Sachem Capital Corp. Announces Registered Public Offering of Notes

June 17 2024 - 7:51AM

Sachem Capital Corp. (NYSE American: SACH) today announced the

commencement of a registered public offering of USD-denominated

unsecured, unsubordinated Notes due five years from the date of

issuance (“Notes”), subject to market conditions.

The Notes are anticipated to be rated BBB+ by

Egan Jones, Egan-Jones Ratings Company, an independent,

unaffiliated rating agency, although this is contingent on

prevailing market conditions. Egan-Jones is a Nationally Recognized

Statistical Ratings Organization (NRSRO) and is recognized by the

National Association of Insurance Commissioners (NAIC) as a Credit

Rating Provider (CRP). Egan-Jones is also certified by the European

Securities and Markets Authority (ESMA). A securities rating is not

a recommendation to buy, sell or hold securities and may be subject

to revision or withdrawal at any time.

The company has mandated Oppenheimer & Co.

Inc. as the sole-bookrunning manager for the offering.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy the securities in

this offering or any other securities nor will there be any sale of

the Notes or any other securities referred to in this press release

in any state or jurisdiction in which such offer, solicitation or

sale would be unlawful prior to the registration or qualification

under the securities laws of such state or jurisdiction.

A registration statement relating to, among

other things, the Notes, was filed and has been declared effective

by the U.S. Securities and Exchange Commission (SEC). The offering

is being made only by means of a related prospectus supplement and

an accompanying base prospectus forming part of the effective

registration statement, copies of which may be obtained, when

available, from: Oppenheimer & Co. Inc. by written request

addressed to 85 Broad Street, 23rd Floor, New York, NY 10004 or by

emailing john.tonelli@opco.com. Copies may also be obtained for

free by visiting EDGAR on the SEC’s website at

http://www.sec.gov.

The preliminary prospectus supplement, dated

June 17th, 2024, together with an accompanying base prospectus,

which have been filed with the SEC, contain this and other

information about Sachem Capital Corp. as well as a description of

the Notes and the terms of the offering and should be read

carefully before investing. The information in the preliminary

prospectus supplement and the accompanying base prospectus, and in

this announcement, is not complete and may be changed. Investors

are advised to carefully consider the investment objective, risks,

charges and expenses of Sachem Capital Corp. before investing.

About Sachem Capital

Corp.Sachem Capital Corp. is a mortgage REIT that

specializes in originating, underwriting, funding, servicing, and

managing a portfolio of loans secured by first mortgages on real

property. It offers short-term (i.e., three years or less) secured,

nonbanking loans to real estate investors to fund their

acquisition, renovation, development, rehabilitation, or

improvement of properties. The Company’s primary underwriting

criteria is a conservative loan to value ratio. The properties

securing the loans are generally classified as residential or

commercial real estate and, typically, are held for resale or

investment. Each loan is secured by a first mortgage lien on real

estate and is personally guaranteed by the principal(s) of the

borrower. The Company also makes opportunistic real estate

purchases apart from its lending activities.

Investors:Email:

investors@sachemcapitalcorp.com

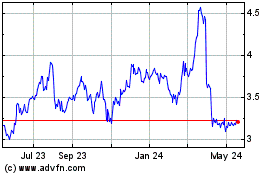

Sachem Capital (AMEX:SACH)

Historical Stock Chart

From Dec 2024 to Jan 2025

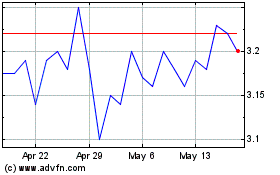

Sachem Capital (AMEX:SACH)

Historical Stock Chart

From Jan 2024 to Jan 2025