| PROSPECTUS SUPPLEMENT |

Filed pursuant to Rule 424(b)(5) |

| (To Prospectus dated February 6, 2024) |

File No. 333-276481 |

CHINA PHARMA

HOLDINGS, INC.

Up to $600,000 of Shares

of Common Stock

China Pharma Holdings, Inc. (the “Company”, “we”,

“our”, or “us”) have entered into a securities purchase agreement (the “SPA”) with an institutional

investor (the “Investor”), relating to the sale of shares of common stock of the Company, par value $0.001 per share (the

“Common Stock”) over a commitment period from December 12, 2024, the effective date of the SPA through December 31, 2024.

In accordance with the terms of the SPA, we may offer and sell shares of our Common Stock, from time to time, with an aggregate offering

price of up to $600,000 covered by this prospectus supplement (“Pro Supp”) to the Investor.

Shares of our Common Stock

covered by this Pro Supp may be sold by any method deemed to be an “at the market offering” as defined in Rule 415(a)(4) under

the Securities Act of 1933, as amended (the “Securities Act”). The Investor may acquire our Common Stock through one or more

closings at a per share price equal to the lower of (i) the closing price the day prior to notice date or (ii) the five (5) day average

closing price as reported by Bloomberg or on the NYSE American Market’s website (the “Purchase Price”) upon our receipt of purchase notices. The Purchase Price shall not be less than $0.15 per share.

The transaction under the

SPA will allow us to raise capital by selling shares of our Common Stock in open market transactions; however, it is at the Investor’s

discretion. There is no assurance that all or any of our shares of the Common Stock covered by this Pro Supp will be issued.

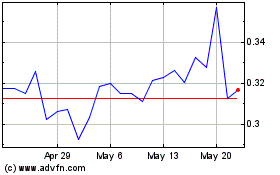

We are currently subject to

General Instruction I.B.6 of Form S-3, which limits the amounts of securities that we may sell under the registration statement of which

the Pro Supp and the accompanying prospectus form a part. The aggregate market value of our outstanding Common Stock held by non-affiliates

pursuant to General Instruction I.B.6 of Form S-3, or public float, is $2,588,182.33, which is based on 10,039,497 shares of our outstanding

Common Stock held by non-affiliates as of the date of this Pro Supp, at a price of $0.26 per share, which was the last reported sale price

of our Common Stock on Nasdaq on November 4, 2024. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell shares

pursuant to this Pro Supp with a value of more than one-third of the aggregate market value of our Common Stock held by non-affiliates

in any 12-month period, which is $862,727.44. We have not offered any securities pursuant to General Instruction I.B.6 of Form S-3 during

the prior 12 calendar month period.

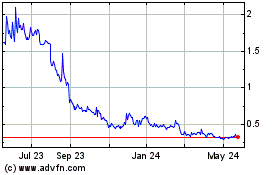

Our Common Stock trades on the NYSE American under the symbol “CPHI”.

The last reported sale price of our Common Stock on the NYSE American on December 12, 2024 was $0.186 per share.

The date of this prospectus supplement is December 12, 2024.

TABLE

OF CONTENTS

ABOUT THIS PROSPECTUS

SUPPLEMENT

This Pro Supp is a supplement

to the accompanying prospectus that is also a part of this document. This Pro Supp and the accompanying prospectus, dated February 6,

2024, are part of a registration statement on Form S-3 (File No. 333-276481, the “Registration Statement”) that we filed with

the Securities and Exchange Commission, or the SEC, utilizing a “shelf” registration process. Under this shelf registration

process, we may offer and sell from time to time in one or more offerings the securities described in the accompanying prospectus.

This document is in two parts.

The first part is this Pro Supp, which describes the securities we are offering and the terms of the offering and also adds to and updates

information contained in the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus. The

second part is the accompanying prospectus, which provides more general information, some of which may not apply to the securities offered

by this Pro Supp. Generally, when we refer to this “prospectus,” we are referring to both documents combined. To the extent

there is a conflict between the information contained in this Pro Supp, on the one hand, and the information contained in the accompanying

prospectus or any document incorporated by reference therein, on the other hand, you should rely on the information in this Pro Supp.

We urge you to carefully read this Pro Supp and the accompanying prospectus, together with the information incorporated herein and therein

by reference as described under the heading “Where You Can Find Additional Information,” before buying any of the securities

being offered.

You should not consider any

information in this Pro Supp or the accompanying prospectus to be investment, legal or tax advice. You should consult your own counsel,

accountants and other advisors for legal, tax, business, financial and related advice regarding the purchase of any of the securities

offered by this Pro Supp. You should assume that the information in this Pro Supp and the accompanying prospectus is accurate only as

of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of

the document incorporated by reference, regardless of the time of delivery of this Pro Supp and the accompanying prospectus or any sale

of a security.

This Pro Supp contains summaries

of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete

information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to

herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this Pro

Supp is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find More Information.”

FORWARD-LOOKING STATEMENTS

This Pro Supp, the accompanying

prospectus and the documents that we have filed with the SEC that are incorporated by reference in this Pro Supp contain “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and may involve material risks, assumptions

and uncertainties. Forward-looking statements typically are identified by the use of terms such as “may,” “will,”

“should,” “believe,” “might,” “expect,” “anticipate,” “intend,”

“plan,” “estimate,” and similar words, although some forward-looking statements are expressed differently.

Any forward looking statements

contained in this Pro Supp, the accompanying prospectus and the documents that we have filed with the SEC that are incorporated by reference

in this Pro Supp are only estimates or predictions of future events based on information currently available to our management and management’s

current beliefs about the potential outcome of future events. Whether these future events will occur as management anticipates, whether

we will achieve our business objectives, and whether our revenues, operating results, or financial condition will improve in future periods

are subject to numerous risks. There are a number of important factors that could cause actual results to differ materially from the results

anticipated by these forward-looking statements. These important factors include those that we discuss under the heading “Risk Factors”

and in other sections of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Form 10-K”), as

well as in our other reports filed from time to time with the SEC that are incorporated by reference into this Pro Supp and the accompanying

prospectus. You should read these factors and the other cautionary statements made in this Pro Supp, the accompanying prospectus and in

the documents we incorporate by reference into this Pro Supp and the accompanying prospectus as being applicable to all related forward-looking

statements wherever they appear in this Pro Supp or the documents we incorporate by reference into this Pro Supp and the accompanying

prospectus. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance

or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking

statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by law.

PROSPECTUS SUPPLEMENT SUMMARY

This summary is not complete

and does not contain all of the information that you should consider before investing in the shares of Common Stock offered by this Pro

Supp. You should read this summary together with the entire Pro Supp and the accompanying prospectus, including our risk factors (as provided

for herein and incorporated by reference), financial statements, the notes to those financial statements and the other documents that

are incorporated by reference in this Pro Supp, before making an investment decision. You should carefully read the information described

under the heading “Where You Can Find More Information.” We have not authorized anyone to provide you with information different

from that contained in this Pro Supp. The information contained in this Pro Supp is accurate only as of the date of this Pro Supp, regardless

of the time of delivery of this Pro Supp or of any sale of our securities.

Unless the context otherwise

requires, references to “we”, “us”, “the Company” or “our Company” refer to China Pharma

Holdings, Inc. and its wholly owned subsidiaries. “China” and the “PRC” refer to the People’s Republic of

China.

Organization and Nature of Operations

The Company, a Nevada corporation,

owns 100% of Onny Investment Limited (“Onny”), a British Virgin Islands corporation, which owns 100% of Hainan Helpson Medical

& Biotechnology Co., Ltd (“Helpson”), a company organized under the laws of the People’s Republic of China (the

“PRC”).

Onny acquired 100% of the

ownership in Helpson on May 25, 2005, by entering into an Equity Transfer Agreement with Helpson’s three former shareholders. The

transaction was approved by the Commercial Bureau of Hainan Province on June 12, 2005 and Helpson received the Certificate of Approval

for Establishment of Enterprises with Foreign Investment in the PRC on the same day. Helpson received its business license evidencing

its WFOE (Wholly Foreign Owned Enterprise) status on June 21, 2005.

