Bitcoin In The Spotlight As World Liberty Financial Debuts Strategic Reserve

February 12 2025 - 12:00PM

NEWSBTC

By launching its Macro Strategic Reserve, World Liberty Financial

(WLFI) has advanced significantly and strengthened its position in

the dynamic Bitcoin market. The approach, which seeks to fortify

the business’s financial foundation, coincides with heightened

turbulence in the digital asset market. Although this seems like a

well-planned approach, questions have already been raised

concerning WLFI’s stability and long-term sustainability. Related

Reading: This Dogecoin Chart Formation Could Catapult Meme Coin

Over $1—Analyst Aiming For Stability With A Bitcoin Reserve The

Macro Strategic Reserve aims to diversify WLFI’s portfolio by

focusing on important digital assets including Bitcoin (BTC) and

Ethereum (ETH). The initiative has already invested an estimated

$470,000 in ONDO tokens, indicating a stronger commitment to

implementing DeFi principles. WLFI’s move is vital to preserve its

stability; while some contend that owning unpredictable digital

assets does not always correspond to financial security. With the

cryptocurrency market witnessing frequent price swings, some

question if this reserve will genuinely serve as a viable form of

investment or simply expose WLFI to increased risk. Dear WLFI

Community, We are thrilled to announce a transformative initiative

that marks a significant milestone in our journey together. World

Liberty Financial (WLFI) is proud to unveil the Macro Strategy, our

strategic token reserve designed to bolster leading projects like…

— WLFI (@worldlibertyfi) February 11, 2025 A Shrinking Treasury

Raises Concerns WLFI has had a financial decline, despite its

ambitious aims. According to reports, the company’s treasury has

shrunk from more than $300 million to barely $35 million, a huge

drop that raises concerns. The decline comes after a series of big

asset liquidations, which some say were required to keep the

project afloat. This capital loss has raised concerns about WLFI’s

ability to continue operating in the long run. Maintaining investor

confidence may be difficult given the substantial fall in reserves.

Ties To Trump Family Under Scrutiny There are also ties between

WLFI and US President Donald Trump and his family, which makes

things even more complicated. Some crypto fans think this is a good

thing that could help them get government support, but others don’t

believe so. Some people are worried that political ties could lead

to problems with regulations or conflicts of interest. Furthermore,

the engagement of prominent personalities in the cryptocurrency

industry has historically elicited conflicting reactions. Some say

that mainstream support could boost legitimacy, while others worry

that it will create debate and harm the industry’s reputation.

Related Reading: Final Dip? Dogecoin Correction Could Precede A

Record Surge—Analyst What’s Next For WLFI? WLFI’s Macro Strategic

Reserve is not without risks. If it works, the company’s

cryptocurrency reputation and financial system stability may

improve. However, obstacles are inevitable. Regulation uncertainty,

market volatility, and a diminishing budget will undermine the

Trump-backed initiative. Featured image from Gemini Imagen, chart

from TradingView

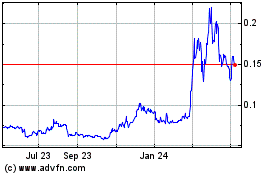

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

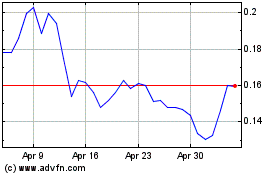

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025