Dogecoin Plunges 11%, But This On-Chain Cushion Could End Decline

June 14 2024 - 2:00PM

NEWSBTC

Dogecoin has observed a plummet of 11% over the past week, but this

decline may not continue further, as DOGE is now just above a major

on-chain support block. Dogecoin Is Now Just Above A Major On-Chain

Demand Zone According to data from the market intelligence platform

IntoTheBlock, DOGE is currently above a zone of significant

on-chain demand. In on-chain analysis, “demand zones” refer to

price ranges in which many investors buy their coins. Related

Reading: Solana Set For “A Major 53% Price Move,” Analyst Reveals

Why These zones are determined using blockchain data; the average

price at which an address receives deposits is considered its cost

basis. Below is a chart showing how the Dogecoin price levels near

the current one are based on how many addresses share their cost

basis with them. In the graph, the size of the dots corresponds to

the number of addresses that acquired their coins within the

respective range. It would appear that the $0.096 to $0.139 range

currently looks to be the largest Dogecoin price range in terms of

this metric. More specifically, 409,330 addresses acquired a total

of 45 billion DOGE inside this range. Now, what’s the relevance of

this demand zone, or any other one, for that matter? Generally, the

cost basis is an important level for any investor, so they may be

more prone to show some reaction when the spot price of the

cryptocurrency retests it. A few investors showing this reaction

would naturally not be relevant for the broader market. Still, if

many of them share their cost basis inside the same narrow range,

then a retest could produce a large reaction for the price to feel

its effects. The demand zone around the average price of $0.115 had

many addresses acquire their coins there, so its retest could be

significant for the memecoin. As the current Dogecoin price is

above this range, these investors who bought inside the range would

be sitting on some profits. Historically, such demand zones below

the price have acted as points of support for the cryptocurrency.

This is because investor psychology tends to work out, so these

holders who were in profits before the retest may believe the price

would go up again so they could decide to buy more of the asset. On

the other hand, investors in the red before the retest can fuel the

cryptocurrency’s resistance as they sell in fear that the

price will fall again. “On the upside, DOGE may face resistance

around the $0.16 level, where 20 billion DOGE is presently held at

a loss,” notes IntoTheBlock. Related Reading: Why Is Bitcoin

Stagnant Despite ETF Inflows? Report Answers It remains to be seen

whether the on-chain demand zone below would help stop the

memecoin’s decline if its price drops enough to retest it. DOGE

Price The past week has been a bad time for Dogecoin investors as

the asset’s price has crashed around 11%. Following this drawdown,

DOGE is now trading around $0.142. Featured image from iStock.com,

IntoTheBlock.com, chart from TradingView.com

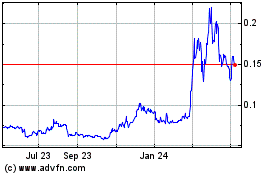

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From May 2024 to Jun 2024

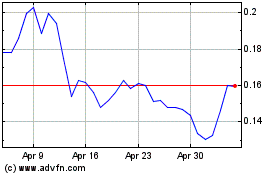

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Jun 2023 to Jun 2024