false

0000842518

0000842518

2024-12-20

2024-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 20, 2024

EVANS BANCORP, INC.

(Exact name of the registrant as specified in

its charter)

| New York |

001-35021 |

16-1332767 |

|

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| 6460 Main Street |

|

|

| Williamsville, New York |

|

14221 |

| (Address of principal executive offices) |

|

(Zip Code) |

(716) 926-2000

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2.

below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.50 per share |

|

EVBN |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

On December 20, 2024, Evans Bancorp,

Inc. (the “Company”) held a Special Meeting of Shareholders (the “Special Meeting”). At the close of business

on the record date for the Special Meeting, there were a total of 5,541,064 shares of Company common stock outstanding and entitled to

vote at the Special Meeting. At the Special Meeting, 4,158,715 shares of common stock were represented, therefore a quorum was present.

At the Special Meeting, the Company’s shareholders voted on three proposals, as more specifically described in the proxy statement/prospectus

of the Company and NBT Bancorp Inc. (“NBT”), dated November 7, 2024 (the “proxy statement/prospectus”). Set forth

below are the final results of shareholder votes for all proposals.

Proposal 1 – Merger Proposal

A proposal to approve the Agreement and Plan of

Merger, by and among NBT, NBT Bank, National Association, the Company, and Evans Bank, National Association, dated as of September 9,

2024, pursuant to which (i) the Company will merge with and into NBT, with NBT as the surviving entity, and (ii) Evans Bank will merge

with and into NBT Bank, with NBT Bank as the surviving entity, was approved by the requisite two-thirds of all outstanding shares of the

Company entitled to vote on the proposal, as indicated below:

| For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| | 3,997,476 | | |

| 98,702 | | |

| 62,536 | | |

| — | |

Proposal 2 – Compensation Proposal

A proposal to approve, on an advisory (non-binding)

basis, specified compensation that may become payable to the named executive officers of the Company in connection with the merger was

approved by the requisite majority of votes cast by shareholders at the Special Meeting, as indicated below:

| For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| | 3,846,140 | | |

| 225,097 | | |

| 87,477 | | |

| — | |

Proposal 3 – Adjournment Proposal

A proposal to approve one or more adjournments

of the Special Meeting, if necessary, to permit further solicitation of proxies if there are insufficient votes at the time of the Special

Meeting, or at an adjournment or postponement of the Special Meeting, to approve the merger proposal was approved by the requisite majority

of votes cast by shareholders at the Special Meeting, as indicated below:

| For | | |

Against | | |

Abstain | | |

Broker Non-Votes | |

| | 3,973,881 | | |

| 123,434 | | |

| 61,399 | | |

| — | |

Although the adjournment proposal was approved,

the adjournment of the Special Meeting was not necessary because the Company’s shareholders approved the merger proposal.

On December 20, 2024, the Company and NBT issued

a press release announcing that they had received the requisite regulatory approvals and waivers from the Office of the Comptroller

of the Currency and the Federal Reserve Bank of New York necessary for NBT to complete its acquisition of the Company and Evans Bank and

that the Company’s shareholders had voted to approve the merger. A copy of the press release is attached as Exhibit 99.1

to this Current Report on Form 8-K and is incorporated herein by reference.

Forward Looking Statements

This report contains forward-looking statements

as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements about NBT and the Company and their

industry involve substantial risks and uncertainties. Statements other than statements of current or historical fact, including statements

regarding NBT’s or the Company’s future financial condition, results of operations, business plans, liquidity, cash flows,

projected costs, and the impact of any laws or regulations applicable to NBT or the Company, are forward-looking statements. Words such

as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,”

“plans,” “projects,” “may,” “will,” “should” and other similar expressions

are intended to identify these forward-looking statements. Such statements are subject to factors that could cause actual results to differ

materially from anticipated results.

