Sachem Capital Corp. Announces Full Repayment and Delisting of Maturing Unsecured Unsubordinated Notes From NYSE American

December 24 2024 - 6:00AM

Sachem Capital Corp. (NYSE American: SACH) reminds

holders that its 6.875% unsecured, unsubordinated Notes due

December 30, 2024 (“Notes”), ticker symbol “SACC,” will mature on

December 30, 2024, as scheduled. The company will redeem the Notes

at par plus accrued and unpaid interest up to, but not including,

the maturity date.

Sachem expects the last trading day for the

Notes will be December 27, 2024. After the maturity date, no

Notes will remain outstanding.

|

Ticker |

CUSIP |

Maturity Date |

Supplemental and Prospectus Link |

|

SACC |

78590A 307 |

12/30/2024 |

SEC Filing |

Impact on Note Holders The

final payment with respect to the Notes, including principal and

accrued interest, will be made on or before December 30, 2024, as

described in the prospectus supplement. No action is required

by Note holders, and they will be notified directly regarding

the details of the redemption process.

About Sachem Capital

Corp.Sachem Capital Corp. is a mortgage REIT that

specializes in originating, underwriting, funding, servicing, and

managing a portfolio of loans secured by first mortgages on real

property. It offers short-term (i.e., three years or less) secured,

nonbanking loan to real estate investors to fund their acquisition,

renovation, development, rehabilitation, or improvement of

properties. The Company’s primary underwriting criteria is a

conservative loan to value ratio. The properties securing the loans

are generally classified as residential or commercial real estate

and, typically, are held for resale or investment. Each loan is

secured by a first mortgage lien on real estate and is personally

guaranteed by the principal(s) of the borrower. The Company also

makes opportunistic real estate purchases apart from its lending

activities.

Forward Looking StatementsThis

press release may contain forward-looking statements. All

statements other than statements of historical facts contained in

this press release, including statements regarding our future

results of operations and financial position, strategy and plans,

and our expectations for future operations, are forward-looking

statements. Such forward-looking statements are subject to several

risks, uncertainties and assumptions as described in the Annual

Report on Form 10-K for 2023 filed with the U.S. Securities and

Exchange Commission (the “SEC”) on April 1, 2024 and the Quarterly

Report on Form 10-Q for the quarter ended September 30, 2024 filed

with the SEC on November 14, 2024. Because of these risks,

uncertainties and assumptions, any forward-looking events and

circumstances discussed in this press release may not occur. You

should not rely upon forward-looking statements as predictions of

future events. Neither the Company nor any other person assumes

responsibility for the accuracy and completeness of any of these

forward-looking statements. The Company disclaims any duty to

update any of these forward-looking statements. All forward-looking

statements attributable to the Company are expressly qualified in

their entirety by these cautionary statements as well as others

made in this press release. You should evaluate all forward-looking

statements made by the Company in the context of these risks and

uncertainties.

Investors:Email:

investors@sachemcapitalcorp.com

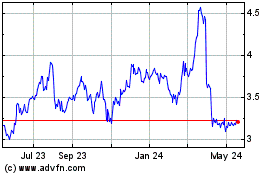

Sachem Capital (AMEX:SACH)

Historical Stock Chart

From Nov 2024 to Dec 2024

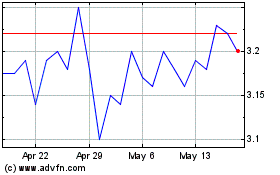

Sachem Capital (AMEX:SACH)

Historical Stock Chart

From Dec 2023 to Dec 2024