)7 | | | (i)8 | 2024 | | | $ | 1,869,311 | | | $ | 2,125,798 | | | $ | 763,283 | | | $ | 811,297 | | | $ | 147.91 | | | $ | 121.52 | | | $ | 43,544 | | | 1.09% | 2023 | | | | 1,839,140 | | | | 1,626,649 | | | | 741,966 | | | | 705,403 | | | | 136.30 | | | | 103.71 | | | | 44,852 | | | 1.15% | 2022 | | | | 1,809,632 | | | | 1,889,352 | | | | 706,885 | | | | 750,137 | | | | 142.65 | | | | 108.65 | | | | 43,557 | | | 1.17% | 2021 | | | | 1,661,531 | | | | 1,970,250 | | | | 618,349 | | | | 720,925 | | | | 124.33 | | | | 108.25 | | | | 39,299 | | | 1.10% | 2020 | | | | 1,577,467 | | | | 1,495,406 | | | | 704,049 | | | | 674,936 | | | | 93.93 | | | | 82.00 | | | | 33,244 | | | 0.93% |

| | 1. | The dollar amounts reported in column (b) are the amounts of total compensation reported for Mr. Simard (our CEO) for each corresponding year in the “Total” column of the Summary Compensation Table. | 2. | The dollar amounts reported in column (c) represent the amount of “compensation actually paid” to Mr. Simard, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Mr. Simard during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to Mr. Simard’s total compensation for fiscal year 2024 to determine the compensation actually paid in 2024: |

| | | | | | | | | | | | | | | | | YEAR | | | REPORTED SUMMARY

COMPENSATION

TABLE TOTAL FOR PEO | | | REPORTED VALUE OF

EQUITY AWARDS(a) | | | EQUITY AWARD

ADJUSTMENTS(b) | | | COMPENSATION

ACTUALLY PAID

TO PEO | 2024 | | | $ | 1,869,311 | | | $ | (479,659) | | | $ | 736,146 | | | $ | 2,125,798 |

| | (a) | The grant date fair value of equity awards represents the total of the amounts reported in the “Stock Awards” column in the Summary Compensation Table. | (b) | The equity award adjustments for fiscal year 2024 include the addition (or subtraction, as applicable) of the following: (i) the fiscal year-end fair value of any equity awards granted in 2024 that are outstanding and unvested as of the end of fiscal year 2024; (ii) the amount of change as of the end of fiscal year 2024 (from the end of the prior fiscal year) in the fair value of any awards granted in prior fiscal years that are outstanding and unvested as of the end of fiscal year 2024; (iii) for awards that are granted and vest in fiscal year 2024, the fair value as of the vesting date; (iv) for awards granted in prior fiscal years that vest in fiscal year 2024, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in the fair value; (v) for awards granted in prior fiscal years that are determined to fail to meet the applicable vesting conditions during fiscal year 2024, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and (vi) the dollar value of any dividends or other earnings paid on stock or option awards in fiscal year 2024 prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for fiscal year 2024. The amounts added or subtracted to determine the adjusted amount are as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | YEAR | | | YEAR END

FAIR VALUE

OF

EQUITY

AWARDS

GRANTED

DURING

THE YEAR | | CHANGE

IN FAIR

VALUE OF

OUTSTANDING

AND

UNVESTED

EQUITY

AWARDS AT YEAR END

GRANTED

IN

PRIOR YEARS | | FAIR VALUE

AT THE

END OF

THE PRIOR

YEAR OF

EQUITY

AWARDS

THAT

FAILED TO

MEET

VESTING

CONDITIONS

IN THE YEAR | | CHANGE

IN FAIR

VALUE OF

EQUITY

AWARDS

GRANTED IN

PRIOR

YEARS

THAT

VESTED

IN THE YEAR | | VALUE OF

DIVIDENDS OR

OTHER

EARNINGS

PAID ON

EQUITY

AWARDS NOT

OTHERWISE

REFLECTED

IN FAIR VALUE

OR TOTAL

COMPENSATION | | TOTAL EQUITY

AWARD

ADJUSTMENTS | 2024 | | | $ | 597,717 | | | $ | 121,582 | | | $ | - | | | $ | (26,266) | | | $ | 43,113 | | | $ | 736,146 |