Among the risks and uncertainties that could cause

actual results to differ from those described in the forward-looking statements include, but are not limited to the following: (1) the

businesses of NBT and the Company may not be combined successfully, or such combination may take longer to accomplish than expected; (2)

the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer

loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected;

(4) the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or

events; (5) diversion of management’s attention from ongoing business operations and opportunities; (6) the possibility that the

parties may be unable to achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all

and to successfully integrate the Company’s operations and those of NBT; (7) such integration may be more difficult, time consuming

or costly than expected; (8) revenues following the proposed transaction may be lower than expected; (9) NBT’s and the Company’s

success in executing their respective business plans and strategies and managing the risks involved in the foregoing; (10) the dilution

caused by NBT’s issuance of additional shares of its capital stock in connection with the proposed transaction; (11) changes in

general economic conditions, including changes in market interest rates and changes in monetary and fiscal policies of the federal government;

and (12) legislative and regulatory changes. Further information about these and other relevant risks and uncertainties may be found in

NBT’s and the Company’s respective Annual Reports on Form 10-K for the fiscal year ended December 31, 2023 and in subsequent

filings with the Securities and Exchange Commission.

Forward-looking statements speak only as of the

date they are made. NBT and the Company do not undertake, and specifically disclaim any obligation, to publicly release the result of

any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements. You are cautioned not to place undue reliance on these forward-looking statements.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

|

|

| |

Evans

Bancorp, Inc. |

| |

|

|

| December

20, 2024 |

By: |

/s/

David J. Nasca |

| |

|

Name:

David J. Nasca |

| |

|

Title:

President and Chief Executive Officer |

Exhibit 99

FOR IMMEDIATE

RELEASE

NBT Bancorp Inc.

Receives Regulatory Approval,

Evans Bancorp, Inc. Shareholders Approve Merger

NORWICH, NY AND WILLIAMSVILLE, NY (December 20, 2024) – NBT Bancorp

Inc. (“NBT”) (NASDAQ: NBTB) announced that it has received regulatory approval to complete the proposed merger (the “Merger”)

of Evans Bancorp, Inc. (“Evans”) (NYSE American: EVBN) with and into NBT and Evans Bank, N.A. (“Evans Bank”) with

and into NBT Bank, N.A. (“NBT Bank”). The Office of the Comptroller of the Currency approved the merger of Evans Bank

with and into NBT Bank, and NBT received a waiver from the Federal Reserve Bank of New York for any application with respect to the

merger of Evans with and into NBT.

On December 20, 2024, the shareholders of Evans voted to approve the

Merger. Evans reported over 75% of the issued and outstanding shares of Evans were represented at a special shareholder meeting and over

96% of the votes cast were voted to approve the Merger.

“We are pleased that we have received the necessary regulatory

approvals to proceed with the Merger and that Evans shareholders have demonstrated strong support for the partnership that will bring

NBT and Evans together,” said NBT President and CEO Scott A. Kingsley. “Team members from NBT and Evans have been working

closely to plan for a smooth transition in the second quarter of 2025, and we look forward to continuing to build on the relationships

Evans has established with their customers, communities and shareholders as we extend NBT’s footprint in Upstate New York into the

attractive Buffalo and Rochester markets.”

“These approvals are important milestones in the merger process,

and we are grateful that Evans shareholders have so positively endorsed this strategic partnership,” said David J. Nasca, Evans

President and Chief Executive Officer. “Joining the NBT family will benefit our customers and communities as they will continue

to be served by a combined organization that upholds our shared culture and values, maintains our relationship-focused approach, and offers

an elevated suite of financial products and services.”

On September 9, 2024, NBT, Evans, NBT Bank and Evans Bank entered into

an Agreement and Plan of Merger pursuant to which Evans will merge with and into NBT in an all-stock transaction, and immediately after,

Evans Bank will merge with and into NBT Bank. This Merger will bring together two highly respected banking companies and extend NBT’s

growing footprint into Western New York. The Merger is expected to close in the second quarter of 2025 in conjunction with the system

conversion, pending customary closing conditions.

About NBT Bancorp Inc.