Our

corporate organizational chart is set forth below.

The Company has acquired and

continues to acquire well-accepted medical formulas to add to its diverse portfolio of Western and Chinese medicines.

We

are not a Chinese operating company but a Nevada holding company. All of our operations are conducted in the PRC through Hainan Helpson

Medical & Biotechnology Co., Ltd (“Helpson”), our wholly owned subsidiary incorporated under the laws of the People’s

Republic of China (the “PRC”), where the manufacturing facilities are located. Helpson is principally engaged in the development,

manufacture and marketing of pharmaceutical products for human use in connection with a variety of high-incidence and high-mortality diseases

and medical conditions prevalent in the PRC. It manufactures pharmaceutical products in the form of dry powder injectables, liquid injectables,

tablets, capsules, and cephalosporin oral solutions. The majority of its pharmaceutical products are sold on a prescription basis and

all of them have been approved for at least one or more therapeutic indications by the National Medical Products Administration (the “NMPA”,

formerly China Food and Drug Administration, or CFDA) based upon demonstrated safety and efficacy.

China’s

consistency evaluation of generic drugs continues to proceed in 2024. Helpson has always taken the task of promoting the consistency evaluation

as a top priority, and worked on them actively. However, for each drug’s consistency evaluation, due to the continuous dynamic changes

of the detailed consistency evaluation policies, market trends, expected investments, and expected returns of investment (“ROI”),

the whole industry, including Helpson, has been making slow progresses in terms of the consistency evaluation. One of the flagship products,

Candesartan tablets, a hypertension product, has passed generic-drug-consistency-evaluation in early August 2023.

Helpson

has taken a more cautious and flexible attitude towards initiating and progressing any project for existing products’ consistency

evaluation to cope with the changing macro environment of drug sales in China. In 2018, relevant Chinese authorities decided to implement

trial Centralized Procurement (“CP”) activities in 11 selected pilot cities (including 4 municipalities and 7 other cities),

since then, nine rounds of CP activities have been carried out as of November 13, 2024, which significantly reduced the price of the drugs

that won the bids. In addition, the consistency evaluation has been adopted as one of the qualification standards for participating in

the CP activities. As a result, Helpson needs to balance between the market access brought by CP, the investment of financial resources

and time to obtain the qualification of CP, and the sharp decline in the price of drugs included in CP before making decisions regarding

CP for any products.

In

addition, Helpson continues to explore the field of comprehensive healthcare. Comprehensive healthcare is a general concept proposed by

the Chinese government according to the development of the times, social needs and changes in disease spectrum. According to the Outline

of “Healthy China 2030” issued by Chinese government in October 2016, the total size of China’s health service industry

is expected to reach RMB 16 trillion (approximately $2.5 trillion) by 2030. This industry focuses on people’s daily life, aging

and diseases, pays attention to all kinds of risk factors and misunderstandings affecting health, calls for self-health management, and

advocates the comprehensive care throughout the entire process of life. It covers all kinds of health-related information, products, and

services, as well as actions taken by various organizations to meet the health needs. In response to this trend, Helpson launched Noni

enzyme, a natural, Xeronine-rich antioxidant food supplement at the end of 2018. It also launched wash-free sanitizers and masks, in 2020,

to address the market needs caused by COVID-19 in China. As Chinese government officially terminated its zero-case policy, now the responsibility

to protect people from the impact of COVID-19 falls more to the citizens themselves, and masks and sanitizers have been popular since

COVID-19. Helpson has sufficient production capacity for medical masks, surgical masks, KN95 masks, and N95 masks, which also meets the

personal needs for protection against other respiratory infectious disease. Helpson’s N95 medical protective mask has received registration

certificate at the end of 2022 and has been on the market in the mainland China nationwide.

Helpson

will continue to optimize its product structure and actively respond to the current health needs of human beings.

Market Trends

As

a generic drug company, Helpson is presented with a huge domestic market. Helpson believes that through further upgrades and better conformity

with Chinese consistency evaluations, which are based on European and American production standards, it will be able to export the products

to overseas markets. In China’s market, Helpson believes that in the future, cost management and control ability will gradually

become important factors in determining the competitiveness of generic pharmaceutical enterprises. Although price control leads to a decline

in the profitability, enterprises who win the CP have a good chance of achieving bulk pricing to increase their market share and support

their continuous innovation and transformation. On a separate note, growing and advancing consumer demand in China drives the increase

of discretionary consumption. With the improvement of residents’ quality of life, the healthcare demand is also changing. Helpson

believes that there is a large number of unmet demands in comprehensive healthcare and internet healthcare sectors.

In

addition, the Office of the State Council issued “Pilot Plan for Marketing Authorization Holders” on May 24, 2016,

allowing eligible drug research and development institutions and scientific researchers to become Marketing Authorization Holders (“MAH”)

by obtaining drug marketing authorization and drug approval numbers from the State Council. This policy uses a management model of separating

drug marketing authorization and drug production licenses, thereby allowing MAHs to produce pharmaceuticals themselves or to consign production

to other pharmaceutical manufacturers. This policy not only transitions the production practices to meet the European and United States

standards by separating drug approval and production qualifications, thereby changing the existing model of bundling drug approval codes

to pharmaceutical manufacturers in China, but also serves as a supplement to the ongoing consistency evaluations policy.

In

general, demand for pharmaceutical products continues its steady growth in China. Helpson believes the ongoing generic drug consistency

evaluations and reform of China’s drug production registration and review policies will have major effects on the future development

of our industry and may change its business patterns. Helpson will continue to actively adapt to the national policy guidance and further

evaluate market conditions for the existing products then adjust accordingly, and compete in the market in order to optimize the development

strategy.

RISK FACTORS

An investment in our shares

of Common Stock involves a high degree of risk. Before making any investment decision, you should carefully consider the risk factors

set forth in this Pro Supp, the accompanying prospectus and the information incorporated by reference herein and therein, including under

the caption “Risk Factors” in our most recent annual report on Form 10-K, as well as in any applicable Pro Supp, as updated

by our subsequent filings under the Exchange Act.

These risks could materially

affect our business, results of operation or financial condition and affect the value of our securities. Additional risks and uncertainties

that are not yet identified may also materially harm our business, operating results and financial condition and could result in a complete

loss of your investment. You could lose all or part of your investment. For more information, see “Where You Can Find More Information.”

+

The Chinese government may intervene with

or influence our business at any time. That may negatively influence our operation, our ability to continue listing on U.S. exchange and

the value of our shares may significantly decline or be worthless, which would materially affect the interest of our stockholders.

The Chinese central or local

governments may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures

and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future,

including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional

or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular

regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

As such, our business segments

may be subject to various government and regulatory interference in the provinces in which they operate. The Company could be subject

to regulation by various political and regulatory entities, including various local and municipal agencies and government sub-divisions.

The Company may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure

to comply. The Chinese government may intervene with or influence our operations at any time with little advance notice, which could result

in a material change in our operations and in the value of our shares.

Future sales or

the potential for future sales of our securities may cause the trading price of our Common Stock to decline and could impair our ability

to raise capital through subsequent equity offerings.

Sales

of a substantial number of our Common Stock or other securities in the public markets, or the perception that these sales may occur, could

cause the market price of our Common Stock or other securities to decline and could materially impair our ability to raise capital through

the sale of additional securities.

We plan to sell

shares of our Common Stock in “at the market offerings” and the Common Stock the investor buys will likely pay different prices.

The

Common Stock the Investor to purchase at different times through this offering will likely have different prices and may experience different

outcomes in their investment results. Investors may experience a decline in the value of their shares of our Common Stock. The trading

price of our Common Stock has been volatile and subject to wide fluctuations. Many factors could have an impact on the market price of

our Common Stock, including the factors described above and in the accompanying prospectus and those incorporated by reference herein

and therein.

