UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange

of 1934 (Amendment No. __)

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o |

Preliminary Proxy Statement. |

| o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| x |

Definitive Proxy Statement. |

| o |

Definitive Additional Materials. |

| o |

Soliciting Material Pursuant to Section 240.14a-12. |

| NEW CONCEPT ENERGY, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

|

|

| |

5) |

Total fee paid: |

| |

|

|

| o |

Fee paid previously with preliminary materials. |

| o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

|

|

| |

4) |

Date Filed: |

| |

|

|

NEW CONCEPT ENERGY, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 4, 2024

New Concept Energy, Inc. will

hold its Annual Meeting of Stockholders on Wednesday, December 4, 2023, at 10:30 a.m., local Dallas, Texas time, at 1603 LBJ Freeway,

Suite 800, Dallas, Texas 75234. The purpose of the meeting is to consider and act upon:

· Election

of a Board of five directors to serve until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified.

· Ratification

of the selection of Turner Stone & Company LLP as the independent registered public accounting firm.

· Such

other matters as may properly be presented at the Annual Meeting.

Only Stockholders of record

at the close of business on Monday, October 28, 2024, will be entitled to vote at the meeting.

Your vote is important.

Whether or not you plan to attend the meeting, please complete, sign, date and return the enclosed proxy card in the accompanying envelope

provided. Your completed proxy will not prevent you from attending the meeting and voting in person should you choose.

Dated: October 29, 2024

| |

By order of the Board of Directors, |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Gene S. Bertcher, President |

__________________________

This Proxy Statement is available at www.newconceptenergy.com.

Among other things, the Proxy Statement contains

information regarding:

| · The date, time and location of the meeting |

| · A list of the matters being submitted to Stockholders |

| · Information concerning voting in person |

NEW CONCEPT ENERGY, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD DECEMBER 4, 2024

The Board of Directors of

New Concept Energy, Inc. (the “Company” or “we” or “us”) is soliciting proxies

to be used at the Annual Meeting of Stockholders following the fiscal year ended December 31, 2023 (the “Annual Meeting”).

Distribution of this Proxy Statement and a Proxy Form is scheduled to begin on November 1, 2024. The mailing address of the Company’s

principal executive offices is 1603 LBJ Freeway, Suite 800, Dallas, Texas 75234.

About the Meeting

Who Can Vote

Record holders of Common Stock

and Series B Preferred Stock of the Company at the close of business on Monday, October 28, 2024 (the “Record Date”),

may vote at the Annual Meeting. On that date, 5,131,934 shares of Common Stock and 559 shares of Series B Preferred Stock were outstanding.

Each share is entitled to cast one vote.

How You Can Vote

If you return your signed

proxy before the Annual Meeting, we will vote your shares as you direct. You can specify whether your shares should be voted for all,

some or none of the nominees for director. You can also specify whether you approve, disapprove or abstain from the other proposal to

ratify the selection of auditors.

Stockholders may also vote

online at the URL: https://onlineproxyvote.com/GBR/2024.

If a proxy is executed and

returned but no instructions are given, the shares will be voted according to the recommendations of the Board of Directors. The Board

of Directors recommends a vote FOR both Proposals 1 and 2.

Revocation of Proxies

You may revoke your proxy

at any time before it is exercised by (a) delivering a written notice of revocation to the Corporate Secretary, (b) delivering another

proxy that is dated later than the original proxy, or (c) casting your vote in person at the Annual Meeting. Your last vote will be the

vote that is counted.

Vote Required

The holders of a majority

of the shares entitled to vote who are either present in person or represented by a proxy at the Annual Meeting will constitute a quorum

for the transaction of business at the Annual Meeting. As of October 28, 2024, there were 5,131,934 shares of Common Stock and 559 shares

of Series B Preferred Stock issued and outstanding. The presence, in person or by proxy, of stockholders entitled to cast at least 2,566,247

votes constitutes a quorum for adopting the proposals at the Annual Meeting. If you have properly signed and returned your proxy card

by mail, you will be considered part of the quorum, and the persons named on the proxy card will vote your shares as you have instructed.

If the broker holding your shares in “street” name indicates to us on a proxy card that the broker lacks discretionary authority

to vote your shares, we will not consider your shares as present or entitled to vote for any purpose.

A plurality of the votes cast

is required for the election of directors. This means that the director nominee with the most votes for a particular slot is elected to

that slot. A proxy that has properly withheld authority with respect to the election of one or more directors will not be voted with respect

to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum.

For the other two proposals,

the affirmative vote of the holders of a majority of the shares represented in person or by proxy entitled to vote on the proposal will

be required for approval. An abstention with respect to such proposal will not be voted, although it will be counted for purposes of determining

whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

If you received multiple proxy

cards, this indicates that your shares are held in more than one account, such as two brokerage accounts, and are registered in different

names. You should vote each of the proxy cards to ensure that all your shares are voted.

Other Matters to be Acted Upon at the Annual

Meeting

We do not know of any other

matters to be validly presented or acted upon at the Annual Meeting. Under our Bylaws, no business besides that stated in the Annual Meeting

Notice may be transacted at any meeting of stockholders. If any other matter is presented at the Annual Meeting on which a vote may be

properly taken, the shares represented by proxies will be voted in accordance with the judgment of the person or persons voting those

shares.

Expenses of Solicitation

The Company is making this

solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting

votes. Some of our directors, officers and employees may solicit proxies personally, without any additional compensation, by telephone

or mail. Proxy materials will also be furnished without cost to brokers and other nominees to forward to the beneficial owners of shares

held in their names.

Available Information

Our internet website address

is www.newconceptenergy.com. We make available free of charge through our website

our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports

as soon as reasonably practicable after we electronically file or furnish such materials to the Securities and Exchange Commission (the

“SEC”). In addition, we have posted the Charters of our Audit Committee, Compensation Committee, and Governance and

Nominating Committee, as well as our Code of Business Conduct and Ethics, Code of Ethics for Senior Financial Officers, Corporate Governance

Guidelines and Corporate Governance Guidelines on Director Independence, all under separate headings. These charters and principles are

not incorporated in this instrument by reference. We will also provide a copy of these documents free of charge to stockholders upon written

request. The Company issues Annual Reports containing audited financial statements to its common stockholders.

Multiple Stockholders Sharing the Same Address

The SEC rules allow for the

delivery of a single copy of an annual report and proxy statement to any household at which two or more stockholders reside, if it is

believed the stockholders are members of the same family. Duplicate account mailings will be eliminated by allowing stockholders to consent

to such elimination, or through implied consent if a stockholder does not request continuation of duplicate mailings. Depending upon the

practices of your broker, bank or other nominee, you may need to contact them directly to continue duplicate mailings to your household.

If you wish to revoke your consent to house holding, you must contact your broker, bank or other nominee.