| | 3. | The dollar amounts reported in column (d) represent the average of the amounts reported for the Company’s (NEOs) as a group (excluding Mr. Simard, who has served as our CEO since 2013) in the “Total” column of the Summary Compensation Table in each applicable year. The names of each of the NEOs (excluding Mr. Simard), including for purposes of calculating the average amounts in each applicable year are as follows: (i) for 2024 Josephine Iannelli, Marion Colombo, John M. Mercier, and Jason Edgar | 4. | The dollar amounts reported in column (e) represent the average amount of “compensation actually paid” to the NEOs as a group (excluding Mr. Simard), as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual average amount of compensation earned by or paid to the NEOs as a group (excluding Mr. Simard) during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to average total compensation for the NEOs as a group (excluding Mr. Simard) for each year to determine the compensation actually paid, using the same methodology described above in Note 2: |

| | | | | | | | | | | | | | | | | YEAR | | | AVERAGE REPORTED

SUMMARY

COMPENSATION

TABLE TOTAL

FOR NON-PEO NEOs | | | AVERAGE

REPORTED

VALUE

OF EQUITY

AWARDS | | | AVERAGE

EQUITY

ADJUSTMENTS | | | AVERAGE

COMPENSATION

ACTUALLY

PAID TO

NON-PEO NEOs | 2024 | | | $ | 763,283 | | | $ | (138,086) | | | $ | 186,101 | | | $ | 811,297 |

| | The amounts deducted or added in calculating the total average equity award adjustments are as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | YEAR | | | AVERAGE

YEAR END

FAIR VALUE OF

EQUITY

AWARDS

GRANTED

DURING

THE YEAR | | AVERAGE

CHANGE

IN FAIR

VALUE OF

OUTSTANDING

AND UNVESTED

EQUITY AWARDS AT YEAR END

GRANTED IN +PRIOR YEARS | | AVERAGE

FAIR VALUE

AT THE END

OF THE

PRIOR YEAR

OF EQUITY

AWARDS THAT

FAILED TO

MEET VESTING

CONDITIONS

IN THE

YEAR | | AVERAGE

CHANGE

IN FAIR

VALUE OF

EQUITY

AWARDS

GRANTED IN

PRIOR YEARS

THAT VESTED

IN THE

YEAR | | AVERAGE

VALUE OF

DIVIDENDS

OR OTHER

EARNINGS

PAID ON EQUITY

AWARDS NOT

OTHERWISE

REFLECTED

IN FAIR VALUE

OR TOTAL

COMPENSATION | | TOTAL

AVERAGE

EQUITY

AWARD

ADJUSTMENTS | 2024 | | | $ | 172,074 | | | $ | 4,892 | | | $ | - | | | $ | (3,274) | | | $ | 12,409 | | | $ | 186,101 |

| | 5. | Cumulative TSR is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period. | 6. | Represents the weighted peer group TSR, weighted according to the respective companies’ stock market capitalization at the beginning of each period for which a return is indicated. The peer group used for this purpose is the Compensation Peer Group. Our Compensation Peer Group for the 2024 reporting year is disclosed under the heading “Market Benchmarking and Performance Comparisons” and found on page 46 of this proxy statement. | 7. | The dollar amounts reported represent the amount of net income reflected in the Company’s audited financial statements for the applicable year. | 8. | This is a non-GAAP measure that excludes gains or losses on sale of securities, gains or losses on sale of premises and equipment, gains or losses on other real estate owned, losses on extinguishments of debt, acquisition, conversion and other non-recurring expenses, net of tax. |