We cannot predict

the actual number of shares, if any, of our Common Stock that we will sell under the SPA, or the gross proceeds resulting from those sales.

The

number of shares of our Common Stock to be sold to the Investor through the SPA will fluctuate based on a number of factors, including

the market price of our Common Stock during the sales period, and the demand for our Common Stock during the sales period. Because the

price per share of each share sold will fluctuate during the sales period, it is not possible to predict the number of shares that will

be sold or the gross proceeds we will raise in connection with those sales.

In

addition, the Purchase Price in this offering is subject to repricing adjustments as contemplated under the SPA as follows. In the event

the Company’s delivery of the shares is not confirmed by 1:00 pm E.T. on the trading day the purchase notice is submitted, the Investor

has the right to adjust the purchase price to match the at-the-market price on the date of the delivery of the purchase notice, which

is only permitted if the market price on the delivery day is lower than the previously established price. Further, the Investor, has the

right, in its sole discretion, to return to the Company any or all the shares issued under the SPA within one business day following the

initial receipt of such shares and prior to the payment of the purchase price to the Company if, based on price discovery or market conditions,

the Investor determines that the issuance of such shares is unfavorable.

USE OF PROCEEDS

We may issue and sell shares

of Common Stock having aggregate sales proceeds of up to $600,000 from time to time. The amount of proceeds from this offering will depend

upon the number of shares of our Common Stock sold and the market price at which they are sold. Because there is no minimum offering amount

required as a condition of this offering, the actual total public offering amount, and proceeds to us, if any, are not determinable

at this time. There can be no assurance that we will be able to sell any shares under the SPA.

We currently intend to use

the net proceeds from this offering for general working capital purposes.

PLAN OF DISTRIBUTION

Pursuant to the SPA, we may issue and sell from time to time shares

during the commitment period from December 12, 2024, the effective date of the SPA through December 31, 2024, of our Common Stock having

an aggregate gross sales price of up to $600,000 to the Investor, subject to certain limitations, pursuant to this Pro Supp and the accompanying

prospectus. The SPA will be filed with the SEC and is incorporated by reference into this Pro Supp. This is a brief summary of the anticipated

material terms of the SPA and does not purport to be a complete statement of its terms and conditions.

Under the terms of the SPA,

in no event will the Company issue or sell to the Investor dollar amount of shares of Common Stock that would (i) exceed the number or

dollar amount of shares of Common Stock registered and available on the registration statement of which this Pro Supp forms a part, (ii)

exceed the number of authorized but unissued shares of Common Stock, (iii) exceed the number or dollar amount of shares of Common Stock

permitted to be sold under Form S-3 (including General Instruction I.B.6 thereof, if applicable), or (iv) exceed the number or dollar

amount of Common Stock for this Pro Supp which forms a part of the registration statemen.

The Investor may acquire our

Common Stock through one or more closings upon our receipt of purchase notices. The number of our Common Stock will be determined based

on the at-the-market price, but in no event shall the per share price be lower than $0.15, which is to be stated in the purchase notice

subject to repricing adjustments as contemplated under the SPA as follows. In the event the Company’s delivery of the shares is

not confirmed by 1:00 pm E.T. on the trading day the purchase notice is submitted, the Investor has the right to adjust the purchase price

to match the at-the-market price on the date of the delivery of the purchase notice, which is only permitted if the market price on the

delivery day is lower than the previously established price. Further, the Investor, has the right, in its sole discretion, to return to

the Company any or all the shares issued under the SPA within one business day following the initial receipt of such shares and prior

to the payment of the purchase price to the Company if, based on price discovery or market conditions, the Investor determines that the

issuance of such shares is unfavorable.

Additionally, we also agreed to provide “most favored nation”

treatment (the “MFN”) to the Investor should the Company enter into any financing, transaction, settlement, or similar agreement

with more favorable terms within thirty (30) days after the effective date of this SPA. In the event any of the forgoing events occurs

during the term above referenced, such more favorable terms shall be retroactively applied to all closed purchases and any future purchases

under the SPA (the “MFN Adjustments”) as if the more favorable terms had been in effect prior to each closing. MFN Adjustments

may include but are not limited to, at-the-market price discounts, the inclusion of warrants, or anti-dilution/true-up provisions. The

difference in value from the MFN adjustments shall be issued to the Investor as a convertible note.

Sales of our Common Stock by the Company as contemplated in this Pro

Supp shall be delivered according to the DWAC (Deposit/Withdrawal at Custodian) instructions specified in the purchase notice.

The actual proceeds to us

will vary depending on the number of shares sold and the prices of such sales. Because there is no minimum offering amount required as

a condition to close this offering, the actual total offering amount, and proceeds to us, if any, are not determinable at

this time.

The offering of our Common

Stock pursuant to the SPA will terminate on the earlier of (i) the date on which the Investor has purchased our Common Stock in a value

equal to $600,000, (ii) the date on which the Registration Statement is no longer effective, or (iii) December 31, 2024, unless extended

or terminated earlier in accordance with the terms of the SPA.

Our Common Stock is traded

on the NYSE American under the symbol “CPHI”.

The foregoing does not purport

to be a complete statement of the terms and conditions of the SPA. A copy of the SPA is included as an exhibit to our Current Report on

Form 8-K that will be filed with the SEC and incorporated by reference into the registration statement of which this Pro Supp and the

accompanying base prospectus form a part.

LEGAL MATTERS

The validity of the issuance

of the securities offered hereby will be passed upon for us by FLANGAS LAW GROUP. Any underwriters will also be advised about the validity

of the securities and other legal matters by their own counsel, which will be named in the Pro Supp.

EXPERTS

The consolidated balance sheets

of China Pharma Holdings, Inc. and the subsidiaries as of December 31, 2023 and 2022, the related consolidated statements of operations

and comprehensive loss, stockholders’ equity, and cash flows for each of the two years in the period ended December 31, 2023, and

the related notes (collectively referred to as the “financial statements”), incorporated in this prospectus by reference to

our Annual Report on Form 10-K for the year ended December 31, 2023, have been so incorporated in reliance upon the report of BF Borgers

CPA, P.C., an independent registered public accounting firm and the Company’s previous auditor, given on the authority of such firm

as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of

a registration statement that we have filed with the SEC. Certain information in the registration statement has been omitted from this

prospectus in accordance with the rules of the SEC. We are subject to the information requirements of the Securities Exchange Act

of 1934, as amended, or the Exchange Act, and, in accordance therewith, file annual, quarterly and current reports, proxy statements

and other information with the SEC. Such annual, quarterly and current reports, proxy statements and other information are available at

the website of the SEC at https://www.sec.gov.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The following documents filed

by us with the Securities and Exchange Commission are incorporated by reference in this prospectus:

| |

● |

Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed on April 1, 2024; |

| |

● |

Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2024, filed on November 13, 2024; |

| |

● |

Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024, filed on August 14, 2024; |

| |

● |

Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024, filed on May 15, 2024; |

| |

● |

Definitive Proxy Statement on Schedule 14A, filed with the SEC on November 12, 2024; |

| |

● |

The description of China Pharma’s securities contained in Exhibit 4.2 of the Company’s Annual Report on Form 10-K filed on March 30, 2022; and |

| |

● |

All of our filings made with the Securities and Exchange Commission pursuant to the Exchange Act after the date of the initial registration statement of which this prospectus forms a part and prior to the effectiveness of the registration statement of which this prospectus forms a part. |

All documents subsequently

filed with the Securities and Exchange Commission by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the

date of this prospectus and prior to the filing of a post-effective amendment which indicates that all securities offered herein have

been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be

part of this prospectus from the respective dates of filing of such documents. Any statement contained herein or in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes hereof or of the related Pro

Supp to the extent that a statement contained herein or in any other subsequently filed document which is also incorporated or deemed

to be incorporated herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except

as so modified or superseded, to constitute a part of this prospectus.

