Is Ethereum ‘Most Hated Rally’ About To Begin? Analyst Finds Bitcoin Cycle Similarities

February 12 2025 - 9:00AM

NEWSBTC

After a relatively subdued price performance in 2024, Ethereum

(ETH) could be on the verge of a significant breakout. A recent

analysis by a well-known crypto analyst suggests that the

second-largest digital asset may soon enter what they call its

“most hated rally.” Is It Finally Ethereum’s Time To Shine? Since

reaching its all-time high (ATH) of $4,878 in November 2021,

Ethereum has struggled to regain momentum, while other

cryptocurrencies such as Solana (SOL), SUI, and XRP have delivered

substantial returns to investors. Related Reading: Ethereum

Positioned For A ‘Major Move Upward’ In 2025, Analyst Forecasts

Currently, ETH is trading at $2,649 – only 5.5% higher than its

price exactly one year ago. In stark contrast, XRP has surged an

astonishing 365% during the same period. Even Bitcoin (BTC),

despite its much larger market cap, has recorded a 100% gain in the

past year. As a result, investor confidence in ETH appears to be

dwindling. Recent on-chain analysis indicates that ETH ‘whales’ –

wallets with significant ETH holdings – have been offloading, even

at a loss. However, this trend could change dramatically. According

to crypto analyst Titan of Crypto, Ethereum’s “most hated rally”

could be just around the corner. The analyst draws parallels

between Ethereum’s current price action and Bitcoin’s behaviour

during its third market cycle between 2018 and 2020. The weekly

chart below illustrates the striking similarities between the two

assets. According to the analysis, Ethereum is currently in what is

known as the “manipulation phase.” If history repeats itself, ETH

is likely to enter the “run-up phase” once it decisively breaks

through the “re-accumulation phase.” Notably, the chart also

highlights that ETH has faced rejection at a crucial resistance

level around $4,000 exactly three times – mirroring Bitcoin’s

behaviour during its third market cycle before eventually breaking

out. Similarly, another crypto analyst, Ted, has compared

Ethereum’s price chart to that of XRP. He notes that XRP remained

in a consolidation phase for nearly three years, experiencing

little to no price movement, only to surge by 250% within just five

weeks. Bullish Signs For Ethereum Despite hedge funds holding a

large short position on ETH due to its recent subpar price

performance, analysts are optimistic that 2025 will bring joy to

the ETH bulls. Related Reading: Ethereum Holds Multi-Year Bullish

Pattern – Expert Suggests The Next Move Will Be ‘The Real Deal’ For

instance, recent analysis by crypto analyst Kiu_Coin suggests that

ETH is on the cusp of an explosive price rally that may send it to

$17,000. Another report published in January 2025 projects ETH

price to climb to $8,000, outperforming BTC. Another sign of

growing confidence in Ethereum is the increasing capital inflow

into Ethereum exchange-traded funds (ETFs), outpacing Bitcoin ETFs

in recent weeks. This trend indicates renewed optimism and a

possible capital rotation into ETH. At press time, ETH trades at

$2,649, down 1.1% in the past 24 hours. Featured image from

Unsplash, charts from X and Tradingview.com

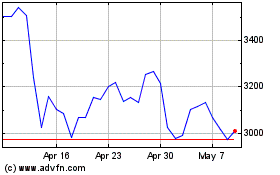

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025