|

|

|

|

|

| Company Selected Measure Name |

ADJUSTED RETURN ON ASSETS

|

|

|

|

|

| Named Executive Officers, Footnote |

The dollar amounts reported in column (d) represent the average of the amounts reported for the Company’s (NEOs) as a group (excluding Mr. Simard, who has served as our CEO since 2013) in the “Total” column of the Summary Compensation Table in each applicable year. The names of each of the NEOs (excluding Mr. Simard), including for purposes of calculating the average amounts in each applicable year are as follows: (i) for 2024 Josephine Iannelli, Marion Colombo, John M. Mercier, and Jason Edgar

|

|

|

|

|

| Peer Group Issuers, Footnote |

Represents the weighted peer group TSR, weighted according to the respective companies’ stock market capitalization at the beginning of each period for which a return is indicated. The peer group used for this purpose is the Compensation Peer Group. Our Compensation Peer Group for the 2024 reporting year is disclosed under the heading “Market Benchmarking and Performance Comparisons” and found on page 46 of this proxy statement.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 1,869,311

|

$ 1,839,140

|

$ 1,809,632

|

$ 1,661,531

|

$ 1,577,467

|

| PEO Actually Paid Compensation Amount |

$ 2,125,798

|

1,626,649

|

1,889,352

|

1,970,250

|

1,495,406

|

| Adjustment To PEO Compensation, Footnote |

| | | | | | | | | | | | | | | | | YEAR | | | REPORTED SUMMARY

COMPENSATION

TABLE TOTAL FOR PEO | | | REPORTED VALUE OF

EQUITY AWARDS(a) | | | EQUITY AWARD

ADJUSTMENTS(b) | | | COMPENSATION

ACTUALLY PAID

TO PEO | 2024 | | | $ | 1,869,311 | | | $ | (479,659) | | | $ | 736,146 | | | $ | 2,125,798 |

| | (a) | The grant date fair value of equity awards represents the total of the amounts reported in the “Stock Awards” column in the Summary Compensation Table. | (b) | The equity award adjustments for fiscal year 2024 include the addition (or subtraction, as applicable) of the following: (i) the fiscal year-end fair value of any equity awards granted in 2024 that are outstanding and unvested as of the end of fiscal year 2024; (ii) the amount of change as of the end of fiscal year 2024 (from the end of the prior fiscal year) in the fair value of any awards granted in prior fiscal years that are outstanding and unvested as of the end of fiscal year 2024; (iii) for awards that are granted and vest in fiscal year 2024, the fair value as of the vesting date; (iv) for awards granted in prior fiscal years that vest in fiscal year 2024, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in the fair value; (v) for awards granted in prior fiscal years that are determined to fail to meet the applicable vesting conditions during fiscal year 2024, a deduction for the amount equal to the fair value at the end of the prior fiscal year; and (vi) the dollar value of any dividends or other earnings paid on stock or option awards in fiscal year 2024 prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for fiscal year 2024. The amounts added or subtracted to determine the adjusted amount are as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | YEAR | | | YEAR END

FAIR VALUE

OF

EQUITY

AWARDS

GRANTED

DURING

THE YEAR | | CHANGE

IN FAIR

VALUE OF

OUTSTANDING

AND

UNVESTED

EQUITY

AWARDS AT YEAR END

GRANTED

IN

PRIOR YEARS | | FAIR VALUE

AT THE

END OF

THE PRIOR

YEAR OF

EQUITY

AWARDS

THAT

FAILED TO

MEET

VESTING

CONDITIONS

IN THE YEAR | | CHANGE

IN FAIR

VALUE OF

EQUITY

AWARDS

GRANTED IN

PRIOR

YEARS

THAT

VESTED

IN THE YEAR | | VALUE OF

DIVIDENDS OR

OTHER

EARNINGS

PAID ON

EQUITY

AWARDS NOT

OTHERWISE

REFLECTED

IN FAIR VALUE

OR TOTAL

COMPENSATION | | TOTAL EQUITY

AWARD

ADJUSTMENTS | 2024 | | | $ | 597,717 | | | $ | 121,582 | | | $ | - | | | $ | (26,266) | | | $ | 43,113 | | | $ | 736,146 |