We will provide to each

person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated

by reference in the prospectus but not delivered with the prospectus. You may request a copy of these filings by written or oral request,

excluding the exhibits to such filings which we have not specifically incorporated by reference in such filings, at no cost, by writing

us at China Pharma Holdings, Inc., 2nd Floor, No. 17, Jinpan Road, Haikou, Hainan Province, China, or calling us at 86-10-898-66811730.

This prospectus is part of

a registration statement we filed with the Securities and Exchange Commission. You should only rely on the information or representations

contained in this prospectus and any accompanying Pro Supp. We have not authorized anyone to provide information other than that provided

in this prospectus and any accompanying Pro Supp. We are not making an offer of these securities in any state where the offer is not permitted.

You should not assume that the information in this prospectus or any accompanying Pro Supp is accurate as of any date other than the date

on the front of the document.

CHINA PHARMA HOLDINGS,

INC.

Up to $600,000 of Shares

of Common Stock

PROSPECTUS SUPPLEMENT

December 12, 2024

Prospectus

CHINA PHARMA HOLDINGS, INC.

$50,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

China Pharma Holdings, Inc. is a Nevada incorporated

holding company (“China Pharma”, the “Company”, “we”, “our” or “us”) with

all of its operations conducted in China through its subsidiaries. Through this prospectus, we may offer and sell, from time to time in

one or more offerings, any combination of common stock, preferred stock, debt securities (which may be convertible into or exchangeable

for common stock), warrants, rights or units that include any of these securities up to an aggregate offering price not exceeding $50,000,000.

When we decide to sell a particular class or series of securities, we will provide specific terms of the offered securities in a prospectus

supplement. The prospectus supplement may also add, update or change information contained in or incorporated by reference into this prospectus.

You should read both this prospectus and the accompanying prospectus supplement together with the additional information described under

the heading “Where You Can Find More Information” in this prospectus.

We may offer and sell these securities directly

to investors, through agents designated from time to time or to or through underwriters or dealers, including on a continuous or delayed

basis. For additional information on the methods of sale, you should refer to the section entitled “Plan of Distribution”

in this prospectus. If any agents or underwriters are involved in the sale of any securities with respect to which this prospectus is

being delivered, the names of such agents or underwriters and any applicable fees, commissions, discounts or over-allotment options will

be set forth in a prospectus supplement. The price to the public of such securities and the net proceeds we expect to receive from such

sale will also be set forth in a prospectus supplement.

Our common stock is traded on the NYSE American

(formerly known as AMEX) under the symbol “CPHI”. The closing price for our common stock on NYSE American on February 5,

2024 was $0.09 per share. Each prospectus supplement will contain information, where applicable, as to any listing on the NYSE American

or any other securities exchange of the securities covered by the prospectus supplement.

INVESTING IN OUR SECURITIES INVOLVES SUBSTANTIAL

RISKS. CHINA PHARMA IS NOT A CHINESE OPERATING COMPANY, BUT A HOLDING COMPANY INCORPORATED IN NEVADA. AS A HOLDING COMPANY WITH NO MATERIAL

OPERATIONS OF ITS OWN, THE COMPANY CONDUCTS A SUBSTANTIAL MAJORITY OF ITS OPERATIONS THROUGH THE OPERATING ENTITY ESTABLISHED IN THE PEOPLE’S

REPUBLIC OF CHINA (THE “PRC”), PRIMARILY THE COMPANY’S WHOLLY OWNED PRC SUBSIDIARY.

ADDITIONALLY, HELPSON, CHINA PHARMA’S

PRC SUBSIDIARY, IS SUBJECT TO CERTAIN LEGAL AND OPERATIONAL RISKS ASSOCIATED WITH ITS OPERATIONS IN CHINA. PRC LAWS AND REGULATIONS GOVERNING

HELPSON’S CURRENT BUSINESS OPERATIONS ARE SOMETIMES VAGUE AND UNCERTAIN, AND THEREFORE, THESE RISKS MAY RESULT IN A MATERIAL CHANGE

IN HELPSON’S OPERATIONS, SIGNIFICANT DEPRECIATION OF THE VALUE OF OUR COMMON STOCK, OR A COMPLETE HINDRANCE OF THE COMPANY’S

ABILITY TO OFFER OR CONTINUE TO OFFER ITS SECURITIES TO INVESTORS. RECENTLY, THE PRC GOVERNMENT INITIATED A SERIES OF REGULATORY ACTIONS

AND STATEMENTS TO REGULATE BUSINESS OPERATIONS IN CHINA WITH LITTLE ADVANCE NOTICE, INCLUDING CRACKING DOWN ON ILLEGAL ACTIVITIES IN THE

SECURITIES MARKET, ADOPTING NEW MEASURES TO EXTEND THE SCOPE OF CYBERSECURITY REVIEWS, AND EXPANDING THE EFFORTS IN ANTI-MONOPOLY ENFORCEMENT.

SINCE THESE STATEMENTS AND REGULATORY ACTIONS ARE NEW, IT IS HIGHLY UNCERTAIN HOW SOON LEGISLATIVE OR ADMINISTRATIVE REGULATION MAKING

BODIES WILL RESPOND AND WHAT EXISTING OR NEW LAWS OR REGULATIONS OR DETAILED IMPLEMENTATIONS AND INTERPRETATIONS WILL BE MODIFIED OR PROMULGATED,

IF ANY, AND THE POTENTIAL IMPACT OF SUCH MODIFIED OR NEW LAWS AND REGULATIONS WILL HAVE ON THE COMPANY’S DAILY BUSINESS OPERATION,

THE ABILITY TO ACCEPT FOREIGN INVESTMENTS AND LIST ON AN U.S. OR OTHER FOREIGN EXCHANGE.

ON FEBRUARY 17, 2023, THE CHINA SECURITIES

REGULATORY COMMISSION (THE “CSRC”), PROMULGATED THE TRIAL ADMINISTRATIVE MEASURES OF OVERSEAS SECURITIES OFFERING AND LISTING

BY DOMESTIC COMPANIES (THE “TRIAL MEASURES”), WHICH BECAME EFFECTIVE ON MARCH 31, 2023. ON THE SAME DATE, THE CSRC CIRCULATED

SUPPORTING GUIDANCE RULES NO.1 THROUGH NO.5, NOTES ON THE TRIAL MEASURES, NOTICE ON ADMINISTRATION ARRANGEMENTS FOR THE FILING OF OVERSEAS

LISTINGS BY DOMESTIC ENTERPRISES AND RELEVEANT CSRC ANSWERS TO REPORT OR QUESTIONS (COLLECTIVELY, THE “GUIDANCE RULES AND NOTICE”),

ON CSRC’S OFFICIAL WEBSITE. THE TRIAL MEAURES, TOGETHER WITH THE GUIDANCE RULES AND NOTICE REITERATE THE BASIC PRINCIPLES OF DRAFT

ADMINSTRATIVE PROVISIONS AND DRAFT FILING MEASURES AND IMPOSE SUBSTANTIALLY THE SAME REQUIREMENTS FOR THE OVERSEAS SECURITIES OFFERING

AND LISTING BY DOMESTIC ENTERPRISES, AND CLARIFIED AND EMPHASIZED SEVERAL ASPECTS. BECAUSE WE ARE ALREADY PUBLICLY LISTED IN THE U.S.,

THE TRIAL MEASURES AND THE GUIDANCE RULES AND NOTICE DO NOT IMPOSE OBVIOUS ADDITIONAL REGULATORY BURDEN ON US BEYOND THE OBLIGATION TO

REPORT TO THE CSRC AND COMPLY WITH THE FILING REQUIREMENTS ON ANY FUTURE OFFERINGS OF OUR SECURITIES, OR MATERIAL EVENTS SUCH AS A CHANGE

OF CONTROL OR DELISTING. AS THE TRIAL MEASURES AND THE GUIDANCE RULES AND NOTICE ARE NEWLY ISSUED, THERE REMAINS UNCERTAINTY AS TO HOW

THEY WILL BE INTERPRETED OR IMPLEMENTED. THEREFORE, WE ARE SUBJECT TO SUCH FILING REQUIREMENTS UNDER THE TRIAL MEASURES UPON FUTURE SUBSEQUENT

OFFERINGS, AND MAY BE SUBJECT TO ADDITIONAL FILING REQUIREMENTS AND, IF THERE ARE ANY CHANGES TO THE TRIAL MEASURES, AT THAT TIME WE

MAY NOT BE ABLE TO GET CLEARANCE FROM THE CSRC IN A TIMELY FASHION.

