Form 8-K - Current report

September 03 2024 - 3:39PM

Edgar (US Regulatory)

false

0000105744

0000105744

2024-09-01

2024-09-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act

| Date of Report (Date of earliest event reported): |

|

September 1, 2024 |

| NEW CONCEPT ENERGY, INC. |

| (Exact Name of Registrant as Specified in its Charter) |

| Nevada |

000-08187 |

75-2399477 |

| (State or other jurisdiction of incorporation) |

(Commission File No.) |

(I.R.S. Employer Identification No.) |

|

1603 LBJ Freeway, Suite 800

Dallas, Texas |

75234 |

| (Address of principal executive offices) |

(Zip Code) |

| Registrant’s telephone number, including area code |

|

972-407-8400 |

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule

14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule

13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading

Symbol

|

Name of Each Exchange on which Registered |

| Common Stock, par value $0.01 |

GBR |

NYSE American |

Indicate by check mark whether the Registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 ('230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 ('240.12b-2 of this chapter).

| |

Emerging growth company |

¨ |

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Section 8 – Other Events

On September 1, 2024, New

Concept Energy, Inc. (“GBR” or the “Company”) and Pillar Income Asset Management, Inc., a Nevada

corporation (“Pillar”) entered into a written Advisory Agreement (the “Advisory Agreement”) pursuant

to which Pillar has agreed to provide management and advisory services to the Company for compensation specified in the Advisory Agreement.

A copy of the Advisory Agreement is attached as Exhibit “10.1.”

Section 9 – Financial Statements and

Exhibits

| Item 9.01. | Financial Statements and Exhibits |

(d) Exhibits.

The following exhibit is furnished

with this Report:

* Furnished herewith

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the

undersigned, hereunto duly authorized.

Dated: September 2, 2024

| |

NEW CONCEPT ENERGY, INC. |

| |

|

| |

By: |

/s/Gene S. Bertcher |

| |

|

Gene S. Bertcher, Chairman, President and Chief Executive and Financial Officer |

EXHIBIT "10.1"

ADVISORY AGREEMENT

BETWEEN

NEW CONCEPT ENERGY, INC.

AND

PILLAR INCOME ASSET MANAGEMENT, INC.

THIS ADVISORY AGREEMENT (the

"Agreement" ) is dated effective as of September 1, 2024, for tax and accounting purposes (the "Effective Date") between New

Concept Energy, Inc., a Nevada corporation (the "Company"), and Pillar Income Asset Management, Inc. (the "Advisor"),

a Nevada corporation.

The Company owns various assets,

including real estate and assets related oil and gas extraction.

The Advisor and its employees

have extensive experience in the administration and management of varied assets, including real estate assets and assets related to oil

and gas extraction.

The parties agree as follows:

| 1. | Duties

of the Advisor. Subject to the supervision of the Board of Directors, the Advisor

will be responsible for the day-to-day management of operations of the Company and shall

provide such services and activities relating to the assets, operations and business plan

of the Company as may be appropriate, including: |

| a. | preparing and submitting an annual budget and business plan for approval by the Board of the Company (the

" Business Plan"); |

| b. | using its best lawful efforts to present to the Company a continuing and suitable investment program consistent

with the investment policies and objectives of the Company as set forth in the Business Plan; |

| c. | source, investigate and evaluate acquisitions and dispositions consistent with the Company's investment

guidelines and make recommendations to the Board of Directors; |

| d. | engage and supervise, on the Company's behalf and at the Company's expense, third parties to provide development

management, property management, project management, design and construction services, investment banking services, financial services,

property dispo sition brokerage services, independent accounting and auditing services and tax reviews and advice, transfer agent and

registrar |

| a. | services, feasibility studies, appraisals, engineering studies, environmental property inspections and

due diligence services, underwriting review services, consulting services and all other services reasonably necessary for Advisor to perform

its duties hereunder; |

| b. | negotiate, on the Company’s behalf, any acquisitions, dispositions, financings, restructurings or

other transactions with sellers, purchasers, lenders, brokers, agents and other applicable representatives; |

| c. | negotiate, on behalf of the Company, terms of property management agreements, and other contracts or agreements

of the Company, and modifications, extensions, waivers or terminations thereof including, without limitation, the negotiation and approval

of annual operating and capital budgets thereunder; |

| d. | negotiate, on behalf of the Company, terms of loan documents for the Company’s financings; |

| e. | enforce, monitor and manage compliance of loan documents to which the Company is a party, in each case,

on behalf of the Company; |

| f. | administer bookkeeping and accounting functions as are required for the management and operation of the

