U.S. Dollar Lower Against Most Majors

February 23 2024 - 5:30AM

RTTF2

The U.S. dollar was subdued on Friday, as investors continued to

cheer strong quarterly results from AI chipmaker Nvidia.

Shares of Nvidia continued to rise after hitting an all-time

high yesterday. Nvidia's earnings lifted the Dow and S&P 500 to

record highs on Thursday.

The Commerce Department's report on personal income and spending

will be in focus next week, as it includes readings on inflation

said to be preferred by the Federal Reserve.

Traders are also likely to keep an eye on reports on durable

goods orders, new home sales, consumer confidence and manufacturing

activity.

The greenback fell to 1.0839 against the euro and 1.2701 against

the pound, off its early highs of 1.0814 and 1.2648, respectively.

The greenback is poised to challenge support around 1.10 against

the euro and 1.28 against the pound.

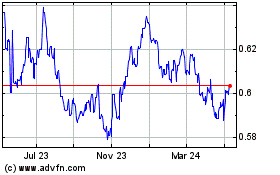

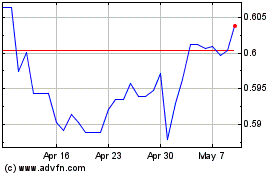

The greenback edged down to 0.6580 against the aussie and 0.6211

against the kiwi, from its early highs of 0.6549 and 0.6180,

respectively. The greenback is seen finding support around 0.68

against the aussie and 0.63 against the kiwi.

The greenback eased to 150.31 against the yen, from an early

9-day high of 150.76. If the currency falls further, it is likely

to test support around the 144.00 region.

In contrast, the greenback climbed against the loonie and was

trading at 1.3503. On the upside, 1.38 is possibly seen as its next

resistance level.

The greenback rebounded against the franc and was trading at

0.8815. The greenback is likely to find resistance around the 0.90

level.

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Oct 2024 to Nov 2024

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Nov 2023 to Nov 2024