ON MAY 20, 2020, THE U.S. SENATE PASSED THE

HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT REQUIRING FOREIGN COMPANIES TO CERTIFY THEY ARE NOT OWNED OR CONTROLLED BY A FOREIGN GOVERNMENT

IF THE PCAOB IS UNABLE TO AUDIT SPECIFIED REPORTS BECAUSE THE COMPANY USES A FOREIGN AUDITOR NOT SUBJECT TO PCAOB INSPECTION. IF THE PCAOB

IS UNABLE TO INSPECT THE COMPANY’S AUDITORS FOR THREE CONSECUTIVE YEARS, THE ISSUER’S SECURITIES ARE PROHIBITED FROM TRADING

ON A U.S. STOCK EXCHANGE. ON DECEMBER 2, 2020, THE U.S. HOUSE OF REPRESENTATIVES APPROVED THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT.

ON DECEMBER 18, 2020, THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT WAS SIGNED INTO LAW. PURSUANT TO THE HOLDING FOREIGN COMPANIES ACCOUNTABLE

ACT, THE PCAOB ISSUED A DETERMINATION REPORT ON DECEMBER 16, 2021 WHICH FOUND THAT THE PCAOB IS UNABLE TO INSPECT OR INVESTIGATE COMPLETELY

REGISTERED PUBLIC ACCOUNTING FIRMS HEADQUARTERED IN: (1) MAINLAND CHINA OF THE PRC BECAUSE OF A POSITION TAKEN BY ONE OR MORE AUTHORITIES

IN MAINLAND CHINA; AND (2) HONG KONG, A SPECIAL ADMINISTRATIVE REGION AND DEPENDENCY OF THE PRC, BECAUSE OF A POSITION TAKEN BY ONE OR

MORE AUTHORITIES IN HONG KONG. ON AUGUST 26, 2022, THE PCAOB ANNOUNCED AND SIGNED A STATEMENT OF PROTOCOL (THE “PROTOCOL”)

WITH THE CHINA SECURITIES REGULATORY COMMISSION AND THE MINISTRY OF FINANCE OF THE PEOPLE’S REPUBLIC OF CHINA. THE PROTOCOL PROVIDES

THE PCAOB WITH: (1) SOLE DISCRETION TO SELECT THE FIRMS, AUDIT ENGAGEMENTS AND POTENTIAL VIOLATIONS IT INSPECTS AND INVESTIGATES, WITHOUT

ANY INVOLVEMENT OF CHINESE AUTHORITIES; (2) PROCEDURES FOR PCAOB INSPECTORS AND INVESTIGATORS TO VIEW COMPLETE AUDIT WORK PAPERS WITH

ALL INFORMATION INCLUDED AND FOR THE PCAOB TO RETAIN INFORMATION AS NEEDED; (3) DIRECT ACCESS TO INTERVIEW AND TAKE TESTIMONY FROM ALL

PERSONNEL ASSOCIATED WITH THE AUDITS THE PCAOB INSPECTS OR INVESTIGATES. OUR AUDITOR IS HEADQUARTERED IN SINGAPORE, SINGAPORE AND WILL

BE INSPECTED BY THE PCAOB ON A REGULAR BASIS.

OUR AUDITOR IS NOT SUBJECT TO THE DETERMINATION.

OUR AUDITOR IS SUBJECT TO LAWS IN THE UNITED STATES PURSUANT TO WHICH THE PCAOB CONDUCTS REGULAR INSPECTIONS TO ASSESS OUR AUDITOR’S

COMPLIANCE WITH THE APPLICABLE PROFESSIONAL STANDARDS. ON JUNE 22, 2021, THE U.S. SENATE PASSED THE ACCELERATING HOLDING FOREIGN COMPANIES

ACCOUNTABLE ACT (“AHFCAA”) WHICH, PROPOSED TO REDUCE THE NUMBER OF CONSECUTIVE NON-INSPECTION YEARS REQUIRED FOR TRIGGERING

THE PROHIBITIONS UNDER THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT FROM THREE YEARS TO TWO. ON DECEMBER 29, 2022, THE CONSOLIDATED APPROPRIATIONS

ACT, 2023 (THE “CAA”) WAS SIGNED INTO LAW, WHICH OFFICIALLY REDUCED THE NUMBER OF CONSECUTIVE NON-INSPECTION YEARS REQUIRED

FOR TRIGGERING THE PROHIBITIONS UNDER THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT FROM THREE YEARS TO TWO, THUS, REDUCING THE TIME BEFORE

AN APPLICABLE ISSUER’S SECURITIES MAY BE PROHIBITED FROM TRADING OR DELISTED. CURRENTLY, OUR AUDITOR IS SUBJECT TO INSPECTION BY

PCAOB. HOWEVER, IF AHFCAA WERE ENACTED INTO LAW, IT MAY POSE MORE RISKS OF POTENTIAL DELISTING AS WELL AS DEPRESS THE PRICE OF COMPANY’S

COMMON STOCK. ON DECEMBER 15, 2022, THE PCAOB ISSUED A NEW DETERMINATION REPORT WHICH CONCLUDED THAT IT WAS ABLE TO INSPECT AND INVESTIGATE

COMPLETELY PCAOB-REGISTERED ACCOUNTING FIRMS HEADQUARTERED IN MAINLAND CHINA AND HONG KONG IN 2022, AND THE PCAOB VACATED THE DECEMBER

16, 2021 DETERMINATION REPORT. SHOULD THE PCAOB AGAIN ENCOUNTER IMPEDIMENTS TO INSPECTIONS AND INVESTIGATIONS IN MAINLAND CHINA OR HONG

KONG AS A RESULT OF POSITIONS TAKEN BY ANY AUTHORITY IN EITHER JURISDICTION, INCLUDING BY THE CSRC OR THE MOF, THE PCAOB WILL MAKE DETERMINATIONS

UNDER THE HFCAA AS AND WHEN APPROPRIATE. HOWEVER, WHETHER THE PCAOB WILL CONTINUE TO CONDUCT INSPECTIONS AND INVESTIGATIONS COMPLETELY

TO ITS SATISFACTION OF PCAOB-REGISTERED PUBLIC ACCOUNTING FIRMS HEADQUARTERED IN MAINLAND CHINA AND HONG KONG IS SUBJECT TO UNCERTAINTY

AND DEPENDS ON A NUMBER OF FACTORS OUT OF CHINA PHARMA’S, AND CHINA PHARMA’S AUDITOR’S, CONTROL, INCLUDING POSITIONS

TAKEN BY AUTHORITIES OF THE PRC. THE PCAOB IS EXPECTED TO CONTINUE TO DEMAND COMPLETE ACCESS TO INSPECTIONS AND INVESTIGATIONS AGAINST

ACCOUNTING FIRMS HEADQUARTERED IN MAINLAND CHINA AND HONG KONG IN THE FUTURE AND STATES THAT IT HAS ALREADY MADE PLANS TO RESUME REGULAR

INSPECTIONS IN EARLY 2023 AND BEYOND. THE PCAOB IS REQUIRED UNDER THE HOLDING FOREIGN COMPANIES ACCOUNTABLE ACT TO MAKE ITS DETERMINATION

ON AN ANNUAL BASIS WITH REGARDS TO ITS ABILITY TO INSPECT AND INVESTIGATE COMPLETELY ACCOUNTING FIRMS BASED IN THE MAINLAND CHINA AND

HONG KONG. SHOULD THE PCAOB AGAIN ENCOUNTER IMPEDIMENTS TO INSPECTIONS AND INVESTIGATIONS IN MAINLAND CHINA OR HONG KONG AS A RESULT OF

POSITIONS TAKEN BY ANY FOREIGN AUTHORITY INCLUDING BUT IS NOT LIMITED TO MAINLAND CHINA OR HONG KONG JURISDICTION, THE PCAOB WILL ACT

EXPEDITIOUSLY TO CONSIDER WHETHER IT SHOULD ISSUE A NEW DETERMINATION.

