TIDMSQZ

RNS Number : 0632X

Serica Energy PLC

18 December 2023

Serica Energy plc

("Serica" or the "Company")

New US$525 million 6-year Borrowing Facility

London, 18 December 2023 - Serica Energy plc (AIM: SQZ) is

pleased to announce the signing of a new US$525 million secured

Reserves Based Lending ("RBL") facility.

Mitch Flegg, Chief Executive of Serica, commented:

"I am very pleased to announce the signing of a new RBL facility

which substantially enhances Serica's financial firepower. This has

been achieved in a challenging market for upstream financing. The

standing of the international banks in the lending syndicate

reflects the quality of Serica's asset portfolio, strong balance

sheet and ambitions for further growth. The new facility, combined

with our existing attributes, means that Serica can approach

acquisition and investment opportunities from a position of

considerable strength."

The new RBL facility replaces Serica's existing RBL and Junior

facilities. The existing RBL facility has US$271 million drawn and

will be fully repaid upon completion of the new RBL facility, which

is expected to occur in January 2024. The Junior facility remains

undrawn.

Facility Highlights

-- Significantly increased liquidity to support future acquisitions and investments.

-- Option of potentially doubling RBL facility to over US$1

billion through an accordion[1] feature.

-- Debt maturity deferred by more than two years to end 2029.

-- Establishes new relationships with a syndicate of leading international banks.

-- Simplified financing arrangement with single facility.

Description of new RBL facility

-- US$525 million revolving credit facility available in

multiple currencies. Serica's existing RBL facility is in

amortisation phase with capacity falling to US$330 million at the

end of 2023.

-- Maturity date of 31 December 2029 with amortisation

commencing on 31 December 2026. Serica's existing RBL facility

matures on 30 June 2027.

-- Additional uncommitted accordion option of a further US$525

million increasing the potential total facility to US$1,050

million.

-- $100 million sub limit which can be utilised to issue Letters

of Credit without the need for cash security.

-- The Borrowing Base Assets comprise all of Serica's interests

in producing fields except the Rhum field.

-- Available amount under the facility is subject to semi-annual redeterminations.

-- If 50% or more of the amount available is drawn, the minimum

commodities hedging requirement is equal to 50% of forecast

production from the Borrowing Base Assets in year one and 30% in

year two. The hedging requirement is halved if less than 50% of the

amount available is drawn.

-- Initial interest rate for loan drawings of SOFR[2] plus a

margin of 3.90% per annum. The margin under the existing RBL

facility is 3.10% per annum.

-- Net Debt to Adjusted EBITDAX financial covenant GBP 3.5x, tested semi-annually.

The Structuring & Coordination Banks include DNB (Facility

Agent & Documentation Bank) and ING Bank N.V.. The Bookrunner

Mandated Lead Arrangers include DNB, ING Bank N.V. and Nedbank CIB.

The Mandated Lead Arranger is Natixis, London Branch. The Lead

Arranger is ICBC Standard Bank plc.

The syndicate of banks received legal advice from Bracewell LLP.

Serica received legal advice from Burness Paull LLP.

The financial advisor to Serica was Kirk Lovegrove and Company

Ltd.

Regulatory

This announcement is inside information for the purposes of

Article 7 of Regulation 596/2014.

Enquiries:

+44 (0)20 7390

Serica Energy plc 0230

Mitch Flegg (CEO) / Andy Bell (CFO)

/ Stephen Lambert (VP Legal and External

Relations)

+44 (0)20 7418

Peel Hunt (Nomad & Joint Broker) 8900

Richard Crichton / David McKeown /

Georgia Langoulant

+44 (0)20 7029

Jefferies (Joint Broker) 8000

Sam Barnett / Will Soutar

+44 (0)20 7390

Vigo Consulting (PR Advisor) 0230

Patrick d'Ancona / Finlay Thomson serica@vigoconsulting.com

NOTES TO EDITORS

Serica Energy is a British independent oil and gas exploration

and production company with a portfolio of UKCS assets.

Serica completed the acquisition of the entire issued share

capital of Tailwind Energy Investments Ltd on 23 March 2023.

Following the addition of the Tailwind assets to its portfolio,

Serica has a balance of gas and oil production. The Company is

responsible for about 5% of the natural gas produced in the UK, a

key element in the UK's energy transition.

Serica's producing assets are focused around two main hubs: the

Bruce, Keith and Rhum fields in the UK Northern North Sea, which it

operates, and a mix of operated and non-operated fields tied back

to the Triton FPSO. Serica also has operated interests in the

producing Columbus (UK Central North Sea) and Orlando (UK Northern

North Sea) fields and a non-operated interest in the producing

Erskine field in the UK Central North Sea.

Serica's portfolio of assets includes several organic investment

opportunities which are currently being pursued or are under

consideration.

Further information on the Company can be found at

www.serica-energy.com . The Company's shares are traded on the AIM

market of the London Stock Exchange under the ticker SQZ and the

Company is a designated foreign issuer on the TSX. To receive

Company news releases via email, please subscribe via the Company

website.

[1] Uncommitted accordion feature provides option for additional

financing of up to US$525 million which can be exercised within

thirty-six months of the facility signing date, subject to certain

conditions.

[2] "Secured Overnight Financing Rate" which has replaced

previous customary use of LIBOR.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUBVWROKUUARA

(END) Dow Jones Newswires

December 18, 2023 02:00 ET (07:00 GMT)

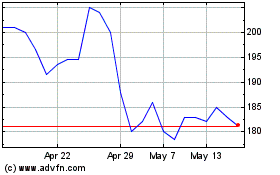

Serica Energy (AQSE:SQZ.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Serica Energy (AQSE:SQZ.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024