2nd UPDATE: ERA 2010 Production Seen Down 18% On Poor Ore-CEO

July 12 2010 - 11:40PM

Dow Jones News

Poorer-than-expected ore grades at the resumption of dry season

mining in Energy Resources of Australia Ltd.'s (ERA.AU) Ranger

uranium mine will be largely responsible for a full-year production

shortfall of as much as 18%, chief executive Rob Atkinson said

Tuesday.

Forecast full-year production was downgraded to 4,300-4,700

metric tons of uranium ore from a previous view that it would be in

line with 2009's level of 5,240 tons, ERA said in a second-quarter

activities report.

The scale of the reduction surprised some analysts, who had

expected an in-line outlook as recently as last month, when ERA

held an investor visit to the site, 230 kilometers east of Darwin

in Australia's Northern Territory.

The production downgrade was "well below what they've stated

before", said Neil Goodwill, a mining analyst at Goldman Sachs

JBWere.

ERA shares fell on the news, and by 0406 GMT were down 65 cents,

or 4.4%, at A$14.08.

Atkinson said the sharp drop in expectations came as ERA at last

gained access to the main ore body after seasonal rains dried up in

recent weeks and stability problems with the south wall of the pit

were dealt with.

"The better ore at Ranger is at the bottom of the pit, and we

had record April rainfall that's meant we were unable to access

that for four to four-and-a-half months," he said.

"Since the investor visit, we haven't come across the [ore]

grades we were expecting, and when your production is so much

weighted to the second half, if you have two to three weeks where

you're not getting the grade, you expect that makes a big

difference."

However, he added: "We see good grades in front of us now and

we're hoping to exploit that".

Despite mining 40% more material in the second quarter than in

the previous three months, uranium oxide production was down 7% as

a result of the poorer grades, the company said.

Compared to the same period last year, material production was

down 54% while uranium oxide production fell 44%.

ERA's Ranger mine is the world's third-biggest producer of the

heavy metal used in nuclear reactors and by the military, after BHP

Billiton Ltd.'s (BHP.AU) Olympic Dam in South Australia state and

Rio Tinto Ltd.'s (RIO.AU) Rossing mine in Namibia.

Rio owns 68% of both ERA and Rossing.

Sales by ERA will remain "somewhat in excess of 5,000 tons"

during 2010 due to inventory management, shipment flexibility, and

secondary purchases, the company said, and July will see a return

to the lower levels of the mine previously blocked by

rainwater.

RBS analyst Lyndon Fagan said that two-thirds of the company's

2010 production was already expected to be skewed toward the second

half of the calendar year and added that while RBS would downgrade

ERA's full-year production figures, sales still looked in line.

Even so, "we see no reason to be in uranium stocks at the

moment", he said, joining Goldman Sachs JBWere in putting a 'hold'

rating on the stock.

ERA's spending on evaluation rose sharply from A$10.3 million

over the first half of 2009 to A$17.2 million this year, the

company said, as it continues its feasibility study for a proposed

heap leach facility to recover uranium from discarded ore.

The heap leach will be ERA's main facility after the current

open-cut mine is closed in 2012, and an environmental assessment is

expected to finish in the first half of 2011, ERA said.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

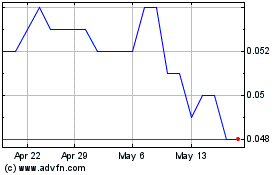

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Mar 2025 to Apr 2025

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Apr 2024 to Apr 2025