If you hold shares of common

stock in your own name as a holder of record, house holding will not apply to your shares.

If you wish to request extra

copies free of charge of any annual report, proxy statement or information statement, please send your request to New Concept Energy,

Inc., Attention: Investor Relations, 1603 LBJ Freeway, Suite 800, Dallas, Texas 75234 or call (800) 400-6407.

Questions

You may call our Investor

Relations Department at 800-400-6407 if you have any questions.

PLEASE VOTE - YOUR VOTE IS IMPORTANT

Corporate Governance and Board Matters

The affairs of the Company

are managed by the Board of Directors. The Directors are elected at the annual meeting of stockholders each year or appointed by the incumbent

Board of Directors and serve until the next annual meeting of stockholders or until a successor has been elected or approved.

Current members of the Board

The current members of the

Board of Directors on the date of this proxy statement, and the committees of the Board on which they serve, are identified below:

| Director |

Audit

Committee |

Compensation

Committee |

Governance

and

Nominating

Committee |

| Gene S. Bertcher |

|

|

|

| |

|

|

|

| Richard W. Humphrey |

|

|

|

| |

|

|

|

| Dan Locklear |

Chair |

ü |

ü |

| |

|

|

|

| Cecelia Maynard |

ü |

ü |

Chair |

| |

|

|

|

| Robert C. Canham

II |

|

|

|

Role of the Board’s

Committees

The Board of Directors has

standing Audit, Governance and Nominating, and Compensation Committees.

Audit Committee.

The functions of the Audit Committee are described below under the heading “Report of the Audit Committee.” The Audit

Committee is an “audit committee” for purposes of Section 3(a)(58) of the Securities Exchange Act of 1934, as amended. The

charter of the Audit Committee was adopted on December 12, 2003, and is available on the Company’s

Investor Relations website (www.newconceptenergy.com). The Audit Committee was initially

formed on December 12, 2003. All of the members of the Audit Committee are independent within the meaning of the SEC regulations, the

listing standards of the NYSE American (formerly, the American Stock Exchange) and the Company’s

Corporate Governance Guidelines. Mr. Locklear, a member and Chair of the Committee, is qualified as an “audit committee financial

expert” within the meaning of SEC regulations and the Board has determined that he has accounting and related financial management

expertise within the meaning of the listing standards of the NYSE American. All of the members of the Audit Committee meet the independence

and experience requirements of the listing standards of the NYSE American. The Audit Committee met four times in 2023.

Governance and Nominating

Committee. The Governance and Nominating Committee is responsible for developing and implementing policies and practices relating

to corporate governance, including reviewing and monitoring implementation of the Company’s

Corporate Governance Guidelines. In addition, the Committee develops and reviews background information on candidates for the Board

and makes recommendations to the Board regarding such candidates. The Committee also prepares and supervises the Board’s

annual review of director independence and the Board’s performance self-evaluation.

The charter of the Governance and Nominating Committee was adopted on October 20, 2004, and is available on the Company’s

Investor Relations website (www.newconceptenergy.com). The Governance and Nominating

Committee was initially formed on October 20, 2004. All of the members of the Governance and Nominating Committee are independent within

the meaning of the listing standards of the NYSE American and the Company's Corporate Governance Guidelines. The Governance and

Nominating Committee met two times in 2023.

Compensation Committee.

The Compensation Committee is responsible for overseeing the policies of the Company relating to compensation to be paid by the Company

to the Company’s principal executive officer and any other officers designated

by the Board and make recommendations to the Board with respect to such policies, produce necessary reports on executive compensation

for inclusion in the Company’s proxy statement in accordance with applicable

rules and regulations and to monitor the development and implementation of succession plans for the principal executive officer and other

key executives and make recommendations to the Board with respect to such plans. The charter of the Compensation Committee was adopted

on October 20, 2004, and is available on the Company’s Investor Relations

website (www.newconceptenergy.com). The Compensation Committee was initially formed

on October 20, 2004. All of the members of the Compensation Committee are independent within the meaning of the listing standards of the

NYSE American and the Company’s Corporate Governance Guidelines.

The Compensation Committee is to be comprised of at least three directors who are independent of management and the Company. The Compensation

Committee met two times in 2023.

Presiding Director

On November 8, 2011, the Board

created a new position of Presiding Director, whose primary responsibility is to preside over periodic executive sessions of the Board

in which management directors and other members of management do not participate. The Presiding Director also advises the Chairman of

the Board and, as appropriate, Committee chairs with respect to agendas and information needs relating to Board and Committee meetings,

provides advice with respect to the selection of Committee chairs and perform other duties that the Board may from time to time delegate

to assist the Board in the fulfillment of its responsibilities. The non-management members of the Board designated Dan Locklear to serve

in this position until the Company’s annual meeting of stockholders to

be held following the fiscal year ended December 31, 2023 (i.e., this meeting).

Selection of Nominees for the Board

The Governance and Nominating

Committee will consider candidates for Board membership suggested by its members and other Board members, as well as management and stockholders.

The Committee may also retain a third-party executive search firm to identify candidates upon request of the Committee from time to time.

A stockholder who wishes to recommend a prospective nominee for the Board should notify the Company's Corporate Secretary or any member

of the Governance and Nominating Committee in writing with whatever supporting material the stockholder considers appropriate. The Governance

and Nominating Committee will also consider whether to nominate any person nominated by a stockholder pursuant to the provisions of the

Company's bylaws relating to stockholder nominations.

Once the Governance and Nominating

Committee has identified a prospective nominee, the Committee will make an initial determination as to whether to conduct a full evaluation

of the candidate. This initial determination will be based on whatever information is provided to the Committee with the recommendation

of the prospective candidate, as well as the Committee's own knowledge of the prospective candidate, which may be supplemented by inquiries

to the person making the recommendation or others. The preliminary determination will be based primarily on the need for additional Board

members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee can satisfy the evaluation factors

described below. If the Committee determines, in consultation with the Chairman of the Board and other Board members as appropriate, that

additional consideration is warranted, it may request the third-party search firm to gather additional information about the prospective

nominee's background and experience and to report its findings to the Committee. The Committee will then evaluate the prospective nominee

against the standards and qualifications set out in the Company's Corporate Governance Guidelines, including:

· the

ability of the prospective nominee to represent the interests of the stockholders of the Company;

· the

prospective nominee's standards of integrity, commitment and independence of thought and judgment;

· the

prospective nominee's ability to dedicate sufficient time, energy and, attention to the diligent performance of his or her duties, including

the prospective nominee's service on other public company boards, as specifically set out in the Company's Corporate Governance Guidelines;

· the

extent to which the prospective nominee contributes to the range of talent, skill and expertise appropriate for the Board;

· the

extent to which the prospective nominee helps the Board reflect the diversity of the Company's stockholders, employees, customers, guests

and communities; and

· the

willingness of the prospective nominee to meet any minimum equity interest holding guideline.

