Sachem Capital Corp. Completes 20% Investment in Shem Creek Capital LLC to Further Diversify Business Model

September 11 2024 - 6:00AM

Sachem Capital Corp. (NYSE American: SACH) announced today it has

acquired a 20% membership interest for $5 million in Shem Creek

Capital, LLC, the third-party management company of the Shem Creek

(“Shem”) private credit funds. Sachem also has the option to

acquire up to an additional 10% membership interest in Shem, by

early 2027, at a set valuation. Shem, established in 2008, is a

commercial real estate finance company with a focus on providing

debt capital solutions to local and regional commercial real estate

owners in the Northeastern United States. Shem invests primarily in

first mortgage loans secured by commercial real estate assets,

notably value-add multifamily, workforce housing, and industrial

properties.

John Villano, CEO of Sachem Capital Corp.,

commented: “Over the past four years, Sachem has invested

approximately $47 million with Shem, which is currently generating

attractive double-digit returns, with no losses to date—a

remarkable achievement given the challenging macroeconomic

environment during that period. Our long-standing relationship with

Shem and its management, the diversification this investment brings

to our business model, the expandable nature of the Shem platform,

and our expansion into asset management, gives us confidence that

this is another value-added opportunity for our shareholders.”

Scott Goldberg, President of Shem Creek Capital,

LLC said: “We are very pleased to have closed on this transaction

with Sachem Capital and look forward to building upon what has

already been a strategic and successful relationship between our

two firms. Going forward we believe the synergies between us will

foster significant growth for the platform and asset base,

ultimately driving strong risk-adjusted returns to our respective

investors.”

About Sachem Capital Corp.

Sachem Capital Corp. is a mortgage REIT that

specializes in originating, underwriting, funding, servicing, and

managing a portfolio of loans secured by first mortgages on real

property. It offers short-term (i.e., three years or less) secured,

nonbanking loans to real estate investors to fund their

acquisition, renovation, development, rehabilitation, or

improvement of properties. The Company’s primary underwriting

criteria is a conservative loan to value ratio. The properties

securing the loans are generally classified as residential or

commercial real estate and, typically, are held for resale or

investment. Each loan is secured by a first mortgage lien on real

estate and is personally guaranteed by the principal(s) of the

borrower. The Company also makes opportunistic real estate

purchases apart from its lending activities.

Forward Looking Statements

This press release may contain forward-looking

statements. All statements other than statements of historical

facts contained in this press release, including statements

regarding our future results of operations and financial position,

strategy and plans, and our expectations for future operations, are

forward-looking statements. Such forward-looking statements are

subject to several risks, uncertainties and assumptions as

described in the Annual Report on Form 10-K for 2023 filed with the

U.S. Securities and Exchange Commission (the “SEC”) on April 1,

2024. Because of these risks, uncertainties and assumptions, any

forward-looking events and circumstances discussed in this press

release may not occur. You should not rely upon forward-looking

statements as predictions of future events. Neither the Company nor

any other person assumes responsibility for the accuracy and

completeness of any of these forward-looking statements. The

Company disclaims any duty to update any of these forward-looking

statements. All forward-looking statements attributable to the

Company are expressly qualified in their entirety by these

cautionary statements as well as others made in this press release.

You should evaluate all forward-looking statements made by the

Company in the context of these risks and uncertainties.

Investors:Email:

investors@sachemcapitalcorp.com

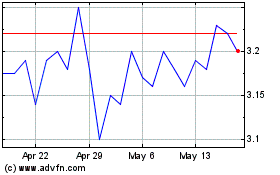

Sachem Capital (AMEX:SACH)

Historical Stock Chart

From Nov 2024 to Dec 2024

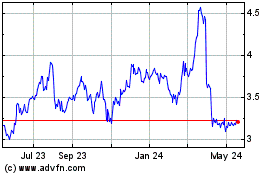

Sachem Capital (AMEX:SACH)

Historical Stock Chart

From Dec 2023 to Dec 2024