Natural Gas ETFs Slide on Bearish Storage Report - ETF News And Commentary

May 16 2013 - 9:04AM

Zacks

Natural gas had managed to resist the commodity trend to start

2013, as the product gained significantly to begin the year.

However, the good days now seem to be over for natural gas

investors, as May has been a horrendous month for the

commodity.

This near-term bearish trend continued with the latest EIA

storage report in which supply additions came in above

expectations. The consensus called for an increase of 95 billion

cubic feet (bcf), but investors saw 99 bcf injected instead (read

the Comprehensive Guide to Natural Gas ETFs).

This addition also compared unfavorably with recent trends for

this week in the year, as the five year average had a rise of just

69bcf. However, the total stocks of natural gas—which stood at

1.964 trillion cubic feet—were still below the five year trend for

this time in the year, though traders focused in on the week’s

above estimate injection, and calls for mild weather in the days

ahead.

As a result, prices of front month natural gas futures

experienced another bout of weakness in Thursday trading, falling

below the key $4 mark. In total, prices fell about 3.5% after the

report was released, signaling to many that more rough trading was

ahead for the commodity.

Natural Gas ETF Impact

Obviously, this bearish report had a big impact on natural gas

ETFs in the trading session. The most popular fund, the

United States Natural Gas ETF (UNG) was down about

3.8% on the session on volume that was above average (read Forget

UNG: Try These Natural Gas ETFs Instead).

The more spread out along the futures curve version, the

United States 12 Month Natural Gas ETF (UNL) did a

bit better on the day, losing just 2.7% in comparison. However, the

fund’s volume is much lighter than UNG, though it also saw a burst

in trading thanks to the EIA report.

Meanwhile in the leveraged ETF market, the 2x fund

(BOIL) was down about 7.3% while the 3x product

UGAZ, lost a bit over 11% in the session.

Unsurprisingly, the inverse natural gas market did quite well on

the news today, with the -2x KOLD adding about

7.5% and DGAZ jumping higher by just over 11%.

Natural Gas ETF Outlook

Given the bearish report and the forecast for more mild weather,

we could see a continued fall in the natural gas ETF market. This

is especially true considering the magnitude of the supply

injections as of late, and the trend that is building for this

metric (read 3 Energy ETFs for America’s Production Boom).

So, investors may want to pause or cash in a bet on natural gas

ETFs at this time, as the commodity is definitely facing some

strong headwinds. Instead, any of the short natural gas ETF plays

could be better options for now, particularly given the supply

demand imbalance, and the long history of natural gas weakness in

the ETF world.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

PPO-ULT DJ-U NG (BOIL): ETF Research Reports

VEL-3X INV NG (DGAZ): ETF Research Reports

PRO-ULS DJ-U NG (KOLD): ETF Research Reports

VEL-3X LNG NG (UGAZ): ETF Research Reports

US-NATRL GAS FD (UNG): ETF Research Reports

US-12M NATL GAS (UNL): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

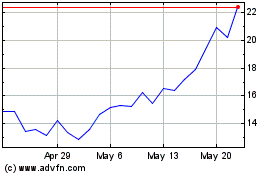

ProShares Ultra Bloomber... (AMEX:BOIL)

Historical Stock Chart

From Dec 2024 to Jan 2025

ProShares Ultra Bloomber... (AMEX:BOIL)

Historical Stock Chart

From Jan 2024 to Jan 2025