The Committee also considers such other relevant

factors as it deems appropriate, including the current composition of the Board, the balance of management and independent directors,

the need for Audit Committee expertise and the evaluations of other prospective nominees. In connection with this evaluation, the Committee

determines whether to interview the prospective nominee, and if warranted, one or more members of the Committee, and others as appropriate,

interview prospective nominees in person or by telephone. After completing this evaluation and interview, the Committee makes a recommendation

to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the

recommendation and report of the Committee.

The Bylaws of the Company

provide that any stockholder entitled to vote in the election of directors generally may nominate one or more persons for election as

directors at a meeting only if one hundred twenty (120) days prior written notice of such stockholders’

intention to make such nomination has been delivered personally to, or has been mailed to and received by the Board of Directors at the

principal office of the Company with a copy to the President and Secretary of the Company. If a stockholder has a suggestion for candidates

for election, the stockholder should follow this procedure. Each notice from a stockholder must set forth (i) the name and address of

the stockholder who intends to make the nomination and the name of the person to be nominated, (ii) the class and number of shares

of stock held of record, owned beneficially and represented by proxy by such stockholder as of the record date for the meeting and as

of the date of such notice, (iii) a representation that the stockholder intends to appear in person or by proxy at the meeting to

nominate the person specified in the notice, (iv) a description of all arrangements or understandings between such stockholder and each

nominee and any other person (naming those persons) pursuant to which the nomination is to be made by such stockholder, (v) such other

information regarding each nominee proposed by such stockholder as would be required to be included in a proxy statement filed pursuant

to the proxy rules, and (vi) the consent of each nominee to serve as a director of the Company if so elected. The chairman of the Annual

Meeting may refuse to acknowledge the nomination of any person not made in compliance with this procedure.

Determinations of Director Independence

In October 2004, the Board

enhanced its Corporate Governance Guidelines. The Guidelines adopted by the Board meet or exceed the new listing standards

adopted during the year by the American Stock Exchange. The full text of the Guidelines can be found in the Investor Relations

section of the Company's website (www.newconceptenergy.com). A copy may also be

obtained upon request from the Company's Corporate Secretary.

Pursuant to the Guidelines,

the Board undertook its annual review of director independence in December 2023. During this review, the Board considered transactions

and relationships between each director or any member of his or her immediate family and the Company and its subsidiaries and affiliates,

including those reported under “Certain Relationships and Related Transactions” below. The Board also examined transactions

and relationships between directors or their affiliates and members of the Company's senior management or their affiliates. As provided

in the Guidelines, the purpose of this review was to determine whether any such relationships or transactions were inconsistent

with a determination that the director is independent.

As a result of the December

2023 review, the Board affirmatively determined that the then directors, Messrs. Locklear and Humphrey and Ms. Maynard, were and are each

independent of the Company and its management under the standards set forth in the Corporate Governance Guidelines. At the

time of consideration on October 7, 2024, by the remaining members of the Board of his election to the Board effective October 16, 2024,

the Board affirmatively determined that Mr. Canham was and is independent of the Company under the standards set forth in the Corporate

Governance Guidelines.

Board Meetings During Fiscal 2023

The Board met five times during

fiscal 2023. Each director attended 75% or more of the meetings of the Board and Committees on which he served. Under the Company’s

Corporate Governance Guidelines, each Director is expected to dedicate sufficient time, energy an attention to ensure the diligent

performance of his or her duties, including by attending meetings of the stockholders of the Company, the Board and Committees of which

he is a member. In addition, the independent directors met in executive session four times during fiscal 2023.

Directors’

Compensation

Each nonemployee director

currently receives an annual retainer of $2,500 plus a meeting fee of $2,000 plus reimbursement for expenses. The Company also reimburses

directors for travel expenses incurred in connection with attending Board, committee and stockholder meetings and for other Company/business

related expenses. Directors who are also employees of the Company receive no additional compensation for service as a director.

During 2023, $52,500 was paid

to the nonemployee directors in total director’s fees for all services,

including the annual fee for service during the period from January 1, 2023, through December 31, 2023. Those fees received by directors

were Dan Locklear ($10,500), Cecelia Maynard ($10,500), Richard W. Humphrey ($10,500) and former director Raymond D. Roberts, Sr. who

resigned on August 15, 2024 ($10,500).

Stockholders’

Communication with the Board

Stockholders and other parties

interested in communicating directly with the presiding director or with the non-management directors as a group may do so by writing

to Dan Locklear, Director, P. O. Box 830163, Richardson, Texas 75083-0160. Effective October 20, 2004, the Governance and Nominating Committee

of the Board also approved a process for handling letters received by the Company and addressed to members of the Board but received at

the Company. Under that process, the Corporate Secretary of the Company reviews all such correspondence and regularly forwards to the

Board a summary of all such correspondence and copies of all correspondence that, in the opinion of the Corporate Secretary, deals with

the functions of the Board or committees thereof or that he otherwise determines requires their attention. Directors may at any time review

a log of all correspondence received by the Company that is addressed to members of the Board and received by the Company and request

copies of any such correspondence. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the

attention of the Chairman of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect

to such matters.

Code of Ethics

The Company has adopted a

Code of Business Conduct and Ethics, which applies to all directors, officers and employees (including those of the contractual advisor).

In addition, on October 20, 2004, the Company adopted a code of ethics entitled “Code of Ethics for Senior Financial Officers”

that applies to the principal executive officer, president, principal financial officer, chief financial officer, the principal accounting

officer and controller. The text of both documents is available on the Company's Investor Relations website (www.newconceptenergy.com).

The Company intends to post amendments to or waivers from its Code of Ethics for Senior Financial Officers (to the extent applicable to

the Company's chief executive officer, principal financial officer or principal accounting officer) at this location on its website.

Compliance with Section 16(a) of Reporting

Requirements

Section 16(a) under the Securities

Exchange Act of 1934 requires the Company’s directors, executive officers

and any persons holding 10% or more of the Company’s shares of Common

Stock are required to report their ownership of the Company’s shares

of Common Stock and any changes in that ownership to the SEC on specified report forms. Specific due dates for these reports have been

established, and the Company is required to report any failure to file by these dates during each fiscal year. All of these filing requirements

were satisfied by the Company’s directors and executive officers and

holders of more than 10% of the Company’s Common Stock during the fiscal

year ended December 31, 2023 and through the date of this Proxy Statement. In making these statements, the Company has relied upon the

written representations of its directors and executive officers and the holders of 10% or more of the Company’s

Common Stock and copies of the reports that each has filed with the SEC.

