All Eyes on Fed as the S&P 500 Index Remains Volatile

September 18 2022 - 5:22PM

Finscreener.org

All three major equity indices in

the United States traded in the red last week. Investors were

spooked by higher-than-expected CPI (consumer price index)

inflation data which triggered the possibility of an aggressive

monetary tightening policy by the Federal Reserve at their upcoming

policy meeting.

In the week ended on September

16, the

S&P 500 fell 4.8%,

while the

Dow Jones Industrial Average and Nasdaq declined by 4% and 5.5%, respectively.

Comparatively, the 10-year Treasury yield closed at 3.45%, its

highest level since June, while the two-year yield rose to 3.87%,

the highest level since 2007.

The yield curve inversion between

the

10-year yield and the

two-year yield has widened. The inverted yield curve is considered

a recession indicator, and the Fed might trade an economic slowdown

to offset rising inflation.

Further, the price of West Texas

Intermediate crude traded at $85 per barrel and was under pressure

as a global recession is bound to impact energy demand.

As we come to the end of Q3, the

S&P 500 index is trading close to bear market territory and

is down 19.3% from all-time highs. The Nasdaq and Dow indices have

fallen 28% and 16% from record highs, respectively.

Let’s see what events in the

upcoming week will drive the equity markets.

Policy meeting of key central banks

The U.S. Federal Reserve will

begin its two-day policy meeting on Tuesday. It is likely to hike

interest rates and subsequently hold a press conference on

Wednesday. Most economists forecast the Fed to hike interest rates

by 75 basis points, while a few are anticipating a 100 basis point

hike. Since March, the central bank has raised the benchmark funds

rate by 225 basis points to combat higher commodity prices as

inflation soared to 40-year highs.

Other central banks, such as the

United Kingdom and Japan, are also scheduled to hold policy

meetings this week. The Bank of England or BoE is on track to

increase benchmark rates on Thursday as inflation is the highest

among G-7 countries. In August, the BoE hiked rates by 50 basis

points, which was the largest increase since 1995. The benchmark

rate in England is around 1.75%.

However, Japan’s central bank is

holding interest rates at record lows as inflation remains at

manageable levels for the export-oriented economy. There is a

chance for Japan to even undertake quantitative easing measures if

required.

Housing market under pressure

The U.S. Census Bureau will

publish data on August housing starts and building permits on

Tuesday. It will basically track the construction of new housing

units for the last month. Housing starts are forecast to fall to

1.44 million units in August, compared to 1.446 million units in

July, due to higher rising materials costs.

Additionally, rising interest

rates have also impacted demand as consumer savings are under

pressure. Building permits are expected to decline to 1.61 million

in August from 1.685 million in July.

The National Association of

Realtors (NAR) will provide an update on existing home sales in

August on Wednesday. Analysts project existing home sales to fall

to 4.7 million units in August, compared to 4.81 million in

July.

These numbers have now fallen for

six consecutive months after touching a peak of 6.49 million in

January.

According to Investopedia,

“Freddie Mac reported this week that the average rate on a 30-year

fixed-year mortgage rose above 6% for the first time since 2008,

putting further pressure on potential homebuyers.”

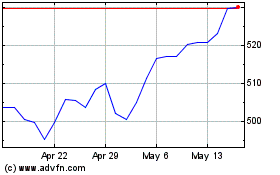

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Feb 2025 to Mar 2025

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Mar 2025