Solana Breaks Above Key Resistance – Top Analyst Sets $300 Target

November 07 2024 - 11:30AM

NEWSBTC

Solana has finally broken through a crucial resistance level that

has kept the price subdued for months, sparking fresh optimism

among investors. However, the breakout has yet to be confirmed,

leaving room for excitement and caution. Prominent analyst

and investor Carl Runefelt recently shared a technical analysis on

Solana, highlighting that the cryptocurrency is on the verge of

breaking out from a massive bullish pattern. According to Runefelt,

if the breakout holds, this setup can propel SOL toward a $300

target in the coming months. Related Reading: Ethereum Analyst Sets

$3,400 Target Once ETH Breaks Key Resistance – Details The days

ahead will be critical for SOL as market sentiment and trading

volume determine whether this push is a sustained rally or a bull

trap. For Solana to confirm this breakout, it must maintain its

upward momentum and establish support above the previous

resistance. Investors are closely watching these levels, as a

failure to hold could lead to a retracement. However, if SOL

can solidify its position, it could begin a powerful rally toward

new highs. The outcome will shape Solana’s trajectory as it

attempts to secure a place among the top-performing assets in the

crypto market. Solana Testing Crucial Supply Solana is

currently testing a critical supply level, a zone that will either

drive SOL to new highs or send it back into consolidation. After

pushing above the $185 mark—a key price level that now needs to

hold as support—Solana is poised for a significant move.

According to top analyst Carl Runefelt, who shared his technical

analysis on X, Solana appears to be breaking out from a massive

Symmetrical Triangle, a well-known bullish chart pattern. In his

view, a confirmed breakout above this level could trigger a rapid

surge to $300, a move that he believes would “destroy bears” and

reinvigorate bullish sentiment. However, the coming days will be

crucial in determining Solana’s direction, especially as the

Federal Reserve’s interest rate decision is set to be announced

today. If the Fed signals a rate cut or maintains current rates, it

could fuel the rally by boosting risk-on sentiment in the market. A

favorable environment from the Fed could lead to increased buying

pressure on SOL, pushing it beyond its recent highs. Related

Reading: Massive Bitcoin Short Liquidations Send BTC Above ATH –

Trump Win Sets A Bullish Environment Conversely, if the $185 level

fails to hold, SOL might re-enter a consolidation phase,

temporarily stalling the upward momentum. For now, all eyes are on

the Federal Reserve’s decision and how it might impact broader

market sentiment, which will play a critical role in determining

whether Solana’s bullish trajectory continues. A successful

breakout here would not only confirm strength but could set the

stage for Solana to challenge $300 in the coming months. SOL

Technical Analysis Solana is currently testing the final

resistance at $190, a crucial level that could pave the way for a

challenge to its yearly highs around $210. For the bullish momentum

to remain intact, SOL needs to break above and hold this level as

support. However, achieving this may take several days as the

market continues to digest the impact of Donald Trump’s victory and

awaits the Federal Reserve’s decision on interest rates. If SOL

fails to break above the $190 resistance, a consolidation phase

between $180 and $190 could be healthy for price action. This range

would allow the market to reassess and stabilize before making

another attempt at breaking higher. However, it’s important that

the price remains above the $180 mark during this consolidation. If

SOL holds above this level, the uptrend can continue, with a

potential push toward yearly highs. Related Reading: Ethereum

Analyst Shares Correlation With S&P500 – Last Dip Before It

Hits $10,000? On the other hand, if the price drops below $180, it

could signal a shift in momentum, putting the current uptrend at

risk. For now, bulls must maintain control by keeping SOL above

$180 while the broader market awaits the Fed’s decision, which

could impact risk sentiment and Solana’s next move. Featured image

from Dall-E, chart from TradingView

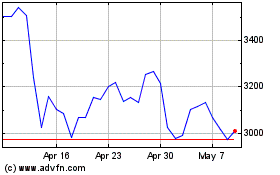

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024