Security Ownership of

Certain Beneficial Owners and Management

Security Ownership of Certain Beneficial Owners

The following table sets forth

the ownership of the Company’s Common Stock, both beneficially and of

record, both individually and in the aggregate, for those persons or entities known by the Company to be the beneficial owners of more

than 5% of its outstanding Common Stock as of the close of business on October 28, 2024.

|

Name and Address of

Beneficial Owner

|

Amount and Nature of

Beneficial Ownership* |

Approximate

Percent of Class**

|

| |

|

|

|

Realty Advisors, Inc.

1603 LBJ Freeway, Suite 800

Dallas, Texas 75234 |

1,144,935 shares

|

22.31%

|

Security Ownership of Management

The following table sets forth

the ownership of the Company’s Common Stock, both beneficially and of

record, both individually and in the aggregate, for the directors and executive officers of the Company as of the close of business on

October 28, 2024.

|

Name and Address of Beneficial Owner |

Amount and Nature of

Beneficial Ownership* |

Approximate Percent

of Class** |

| |

|

|

| |

|

|

| Gene S. Bertcher |

- |

0% |

| |

|

|

| Richard W. Humphrey |

- |

0% |

| |

|

|

| Dan Locklear |

- |

0% |

| |

|

|

| Cecelia Maynard |

- |

0% |

| |

|

|

| Robert C. Canham II |

- |

0% |

| |

|

|

| All directors and executive officers as a group (5 people) |

- |

0%

|

|

_____________________________

* “Beneficial Ownership”

means the sole or shared power to vote, or to direct the voting of, a security or investment power with respect to a security, or any

combination thereof per Rule 13d-3 under the Securities Exchange Act of 1934.

** Percentages are based

upon 5,131,934 shares of Common Stock outstanding at October 28, 2024. |

PROPOSAL 1

ELECTION OF DIRECTORS

Five directors are to be elected

at the Annual Meeting. Each director elected will hold office until the Annual Meeting following the fiscal year ending December 31, 2024.

All of the nominees for director are now serving as directors. Each of the nominees has consented to being named in this proxy statement

as a nominee and has agreed to serve as a director if elected. The persons named on the proxy card will vote for all of the nominees for

director listed unless you withhold authority to vote for one or more of the nominees. The nominees receiving a plurality of votes cast

at the Annual Meeting will be elected as directors. Abstentions and broker non-votes will not be treated as a vote for or against any

particular nominee and will not affect the outcome of the election of directors. Cumulative voting for the election of directors is not

permitted. If any director is unable to stand for reelection, the Board will designate a substitute. If a substitute nominee is named,

the persons named on the proxy card will vote for the election of the substitute director.

Raymond D. Roberts, Sr. who

was originally elected a director on June 17, 2015, to fill a vacancy; was re-elected at the last Annual Meeting, but resigned as a director

and from all committees on August 15, 2024 at age 92; he passed away August 29, 2024. He had been retired since December 31, 2014; prior

thereto, he was Director of Aviation of Steller Aviation, Inc., a privately held Nevada corporation, engaged in the business of aircraft

and logistical management.

The nominees for election

as directors at the Annual Meeting are listed below, together with their ages, terms of service, all positions and offices with the Company,

other principal occupations, business experience and directorships with other companies during the last five years or more. All of the

nominees are currently serving as directors of the Company, and were elected at the prior Annual Meeting of Stockholders held on December

13, 2023. No family relationship exists among any of the directors or executive officers of the Company. The designation “affiliated,”

when used below with respect to a director, means that the director is an officer, director or employee of the Company or one of its affiliated

entities.

Gene S. Bertcher, age 75,

(Affiliated) Director since November 1989 to September 1996 and since June 1999

Mr. Bertcher was elected President

and Chief Financial Officer effective November 1, 2004. He was elected Chairman and Chief Executive Officer in December 2006. He relinquished

the position of President in September 2008 and was reelected President in April 2009. From January 3, 2003 until that date he was also

Chief Executive Officer. Mr. Bertcher was Executive Vice President, Chief Financial Officer and Treasurer of the Company (November 1989

to November 2004). He has been a certified public accountant since 1973. Mr. Bertcher is also (since August, 2020) a Director of Pillar

Income Asset Management, Inc., a Nevada corporation (“PILLAR”) which provides management and advisory services to a

number of publicly held and private entities. Mr. Bertcher was also Executive Vice president (since February 2008) and Chief Financial

Officer (November 2, 2009 until December 16, 2021) of Income Opportunity Realty Investors, Inc., a Nevada corporation (“IOR”),

which has its common stock listed and traded on the NYSE American. Also, he was Executive Vice President (February 2008 to July 2019)

and Chief Financial Officer (May 2008 to July 2019) of American Realty Investors, Inc., a Nevada corporation (“ARL”),

which has its common stock listed and traded on the New York Stock Exchange (“NYSE”) and Transcontinental Realty Investors,

Inc., a Nevada corporation (“TCI”), which also has its common stock listed and traded on the NYSE. All of ARL, TCI

and IOR are Dallas, Texas based real estate entities; prior to May 2008 and from February 2008 to April 2008, he was also Interim Chief

Financial Officer of ARL, TCI and IOR. Until November 1989, Mr. Bertcher was a partner in Grant Thornton, LLP having served as Chairman

of its National Real Estate and Construction Committee.

Richard W. Humphrey, age

77, (Independent) Director since October 9, 2020

Mr. Humphrey is retired since

December 2021. For more than five years prior thereto, he was a broker at Regis Realty Prime, LLC, involved in sales and acquisitions

of real estate properties. Mr. Humphrey received from Southern Methodist University Cox School of Business both a Bachelors of Business

Administration and Masters of Business Administration degree with emphasis in real estate. From 1976 to 1979, he was also a part-time

faculty member at Southern Methodist University Cox School of Business in Dallas, teaching real estate classes in undergraduate and graduate

school. Regis Realty Prime, LLC and its predecessors are affiliated with Realty Advisors, Inc. (“RAI”).

Dan Locklear, age 72, (Independent)

Director since December 2003

Mr. Locklear has been Chief

Financial Officer of Sunridge Management Group, a real estate management company, for more than five years. Mr. Locklear was formerly

employed by Johnstown Management Company, Inc. and Trammel Crow Company. Mr. Locklear has been a certified public accountant since 1981

and a licensed real estate broker in the State of Texas since 1978.

Cecelia Maynard, age 73,

(Independent) Director from January 2019 to July 10, 2020 and since August 20, 2020

Ms. Maynard was employed by

Pillar from January 2011 through December 31, 2018. Cecelia Maynard was first elected as a director by the Board of Directors on January

18, 2019. Ms. Maynard resigned as a director on July 10, 2020. Victor Lund, age 89, a director from March 1996, resigned on July 26, 2020,

and on August 20, 2020, Cecelia Maynard was re-elected as a director to fill the vacancy created by the resignation of Victor Lund. Ms.