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 763,283

|

741,966

|

706,885

|

618,349

|

704,049

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 811,297

|

705,403

|

750,137

|

720,925

|

674,936

|

| Adjustment to Non-PEO NEO Compensation Footnote |

| | | | | | | | | | | | | | | | | YEAR | | | AVERAGE REPORTED

SUMMARY

COMPENSATION

TABLE TOTAL

FOR NON-PEO NEOs | | | AVERAGE

REPORTED

VALUE

OF EQUITY

AWARDS | | | AVERAGE

EQUITY

ADJUSTMENTS | | | AVERAGE

COMPENSATION

ACTUALLY

PAID TO

NON-PEO NEOs | 2024 | | | $ | 763,283 | | | $ | (138,086) | | | $ | 186,101 | | | $ | 811,297 |

| | The amounts deducted or added in calculating the total average equity award adjustments are as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | YEAR | | | AVERAGE

YEAR END

FAIR VALUE OF

EQUITY

AWARDS

GRANTED

DURING

THE YEAR | | AVERAGE

CHANGE

IN FAIR

VALUE OF

OUTSTANDING

AND UNVESTED

EQUITY AWARDS AT YEAR END

GRANTED IN +PRIOR YEARS | | AVERAGE

FAIR VALUE

AT THE END

OF THE

PRIOR YEAR

OF EQUITY

AWARDS THAT

FAILED TO

MEET VESTING

CONDITIONS

IN THE

YEAR | | AVERAGE

CHANGE

IN FAIR

VALUE OF

EQUITY

AWARDS

GRANTED IN

PRIOR YEARS

THAT VESTED

IN THE

YEAR | | AVERAGE

VALUE OF

DIVIDENDS

OR OTHER

EARNINGS

PAID ON EQUITY

AWARDS NOT

OTHERWISE

REFLECTED

IN FAIR VALUE

OR TOTAL

COMPENSATION | | TOTAL

AVERAGE

EQUITY

AWARD

ADJUSTMENTS | 2024 | | | $ | 172,074 | | | $ | 4,892 | | | $ | - | | | $ | (3,274) | | | $ | 12,409 | | | $ | 186,101 |

|

|

|

|

|

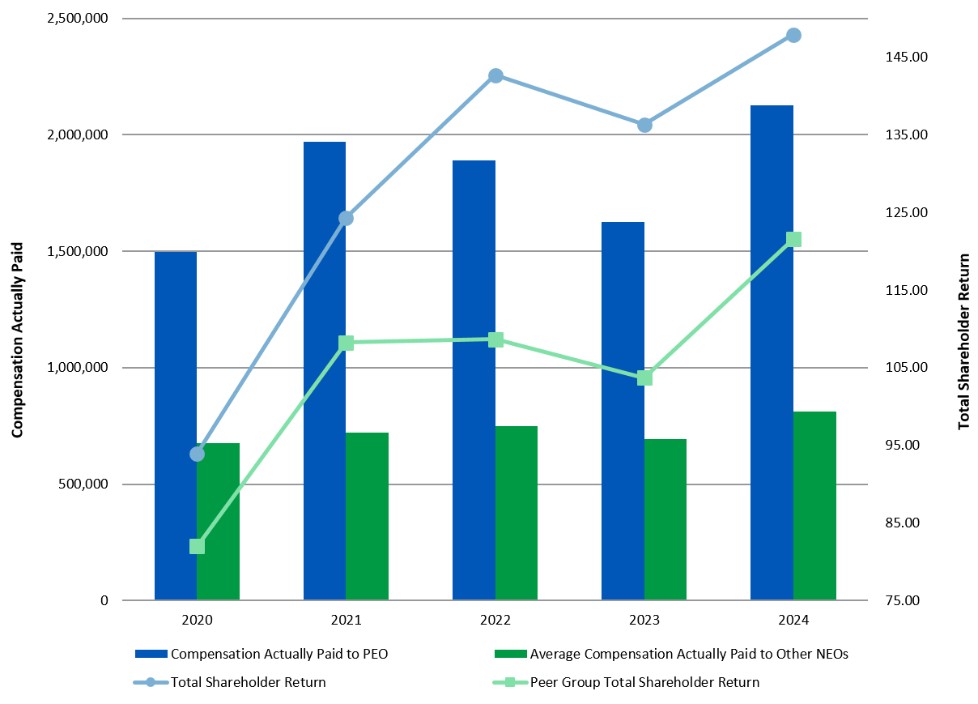

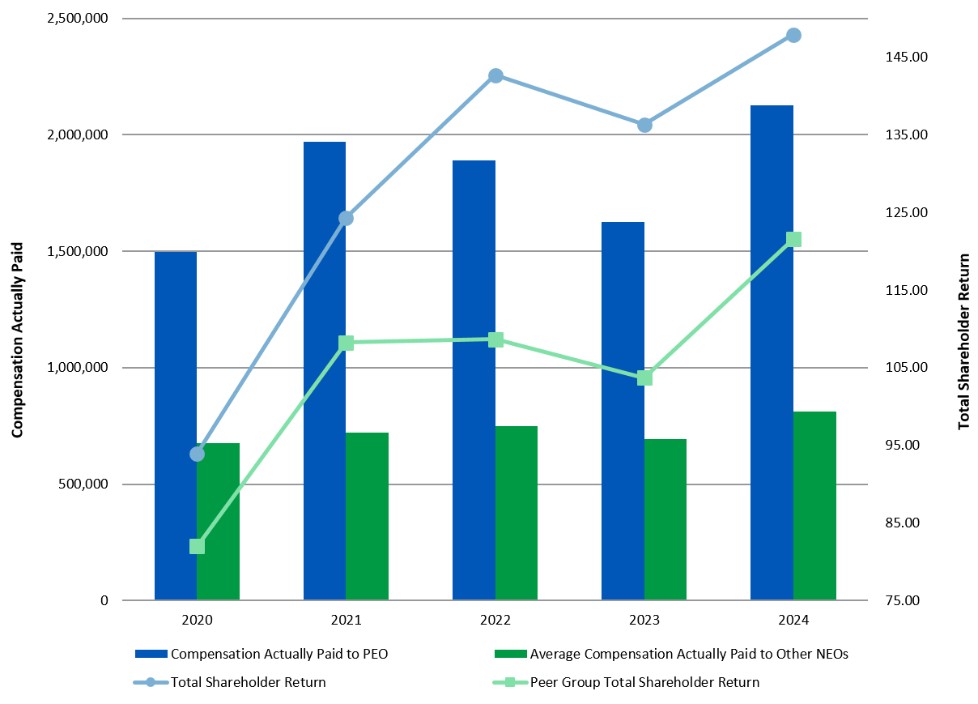

| Compensation Actually Paid vs. Total Shareholder Return |