Company, contract for audits and prepare or cause to be prepared such periodic reports and filings as may be required by any governmental

authority in connection with the ordinary conduct of the Company’s business, and otherwise advise and assist the Company with its

compliance with applicable legal and regulatory requirements, including without limitation, periodic reports, returns or statements required

by the Securities Exchange Commission (“SEC”), the Internal Revenue Service and any other regulatory entity to which the Company

is obligated to file such reports; |

| g. | retain counsel, consultants and other third-party professionals on behalf of the Company, coordinate,

supervise and manage all consultants, third party professionals and counsel, and investigate, evaluate, negotiate and oversee the processing

of claims by or against the Company; |

advise and assist with the

Company’s risk management and oversight function;

| h. | provide office space, office equipment and personnel necessary for the performance of services; |

| i. | perform or supervise the performance of such administrative functions reasonably necessary for the establishment

of bank accounts, related controls, collection of revenues and the payment of Company debts and obligations; |

| j. | communicate with the Company’s investors and analysts as required to satisfy reporting or other

requirements of any governing body or exchange on which the Company’s securities are traded and to maintain effective relations

with such investors; |

| k. | advise and assist the Company with respect to the Company’s public relations, preparation of marketing

materials, website and investor relation services; |

| l. | prepare and file all US Federal, state and foreign income tax filings on the Company’s behalf and

represent the Company in any tax audit or tax matter; |

| m. | counsel the Company in connection with policy decisions to be made by the Board of Directors; |

| n. | furnish reports and statistical and economic research to the Company regarding the Company’s activities,

investments, financing and capital market activities and services performed for the Company by the Advisor; |

| o. | asset manage and monitor the operating performance of the Company’s real estate investments, including

the management and implementation of capital improvement programs, pursue property tax appeals (as appropriate), and provide periodic

reports with respect to the Company’s investments to the Board of Directors, including comparative information with respect to such

operating performance and budgeted or projected operating results; |

| p. | maintain cash in bank accounts and/or investment accounts and make payment of fees, costs and expenses,

or the payment of distributions to stockholders of the Company; |

| q. | advise the Company as to its capital structure and capital raising; |

| r. | take all actions reasonably necessary to enable the Company to comply with and abide by all applicable

laws and regulations in all material respects subject to the Company providing appropriate, necessary and timely funding of capital; |

| s. | any additional duties that are determined reasonably necessary or appropriate by the Company’s audit

committee; and |

| t. | take such other actions and render such other services as may reasonably be requested by the Company consistent

with the purpose of this Agreement and the aforementioned services. |

| 1. | No Partnership or Joint Venture. The Company and the Advisor are not partners or joint venturers

with each other, and nothing herein shall be construed so as to make them such partners or joint venturers or impose any liability as

such on either of them. |

| 2. | Records. At all times, the Advisor shall keep proper books of accounts and records of the

Company's affairs which shall be accessible for inspection by the Company at any time during ordinary business hours. |

| 3. | Additional Obligations of the Advisor. The Advisor shall refrain from any action that would

(a) violate any law, rule, regulation, or statement of policy of any governmental body or agency having jurisdiction over the Company

or over its securities, (b) cause the Company to be required to register as an investment company under the Investment Company Act of

1940, or (c) otherwise not be permitted by the Articles of Incorporation of the Company. |

| 4. | Bank Accounts. The Advisor may establish and maintain one or more bank accounts in its own

name, and may collect and deposit into any such account or accounts, any money on behalf of the Company, under such terms and conditions

as the Directors may approve, provided that no funds in any such account shall be commingled with funds of the Advisor; and the Advisor

shall from time to time render appropriate accounting of such collections and payments to the Directors and to the auditors of the Company. |

| 5. | Bonds. The Advisor shall maintain for the benefit of the Company a fidelity bond or indemnity

agreement (“Surety Agreement) in such amount as may be required by the Directors from time to time, covering all directors, officers,

employees, and agents of the Advisor handling funds of the Company and any investment documents or records pertaining to investments of

the Company. Such Surety Agreement shall inure to the benefit of the Company in respect to losses of any such property from acts of such

directors, officers, employees, and agents through theft, embezzlement, fraud, negligence, error, or omission or otherwise, the premium

for said Surety Agreement to be at the expense of the Company. |

| 6. | Information Furnished Advisor. The Directors shall have the right to change the Business

