TIDMSQZ

RNS Number : 3926U

Serica Energy PLC

23 November 2023

Serica Energy plc

("Serica" or the "Company")

Acquisition of Interest in Greater Buchan Area

London, 23 November 2023 - Serica Energy plc (AIM: SQZ) is

pleased to announce the execution of agreements for the acquisition

by its wholly owned subsidiary, Serica Energy (UK) Limited, of 30%

non-operated interests in the P2498 and P2170 licences (together

the Greater Buchan Area ("GBA")) from Jersey Oil & Gas ("JOG")

(the "Transaction"). Completion is subject to regulatory, partner

and interested party approvals and is expected to occur early in

2024. Following completion, the partners in the GBA will be Serica

Energy (UK) Limited (30%), NEO Energy (50% and operator) and JOG

(20%).

As a result of the Transaction, Serica will have the option of

participating in the re-development of the Buchan field and other

potential developments in the GBA.

Greater Buchan Area

The GBA encompasses several oil and gas accumulations some 150

km north-east of Aberdeen, in the Outer Moray Firth. The largest of

these accumulations is the Buchan field which produced for over

thirty years, ceasing production in 2017 owing to the end of the

useable life of the floating production facility. The Concept

Select Report submitted to the NSTA for the re-development of

Buchan is based on a new production hub located at the Buchan field

utilising the floating production, storage and offloading ("FPSO")

vessel currently operating on the UK Western Isles fields and

planned to come off-station in the second half of 2024. The

acquisition of the FPSO by NEO on behalf of the participants in the

Buchan joint venture was announced on 17 November 2023.

A phased development is envisaged involving the re-development

of the Buchan field in Phase 1 and the possible development of the

J2 and Verbier discoveries in Phase 2. Mid-case contingent

resources from the Buchan field alone are estimated to be in region

of 70 million barrels of oil equivalent, making it the third

largest pre-development field in the UKCS. There are other

discoveries and prospects in close proximity which might provide

additional tie-back opportunities to the FPSO.

The NSTA has issued a no objection letter following the

submission of the Concept Select Report in support of the Buchan

re-development programme. A proposed Field Development Plan ("FDP")

for Buchan is expected to be submitted to the NSTA shortly, with

approval of the FDP potentially in the second half of 2024.

The development concept includes limited works on the FPSO in

order to prepare it for re-deployment. These works involve the

installation of water injection booster pumps, produced water

injection modifications and preparation of the vessel for future

electrification. Following the recent Innovation and Targeted Oil

& Gas ("INTOG") licence awards, there is the possibility of

third-party floating wind power developments located close to the

GBA. It is anticipated that the FPSO will be connected to one of

these, should they become available. Oil export is planned to be

via shuttle tankers.

Subject to project sanction and regulatory approval, the target

for first production is late 2026. Peak production rates are

expected to be around 35,000 barrels per day. Gross development

costs are estimated to be in the order of GBP850-950 million, which

under the current fiscal terms, are expected to qualify for tax

relief at a rate of approximately 91%.

Transaction Summary

The Transaction is structured as a farm-in, with modest up-front

and contingent consideration payments, and a carry of pre-Financial

Investment Decision ("FID") and development costs.

In return for a 30% working interest in the GBA licences, on

completion Serica will make a cash payment to JOG of US$ 6.8

million [1] . subject to the adjustments between buyer and seller

to reflect an economic date for the transaction of 1 April

2023.

Serica is not committed under the terms of the Transaction to

participate in the GBA developments. In the event of participation

at each relevant stage, Serica will make further payments to JOG as

follows:

-- US$7.5 million on approval of the Buchan FDP by the NSTA.

-- A 7.5% carry of the Buchan field pre-FID and development

costs (paying 37.5% for a 30% working interest). The development

cost carry is capped at 7.5% of the budget approved by the Buchan

Joint Venture for the development of the Buchan field at the time

of the FDP. Subject to the cap, the development cost carry equates

to a 1.25 carry ratio for development costs; the same as the

arrangement agreed between JOG and NEO Energy earlier this

year.

-- US$3 million on approval by the NSTA of a J2 FDP.

-- US$3 million on approval by the NSTA of a Verbier FDP.