Maynard was also (from May 2018 to April 2021) a director, Vice President and Secretary of First Equity Properties, Inc., a Nevada corporation,

the Common Stock of which was then registered under Section 12(g) of the Securities Exchange Act of 1934.

Robert C. Canham II, age

76 (Independent) Director since October 16, 2024

Mr. Canham, based in Greensboro,

North Carolina, is, and has been for more than the past twenty years, the President and part owner of Sunchase American, LTD., a Regional

Apartment Management Company with properties under management primarily concentrated in the Southeastern U. S., including Arkansas, Florida

and Texas and surrounding States and areas. He was elected a Director effective on October 16, 2024, to fill the vacancy created by the

resignation of Raymond D. Roberts, Sr. on August 15, 2024.

The Board of Directors unanimously recommends

a vote FOR

the election of all of the Nominees named above.

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed

Turner Stone & Company LLP as the independent registered public accounting firm for New Concept Energy, Inc. for the 2024 fiscal year

and to conduct quarterly reviews through September 30, 2025. The Company’s

Bylaws do not require that stockholders ratify the appointment of Turner Stone & Company LLP as the Company’s

independent registered public accounting firm. Turner Stone & Company LLP served as the Company’s

independent registered public accounting firm for the fiscal year ended December 31, 2023. The Audit Committee will consider the outcome

of this vote in its decision to appoint an independent registered public accounting firm next year; however, it is not bound by the stockholders’

decision. Even if the selection is ratified, the Audit Committee, in its sole discretion, may change the appointment at any time during

the year if it determines that such a change would be in the best interest of the Company and its stockholders.

A representative of Turner

Stone & Company LLP will attend the Annual Meeting. The representative will have an opportunity to make a statement if he or she

desires to do so and will be available to respond to appropriate questions from the stockholders.

The Board of Directors unanimously recommends

a vote FOR the ratification of the

appointment of Turner Stone & Company LLP

as the Company’s

independent registered public accounting firm.

Fiscal Years 2023 and 2022 Audit Firm

Fee Summary

The following table sets forth

the aggregate fees for professional services rendered to the Company for the year 2022 by the Company’s

then principal accounting firm, Swalm & Associates, P.C. and for the year 2023 by the Company’s principal accounting firm, Turner

Stone & Company LLP:

Type of

Fees | |

2022 | | |

2023 | |

| Audit Fees | |

$ | 42,750 | | |

$ | 44,250 | |

| Audit-Related Fees | |

| - | | |

| - | |

| Tax Fees | |

$ | 2,750 | | |

$ | 3,750 | |

| All Other Fees | |

| - | | |

| - | |

| Total Fees: | |

$ | 45,500 | | |

$ | 48,000 | |

All services rendered by the

principal auditors are permissible under applicable laws and regulations and were pre-approved by either the Board of Directors or the

Audit Committee, as required by law. The fees paid the principal auditors for services as described in the above table fall under the

categories listed below:

Audit Fees.

These are fees for professional services performed by the principal auditor for the audit of the Company’s

annual financial statements and review of financial statements included in the Company’s

10-Q filings and services that are normally provided in connection with statutory and regulatory filing or engagements.

Audit-Related

Fees. These are fees for assurance and related services performed by the principal auditor that are reasonably related to the performance

of the audit or review of the Company’s financial statements. These services

include attestations by the principal auditor that are not required by statute or regulation and consulting on financial accounting/reporting

standards.

Tax Fees.

These are fees for professional services performed by the principal auditor with respect to tax compliance, tax planning, tax consultation,

returns preparation and review of returns. The review of tax returns includes the Company and its consolidated subsidiaries.

All Other Fees.

These are fees for other permissible work performed by the principal auditor that do not meet the above category descriptions.

These services are actively

monitored (as to both spending level and work content) by the Audit Committee to maintain the appropriate objectivity and independence

in the principal auditor’s core work, which is the audit of the Company’s

consolidated financial statements.

Turner Stone & Company

LLP did not render professional services to the Company in 2023 involving any financial information systems design and implementation.

Report of the Audit Committee

of the Board of Directors

The Audit Committee of the

Board of Directors is composed of three directors, each of whom satisfies the requirements of independence, experience and financial literacy

under the requirements of the NYSE American and the SEC. The Audit Committee has directed the preparation of this report and has approved

its content and submission to the stockholders.

The Audit Committee is responsible

for, among other things:

· retaining

and overseeing the independent registered public accounting firm that serves as our independent auditor and evaluating their performance

and independence;

· reviewing

the annual audit plan with management and the independent registered public accounting firm;

· preapproving

any permitted non-audit services provided by our independent registered public accounting firm;

· approving

the fees to be paid to our independent registered public accounting firm;

· reviewing

the adequacy and effectiveness of our internal controls with management, internal auditors and the independent registered public accounting

firm;

· reviewing

and discussing the annual audited financial statements and the interim unaudited financial statements with management and the registered

public accounting firm; and

· approving

our internal audit plan and reviewing reports of our internal auditors.

The Audit Committee operates

under a written charter adopted by the Board of Directors. The Committee’s

responsibilities are set forth in this charter which is available on our website at www.newconceptenergy.com.

The Audit Committee assists

the Board in fulfilling its responsibilities for general oversight of the integrity of the Company’s

financial statements, the adequacy of the Company’s system of internal

controls, the Company’s risk management, the Company’s

compliance with legal and regulatory requirements, the independent auditors’

qualifications and independence, and the performance of the Company’s

independent auditors. The Committee has sole authority over the selection of the Company’s

independent auditors and manages the Company’s relationship with its independent

auditors. The Committee has the authority to obtain advice and assistance from outside legal, accounting or other advisors as the Committee

deems necessary to carry out its duties and receive appropriate funding, as determined by the Committee, from the Company for such advice

and assistance.

The Committee met four times

during 2023. The Committee schedules its meetings with a view to ensuring that it devotes appropriate attention to all of its tasks. The

Committee’s meetings include private sessions with the Company’s

independent auditors without the presence of the Company’s management,

as well as executive sessions consisting of only Committee members. The Committee also meets senior management from time to time.

Management has the primary

responsibility for the Company’s financial reporting process, including

its system of internal control over financial reporting and for the preparation of consolidated financial statements in accordance with

accounting principles generally accepted in the United States of America. The Company’s

independent auditors are responsible for auditing those financial statements in accordance with professional standards and expressing

an opinion as to their material conformity with U.S. generally accepted accounting principles and for auditing management’s

assessment of, and the effective operation of, internal control over financial reporting. The Committee’s

responsibility is to monitor and review the Company’s financial reporting

process and discuss management’s report on the Company’s

internal control over financial reporting. It is not the Committee’s duty

or responsibility to conduct audits or accounting reviews or procedures. The Committee has relied, without independent verification, on

management’s representation that the financial statements have been prepared

with integrity and objectivity and in conformity with accounting principles generally accepted in the United States of America and on

the opinion of the independent registered public accountants included in their report on the Committee’s

financial statements.