Plan at any time, effective upon receipt by the Advisor of notice of such a change. The Company shall furnish the Advisor with a certified

copy of all financial statements, a signed copy of each report prepared by independent certified public accountants, and such other information

with regard to the Company's affairs as the Advisor may from time-to-time reasonably request. |

| 7. | Consultation and Advice. In addition to the services described above, the Advisor shall

consult with the Directors, and shall, at the request of the Directors or the officers of the Company, furnish advice and recommendations

with respect to any aspect of the business and affairs of the Company, including any factors that in the Advisor's best judgment should

influence the policies of the Company. |

| 8. | Annual Business Plan and Budget. No later than January 15th of each year, the

Advisor shall submit to the Directors a written Business Plan for the current Fiscal year of the Company. Such Business Plan shall include

a twelve-month forecast of operations and cash flow with explicit assumptions and a general plan for asset sales or acquisitions, lending,

foreclosure and borrowing activity, other investments or ventures and proposed securities offerings or repurchases or any proposed restructuring

of the Company. To the extent possible, the Business Plan shall set forth the Advisor's recommendations and the basis therefore with respect

to all material investments of the Company. Upon approval by the Board of Directors, the Advisor shall be authorized to conduct the business

of the Company in accordance with the explicit provisions of the Business Plan, specifically including the borrowing, leasing, maintenance,

capital improvements, renovations and sale of investments set forth in the Business Plan. Any transaction or investment not explicitly

provided for in the approved Business Plan shall require the prior approval of the Board of Directors unless made pursuant to authority

expressly delegated to the Advisor. Within sixty (60) days of the end of each calendar quarter, the Advisor shall provide the Board of

Directors with a report comparing the Company's actual performance for the quarter against the Business Plan. |

| 9. | Definitions. As used herein, the following terms shall have the meanings set forth below: |

| a. | “Adjusted Net Income” shall mean Net Income as defined herein, before income tax and interest

on any receivables from the Advisor and less net income with derived from any subsidiary subject to an advisory agreement with the Advisor. |

| b. | "Affiliate" shall mean, as to any Person, any other Person who owns beneficially, directly,

or indirectly, 1% or more of the outstanding capital stock, shares or equity interests of such Person or of any other Person which controls,

is controlled by, or is under common control with such Person or is an officer, director, or employee of such Person or of any other Person

which controls, is controlled by, or is under common control with, such Person. |

| c. | "Business Plan" shall mean the Company's investment policies and objectives and the capital

and operating budget based thereon, approved by the Board as thereafter modified or amended. |

| d. | "Fiscal Year" shall mean any period for which an income tax return is submitted to the Internal

Revenue Service, and which is treated by the Internal Revenue Service as a reporting period. |

| e. | "Gross Asset Value" shall mean the total assets of the Company in accordance with U.S. GAAP

after deduction of allowance for amortization, depreciation or depletion and valuation reserves. Gross Asset value shall also exclude

any intercompany receivables from the Advisor and shall exclude all assets of subsidiaries subject to separate advisory agreements with

the Advisor. |

| f. | "Mortgage Loans" shall mean notes, debentures, bonds, and other evidence of indebtedness or

obligations, whether negotiable or non-negotiable, and which are secured or collateralized by mortgages, including first, wraparound,

construction and development, and junior mortgages. |

| g. | "Net Income" for any period shall mean the Net Income of the Company for such period computed

in accordance with generally accepted accounting principles after deduction of the Gross Asset Fee, but before deduction of the Net Income

Fee, as set forth in Sections 11(a) and 11(b), respectively, herein, and inclusive of gain or loss of the sale of assets. |

| h. | "Person" shall mean and include individuals, corporations, limited partnerships, general partnerships,

joint stock companies or associations, joint ventures, associations, companies, trusts, banks, trust companies, land trusts, business

trusts, or other entities and governments and agencies and political subdivisions thereof. |

| i. | "Real Property" shall mean and include land, rights in land, leasehold interests (including,

but not limited to, interests of a lessor or lessee therein), and any buildings, structures, improvements, fixtures, and equipment located

on or used in connection with land, leasehold interests, and rights in land or interests therein. |