THE CHINESE REGULATORY AUTHORITIES COULD DISALLOW

THE COMPANY’S STRUCTURE, WHICH COULD RESULT IN A MATERIAL CHANGE IN THE COMPANY’S OPERATIONS AND THE VALUE OF THE COMPANY’S

SECURITIES COULD DECLINE OR BECOME WORTHLESS. FOR A DESCRIPTION OF THE COMPANY’S CORPORATE STRUCTURE, SEE “PROSPECTUS SUMMARY”

STARTING PAGE 1. SEE ALSO “RISK FACTORS - RISKS RELATED TO DOING BUSINESS IN CHINA” INCORPORATED BY REFERENCE INTO THIS PROSPECTUS.

SEE THE SECTION TITLED “RISK FACTORS”

BEGINNING ON PAGE 4 OF THIS PROSPECTUS, AND THE RISK FACTORS IN ANY ACCOMPANYING PROSPECTUS SUPPLEMENT TO READ ABOUT FACTORS YOU SHOULD

CONSIDER BEFORE BUYING SHARES OF CHINA PHARMA’S COMMON STOCK.

OUR SUBSIDIARIES HAVE NEVER ISSUED ANY DIVIDENDS

OR DISTRIBUTIONS TO US, OR TO ANY INVESTORS AS OF THE DATE OF THIS PROSPECTUS. HELPSON, OUR PRC SUBSIDIARY, GENERATES AND RETAINS CASH

GENERATED FROM OPERATING ACTIVITIES AND RE-INVEST IT IN DAILY BUSINESS. IN THE FUTURE, CASH PROCEEDS RAISED FROM OVERSEAS FINANCING ACTIVITIES

AND THE EXERCISE OF WARRANTS BY WARRANT HOLDERS, MAY BE TRANSFERRED BY US TO HELPSON VIA CAPITAL CONTRIBUTION AND SHAREHOLDER LOANS, AS

THE CASE MAY BE.

THE MAJORITY OF OUR INCOME IS RECEIVED IN RENMINBI

(“RMB”) AND RESTRICTIONS IN FOREIGN CURRENCIES MAY LIMIT THE COMPANY’S ABILITY TO PAY DIVIDENDS OR OTHER PAYMENTS, OR

OTHERWISE SATISFY THE COMPANY’S FOREIGN CURRENCY DENOMINATED OBLIGATIONS, IF ANY. UNDER EXISTING PRC FOREIGN EXCHANGE REGULATIONS,

PAYMENTS OF CURRENT ACCOUNT ITEMS, INCLUDING PROFIT DISTRIBUTIONS, INTEREST PAYMENTS AND EXPENDITURES FROM TRADE-RELATED TRANSACTIONS,

CAN BE MADE IN FOREIGN CURRENCIES WITHOUT PRIOR APPROVAL FROM THE STATE ADMINISTRATION OF THE FOREIGN EXCHANGE (“SAFE”) IN

THE PRC AS LONG AS CERTAIN PROCEDURAL REQUIREMENTS ARE MET. APPROVAL FROM APPROPRIATE GOVERNMENT AUTHORITIES IS REQUIRED IF RMB IS CONVERTED

INTO FOREIGN CURRENCY AND REMITTED OUT OF THE PRC TO PAY CAPITAL EXPENSES SUCH AS THE REPAYMENT OF LOANS DENOMINATED IN FOREIGN CURRENCIES.

THE PRC GOVERNMENT MAY, AT ITS DISCRETION, IMPOSE RESTRICTIONS ON ACCESS TO FOREIGN CURRENCIES FOR CURRENT ACCOUNT TRANSACTIONS AND IF

THIS OCCURS IN THE FUTURE, WE MAY NOT BE ABLE TO PAY DIVIDENDS IN FOREIGN CURRENCIES TO OUR STOCKHOLDERS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is February 6,

2024

Table

of Contents

You should rely only on the information contained

or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized anyone to provide you with information

different from that contained or incorporated by reference into this prospectus. If any person does provide you with information that

differs from what is contained or incorporated by reference in this prospectus, you should not rely on it. No dealer, salesperson or other

person is authorized to give any information or to represent anything not contained in this prospectus. You should assume that the information

contained in this prospectus or any prospectus supplement is accurate only as of the date on the front of the document and that any information

contained in any document we have incorporated by reference is accurate only as of the date of the document incorporated by reference,

regardless of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. These documents are not

an offer to sell or a solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

ABOUT THIS PROSPECTUS

This prospectus is part of

a Registration Statement on Form S-3 that we filed with the Securities and Exchange Commission utilizing a “shelf” registration

process. Under this shelf process, we may sell common stock, preferred stock, debt securities (which may be convertible into or exchangeable

for common stock), warrants, rights or units from time to time in one or more offerings at indeterminate prices, up to an aggregate offering

price for all such securities of $50,000,000. This prospectus provides you with a general description of the securities we may offer.

Each time we sell any securities under this prospectus, we will provide a prospectus supplement that will contain specific information

about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. You

should read both this prospectus and any prospectus supplement together with additional information described below under the heading

“Where You Can Find More Information.”

You should rely only on the

information contained in or incorporated by reference in this prospectus, any accompanying prospectus supplement or in any related free

writing prospectus filed by us with the SEC. China Pharma has not authorized anyone to provide you with different information. This prospectus

and the accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities other

than the securities described in the accompanying prospectus supplement or an offer to sell or the solicitation of an offer to buy such

securities in any circumstances in which such offer or solicitation is unlawful. Persons who come into possession of this prospectus in

jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and

the distribution of this prospectus applicable to those jurisdictions. You should assume that the information appearing in this prospectus,

any prospectus supplement, the documents incorporated by reference and any related free writing prospectus is accurate only as of their

respective dates, and our business, financial condition, results of operations and prospects may have changed since such date. Other than

as required under the federal securities laws, we undertake no obligation to publicly update or revise such information, whether as a

result of new information, future events or any other reason.

This prospectus and any accompanying

prospectus supplement or other offering materials do not contain all of the information included in the registration statement as permitted

by the rules and regulations of the SEC. For further information, we refer you to the registration statement on Form S-3, including its

exhibits. We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and, therefore, file reports and other information with the SEC. Statements contained in this prospectus and any accompanying prospectus

supplement, or other offering materials about the provisions or contents of any agreement or other document are only summaries. If SEC

rules require that any agreement or document be filed as an exhibit to the registration statement, you should refer to that agreement

or document for its complete contents.

You should not assume that

the information in this prospectus, any prospectus supplement or any other offering materials is accurate as of any date other than the

date on the front of each document. Our business, financial condition, results of operations and prospects may have changed since then.

