The exchange traded fund industry has expanded at a rapid pace

over the past few years, allowing investors to tap into a variety

of strategies that were once off limits to the average investor

(Five Great Global ETFs For Complete Equity Exposure). However,

some have become paralyzed by the large amount of choices and the

small nuanced differences between the current crop of ETFs on the

market.

In the ETF world, there are many options available for tapping a

single sector, region or market spectrum. But confusion begins when

ETFs of the same category do not have the same structure. Some may

differ on holding patterns or top 10 holdings, a few may be very

liquid, while others may have an edge in expenses. One cannot pick

an ETF simply on the basis of its size or the fund name.

In this scenario, what should be the investor basis for picking

an ETF for investment? In this article we would like to highlight

some key points that every investor needs to be aware of before

deciding which ETF is the right one for their portfolio:

Liquidity

The ease with which investors can buy or sell an ETF, or

liquidity, plays a very important role in a decision to purchase a

fund. If a bid ask spread is tight, a product will be easy to move

in and out of for a low cost, while if a spread is wide it could

add to total costs for an ETF (Guide to Most Popular ETFs).

Many of the top, most liquid ETFs on the market today have a

spread between the bid and the ask of just a few pennies while a

number of them have a spread that is just one penny wide. This

means that sellers/buyers can very often get in or out of a

particular fund right at the current price, something that is not

always possible in the less liquid products.

In fact, some of the less liquid ones have spreads that can

range from a dime wide to as much as a few dollars. When that is

the case, it really adds to the overall cost of buying an ETF,

greatly hampering returns over the long run, and showcasing why a

tight bid ask spread is so important to ETF investors.

Asset under Management (AUM)

The ETF industry has come a long way from the time when the ETFs

were first launched as investment tools to gain exposure to

different asset classes. Since then, many ETFs came into existence,

of which many could not survive and had to be shut down. So what

could be the possible reason behind some of these closures?

One possible reason that can be cited is low asset under

management. It should be noted that a fund’s very existence depends

to a large extent on this level of AUM and the revenues that can be

generated from this base.

Generally, for a fund, asset under management of over $100

million works as a threshold for any sponsor’s profitability. While

big fund houses may be able to run their ETFs with low AUM for

years, it becomes really difficult for small fund firms to keep a

loser running indefinitely.

So when a fund is shut down due to a low asset base, the

investor needs to cash out and look for another ETF which provides

the same kind of exposure. So while this shouldn’t be a huge issue

for most, it is definitely something to consider when buying an

ETF.

Market Capitalization

Market cap and diversification also play a very important role

in any fund selection. ETFs are usually based on indexes and these

benchmarks usually weight on market capitalization. This means,

that for the most part, large cap stocks dominate all others in

most ETFs (Ten Biggest U.S. Equity Market ETFs).

Large caps generally include those companies with higher

earnings power and are much more famous than their small cap

brethren. However, some investors may want to invest in small caps

or mid caps which have the potential to grow in the future.

So, for investors picking an ETF must note the tilt of the ETF

in regards to the market spectrum. Additionally, just because a

fund doesn’t declare a large focus or if it is a ‘total market’

ETF, it doesn’t mean that it won’t be dominated by large cap

securities.

Diversification

Diversification is also one of the important tools to consider

before investing in any ETF. Investors should note that whether the

fund has a preference for any specific company or sector. High

concentration in one particular company or sector leads to

dependence of the fund on the performance of that given segment or

firm, which probably isn’t ideal for most investors (Three ETFs

with Incredible Diversification).

Ideally, an ETF should be well spread out across companies in

order to reduce concentration risk, as if it is too focused, you

might as well just buy the underlying securities instead.

It can also be useful to keep an eye on the total number of

holdings of a fund and its allocation towards the top 10 holdings.

Most should stay away from the few ETFs that buy only a handful of

stocks, or those that put extreme weights into a few choice

companies.

Expense Ratio

We have so far discussed some of the factors that govern

the purchasing decision in ETF investing. Among others,

expenses play an important role in the decision making process.

While these ratios are much smaller for ETFs than they are for

mutual funds on average, investors should note that expenses still

play a crucial role in determining the best fund in a segment (ETFs

vs. Mutual Funds)

Furthermore, while many products may appear similar on the

surface—with similar industry, holdings, and market cap focuses—the

expense ratio can often be the main, and usually key,

differentiator between the two products.

The methodology of the selection of stocks in an ETF may result

in higher cost for the investor. There are many ETFs which use

criteria like the alphaDEX methodology which generally proves to be

more expensive for an investor, but can lead to outperformance as

well.

Expenses, like the other key factors on this list, must be

balanced with the overall investment thesis in order to select the

right ETF. There isn’t a ‘best ETF’ for every investor, but rather

by looking at combination of the items outlined above, a good fit

can be achieved for most in virtually any investing scenario.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMG MKT (EEM): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

ISHARES GS CPBD (LQD): ETF Research Reports

NASDAQ-100 SHRS (QQQ): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

VIPERS-M EM MKT (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

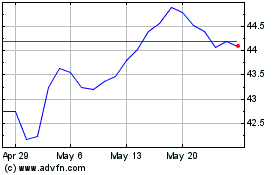

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Nov 2024 to Dec 2024

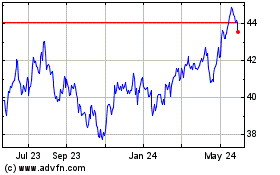

Vanguard FTSE Emerging M... (AMEX:VWO)

Historical Stock Chart

From Dec 2023 to Dec 2024