All calculations made pursuant

to this Agreement shall be based on statements (which may be unaudited, except as provided herein) prepared on an accrual basis consistent

with generally accepted accounting principles, regardless of whether the Company may also prepare statements on a different basis. All

other terms shall have the same meaning as set forth in the Company's Articles of Incorporation and Bylaws.

| 10. | Advisory Compensation. |

| a. | Gross Asset Fee. On or before the last day of each month during the term hereof, the Company shall

pay to the Advisor, as compensation for the basic management and advisory services rendered to the Company hereunder, a fee at a rate

of 0.0625% per month of the average of the Gross Asset Value of the Company at the beginning and at the end of the next preceding calendar

month. Without negating the provisions of Sections 19, 22 and 23 hereof, the annual rate of the Gross Asset Fee shall be 0.75% per annum. |

| b. | Net Income Fee. As an incentive for successful investment and management of the Company's assets,

the Advisor will be entitled to receive a fee equal to the greater of $25,000 or 7.5% per annum of the Company's Adjusted Net Income for

each Fiscal Year or portion thereof for which the Advisor provides services. To the extent the Company has Adjusted Net Income in a quarter,

the Net Income fee is to be paid quarterly on or after the third business day following the filing of the report on Form 10-Q with the

SEC, except for the payment for the fourth quarter, ended December 31, which is to be paid on or after the third business day following

the filing of the report on Form 10-K with the SEC. The 7.5% Net Income Fee is to be cumulative within any Fiscal Year, such that if the

Company has a loss in any quarter during the Fiscal Year, each subsequent quarter's payment during such Fiscal Year shall be adjusted

to maintain the 7.5% per annum rate, with final settlement being made with the fourth quarter payment and in accordance with audited results

for the Fiscal Year. The 7.5% Net Income Fee is not cumulative from year to year. |

| 11. | Statements. The Advisor shall furnish to the Company not later than the tenth day of each

calendar month, a statement showing the computation of the fees, if any, payable in respect to the next preceding calendar month (or,

in the case of incentive compensation, for the preceding Fiscal Year, as appropriate) under the Agreement. The final settlement of incentive

compensation for each Fiscal year shall be subject to adjustment in accordance with, and upon completion of, the annual audit of the Company's

financial statements; any payment by the Company or repayment by the Advisor that shall be indicated to be necessary in accordance therewith

shall be made promptly after the completion of such audit and shall be reflected in the audited statements to be published by the Company. |

| 12. | Compensation for Additional Services. If to the extent that the Company shall request the

Advisor or any director, officer, partner, or employee of the Advisor to render services for the Company other than those required to

be rendered by the Advisor hereunder, such additional services, if performed, will be compensated separately on terms to be agreed upon

between such party and the Company from time to time. In particular, but without limitation, if the Company shall request that the Advisor

perform property management, leasing, loan disbursement or similar functions, the Company and the Advisor shall enter into a separate

agreement specifying the obligations of the parties and providing for reasonable additional compensation to the Advisor for performing

such services. |

| 13. | Expenses of the Advisor. Without regard to the amount of compensation or reimbursement received

hereunder by the Advisor, the Advisor shall bear the following expenses: |

| a. | employment expenses of the personnel employed by the Advisor (including Directors, officers, and employees

of the Company who are directors, officers, or employees of the Advisor or of any company that controls, is controlled by, or is under

common control with the Advisor), including, but not limited to, fees, salaries, wages, payroll taxes, travel expenses, and the cost of

employee benefit plans and temporary help expenses except for those personnel expenses described in Section 16(a); |

| b. | rent, telephone, utilities, office furniture and furnishings, and other office expenses of the Advisor

and the Company, except as any of such expenses relates to an office maintained by the Company separate from the office of the Advisor;

and |

| c. | miscellaneous administrative expenses relating to performance by the Advisor of its duties and responsibilities

hereunder. |

| 14. | Expenses of the Company. The Company shall pay all its expenses not assumed by the Advisor

and, without limiting the generality of the foregoing, it is specifically agreed that the following expenses of the Company shall be paid

by the Company and shall not be paid by the Advisor: |

| a. | the Company shall reimburse the Advisor, on a monthly basis, the Company’s pro-rata portion (as

reasonably agreed to between the Advisor and a majority of the Company’s Independent Directors) of all expenses related to (i) employment