Unless otherwise stated in

this prospectus, references to:

| |

● |

“China” or the “PRC” refers to the People’s Republic of China, excluding, for the purposes of this prospectus only, Hong Kong, Macau and Taiwan; |

| |

|

|

| |

● |

“Helpson” refers to Hainan Helpson Medical & Biotechnology Co., Ltd. |

| |

|

|

| |

● |

“Onny” refers to Onny Investment Ltd. |

| |

|

|

| |

● |

“RMB” and “Renminbi” refer to the legal currency of China; and |

| |

|

|

| |

● |

“US$,” “U.S. dollars,” “$,” and “dollars” refer to the legal currency of the United States. |

We use RMB as the functional

currency and U.S. dollars as reporting currency in our financial statements and in this prospectus. Monetary assets and liabilities denominated

in Renminbi are translated into U.S. dollars at the rates of exchange as of the balance sheet date, equity accounts are translated at

historical exchange rates, and revenues, expenses, gains and losses are translated using the average rate for the period. In other parts

of this prospectus, any Renminbi denominated amounts are accompanied by translations. We make no representation that the Renminbi or U.S.

dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars or Renminbi, as the case may be,

at any particular rate or at all. The PRC government restricts or prohibits the conversion of Renminbi into foreign currency and foreign

currency into Renminbi for certain types of transactions.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in

this Form S-3 that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act, and

Section 21E of the Exchange Act. These include statements about the Company’s expectations, beliefs, intentions or strategies for

the future, which are indicated by words or phrases such as “anticipate”, “expect”, “intend”, “plan”,

“will”, “the Company believes”, “management believes” and similar words or phrases. The forward-looking

statements are based on the Company’s current expectations and are subject to certain risks, uncertainties and assumptions. The

Company’s actual results could differ materially from results anticipated in these forward-looking statements. All forward-looking

statements included in this document are based on information available to the Company on the date hereof, and the Company assumes no

obligation to update any such forward-looking statements.

These forward-looking statements

are neither promises nor guarantees of future performance, due to a variety of risks and uncertainties and other factors more fully discussed

in the “Risk Factors” section in this prospectus, the section of any accompanying prospectus supplement entitled “Risk

Factors” and the risk factors and cautionary statements described in other documents that China Pharma files from time to time with

the SEC. Given these uncertainties, readers should not place undue reliance on China Pharma’s forward-looking statements. These

forward-looking statements speak only as of the date on which the statements were made and are not guarantees of future performance. Except

as may be required by applicable law, China Pharma does not undertake to update any forward-looking statements after the date of this

prospectus or the respective dates of documents incorporated by reference herein or therein that include forward-looking statements.

Except as required by law,

China Pharma assumes no obligation to update these forward-looking statements publicly, or to revise any forward-looking statements to

reflect events or developments occurring after the date of this prospectus, even if new information becomes available in the future.

PROSPECTUS

SUMMARY

Organization and Nature of Operations

China Pharma, a Nevada corporation,

owns 100% of Onny, a British Virgin Islands corporation, which owns 100% of Helpson, a company organized under the laws of the People’s

Republic of China (the “PRC”).

Onny acquired 100% of the

ownership in Helpson on May 25, 2005, by entering into an Equity Transfer Agreement with Helpson’s three former shareholders. The

transaction was approved by the Commercial Bureau of Hainan Province on June 12, 2005 and Helpson received the Certificate of Approval

for Establishment of Enterprises with Foreign Investment in the PRC on the same day. Helpson received its business license evidencing

its WFOE (Wholly Foreign Owned Enterprise) status on June 21, 2005.

Our corporate organizational

chart is set forth below:

Helpson has acquired and continues

to acquire well-accepted medical formulas to add to its diverse portfolio of Western and Chinese medicines.

Business Overview & Recent Developments

Helpson is principally engaged in the development, manufacture and

marketing of pharmaceutical products for human use in connection with a variety of high-incidence and high-mortality diseases and medical

conditions prevalent in the PRC. As a Nevada holding company without any operations, all of China Pharma’s operations are conducted

in the PRC, where the manufacturing facilities are located, through Helpson, China Pharma’s indirectly wholly owned PRC subsidiary.

Helpson manufactures pharmaceutical products in the form of dry powder injectables, liquid injectables, tablets, capsules, and cephalosporin

oral solutions. The majority of our pharmaceutical products are sold on a prescription basis and all have been approved for at least one

or more therapeutic indications by the National Medical Products Administration (the “NMPA”, formerly China Food and Drug

Administration, CFDA) based upon demonstrated safety and efficacy.

As

of the date of this prospectus, Helpson manufactured 19 pharmaceutical products for a wide variety of diseases and medical indications,

each of which may be classified into one of three general categories:

| |

● |

Basic generic drugs, which are common drugs in the PRC for which there is a very large market demand; |

| |

● |

First-to-market generic drugs, which are generic western drugs that are new to the PRC marketplace; or |

| |

● |

Modern Traditional Chinese Medicines, which are generally comprised of non-synthetic, plant-based medicinal compounds that have been widely used in the PRC for thousands of years. Helpson applies modern production techniques to produce pharmaceutical products in different formulations, such as tablets, capsules or powders. |

In

selecting generic drugs to develop and manufacture, Helpson considers several factors, including the number of other manufacturers currently

producing this particular drug, the size of the market for that drug, the proposed or required method of distribution, the existing and

expected pricing for that particular drug in the marketplace, the costs of manufacturing that drug, and the costs of acquiring or developing

the formula for that drug. Helpson believes that generic drugs that it has selected to manufacture have large addressable markets and

higher profit margins relative to other generic drugs manufactured and distributed in the PRC.

In

addition, Helpson manufactured comprehensive healthcare products and protective products in two production facilities it owns and operates

in Haikou, Hainan Province, PRC. One has a construction area of 663.94 square meters, the other factory has two buildings with production

area of 20,282.42 square meters and 6,593.20 square meters.

China’s consistency

evaluation of generic drugs continued to proceed in 2023. Helpson has always taken the task of promoting the consistency evaluation as

a top priority, and worked on them actively. However, for each drug’s consistency evaluation, due to the continuous dynamic changes

of the detailed consistency evaluation policies, market trends, expected investments, and expected returns of investment (“ROI”),

all companies in this industry have been adjusting to the policies under consistency evaluation. One of the flagship products, Candesartan

tablets, a hypertension product, passed generic-drug-consistency-evaluation in early August 2023.

Helpson has taken a more cautious

and flexible attitude towards the initiating and progressing any project for an existing product’s consistency evaluation and to

cope with the changing macro environment of drug sales in China. Since initiated in 2018, when relevant Chinese authorities decided to

implement trial Centralized Procurement (“CP”) activities in 11 selected pilot cities (including four municipalities and seven

other cities), nine rounds of CP activities have been carried out as of November 6, 2023, which significantly reduced the price of

the drugs that won the bids. In addition, the consistency evaluation has been adopted as one of the qualification standards for participating

in the GPO activities. As a result, Helpson must balance at least the investment of financial resources and time to obtain the qualification

of CP, and the sharp decline in the price of drugs included in CP, before making decisions for any products.

In addition, Helpson continues

to explore the field of comprehensive healthcare. Comprehensive healthcare is a general concept proposed by the Chinese government according

to the development of the times, social needs and changes in disease spectrum. According to the Outline of “Healthy China 2030”

issued by Chinese government in October 2016, the total size of China’s health service industry is expected to reach RMB 16 trillion

(approximately $2.5 trillion) by 2030. This industry focuses on people’s daily life, aging and diseases, pays attention to all kinds

of risk factors and misunderstandings affecting health, calls for self-health management, and advocates the comprehensive care throughout

the entire process of life. It covers all kinds of health-related information, products, and services, as well as actions taken by various

organizations to meet the health needs. In response to this trend, Helpson launched Noni enzyme, a natural, Xeronine-rich antioxidant

food supplement at the end of 2018. Helpson also launched wash-free sanitizers and masks, in 2020, to address the market needs caused

by COVID-19 in China. As Chinese government officially terminated its zero-case policy, now the responsibility to protect people from

the impact of COVID-19 falls more to the citizens themselves, and masks and sanitizers have been more and more popular due to increasing

demand. Helpson has sufficient production capacity for medical masks, surgical masks, KN95 masks, and N95 masks, which meets the personal

needs for protection against the epidemic outbreak. Thanks to the green channel provided by Hainan Medical Products Administration, Helpson

received the Registration Certificate of N95 medical protective mask at the fastest speed by the end of 2022, when the infection of COVID-19

had surged in China.

Helpson plans to continue

to optimize its product structure and actively respond to the current health needs of human beings.