As part of its oversight of

the Company’s financial statements, the Committee reviews and discusses

with both management and the Company’s independent registered public accountants

all annual and quarterly financial statements prior to their issuance. During 2021, management advised the Committee that each set of

financial statements reviewed had been prepared in accordance with accounting principles generally accepted in the United States of America,

and reviewed significant accounting and disclosure issues with the Committee. These reviews include discussions with the independent accountants

of the matters required to be discussed pursuant to Statement on Auditing Standards No. 61 (Codification of Statements on Auditing

Standards), including the quality (not merely the acceptability) of the Company’s

accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and disclosures

related to critical accounting practices. The Committee has also discussed with Swalm & Associates, P.C. matters relating to its independence,

including a review of audit and non-audit fees, and written disclosures from Swalm & Associates, P.C. to the Company pursuant to Independence

Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The Committee also considered whether non-audit services,

provided by the independent accountants are compatible with the independent accountant’s

independence. The Company also received regular updates on the amount of fees and scope of audit, audit related, and tax services provided.

In addition, the Committee

reviewed key initiatives and programs aimed at strengthening the effectiveness of the Company’s

internal and disclosure control structure. As part of this process, the Committee continued to monitor the scope and adequacy of the Company’s

internal controls, reviewed staffing levels and steps taken to implement recommended improvements in any internal procedures and controls.

Based on the Committee’s

discussion with management and the independent accountants and the Committee’s

review of the representation of management and the report of the independent accountants to the Board of Directors, the Audit Committee

recommended to the Board of Directors, and the Board of Directors has approved, that the audited consolidated financial statements be

included in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023, filed with the SEC. The Audit Committee and the Board of Directors have also selected Turner Stone & Company LLP

as the Company’s independent registered public accountants and auditors

for the fiscal year ending December 31, 2024.

August 8, 2024

AUDIT COMMITTEE

| Raymond D. Roberts, Sr.† |

Dan Locklear |

Cecelia Maynard |

Pre-Approval Policy for Audit and Non-Audit

Services

Under the Sarbanes-Oxley

Act of 2002 (the “SO Act”), and the rules of the SEC, the Audit Committee of the Board of Directors is responsible

for the appointment, compensation and oversight of the work of the independent auditor. The purpose of the provisions of the SO Act and

the SEC rules for the Audit Committee role in retaining the independent auditor is twofold. First, the authority and responsibility for

the appointment, compensation and oversight of the auditors should be with directors who are independent of management. Second, any non-audit

work performed by the auditors should be reviewed and approved by these same independent directors to ensure that any non-audit services

performed by the auditor do not impair the independence of the independent auditor. To implement the provisions of the SO Act, the SEC

issued rules specifying the types of services that an independent auditor may not provide to its audit client, and governing the Audit

Committee’s administration of the engagement of the independent auditor.

As part of this responsibility, the Audit Committee is required to pre-approve the audit and non-audit services performed by the independent

auditor in order to assure that they do not impair the auditor’s independence.

Accordingly, the Audit Committee adopted on March 22, 2004 a written pre-approval policy of audit and non-audit services (the “Policy”),

which sets forth the procedures and conditions pursuant to which services to be performed by the independent auditor are to be pre-approved.

Consistent with the SEC rules establishing two different approaches to approving non-prohibited services, the policy of the Audit Committee

covers pre-approval of audit services, audit related services, international administration tax services, non-U.S. income tax compliance

services, pension and benefit plan consulting and compliance services, and U.S. tax compliance and planning. At the beginning of each

fiscal year, the Audit Committee will evaluate other known potential engagements of the independent auditor, including the scope of work

proposed to be performed and the proposed fees, and approve or reject each service, taking into account whether services are permissible

under applicable law and the possible impact of each non-audit service on the independent auditor’s

independence from management. Typically, in addition to the generally pre-approved services, other services would include due diligence

for an acquisition that may or may not have been known at the beginning of the year. The Audit Committee has also delegated to any member

of the Audit Committee designated by the Board or the financial expert member of the Audit Committee responsibilities to pre-approve

services to be performed by the independent auditor not exceeding $25,000 in value or cost per engagement of audit and non-audit services,

and such authority may only be exercised when the Audit Committee is not in session.

_________________________

† Resigned August 15, 2024

EXECUTIVE COMPENSATION

The Company has few employees,

no payroll or benefit plans and pays compensation to only one executive officer. The following tables set forth the compensation in all

categories paid by the Company for services rendered during the fiscal years ended December 31, 2023, 2022, and 2021, by the Principal

Executive Officer of the Company and to the other

executive officers and Directors of the Company, whose total annual salaries in 2023 exceeded $50,000, the number of options granted to

any of such persons during 2023 and the value of the unexercised options held by any of such persons on December 31, 2023.

SUMMARY COMPENSATION TABLE

Name and

Principal

Position | |

Year | | |

Salary | | |

Bonus | | |

Stock

Awards | | |

Option

Awards | | |

Non-Equity

Incentive Plan

Compensation | | |

Change in

Pension Value

and Non-

qualified

Deferred

Compensation

Earnings | | |

All Other

Compensation | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

| 2023 | | |

$ | 56,500 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

$ | 56,500 | |

| Gene S. Bertcher (1) | |

| 2022 | | |

$ | 56,500 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

$ | 56,500 | |

| Chairman, President | |

| 2021 | | |

$ | 56,500 | | |

| - | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

$ | 56,500 | |

& Chief Financial

Officer | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

(1) The

amount reflected in the table above is one quarter (2023, 2022 and 2021) of the total compensation for Mr. Bertcher, attributable to the

Company; he also received additional compensation for services to other entities which are affiliated with the Company.

GRANTS OF PLAN BASED AWARDS

None

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END

None

OPTION EXERCISES AND STOCK VESTED

None

PENSION BENEFITS

None

NON-QUALIFIED DEFERRED COMPENSATION

None

DIRECTOR COMPENSATION 2023

| Name |

| |

Fees

Earned or

Paid in

Cash | | |

Stock

Awards |

| |

Option

Awards |

| |

Non-Equity

Incentive Plan

Compensation |

| |

Change in

Pension Value

and Non-

qualified

Deferred

Compensation

Earnings |

| |

All

Other

Compensation |

| |

Total | |

| Gene S. Bertcher |

| |

$-- | | |

|

| |

|

| |

|

| |

|

| |

|

| |

$-- | |

| Dan Locklear |

| |

$10,500 | | |

|

| |

|

| |

|

| |

|

| |

|

| |

$10,500 | |

| Cecelia Maynard |

| |

$10,500 | | |

|

| |

|

| |

|

| |

|

| |

|

| |

$10,500 | |

| Raymond D. Roberts, Sr. |

| |

$10,500 | | |

|

| |

|

| |

|

| |

|

| |

|

| |

$10,500 | |

| Richard W. Humphrey |

| |

$10,500 | | |

|

| |

|

| |

|

| |

|

| |

|

| |

$10,500 | |

The Company pays each nonemployee

director a fee of $2,500 per annum plus a meeting fee of $2,000 for each Board meeting attended. Directors who are also employees

of the Company serve without additional compensation.