of the Advisor’s personnel who are actively engaged in the services to the Company (“Service Employees”) and (ii) the

reasonable travel and other out-of-pocket costs of the Service Employees. Such expenses shall include, but are not limited to, salary,

wages, payroll taxes and the cost of employee benefit plans. |

| b. | the cost of money borrowed by the Company; |

| c. | income taxes, taxes and assessments on real property, and all other taxes applicable to the Company; |

| d. | legal, auditing, accounting, underwriting, brokerage, listing, registration and other fees, printing,

and engraving and other expenses, and taxes incurred in connection with the issuance, distribution, transfer, registration, and stock

exchange listing of the Company's securities; |

| e. | fees, salaries, and expenses paid to officers and employees of the Company who are not directors, officers

or employees of the Advisor, or of any company that controls, is controlled by, or is under common control with the Advisor; |

| f. | expenses directly connected with the origination or purchase of Mortgage Loans and with the acquisition,

disposition and ownership of real estate equity interests or other property (including the costs of foreclosure, insurance, legal, protective,

brokerage, maintenance, repair, and property improvement services) and including all compensation, traveling expenses, and other direct

costs associated with the Advisor's employees or other personnel engaged in (i) real estate transaction legal services, (ii) foreclosure

and other mortgage finance services, (iii) sale or solicitation for sale of mortgages, (iv) engineering and appraisal services, and (v)

transfer agent services; |

| g. | insurance, as required by the Company (including Directors’ liability insurance); |

| h. | the expenses of organizing, revising, amending, converting, modifying, or termination of the Company; |

| i. | expenses connected with payments of dividends or interest or distributions in cash or any other form made

or caused to be made by the Directors to holders of securities of the Company; |

| j. | all expenses connected with communications to holders of securities of the Company and the other bookkeeping

and clerical work necessary in maintaining relations with holders of securities, including the cost of printing and mailing certificates

for securities and proxy solicitation materials and reports to holders of the Company's securities; |

| k. | the cost of any accounting, statistical, bookkeeping or computer equipment or computer time necessary

for maintaining the books and records of the Company and for preparing and filing Federal, State and Local tax returns; |

| l. | transfer agent's, registrar's, and indenture trustee's fees and charges; |

| m. | legal, accounting, investment banking, and auditing fees and expenses charged by independent parties performing

these services; |

| n. | expenses incurred by the Advisor, arising from the sales of Company properties, including those expenses

related to carrying out foreclosure proceedings; |

| o. | commercially reasonable fees paid to the Advisor for efforts to liquidate mortgages before maturity, such

as the solicitation of offers and negotiation of terms of sale; |

| p. | costs and expenses connected with computer services, including, but not limited to, employee or other

personnel compensation, hardware and software costs, and related development and installation costs associated therewith; |

| q. | costs and expenses associated with risk management (i.e. insurance relating to the Company’s assets); |

| r. | loan refinancing compensation; and |

| t. | associated with special services requested by the Directors. |

| 15. | Other Activities of Advisor. The Advisor, its officers, directors or employees or any of

its Affiliates may engage in other business activities related to real estate investments or act as advisor to any other person or entity

(including another real estate investment trust), including those with investment policies similar to the Company, and the Advisor and

its officers, directors, or employees and any of its Affiliates shall be free from any obligation to present to the Company any particular

investment opportunity that comes to the Advisor or such persons, regardless of whether such opportunity is in accordance with the Company's

Business Plan. However, to minimize any possible conflict, the Advisor shall consider the respective investment objectives of; and the

appropriateness of a particular investment to each such entity in determining to which entity a particular investment opportunity should

be presented. If appropriate to more than one entity, the Advisor shall present the investment opportunity to the entity that has had

sufficient uninvested funds for the longest period of time. |

| 16. | Officers and Other Personnel. The Advisor shall make available sufficient experienced and

appropriate personnel to perform the services and functions specified including, without limitation, the positions of the chief executive

officer, chief financial officer, and general counsel (collectively, “Executives”) or such positions as Advisor deems reasonably

necessary. The Advisor shall not be obligated to dedicate any of its officers or other personnel exclusively to the Company nor is the

Advisor, its Affiliates or any of its officers or other employees obligated to dedicate any specific portion of its or their time to the