Market Trends

As a generic drug company,

Helpson is presented with a huge domestic market. We believe that through further upgrades and consistency evaluations, which are based

on European and American production standards, Helpson will be able to export the products to overseas markets. In China’s market,

we believe that in the future, cost management and control ability will gradually become an important factor in determining the competitiveness

of generic pharmaceutical enterprises. Although price control leads to a decline in the profitability, the CP’s winning enterprise

has a good chance of achieving price-for-volume in order to increase its market share and support its continuous innovation transformation.

Additionally, rising and advancing consumer demand in China drives increases in discretionary consumption, and with the improvement of

residents’ quality of life, the healthcare demand is also changing. We believe that there are a large number of unmet demands in comprehensive

healthcare and Internet healthcare sectors.

In addition, the Office of

the State Council issued “Pilot Plan for Marketing Authorization Holders” on May 24, 2016, allowing eligible drug research

and development institutions and scientific researchers to become Marketing Authorization Holders (“MAH”) by obtaining drug

marketing authorization and drug approval numbers from the State Council. This policy uses a management model of separating drug marketing

authorization and drug production licenses, thereby allowing MAHs to produce pharmaceuticals themselves or to consign production to other

pharmaceutical manufacturers. This policy not only transitions our production practices to meet the European and United States standards

by separating drug approval and production qualifications, thereby changing the existing model of bundling drug approval numbers to pharmaceutical

manufacturers in China, but also serves as a supplement to the ongoing consistency evaluations policy.

In general, demand for pharmaceutical

products is still experiencing steady growth in China. We believe the ongoing generic drug consistency evaluations and reform of China’s

drug production registration and review policies will have major effects on the future development of our industry and may change its

business patterns. Helpson will continue to actively adapt to the national policy guidance and further evaluate market conditions for

its existing products, and competition in the market in order to optimize its development strategy.

Intercompany activities between the holding company and our subsidiaries

As of the date of this

prospectus, none of our subsidiaries have distributed any dividends to China Pharma, nor has China Pharma distributed any dividends to

its investors. China Pharma currently has no intention to distribute earnings to its stockholders and investors. The tables below present

cash flow transfer between China Pharma and Helpson, through China Pharma’s wholly owned subsidiary Onny for the years ended December

31, 2022 and 2021. China Pharma’s management believes that there are no tax consequences for cash flow transfers between China

Pharma and Helpson through Onny.

| For the year ended December 31, 2022 |

| No. |

|

Transfer from |

|

Transfer to |

|

Approximate value ($) |

|

|

Note |

| 1 |

|

China Pharma (via Onny) |

|

Helpson |

|

|

1,300,000 |

|

|

For Helpson’s operations |

| For the year ended December 31, 2021 |

| No. |

|

Transfer from |

|

Transfer to |

|

Approximate value ($) |

|

|

Note |

| 1 |

|

China Pharma (via Onny) |

|

Helpson |

|

|

3,000,000 |

|

|

For Helpson’s operations |

| 2 |

|

Helpson (via Onny) |

|

China Pharma |

|

|

320,000 |

|

|

For the payment of the agent service fees of China Pharma |

Executive Offices

Our principal executive offices

are located at 2nd Floor, No. 17, Jinpan Road, Haikou, Hainan Province, China. Our telephone number at that address is +86-898-66811730.

RISK FACTORS

Investing in our common stock

involves risk. You should carefully consider the specific risks discussed or incorporated by reference into the applicable prospectus

supplement, together with all the other information contained in the prospectus supplement or incorporated by reference into this prospectus

and the applicable prospectus supplement. You should also consider the risks, uncertainties and assumptions discussed under the caption

“Risk Factors” included in our Annual Report on Form 10-K for the year ended December 31, 2022, and in subsequent filings,

which are incorporated by reference into this prospectus. These risk factors may be amended, supplemented or superseded from time to time

by other reports we file with the SEC in the future or by a prospectus supplement relating to a particular offering of securities. These

risks and uncertainties are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us,

or that we currently view as immaterial, may also impair our business. If any of the risks or uncertainties described in our SEC filings

or any prospectus supplement or any additional risks and uncertainties actually occur, our business, financial condition and results of

operations could be materially and adversely affected. In that case, the trading price of our securities could decline and you might lose

all or part of your investment.

Risks Related to Doing Business in China

There

are Legal and Operational Risks Associated with Having the Majority of the Company’s Operations in the PRC.

The

PRC legal system is based on written statutes. The laws, regulations and legal requirements of China are relatively new and change often,

and their interpretation and enforcement depend to a large extent on relevant government policy and involve significant uncertainties

that could limit the reliability of the legal protections available to us.

The

PRC government has broad discretion in dealing with violations of laws and regulations, including levying fines, revoking business and

other licenses and requiring actions necessary for compliance. We cannot predict the effect of the interpretation of existing or new PRC

laws or regulations on our businesses. We cannot assure you that our current ownership and operating structure would not be found in violation

of any current or future PRC laws or regulations. As a result, we may be subject to sanctions, including fines, and could be required

to restructure our operations or cease to provide certain services.

In

addition, the enforcement of laws and regulations in China can change quickly with little advance notice. In 2021, the PRC government

initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including

cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas, adopting

new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements

and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and

what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and

the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign

investments and list on an U.S. or other foreign exchange. Any action by the Chinese government to exert more oversight and control over

foreign investment in China-based companies could result in a material change in our operation, cause the value of our shares to significantly

decline or become worthless, and significantly limit, or completely hinder our ability to offer or continue to offer our shares to investors

and cause the value of such securities to significantly decline or be worthless.

We

cannot predict the effects of future developments in government policy or the PRC legal system in general. We may be required in the future

to procure additional permits, authorizations and approvals for our existing and future operations, which may not be obtainable in a timely

fashion or at all, or may involve substantial costs and unforeseen risks.

Certain PRC regulations may make it more difficult

for us to pursue growth through acquisitions.

Anti-Monopoly

Law of the People’s Republic of China promulgated by the Standing Committee of the National People’s Congress, which became

effective in 2008 and amended in 2022 (“Anti-Monopoly Law”), established additional procedures and requirements that could

make merger and acquisition activities by foreign investors more time-consuming and complex. Such regulation requires, among other things,

that State Administration for Market Regulation (“SAMR”) be notified in advance of any change-of-control transaction in which

a foreign investor acquires control of a PRC domestic enterprise or a foreign company with substantial PRC operations, if certain thresholds

under the Provisions of the State Council on the Standard for Declaration of Concentration of Business Operators, issued by the State

Council in 2008 and amended in 2018, are triggered. Moreover, the Anti-Monopoly Law requires that transactions which involve the national

security, the examination on the national security shall also be conducted according to the relevant provisions of the State. In addition,

PRC Measures for the Security Review of Foreign Investment which became effective in January 2021 require acquisitions by foreign investors

of PRC companies engaged in military-related or certain other industries that are crucial to national security be subject to security

review before consummation of any such acquisition. We may pursue potential strategic acquisitions that are complementary to our business

and operations.

Complying

with the requirements of these regulations to complete such transactions could be time-consuming, and any required approval processes,

including obtaining approval or clearance from the MOFCOM, may delay or inhibit our ability to complete such transactions, which could

affect our ability to expand our business or maintain our market share.

The Chinese government

may intervene or influence our business or operations at any time. Any such intervention or influence may negatively affect our operation

or interfere with our continued listing on a U.S. exchange, and could cause the value of our shares to significantly decline or be worthless,

which would materially affect the interest of our stockholders.

The Chinese central or

local governments may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures

and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, Chinese government actions in

the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy

or regional or local variations in the implementation of economic policies, could have a significant adverse effect on economic conditions

in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

As such, our business

segments may be subject to various government and regulatory interference in the provinces in which they operate. We could be subject

to regulation by various political and regulatory entities, including various local and municipal agencies and government sub-divisions.

We may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to

comply. The Chinese government may intervene or influence our operations at any time with little advance notice, which could result in

a material change in our operations and in the value of our shares.

Adverse regulatory developments

in China may subject us to additional regulatory review, and additional disclosure requirements and regulatory scrutiny to be adopted

by the SEC in response to risks related to recent regulatory developments in China may impose additional compliance requirements for companies