Bitcoin ETFs Get $2 Million Boost From National Bank Of Canada

February 14 2025 - 2:00PM

NEWSBTC

The National Bank of Canada has ventured boldly into the realm of

cryptocurrencies. The bank has made $2 million investments in

Bitcoin exchange-traded funds (ETFs), changing the way conventional

finance views digital assets. This choice emphasizes the evolving

scene of controlled crypto investments and the increasing

institutional curiosity in Bitcoin. Related Reading: Ethereum

Whales On The Move—224,000+ ETH Withdrawn In Record Outflow A

Calculated Risk On Bitcoin ETFs The National Bank of Canada decided

on ETFs instead of directly purchasing Bitcoin, following a pattern

among financial institutions looking for controlled access to the

digital asset. By means of Bitcoin ETFs, one can invest in Bitcoin

free from the complications of direct ownership, including security

of private keys or navigating cryptocurrency exchanges. This

investment also coincides with a period of erratic BTC prices,

which have lately ranged between $95,000-$97k. 🚨 National Bank of

Canada Invests $2M in Bitcoin ETFs 🇨🇦💰 Canada’s sixth-largest

commercial bank ($462B in assets) just made a bold move into

Bitcoin, purchasing $2M worth of Bitcoin ETFs. 🏦 Institutional

adoption is accelerating, with traditional financial giants

deepening… pic.twitter.com/aLuBGjUbed — Blockchain North

(@BlockchaiNorth) February 13, 2025 Following The Footsteps Of

Global Institutions Regarding the reception of Bitcoin ETF, Canada

is setting the benchmark. The action of the National Bank of Canada

is in line with those of other big multinational companies like as

BlackRock, which lately started the iShares BTC Trust in the US.

The growing participation of conventional banks and asset managers

suggests that Bitcoin is starting to acquire popularity as a choice

of investment. Weighing Opportunity And Risk Despite the

surrounding buzz, detractors of ETFs contend they do not provide

the advantages of direct Bitcoin ownership. Although ETFs depend on

outside custodians, direct ownership of the cryptocurrencies gives

investors total control over their money. ETF investments often

come with management fees that could cut possible returns. Still,

the National Bank of Canada seems to consider ETFs as a safer, more

readily available way to expose to Bitcoin free from direct

ownership and related legal concerns. Related Reading: Cardano

Price Balloons 107% As Whales Scoop Up 1.41 Billion ADA What This

Means For Bitcoin’s Future Bitcoin’s increasing engagement with the

financial sector suggests that digital assets are gradually

becoming a part of traditional finance. If additional businesses

follow suit, crypto acceptance might increase even more, which

would improve its price and market dynamics. The National Bank of

Canada’s $2 million investment, albeit tiny at the moment, reflects

a broader trend of mainstream financial actors adopting Bitcoin as

a long-term asset. As interest in Bitcoin ETFs grows, it is

uncertain whether other banks will follow suit, potentially

bridging the gap between traditional banking and the cryptocurrency

market. Featured image from Gemini Imagen, chart from TradingView

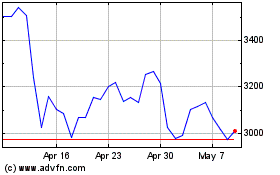

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025