Company or its business, except as necessary to perform the services provided above. The Advisor shall be entitled to rely on qualified

experts and professionals (including, without limitation, accountants, legal counsel and other professional service providers) hired by

the Advisor at the Company’s sole cost and expense. The Advisor may retain, for and on behalf, and at the sole cost and expense,

of the Company, such services of any individual, corporation, partnership, limited liability company, joint venture, association, trust,

unincorporated organization or other entity (each, a “Person”) as the Advisor deems necessary or advisable in connection with

the management and operations of the Company. |

| 17. | Term; Termination of Agreement. This Agreement shall continue in force until the next Annual

Meeting of Stockholders of the Company, and, thereafter, it may be renewed from year to year, subject to the approval of a majority of

the independent Directors of the Company. Notice of renewal shall be given in writing by the Directors to the Advisor not less than 60

days before the expiration of this Agreement or of any extension thereof. This Agreement may be terminated for any reason without penalty

upon 60 days written notice by the Company to the Advisor or 120 days written notice by the Advisor to the Company, in the former case

by the vote of a majority of the independent Directors of the Company. Notwithstanding the foregoing, however, in the event of any material

change in the ownership, control or management of the Advisor, the Company may terminate this Agreement without penalty and without advance

notice to the Advisor. |

| 18. | Amendment. This Agreement shall not be changed, modified, terminated or discharged in whole

or in part except by an instrument in writing signed by both parties hereto, or their respective successors or assigns, or otherwise as

provided herein/ |

| 19. | Assignment. This Assignment shall not be assigned by the Advisor without the prior consent

of the Company. The Company may terminate this Agreement in the event of its assignment by the Advisor without the prior consent of the

Company. Such an assignment or any other assignment of this Agreement shall bind the assignee hereunder in the same manner as the Advisor

is bound hereunder. This Agreement shall not be assignable by the Company without the consent of the Advisor, except in the case of assignment

by the Company to a corporation, association, trust, or other organization that is a successor to the Company. Such successor shall be

bound hereunder and by the terms of said assignment in the same manner as the Company is bound hereunder. |

| 20. | Default, Bankruptcy, etc. At the option solely of the Directors, this Agreement shall be

and become terminated immediately upon written notice of termination from the Directors to the Advisor of any of the following events

shall occur: |

| a. | If the Advisor shall violate any provision of this Agreement, any after notice of such violation shall

not sure such default within 30 days; or |

| b. | if the Advisor shall be adjudged bankrupt or insolvent by a court of competent jurisdiction, or an order

shall be made by a court of competent jurisdiction for the appointment of a receiver, liquidator, or trustee of the Advisor or of all

or substantially all of its property by reason of the foregoing, or approving any petition filed against the Advisor for its reorganization,

and such adjudication or order shall remain in force or un-stayed for a period of 30 days; or |

| c. | if the Advisor shall institute proceedings for voluntary bankruptcy or shall file a petition seeking reorganization

under the Federal bankruptcy laws, or for relief under any law for the relief of debtors, or shall consent to the appointment of a receiver

of itself or of all or substantially all its property, or shall make a general assignment for the benefit of its creditors, or shall admit

in writing its inability to pay its debts generally, as they become due. |

The Advisor agrees that if

any of the events specified in subsections (b) and (c) of this Section 22 shall occur, it will give written notice thereof to the Directors

within seven days after the occurrence of such event.

| 21. | Action Upon Termination. From and after the effective date of termination of this Agreement,

pursuant to Sections 18, 19, 20 or 21 hereof, the Advisor shall not be entitled to compensation for further services hereunder but shall

be paid all compensation accruing to the date of termination. The Advisor shall forthwith upon such termination: |

| a. | Pay over to the Company any monies collected and held for the account of the Company pursuant to this

Agreement; |

| b. | deliver to the Company a full accounting, including a statement showing all payments collected by it and

a statement of any monies held by it, covering the period following the date of the last accounting furnished to the Directors; and |

| c. | deliver to the Company all property and documents of the Company then in the custody of the Advisor. |

| 22. | Miscellaneous. The Advisor shall be deemed to be in a fiduciary relationship to the stockholders

of the Company. The Advisor assumes no responsibility under this Agreement other than to render the services called for hereunder in good

faith and shall not be responsible for any action of the Directors in following or declining to follow any advice or recommendations of

the Advisor. Neither the Advisor nor any of its shareholders, directors, officers, or employees shall be liable to the Company, the Directors,

the holders of securities of the Company or to any successor or assign of the Company for any losses arising from the operation of the