PEO and Non-PEO Compensation Actually Paid and TSR and Peer TSR

|

|

|

|

|

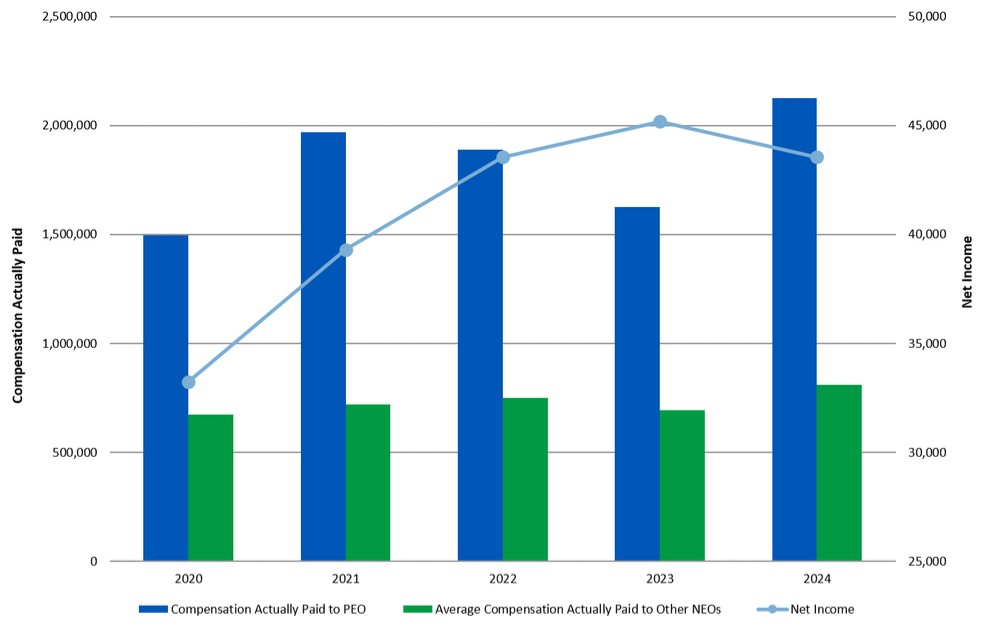

| Compensation Actually Paid vs. Net Income |

PEO and Non-PEO Compensation Actually Paid and Net Income

|

|

|

|

|

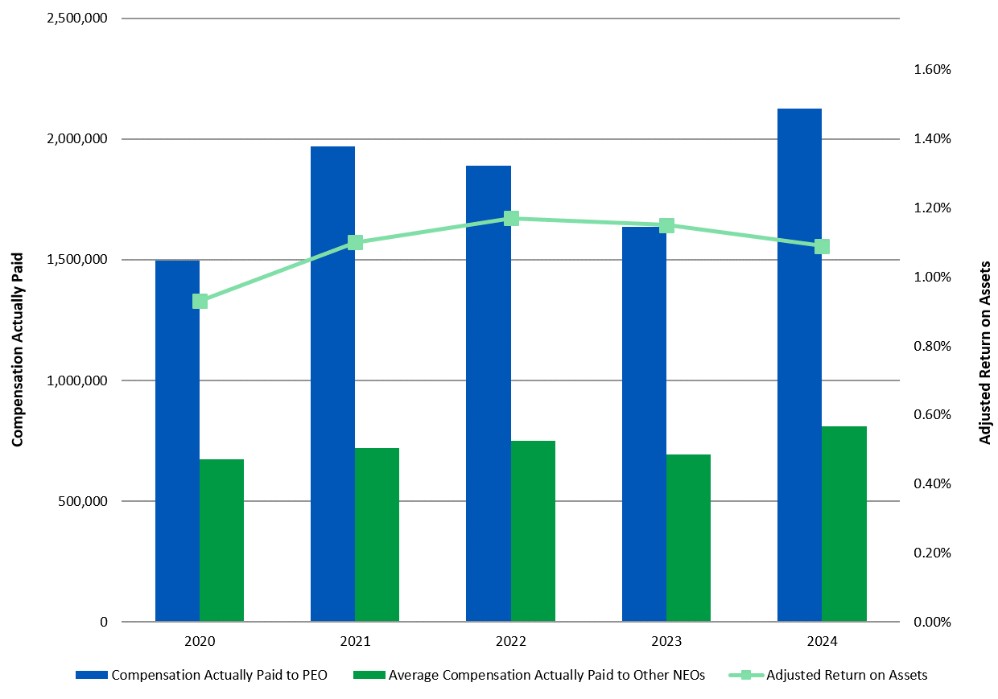

| Compensation Actually Paid vs. Company Selected Measure |

PEO and Non-PEO Compensation Actually Paid and Adjusted Return on Assets

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

PEO and Non-PEO Compensation Actually Paid and TSR and Peer TSR

|

|

|

|

|

| Tabular List, Table |

Key Performance Measurements The Company considers the following the most important financial performance measures it used to link executive compensation actually paid to its NEOs, for the most recently completed fiscal year, to company performance: | ● | Adjusted net income (non-GAAP)8 |

