Yen Falls As BoJ Keeps Policy Rate Unchanged

December 18 2024 - 8:06PM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Thursday, after the Bank of Japan left its key

interest rates unchanged as policymakers were concerned about risks

related to economic activity and prices.

At the policy board meeting, members voted 8-1 to maintain the

uncollateralized overnight call rate to remain at around 0.25

percent. This was the highest since late 2008.

The BoJ had ended its negative interest rate policy in March and

last lifted the interest rate in July to 0.25 percent. So far, the

BoJ has tightened the policy twice this year.

The board said it is necessary to pay due attention to

developments in financial and foreign exchange markets and their

impact on Japan's economic activity and prices.

"In particular, with firms' behavior shifting more toward

raising wages and prices recently, exchange rate developments are,

compared to the past, more likely to affect price," the bank

said.

The safe-haven yen slid further following the speech of the BoJ

Governor Kazuo Ueda on policy outlook after holding interest

rate.

"Will keep adjusting degree of easing if our economic, price

outlook is to be realised," Ueda said.

The U.S. Federal Reserve on Wednesday cut the key lending rate

by 25 basis point as expected but revised its projections to signal

just two interest rate cuts next year compared to the four

previously forecast, citing stubbornly high inflation.

Fed Chair Jerome Powell's explicit - and repeated - references

to the need for caution from here underscored investor concerns

that Trump's fiscal, trade and tariff policies may fuel inflation

and keep U.S. interest rates higher for longer.

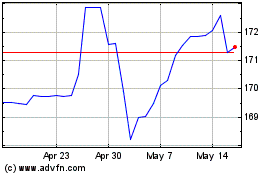

In the Asian trading today, the yen fell to nearly a 1-month low

of 155.49 against the U.S. dollar and more than a 3-week low of

173.25 against the Swiss franc, from yesterday's closing quotes of

154.80 and 171.73, respectively. If the yen extends its downtrend,

it is likely to find support around 157.00 against the greenback

and 175.00 against the franc.

Against the euro and the pound, the yen slipped to a 2-day low

of 161.85 and nearly a 1-month low of 196.27 from Wednesday's

closing quotes of 160.25 and 194.63, respectively. The yen may test

support near 164.00 against the euro and 196.00 against the

pound.

Against the Australia and the New Zealand dollars, the yen

slipped to 97.10 and 87.81 from an early 10-day high of 95.90 and

more than a 3-month high of 86.75, respectively. On the downside,

100.00 against the aussie and 92.00 against the kiwi are seen as

the next support levels for the yen.

The yen slid to a 2-day low of 108.00 against the Canadian

dollar, from an early 8-day high of 106.92. The next possible

downside target for the yen is seen around the 112.00 region.

Looking ahead, the European Central Bank publishes euro area

current account data for October in the European session at 4:00 am

ET.

The Bank of England is set to announce its the interest rate

decision at 7:00 am ET. The Monetary Policy Committee is forecast

to leave the interest rate unchanged at 4.75 percent. The bank had

reduced the rate by quarter-point each in November and August.

In the New York session, Canada average weekly earnings data for

October, U.S. weekly jobless claims data, U.S. Philadelphia Fed

manufacturing index for December, U.S. core PCE prices data for the

third quarter, existing home sales for November, U.S. Consumer

Board's leading index for November and U.S. Kansas Fed composite

index for December are slated for release.

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Nov 2024 to Dec 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Dec 2023 to Dec 2024