Company if the Advisor had determined, in good faith, that the course of conduct which caused the loss or liability was in the best interests

of the Company and the liability or loss was not the result of negligence or misconduct by the Advisor. However, in no event will the

directors, officers or employees of the Advisor be personally liable for any act or failure to act unless it was the result of such person's

willful misfeasance, bad faith, gross negligence or reckless disregard of duty. |

| 23. | Notices. Any notice, report, or other communication required or permitted to be given hereunder

shall be in writing unless some other method of giving such notice, report, or other communication is accepted by the party to whom it

is given, and shall be given by being delivered at the following addresses of the parties hereto: |

The Directors and/or the Company:

New Concept Energy, Inc.

1603 LBJ Freeway, Suite 800

Dallas, Texas 75234

Attn: President

The Advisor:

Pillar Income Asset Management, Inc.

1603 LBJ Freeway, Suite 800

Dallas, Texas 75234

Attn: Legal Department

Either party may at any time

give notice in writing to the other party of a change of address for the purpose of this Section 24.

| 24. | Headings. The section headings hereof have been inserted for convenience of reference only

and shall not be construed to affect the meaning, construction, or effect of this Agreement. |

| 25. | Governing Law. This Agreement has been prepared, negotiated and executed in the State of Texas. The provisions of this

Agreement shall be construed and interpreted in accordance with the laws of the State of Texas applicable to agreements made and to be

performed entirely in the State of Texas. Venue for any legal action arising out of this Agreement shall be in the Federal and State Courts

of Dallas County, Texas. In the event any Party fails to perform any of its obligations under the terms of this Agreement, such Party

hereby agrees to pay all reasonable attorneys’ fees which may be incurred by the non-breaching Party in enforcing this Agreement,

whether or not any suit or legal proceeding shall be brought. |

| 26. | Execution. This Agreement is executed and made on behalf of the Company by and officer of

the Company, not individually but solely as an Officer, and the obligations under this Agreement are not binding upon, nor shall resort

be had to the private property of, any of the Directors, stockholders, officers, employees, or agents of the Company personally, but bind

only the Company property. |

| 27. | Facsimile; Electronic Transmission. This Agreement may be transmitted by facsimile or electronic

transmission, and it is the intent of the Parties for the facsimile of any autograph reproduced by a receiving facsimile machine or computer

to be an original signature, and for the facsimile or computer-generated version and any complete photograph of this Agreement to be deemed

an original counterpart. |

IN WITNESS WHEREOF, AMERICAN

REALTY INVESTORS, INC. and PILLAR INCOME ASSET MANAGEMENT, INC., by their duly authorized officers, have signed this Agreement.

| |

|

PILLAR INCOME ASSET MANAGEMENT, INC. |

| |

|

|

| Dated: September 1, 2024 |

By: |

/s/ LOUIS J. CORNA |

| |

|

Louis J. Corna |

| |

|

Executive Vice President and Secretary |

| |

|

|

| |

|

NEW CONCEPT ENERGY, INC. |

| |

|

|

| Dated: September 1, 2024 |

By: |

/s/ GENE S. BERTCHER |

| |

|

Gene S. Bertcher |

| |

|

President |

| |

|

(Principal Executive and Financial Officer) |

v3.24.2.u1

Cover

|

Sep. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 01, 2024

|

| Entity File Number |

000-08187

|

| Entity Registrant Name |

NEW CONCEPT ENERGY, INC.

|

| Entity Central Index Key |

0000105744

|

| Entity Tax Identification Number |

75-2399477

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

1603 LBJ Freeway

|

| Entity Address, Address Line Two |

Suite 800

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75234

|

| City Area Code |

972

|

| Local Phone Number |

407-8400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01

|

| Trading Symbol |

GBR

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

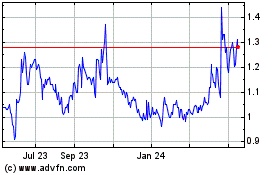

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From Dec 2024 to Jan 2025

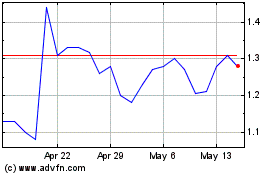

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From Jan 2024 to Jan 2025