Ethereum Transaction Costs Hit Historic Lows: What Does This Mean For ETH?

August 20 2024 - 12:00AM

NEWSBTC

According to recent insights from a CryptoQuant analyst, Ethereum’s

daily mean gas price has reached an all-time low, falling to

roughly 2.9 Gwei. This decline in gas prices correlates with a

significant drop in daily transaction fees, which now average

merely $0.85, marking a multi-year low for the network. The analyst

reported that this cost reduction comes amid a stable or

slightly increasing daily transaction volume compared to the

past two years, suggesting that lower fees haven’t deterred user

activity on the network. Despite drastically reduced costs, a

sustained number of transactions indicates strong network health

and continued user engagement, even as financial barriers lessen.

Related Reading: Is Ethereum Poised for Inflation? Supply Reaches

New High as Staking Takes Off Reason Behind The Plunge In

Transaction Costs Discussing the reason behind the historic lows in

the Ethereum fee structure, the CryptoQuant analyst under the

pseudonym ‘EgyHash’ attributed it to the Dencun upgrade implemented

on March 13 this year. This update introduced ‘Blobs’—a novel

transaction type designed to economize data publishing for Layer 2

networks on Ethereum. Networks such as Arbitrum, Base, and Optimism

can post their data on Ethereum at substantially reduced fees,

potentially eliminating costs by up to 100%. This enhancement has

directly contributed to the lowered gas prices and has made

Ethereum a more accessible platform for a broader user base, the

analyst disclosed. #Ethereum Gas Price Hits New All-Time Low

“Despite the approval of Ethereum ETFs, the price of $ETH has been

struggling since the Dencun upgrade. ETH supply has increased by

more than 197,000 ETH, and its price has fallen by 35%.” – By

@EgyHashX Link 👇https://t.co/GZ1Dt0NStv pic.twitter.com/PtbjWGyUzc

— CryptoQuant.com (@cryptoquant_com) August 19, 2024 However,

EgyHash also highlighted that although lower transaction costs

benefit users by making the network more affordable for various

applications, they pose a nuanced challenge for investors. EgyHash

noted in the post: While low fees are beneficial for users, they

might not be advantageous for investors, especially given the

substantial portion of Ethereum’s usage that is being offloaded to

its Layer 2 networks, and the potential problems this could cause,

such as user and liquidity fragmentation. Related Reading: Will

Ethereum Reach Over $3,000 In September? Analyst Bets On 80% Odds

Ethereum Market Performance So far, ETH has been unable to maintain

its price above notable price marks. Over the past week, ETH has

plunged by 4.2%–this bearish performance has brought the asset to

currently trade for $2,591 at the time of writing. As highlighted

by EgyHash, this struggle for the ETH’s price to hit new heights

has been around since the Dencun upgrade and has continued despite

the recent approval of spot Ethereum exchange-traded funds (ETFs).

Featured image created with DALL-E, Chart from TradingView

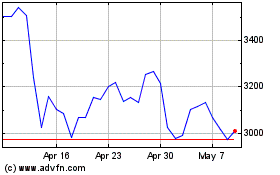

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Oct 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2023 to Oct 2024