MANAGEMENT AND CERTAIN SECURITY HOLDERS

None

Compensation Committee Report

The Compensation Committee

of the Board of Directors is comprised of at least two directors who are independent of management and the Company. Each member of the

Compensation Committee must be determined to be independent by the Board under the Corporate Governance Guidelines on Director Independence

adopted by the Board and under the NYSE American standards for nonemployee directors and Rule 16b-3(b)(3)(i) of the rules and regulations

promulgated under the Securities Exchange Act of 1934 and the requirements for “outside directors” set forth in Treasury Regulations,

Section 27(e)(3). Each member of the Committee is to be free of any relationship that in the judgment of the Board from time to time may

interfere with the exercise of his or her independent judgment. Each Committee member is appointed annually subject to removal at any

time by the Board and serves until his or her Committee appointment is terminated by the Board. The Compensation Committee is composed

of three directors, each of whom meets the standards described above.

The

purposes of the Compensation Committee are to oversee the policies of the Company relating to compensation to be paid by the Company to

the Company’s principal executive officer (“CEO”) and any other officers designated by the Board and make recommendations

to the Board with respect to such policies, produce necessary reports and executive compensation for inclusion in the Company’s

proxy statement, in accordance with applicable rules and regulations, and monitor the development and implementation of succession plans

for the CEO and other key executives and make recommendations to the Board with respect to such plans.

The Board of Directors determined

that the primary forms of executive compensation should be the incentive system discussed above. The Company’s performance is a

key consideration (to the extent that such performance can be fairly attributed or related to an executive’s performance) and each

executive’s responsibilities and capabilities are key considerations. The independent directors strive to keep executive compensation

competitive for comparable positions in other corporations where possible. In addition, the Compensation Committee believes in equity

compensation wherein executives will be additionally rewarded based on increasing the Company’s stockholder value. Base salaries

are predicated on a number of factors, including:

● recommendation

of the CEO;

● knowledge

of similarly situated executives at other companies;

● the executive’s

position and responsibilities within the Company;

● the Board

of Directors’ subjective evaluation of the executive’s contribution to the Company’s performance;

● the executive’s

experience; and

● the term

of the executive’s tenure with the Company.

The charter of the Compensation

Committee was adopted on October 2, 2004, and the members of the Compensation Committee, all of whom are independent within the meaning

of the listing standards of the NYSE American and the Company’s Corporate Governance Guidelines, are listed below. Since its formation,

the Compensation Committee has annually reviewed its existing charter and regularly performed the tasks described above.

August 8, 2024

COMPENSATION COMMITTEE

| Cecelia Maynard |

Raymond D. Roberts, Sr.† |

Dan Locklear |

Compensation Committee Interlocks and Insider Participation

The Company’s Compensation

Committee is made up of nonemployee directors who have never served as officers of, or been employed by the Company. None of the Company’s

executive officers serve on a board of directors of any entity that has a director or officer serving on this Committee.

Executive Officers

The only executive officer

of the Company is Gene S. Bertcher, Chairman of the Board, President, Chief Executive and Financial Officer. His age, term of service

and all positions and offices with the Company and other information is described above under “PROPOSAL 1 - ELECTION OF DIRECTORS.”

Certain Relationships and Related Transactions

Historically, the Company

has engaged in and may continue to engage in business transactions, including real estate partnerships, with related parties. Management

believes that all of the related party transactions represented the best investments available at the time and were at least as advantageous

to the Company as could have been obtained from unrelated third parties.

_________________________

† Resigned August 15, 2024

Pillar, which provides management

and advisory services to other entities has conducted business with the Company in the past whereby Pillar provided the Company with services,

including processing payroll, acquiring insurance and other administrative matters. The Company believed that, by purchasing these services

through certain larger entities, it can lower costs and better service responsibilities. Prior to January 1, 2024, Pillar has not charged

the Company a fee for providing these services in the past. Pillar is a wholly owned subsidiary of Realty Advisors, Inc., a Nevada corporation

(“RAI”) which is the holder of 27.18% of the outstanding Common Stock of the Company. RAI is wholly owned by May Realty

Holdings, Inc., a Nevada corporation (“MRHI”) which is wholly owned by The May Trust, a New York Trust, the beneficiaries

of which are children of Gene E. Phillips, deceased.

On September 1, 2024, the

Company and Pillar entered into a written Advisory Agreement effective as of September 1, 2024 for tax and accounting purposes (the “Advisory

Agreement”) pursuant to which Pillar has agreed to provide management and advisory Services to the Company. The duties of Pillar

as the Advisor, are subject to the supervision of the Board of Directors but include (i) responsibility for the day-to-day operations

of the Company providing services and activities relating to the assets, operations and business plan of the Company, including preparing

and submitting an annual budget and business plan for approval by the Board of Directors, (ii) presenting the Company a continuing and

suitable investment program; (iii) sourcing, investigating and evaluating any possible acquisitions and/or dispositions; (iv) engaging

and supervising at the Company’s expense third parties to provide services and expertise on various matters including independent

accounting and auditing services as well as tax advice, transfer agent and registrar services; (v) administering bookkeeping and accounting

functions as required for the management and operation of the Company; (vi) retaining counsel when necessary; (vii) communicating with

the Company’s investors and analysists as required and generally assisting the Company with asset management and monitoring the

operational performance of the Company’s assets. Pillar as the advisor is compensated for basic management and advisory services

a fee at a rate of 0.0625% per month of the average “Gross Asset Value” as defined) which will be an annual rate of

0.75% per annum Gross Asset Fee. In addition, as an incentive for successful investment and management of the Company’s assets,

Pillar will be entitled to receive a fee equal the greater of $25,000 or 7.5% per annum of the Company’s “Adjusted Net

Income” (as defined) for each fiscal year. All calculations are to be based upon the regular Financial Statement of the Company.

If the Company requests Pillar

or its affiliates to render services for the Company other than those required under the Advisory Agreement, such additional services

will be compensated separately on terms to be agreed upon between such party and the Company from time to time. The Company will also

reimburse Pillar for certain expenses specified in the Advisory Agreement.

The Advisory Agreement is

to be renewed annually but may be terminated for any reason without penalty upon sixty days written notice by the Company to Pillar or

one hundred twenty days written notice Pillar to Company. The Advisory Agreement is subject to the written approval of a majority of the

Independent Directors of the Company.