Mitch Flegg, Chief Executive of Serica commented:

"We are delighted with this transaction which gives Serica a

significant interest in the proposed Greater Buchan Area project,

potentially adding a third production hub and further resilience to

Serica's North Sea portfolio. In common with our other hubs, the

GBA plan involves utilising existing infrastructure - in this case

an FPSO - with the possibility of exploiting multiple accumulations

in the area. Moreover, the development has been designed to deliver

an industry-leading low level of carbon emissions, consistent with

Serica's objective of reducing the overall carbon intensity of its

activities.

The transaction demonstrates the benefits of Serica's strong

balance sheet. Our financial strength enables us to take advantage

of suitable opportunities to expand the portfolio and we will

continue to take a very proactive approach to business development,

while also investing in our existing portfolio and paying dividends

to shareholders. The transaction is structured such that most of

the consideration payable by Serica is contingent and linked to

making progress in the project.

Our participation will also be financially efficient with Serica

benefiting from tax reliefs on its investment.

We congratulate Jersey Oil & Gas for having created and

progressed the GBA project before recently transferring

operatorship to NEO Energy. We look forward to working with them

and NEO, including the latter's experienced and well-respected

project team."

Regulatory

This announcement is inside information for the purposes of

Article 7 of Regulation 596/2014.

The technical information contained in the announcement has been

reviewed and approved by Fergus Jenkins, VP Technical at Serica

Energy plc. Mr. Jenkins (MEng in Petroleum Engineering from

Heriot-Watt University, Edinburgh) is a Chartered Engineer with

over 25 years of experience in oil & gas exploration,

development and production and is a member of the Institute of

Materials, Minerals and Mining (IOM3) and the Society of Petroleum

Engineers (SPE).

Enquiries:

+44 (0)20 7390

Serica Energy plc 0230

Mitch Flegg (CEO) / Andy Bell (CFO)

/ Stephen Lambert (VP Legal and External

Relations)

+44 (0)20 7418

Peel Hunt (Nomad & Joint Broker) 8900

Richard Crichton / David McKeown /

Georgia Langoulant

+44 (0)20 7029

Jefferies (Joint Broker) 8000

Sam Barnett / Will Soutar

+44 (0)20 7390

Vigo Consulting (PR Advisor) 0230

Patrick d'Ancona / Finlay Thomson serica@vigoconsulting.com

NOTES TO EDITORS

Serica Energy is a British independent oil and gas exploration

and production company with a portfolio of UKCS assets.

Serica completed the acquisition of the entire issued share

capital of Tailwind Energy Investments Ltd on 23 March 2023.

Following the addition of the Tailwind assets to its portfolio,

Serica has a balance of gas and oil production. The Company is

responsible for about 5% of the natural gas produced in the UK, a

key element in the UK's energy transition.

Serica's producing assets are focused around two main hubs: the

Bruce, Keith and Rhum fields in the UK Northern North Sea, which it

operates, and a mix of operated and non-operated fields tied back

to the Triton FPSO. Serica also has operated interests in the

producing Columbus (UK Central North Sea) and Orlando (UK Northern

North Sea) fields and a non-operated interest in the producing

Erskine field in the UK Central North Sea.

Serica's portfolio of assets includes several organic investment

opportunities which are currently being pursued or are under

consideration.

Futher information on the Company can be found at

www.serica-energy.com . The Company's shares are traded on the AIM

market of the London Stock Exchange under the ticker SQZ and the

Company is a designated foreign issuer on the TSX. To receive

Company news releases via email, please subscribe via the Company

website.

[1] The up front and contingent amounts of consideration are

denominated in a mix of GBP and US$. The US$ equivalent amounts are

reported based on a conversion date of US$1.23 to GBP1.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFEUEFEEDSEEF

(END) Dow Jones Newswires

November 23, 2023 02:00 ET (07:00 GMT)

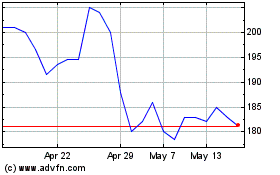

Serica Energy (AQSE:SQZ.GB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Serica Energy (AQSE:SQZ.GB)

Historical Stock Chart

From Apr 2023 to Apr 2024