NBT Bancorp Inc. is a financial holding company headquartered

in Norwich, NY, with total assets of $13.84 billion at September 30, 2024. NBT primarily operates through NBT

Bank, N.A., a full-service community bank, and through two financial services companies. NBT Bank, N.A. has 155 banking locations

in New York, Pennsylvania, Vermont, Massachusetts, New Hampshire, Maine and Connecticut. EPIC

Retirement Plan Services, based in Rochester, NY, is a national benefits administration firm. NBT Insurance Agency, LLC, based

in Norwich, NY, is a full-service insurance agency. More information about NBT and its divisions is available online at: www.nbtbancorp.com, www.nbtbank.com, www.epicrps.com and https://www.nbtbank.com/Insurance.

About Evans Bancorp, Inc.

Evans is a financial holding company headquartered in Williamsville,

NY, with total assets of $2.28 billion at September 30, 2024. Its primary subsidiary, Evans Bank, N.A., is a full-service community bank

with 18 branches providing comprehensive financial services to consumer, business and municipal customers throughout Western New York.

More information about Evans is available online at www.evansbancorp.com and www.evansbank.com.

Forward-Looking Statements

This communication contains forward-looking statements as defined in

the Private Securities Litigation Reform Act of 1995. Such forward-looking statements about NBT and Evans and their industry involve substantial

risks and uncertainties. Statements other than statements of current or historical fact, including statements regarding NBT’s or

Evans’ future financial condition, results of operations, business plans, liquidity, cash flows, projected costs, and the impact

of any laws or regulations applicable to NBT or Evans, are forward-looking statements. Words such as “anticipates,” “believes,”

“estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,”

“may,” “will,” “should” and other similar expressions are intended to identify these forward-looking

statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results.

Among the risks and uncertainties that could cause actual results to

differ from those described in the forward-looking statements include, but are not limited to the following: (1) the businesses of NBT

and Evans may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from

the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss and business disruption

following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) the possibility that

the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (5) diversion of

management’s attention from ongoing business operations and opportunities; (6) the possibility that the parties may be unable to

achieve expected synergies and operating efficiencies in the merger within the expected timeframes or at all and to successfully integrate

Evans’ operations and those of NBT; (7) such integration may be more difficult, time consuming or costly than expected; (8) revenues

following the proposed transaction may be lower than expected; (9) NBT’s and Evans’ success in executing their respective

business plans and strategies and managing the risks involved in the foregoing; (10) the dilution caused by NBT’s issuance of additional

shares of its capital stock in connection with the proposed transaction; (11) changes in general economic conditions, including changes

in market interest rates and changes in monetary and fiscal policies of the federal government; and (12) legislative and regulatory changes.

Further information about these and other relevant risks and uncertainties may be found in NBT’s and Evans’ respective Annual

Reports on Form 10-K for the fiscal year ended December 31, 2023 and in subsequent filings with the Securities and Exchange Commission.

Forward-looking statements speak only as of the date they are made.

NBT and Evans do not undertake, and specifically disclaim any obligation, to publicly release the result of any revisions which may be

made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date

of such statements. You are cautioned not to place undue reliance on these forward-looking statements.

| Contacts |

NBT Bancorp Inc. |

Evans Bancorp, Inc. |

| |

|

|

| |

Scott A. Kingsley

President and Chief Executive

Officer |

David J. Nasca

President and Chief Executive Officer |

| |

|

|

| |

Annette L. Burns

EVP and Chief Financial Officer |

John B. Connerton

EVP and Chief Financial Officer |

| |

|

|

| |

607-337-6589 |

716-926-2000 |

| |

|

|

| |

|

Evans Investor Relations

Deborah K. Pawlowski, Alliance

Advisors

dpawlowski@allianceadvisors.com

716-843-3908 |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

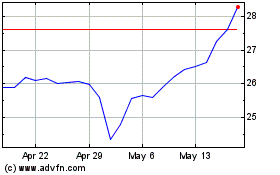

Evans Bancorp (AMEX:EVBN)

Historical Stock Chart

From Mar 2025 to Apr 2025

Evans Bancorp (AMEX:EVBN)

Historical Stock Chart

From Apr 2024 to Apr 2025