THORChain has been called a money laundering protocol — a label

no decentralized finance (DeFi) project wants unless it’s prepared

to have regulators breathing down its neck.

Its supporters have fended off the criticism by championing

decentralization, while its critics point to recent activities that

showed some of the protocol’s centralized tendencies.

After exploiting Bybit for $1.4 billion, the North Korean

state-backed hackers behind the attack, known as the Lazarus Group,

flocked to THORChain, making it their top choice to convert stolen

funds from Ether (ETH) to Bitcoin

(BTC). Lazarus finished

converting its Ether within just 10 days of the hack.

The controversy has triggered internal conflict, governance

cracks and developer resignations, exposing a deeper issue and

question: Can DeFi remain neutral when criminals exploit it at

scale?

THORChain is not a mixer

THORChain is a decentralized swap protocol, so some say it’s

unfair to call it a laundering machine, as the output is traceable.

It’s not like a mixer, whose purpose is to conceal cryptocurrency

fund trails — though the reasons for using mixers vary between

users, with some simply wanting to preserve their privacy and

others using them for illicit purposes.

Federico Paesano, investigations lead at Crystal Intelligence,

argued in a

LinkedIn post that it is misleading to state that the North Korean

hackers “laundered” the Bybit hack proceeds.

“So far, there’s been no concealment, only conversion. The

stolen ETH have been swapped for BTC using various providers, but

every swap is fully traceable. This isn’t laundering; it’s just

asset movement across blockchains.”

Tracing funds swapped to Bitcoin is time-consuming, but not

impossible. Source: Federico

Paesano

Hackers also moved funds through Uniswap and OKX DEX, yet

THORChain has become the focal point of scrutiny due to the sheer

volume of funds that passed through it. In a March 4 X post, Bybit

CEO Ben Zhou said that 72% of the

stolen funds (361,255 ETH) had flowed through THORChain, far

surpassing activity on other DeFi services.

Over $1 billion in Ether from the Bybit theft was traced to

THORChain. Source: Coldfire/Dune

Analytics

A truly decentralized platform’s strength lies in its neutrality

and censorship-resistance, which are foundational to blockchain’s

value proposition, according to Rachel Lin, CEO of decentralized

exchange SynFutures.

“The line between decentralization and responsibility can evolve

with technology,” Lin told Cointelegraph. “While human intervention

contradicts decentralization’s ethos, protocol-level innovations

could automate safeguards against illicit activity.”

Related: From

Sony to Bybit: How Lazarus Group became crypto’s

supervillain

THORChain collected at least $5 million in

fees from these transactions, a windfall for a project already

struggling with financial instability. This financial benefit has

further fueled criticism, with some questioning whether THORChain’s

reluctance to intervene was ideological or simply a matter of

self-preservation.

Source: Yogi

(Screenshot cropped by Cointelegraph for visibility)

Governance cracks show when decentralization becomes a

shield

The controversy sparked a dilemma on whether THORChain should

act. In an attempt to block the hackers, three validators voted to

halt ETH trading, effectively closing off their swapping route.

However, four validators quickly voted to overturn the

decision.

This exposed a contradiction in THORChain’s governance model.

The protocol claims to be absolutely decentralized, yet it had

previously intervened to pause its lending

feature due to insolvency risks (swaps still remained

operational).

Some crypto community members called out THORChain’s actions as

selective decentralization, where governance intervention only

occurs when it serves the protocol’s own interests.

Source: Dan

Dadybayo

The backlash was

immediate. Pluto, a key THORChain developer,

resigned. Another

developer, TCB, who identified themselves as one of the three

validators who voted to halt Ether trades,

hinted at leaving unless

governance issues were addressed.

Meanwhile, blockchain investigator ZachXBT

called out Asgardex, a

THORChain-based decentralized exchange, for not returning fees

earned from hackers, while other protocols reportedly refunded

ill-gotten gains.

THORChain founder John-Paul Thorbjornsen responded by claiming

that centralized exchanges pocket millions from facilitating

illicit transactions unless pressured by authorities.

