Bitcoin Daily Close To ‘Dictate The Next Move’, Is Another Price Drop Ahead?

January 13 2025 - 11:00PM

NEWSBTC

Bitcoin (BTC) started the week in the red, falling to its lowest

level in over a month. Amid this performance, some analysts

consider BTC’s price will likely see another drop before the

flagship crypto aims for new highs. Related Reading: Ethereum

Tagged As Crypto’s ‘Most Cursed’ Coin—What’s Haunting It? Bitcoin

Needs Daily Close Above $91,000 On Monday, Bitcoin shook off the

weekend gains, dropping 5.8% to $90,300, its lowest price since

November 18. The flagship crypto ended last week with an overall

positive performance, nearing $96,000 and closing Friday above

$94,000. This performance was held throughout the weekend, with

Bitcoin moving between the $93,700 and $95,900 price range the past

two days. This week started with seven straight red 1-hour candles,

dropping below $91,000 for the first time since the December 19

correction and dipping lower than the December 5 pullback. However,

Bitcoin bounced after dropping below this key level, recovering the

recently lost mark. Crypto analyst Rekt Capital stated that BTC’s

daily close will dictate the next move, suggesting it needs a close

above $91,000 to confirm the reclaim. The analyst explained, “Last

week, Bitcoin was deviating beyond the Range High resistance of

$101,000. This week, Bitcoin is potentially deviating below the

Range Low support of $91,000.” He asserted that BTC closed

above the $101,000 range high last Monday but failed to retest it

into new support after the breakout, reverting to the

$91,000-$101,000 range. For this week, Rekt Capital added that even

if Bitcoin closes the day below the $91,000 range low, it will

likely need to turn that level into resistance for its price to

drop into the $87,000-$91,000 range. Nonetheless, he stated that

Bitcoin generally needs to close above this key level to persevere

in its current range but noted that “a lot can change through the

day.” Is A Dip To $87,000 Coming? Rekt Capital highlighted that

BTC’s monthly returns tend to be “patchy and predominately bearish”

in January. As CoinGlass data shows, Bitcoin’s performance has been

mostly bearish in January. Since 2013, BTC has started the year in

red seven times, including 2025’s current performance. According to

the post, the market usually “picks up” in February. He added that

the higher timeframe levels that are “teasing to be lost as

support” are “likely to be reclaimed” in the future. Meanwhile,

Altcoin Sherpa considers that “1 last liquidation wick” is due

before “we reverse for BTC.” The analyst also suggested that

Altcoins are likely to drop another 30%-50% before the Altseason.

Similarly, Daan Crypto Trades pointed out that a “bunch of shorts

have entered the market in the past few hours.” The trader noted

that “price just keeps slowly dribbling back down” as these

positions are usually “punished” when bulls are in control. Related

Reading: Solana (SOL) Teeters on the Edge: Is a Steep Decline Next?

Daan explained, “At some point, the shorts will have to close out,

but they probably won’t do so before pushing the market down

further, combined with the spot selling from Coinbase.” And added

that “the slow grinds down end in a violent wick, after which

shorts take profit, and we see a (local) bottom.” Additionally, the

trader highlighted the similarities between BTC’s performance

between December 2023 and January 2024 and December 2024 and

January 2025. If history were to repeat, Bitcoin’s next move could

be a correction to the $87,000 support, followed by a consolidation

period in the new range. As of this writing, BTC is trading at

$91,700, a 2.9% decline in the daily timeframe. Featured Image from

Unsplash.com, Chart from TradingView.com

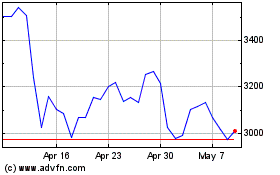

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025