| ● | Adjusted return on assets (non-GAAP) 8 |

| ● | Adjusted return on equity (non-GAAP)8 |

| ● | Non-performing loans to total loans ratio |

|

|

|

|

|

| Total Shareholder Return Amount |

$ 147.91

|

136.30

|

142.65

|

124.33

|

93.93

|

| Peer Group Total Shareholder Return Amount |

121.52

|

103.71

|

108.65

|

108.25

|

82.00

|

| Net Income (Loss) |

$ 43,544,000

|

$ 44,852,000

|

$ 43,557,000

|

$ 39,299,000

|

$ 33,244,000

|

| Company Selected Measure Amount |

0.0109

|

0.0115

|

0.0117

|

0.0110

|

0.0093

|

| PEO Name |

Mr. Simard

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Adjusted net income (non-GAAP)

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Adjusted return on assets (non-GAAP)

|

|

|

|

|

| Non-GAAP Measure Description |

This is a non-GAAP measure that excludes gains or losses on sale of securities, gains or losses on sale of premises and equipment, gains or losses on other real estate owned, losses on extinguishments of debt, acquisition, conversion and other non-recurring expenses, net of tax.

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Adjusted return on equity (non-GAAP)

|

|

|

|

|

| Measure:: 4 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Non-performing loans to total loans ratio

|

|

|

|

|

| Measure:: 5 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Efficiency ratio

|

|

|

|

|

| PEO | REPORTED VALUE OF EQUITY AWARDS |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (479,659)

|

|

|

|

|

| PEO | EQUITY AWARD ADJUSTMENTS |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

736,146

|

|

|

|

|

| PEO | YEAR END FAIR VALUE OF EQUITY AWARDS GRANTED DURING THE YEAR |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

597,717

|

|

|

|

|

| PEO | CHANGE IN FAIR VALUE OF OUTSTANDING AND UNVESTED EQUITY AWARDS AT YEAR END GRANTED IN PRIOR YEARS |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

121,582

|

|

|

|

|

| PEO | CHANGE IN FAIR VALUE OF EQUITY AWARDS GRANTED IN PRIOR YEARS THAT VESTED IN THE YEAR |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(26,266)

|

|

|

|

|

| PEO | VALUE OF DIVIDENDS OR OTHER EARNINGS PAID ON EQUITY AWARDS NOT OTHERWISE REFLECTED IN FAIR VALUE OR TOTAL COMPENSATION |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

43,113

|

|

|

|

|

| Non-PEO NEO | REPORTED VALUE OF EQUITY AWARDS |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(138,086)

|

|

|

|

|

| Non-PEO NEO | EQUITY AWARD ADJUSTMENTS |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

186,101

|

|

|

|

|

| Non-PEO NEO | YEAR END FAIR VALUE OF EQUITY AWARDS GRANTED DURING THE YEAR |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

172,074

|

|

|

|

|

| Non-PEO NEO | CHANGE IN FAIR VALUE OF OUTSTANDING AND UNVESTED EQUITY AWARDS AT YEAR END GRANTED IN PRIOR YEARS |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

4,892

|

|

|

|

|

| Non-PEO NEO | CHANGE IN FAIR VALUE OF EQUITY AWARDS GRANTED IN PRIOR YEARS THAT VESTED IN THE YEAR |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(3,274)

|

|

|

|

|

| Non-PEO NEO | VALUE OF DIVIDENDS OR OTHER EARNINGS PAID ON EQUITY AWARDS NOT OTHERWISE REFLECTED IN FAIR VALUE OR TOTAL COMPENSATION |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 12,409

|

|

|

|

|