“This pisses me off. Do we get ETH and BTC nodes to give back

their transaction fees? What about GETH or BTCCore devs - who write

the software, funded by grants/donations?”

asked Thorbjornsen.

Source: ZachXBT

THORChain's growing regulatory risks, as previously

demonstrated by privacy tools

For now, THORChain has avoided any direct enforcement actions

from governments, but history suggests that DeFi protocols

facilitating illicit finance may not escape scrutiny forever.

Tornado Cash, a well-known crypto mixer, was

sanctioned by the US

Treasury in 2022 after being used to launder billions of dollars,

though it was later

overturned by a US court. Similarly, Railgun came under FBI

scrutiny in

2023 after North Korean hackers used it to move $60 million in

stolen Ether.

Related: Tornado Cash developer Alexey Pertsev leaves

prison custody

Railgun presents a unique case, as it’s marketed as a privacy

protocol rather than a mixer or a DEX. But the distinction still

draws comparisons to THORChain, given that privacy protocols

frequently face criticism for potentially enabling illicit

activities.

“Critics often claim that privacy-focused projects enable crime,

but in reality, protecting financial privacy is a fundamental right

and a cornerstone of decentralized innovation,” Chen Feng, head of

research at Autonomys and associate professor and research chair in

blockchain at the University of British Columbia’s Okanagan Campus,

told Cointelegraph.

“Technologies like ZK-proofs and trusted execution environments

can secure user data without obscuring illicit activity entirely.

Through optional transparency measures and robust onchain

forensics, suspicious patterns can still be detected. The goal is

to strike a balance: empower users with privacy while ensuring the

system has built-in safeguards to discourage and trace illicit

use.”

Lin of SynFutures said continued illicit use of decentralized

protocols would “absolutely” lead to drastic measures from

authorities.

“Governments will likely escalate measures if they perceive

decentralized protocols as systemic risks. This could include

sanctioning protocol addresses, pressuring infrastructure

providers, blacklisting entire networks or going after the

builders,” she said.

Rising pressure against THORChain

THORChain supporters argue it is being

unfairly singled out, as hackers have also used other DeFi

protocols. But regulators tend to focus on the biggest enablers,

and THORChain processed the vast majority of the stolen funds from

the Bybit hack. This makes it an easy target for enforcement

actions ranging from Office of Foreign Assets Control (OFAC)

sanctions to developer prosecutions.

“When the huge majority of your flows are stolen funds from

north korea for the biggest money heist in human history, it will

become a national security issue, this isn’t a game anymore,” TCB

wrote on X.

“The threshold you want to be credibly decentralized

you need a network of 1000+ unique validators. There is a reason

why @Chainflip fixed this issue on the network level so quickly and

all front end are applying censorship.”

If regulators decide to crack down, the consequences could be

severe. Sanctions on THORChain’s validators, front-end service, and

liquidity providers could cripple its ecosystem, while major

exchanges might delist RUNE (RUNE), cutting off its

access to liquidity.

There is also the possibility of legal action against

developers, as seen in the Tornado Cash

case, or pressure to introduce compliance measures like

sanctioned address filtering — something that would contradict

THORChain’s decentralized ethos and alienate its core user

base.

THORChain’s entanglement with North Korean hackers has put it at

a crossroads. The protocol must decide whether to take action now

or risk having regulators step in to make that decision for

them.

For now, the protocol remains firm in its laissez-faire

approach, but history suggests DeFi projects that ignore illicit

activity don’t stay untouchable forever.

Magazine: THORChain founder and his plan to ‘vampire

attack’ all of DeFi

...

Continue reading THORChain at crossroads:

Decentralization clashes with illicit activity

The post

THORChain at crossroads: Decentralization clashes

with illicit activity appeared first on

CoinTelegraph.

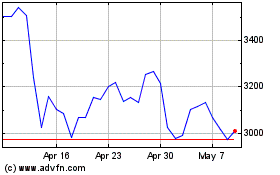

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025