XRP Price Defies Bearish Crypto Trend, Rallies 6%: Key Drivers Revealed

December 11 2024 - 12:00PM

NEWSBTC

In a notable display of resilience amidst a broadly subdued crypto

market, XRP has surged 6.7% in the last 24 hours. Following a dip

to as low as $1.90 on December 10, the asset is once again trading

above $2.36, defying the predominantly bearish sentiment that has

taken hold of the altcoin sector. While most altcoins have posted

losses or traded sideways over the same period, and Bitcoin has

registered only a modest 0.7% gain, XRP’s recent outperformance

stands out as a clear anomaly. So, why Is XRP outperforming the

crypto market? #1 Imminent Launch Of Ripple’s Stablecoin RLUSD A

key catalyst behind XRP’s rally appears to be the imminent launch

of Ripple’s long-discussed stablecoin, RLUSD. Yesterday, Ripple CEO

Brad Garlinghouse confirmed via X that RLUSD had secured a pivotal

regulatory approval. He stated: “This just in…we have final

approval from NYDFS for RLUSD! Exchange and partner listings will

be live soon – and reminder: when RLUSD is live, you’ll hear it

from Ripple first.” Related Reading: Analyst Sets $4.40 XRP Target

As 3rd-Straight Bull Pennant Forms RLUSD, currently in beta testing

on both the Ethereum network and the XRP Ledger (XRPL), has sparked

enthusiasm within the XRP community. Members speculate that the

stablecoin’s introduction could catalyze increased liquidity and

utility for XRP, and the anticipation may be contributing to a

surge in speculative interest and so-called “FOMO” (fear of missing

out). #2 Strong XRP On-Chain Activity On-chain analysis from

Santiment points to encouraging metrics for XRP. The firm noted

that “Mean Dollar Invested Age is flashing a bullish signal,”

highlighting that younger coin age distributions often precede

continued rallies. According to Santiment, the Mean Age of

investment for XRP is 865 days (22% younger in 14 weeks). Thus,

activity on the XRP network is increasing, with historically

similar patterns not reversing until these key indicators start

reversing. Related Reading: Weekly Bull Flag Appears On XRP Price

Chart, Why A Double-Digit Is Still Feasible “This is one of the key

indicators throughout the history of each coin’s lifespan that

helps validate that a bull market can and should continue. The 2017

and 2021 bull markets similarly did not come to a halt until

assets’ mean ages started going ‘up’ (getting older) again. Though

short-term price volatility can continue to be expected, consider

this a very valuable bode of confidence if you remain bullish on

market prices in the mid and long term,” Santiment states. #3

Whales Buy The Dip Amid Bullish Technical Setup From a technical

perspective, the XRP price structure remains extremely bullish on

the higher time frames. On the daily chart, XRP managed to hold

support above the April 2021 high at $1.96, rebounding swiftly

towards the 1.272 Fibonacci extension level near $2.42, where it

currently hovers. A sustained break above $2.42 could further

reinforce the bullish narrative. Notably, whales recognized the

chance and bought the retracement. Crypto analyst Ali Martinez

noted via X: “In the recent dip, whales bought over 100 million

XRP!” Featured image created with DALL.E, chart from

TradingView.com

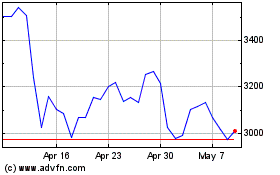

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024