Gene S. Bertcher and Erik

L. Johnson are the two members of the Board of Directors of Pillar. The principal executive officers of Pillar are set forth below:

| Name |

Offices |

| |

|

| Erik L. Johnson |

President and Chief Executive Officer |

| Gina H. Kay |

Executive Vice President and Chief Accounting Officer |

| Louis J. Corna |

Executive Vice President and Secretary |

| Bradley J. Kyles |

Executive Vice President |

It is the policy of the Company

that all transactions between the Company and any officer or director, or any of their affiliates, must be approved by nonmanagement members

of the Board of Directors of the Company. All of the transactions described above were so approved.

OTHER MATTERS

The Board of Directors knows

of no other matters that may be properly or should be brought before the Annual Meeting. However, if any other matters are properly brought

before the Annual Meeting, the persons named in the enclosed proxy or their substitutes will vote in accordance with their best judgment

on such matters.

FINANCIAL STATEMENTS

The audited financial statements

of the Company, in comparative form, for the years ended December 31, 2023 and 2022, are contained in the 2023 Annual Report to Stockholders,

which was mailed to stockholders in April 2024. Such report and the financial statements contained therein are not to be considered part

of this solicitation.

SOLICITATION OF PROXIES

THIS PROXY STATEMENT IS

FURNISHED TO STOCKHOLDERS TO SOLICIT PROXIES ON BEHALF OF THE BOARD OF DIRECTORS OF NEW CONCEPT ENERGY, INC. The cost of soliciting

proxies will be borne by the Company. Directors and officers of the Company may, without additional compensation, solicit by mail, in

person or by telecommunication.

FUTURE PROPOSALS OF STOCKHOLDERS

Stockholder proposals for

our Annual Meeting to be held in 2025 should be received by us by December 31, 2025, and must otherwise comply with the rules promulgated

by the Securities and Exchange Commission to be considered for inclusion in our proxy statement for that year; provided, however, that

any stockholder proposal received after December 31, 2024, but prior to August 10,2025, will be considered for inclusion if the 2024

Annual Meeting Proxy Statement has not been printed prior to the Company’s receipt of such proposal. Any stockholder proposal,

whether or not to be included in our proxy materials, must be sent to our Corporate Secretary at 1603 LBJ Freeway, Suite 800, Dallas,

Texas 75234.

COPIES OF NEW CONCEPT ENERGY,

INC.’S ANNUAL REPORT FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023, TO THE SECURITIES AND EXCHANGE COMMISSION ON FORM 10-K AS FILED

WITH THE SECURITIES AND EXCHANGE COMMISSION (WITHOUT EXHIBITS) ARE AVAILABLE TO STOCKHOLDERS WITHOUT CHARGE THROUGH OUR WEBSITE AT WWW.NEWCONCEPTENERGY.COM

OR UPON WRITTEN REQUEST TO NEW CONCEPT ENERGY, INC., 1603 LBJ FREEWAY, SUITE 800, DALLAS, TEXAS 75234, ATTN: DIRECTOR OF INVESTOR RELATIONS.

Dated: October 29, 2024

| |

By order of the Board of Directors, |

| |

|

| |

|

| |

|

| |

Gene S. Bertcher, President |

New Concept Energy, Inc.

NOTICE OF INTERNET AVAILABILITY OF PROXY

MATERIAL

The Notice of Meeting, Proxy Statement and Proxy

Card

are available at www.newconceptenergy.com.

This Proxy is Solicited on Behalf of the Board

of Directors

The undersigned acknowledges receipt of the notice

of annual meeting of stockholders of New Concept Energy, Inc. (the “Company”), to be held at 1603 LBJ Freeway, Suite 800,

Dallas, Texas 75234, on December 4 2024, beginning at 10:30 AM, Dallas Time, and the proxy statement in connection therewith and appoints

Gene S. Bertcher the undersigned’s proxy with full power of substitution for and in the name, place and stead of the undersigned, to vote

upon and act with respect to all of the shares of Common Stock and Series B Preferred Stock of the Company standing in the name of the

undersigned, or with respect to which the undersigned is entitled to vote and act, at the meeting and at any adjournment thereof.

The undersigned directs that

the undersigned’s proxy be voted as follows:

| 1. | ELECTION OF DIRECTORS [ ] For all nominees (except as marked to the contrary below) |

[ ] Withhold authority to vote

for all nominees listed below

Nominees: Gene S. Bertcher,

Richard W. Humphrey, Dan Locklear, Cecelia Maynard, Robert C. Canham II

_____________________________________________________________________________________

(Instruction: To withhold authority to vote any

individual nominee, write that nominee’s name on the line provided above.)

| 2. | RATIFICATION OF THE SELECTION OF TURNER STONE & COMPANY LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM FOR 2024 AND ANY INTERIM PERIOD. |

| |

[ ] FOR |

[ ] AGAINST |

[ ] ABSTAIN |

| 3. | IN THE DISCRETION OF THE PROXIES, ON ANY OTHER MATTER WHICH MAY PROPERLY COME BEFORE THE MEETING. |

| |

[ ] FOR |

[ ] AGAINST |

[ ] ABSTAIN |

This proxy will be voted as specified above. If

no specification is made, this proxy will be voted FOR the election of all the director nominees in 1 above and/or FOR the ratification

of the selection of Turner Stone Company LLP in 2 above.

Stockholders may also vote

online at the following URL: https://onlineproxyvote.com/GBR/2024.

The undersigned hereby revokes

any proxy heretofore given to vote or act with respect to the Common Stock or Series B Preferred Stock of the Company and hereby ratifies

and confirms all that the proxies, their substitutes, or any of them may lawfully do by virtue hereof.

If more than one of the proxies

named shall be present in person or by substitute at the meeting or at any adjournment thereof, the majority of the proxies so present

and voting, either in person or by substitute, shall exercise all of the powers hereby given.

Please date, sign and mail this proxy in the enclosed

envelope. No postage is required.

Date: _____________________, 2024

| |

|

| |

Signature of Stockholder |

| |

|

| |

|

| |

Signature of Stockholder |

Please date this proxy and sign your name exactly

as it appears hereon. Where there is more than one owner, each should sign. When signing as an attorney, administrator, executor, guardian

or trustee, please add your title as such. If executed by a corporation, the proxy should be signed by a duly authorized officer.

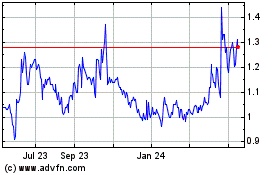

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From Feb 2025 to Mar 2025

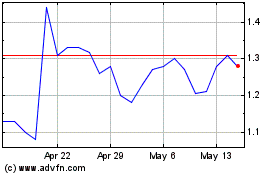

New Concept Energy (AMEX:GBR)

Historical Stock Chart

From Mar 2024 to Mar 2025