Bitcoin Shakeout Ahead: Analysts Predict Final Dip Before Bull Run Resumes

September 10 2024 - 1:52PM

NEWSBTC

The Bitcoin market has seen some consolidation since Monday,

maintaining a price above the $56,000 mark after a brief drop from

$65,000 to around $52,600 last Friday. However, one analyst

suggests that the bearish sentiment may still be ongoing, with

expectations of a potential revisit to lower levels before a

significant upward movement. BTC’s Future Price Action In Focus

Crypto analysts known as “VirtualBacon” on X (formerly Twitter)

have raised concerns about an impending “huge Bitcoin shakeout.” In

the coming 2-3 weeks, the analyst explains that Bitcoin could

experience one last decline before initiating a bull run.

“Panic is everywhere—people are calling for lows in the $40,000s,

claiming the bull run is over,” VirtualBacon noted. Yet, he argues

that whether Bitcoin dips to $45,000, $48,000, or even $43,000, a

bull run remains on the horizon. This period often sees a shakeout

of many holders right before significant rallies. Related Reading:

Solana (SOL) Surges Past $130 Resistance As Funding Rate Signals

Bullish Momentum While the current charts indicate lower highs and

lower lows, suggesting a downtrend, VirtualBacon believes that a

prolonged bear market appears unlikely. The primary driver of this

sentiment is the anticipated liquidity injection and interest rate

cuts by the Federal Reserve, conditions that typically favor a bull

run, particularly looking ahead to 2025. Another crucial aspect of

VirtualBacon’s analysis lies in Bitcoin’s key support level—the

100-week Exponential Moving Average (EMA). This level has

historically marked the end of bear markets, with Bitcoin bouncing

off similar levels in 2015 and 2019. Currently, this support

level sits around $45,000, with various technical indicators,

including Fibonacci retracements and high-volume nodes, suggesting

strong support in the $43,000 to $49,000 range. Even if Bitcoin

does dip into this range, the analyst believes it would likely be a

temporary “wick” rather than a sustained drop. VirtualBacon also

highlights that some traders speculate about around $50,000 to

$51,000. However, this could be risky; a touch at these levels

might trigger a cascading liquidation event that could push prices

to $44,000. How Upcoming Fed Decisions May Fuel Bitcoin Bullish

Momentum Historically, September has been a weaker month for

Bitcoin. However, the upcoming months—October, November, and

December—tend to show more bullish trends. VirtualBacon notes that

over the last decade, eight out of ten Octobers have ended

positively for Bitcoin, with November also historically strong. The

backdrop of this market analysis coincides with the Federal

Reserve’s upcoming Federal Open Market Committee (FOMC) meeting,

where the analyst predicts a 70% chance of a 25 basis point rate

cut and a 30% chance of a double cut. VirtualBacon notes that

this could initiate a 12-month liquidity injection cycle that

typically boosts risk assets like BTC and propels the leading

cryptocurrency above current all-time high levels of $73,700.

Related Reading: Ethereum In 3 Months: Legendary Analyst Reveals

Prediction For December Despite the prevailing fear in the market,

as the Fear and Greed Index indicates, the analyst argues that this

fear may be irrational, especially with the impending monetary

policy shifts. As the Fed begins to cut rates, sentiment is

expected to shift rapidly, potentially leading to renewed interest

and investment in Bitcoin. BTC trades at $56,930 when writing,

recording a slightly 0.7% gain in the last 24 hours. Featured image

from DALL-E, chart from TradingView.com

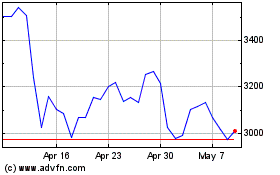

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024