true

0001800637

0001800637

2024-12-12

2024-12-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13

OR 15(d)

of The Securities Exchange

Act of 1934

Date of report (Date of earliest event reported):

December 12, 2024

AGRIFY CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-39946 |

|

30-0943453 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of incorporation) |

|

|

|

Identification No.) |

| 2468 Industrial Row Dr. |

|

|

| Troy, MI |

|

48084 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (617) 896-5243

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

AGFY |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

EXPLANATORY NOTE

This Amendment No. 1 to a Current Report on Form 8-K/A (this “Amendment

No. 1”) is being filed by Agrify Corporation (the “Company”) for the purpose of amending Item 9.01 of that certain Current

Report on Form 8-K filed by the Company with the U.S. Securities and Exchange Commission (“SEC”) on December 16, 2024 (the

“Original Form 8-K”) in connection with the December 12, 2024 completion of the acquisition of substantially all of the assets

of Double or Nothing, LLC (“Double or Nothing”). As indicated in the Original Form 8-K, this Amendment is being filed to provide

the financial statements and pro forma financial information required by Items 9.01(a) and (b) of Form 8-K, which were not previously

filed with the Original Form 8-K as permitted by the rules of the SEC.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired

The audited financial statements of Double or Nothing as of and for

the years ended December 31, 2023 and 2022 and the unaudited financial statements of Double or Nothing as of and for the nine months ended

September 30, 2024 and 2023 are filed as Exhibits 99.1 and 99.2, respectively, to this Amendment No. 1, and are incorporated herein by

reference.

(b) Pro Forma Financial Information

The unaudited pro forma combined financial information of the Company,

giving effect to the acquisition of substantially all of the assets of Double of Nothing, which includes the unaudited pro forma condensed

combined balance sheet as of September 30, 2024 and the unaudited pro forma condensed combined statements of operations and comprehensive

loss for the year ended December 31, 2023 and for the nine months ended September 30, 2024 and the related notes, is filed as Exhibit

99.3 to this Amendment No. 1, and is incorporated herein by reference.

(d) Exhibits.

The Company hereby files or furnishes, as applicable, the following

exhibits:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AGRIFY CORPORATION |

| |

|

|

| Date: February 25, 2025 |

By: |

/s/ Benjamin Kovler |

| |

|

Benjamin Kovler |

| |

|

Chairman and Interim Chief Executive Officer |

Exhibit 23.1

CONSENT OF INDEPENDENT AUDITORS

We hereby consent to the use of our report dated

February 21, 2025, relating to the financial statements of the Double or Nothing, LLC as of and for the years ended December 31, 2023

and 2022 included in this Amended Current Report on Form 8-K/A of Agrify Corporation.

| /s/ GuzmanGray |

|

| |

|

| Costa Mesa, California |

|

| February 25, 2025 |

|

Exhibit 99.1

DOUBLE

OR NOTHING, LLC

FINANCIAL STATEMENTS

DECEMBER 31, 2023 AND 2022

DOUBLE

OR NOTHING, LLC

FINANCIAL STATEMENTS

DECEMBER 31, 2023 AND 2022

TABLE OF CONTENTS

CERTIFIED PUBLIC ACCOUNTANTS

INDEPENDENT AUDITOR’S REPORT

To the Members of

Double or Nothing, LLC

St. Helena,

CA

Opinion

We have audited the accompanying

financial statements of Double or Nothing, LLC (a California corporation) (hereinafter referred to as the “Company”), which

comprise the balance sheets as of December 31, 2023 and 2022, and the related statements of operations, changes in members’ equity,

and cash flows for the years then ended, and the related notes to the financial statements.

In our opinion, the financial

statements referred to above present fairly, in all material respects, the financial position of the Company as of December 31, 2023 and

2022, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally

accepted in the United States of America.

Basis for Opinion

We conducted our audits in accordance

with auditing standards generally accepted in the United States of America. Our responsibilities under those standards are further described

in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent

of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial

Statements

Management is responsible for

the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United

States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation

of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements,

management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about

the Company’s ability to continue as a going concern within one year after the date that the financial statements are available

to be issued.

| 1 |

| 3200 Bristol Street, Suite 640, Costa Mesa, CA 92626 |

Auditor’s Responsibilities

for the Audit of the Financial Statements

Our objectives are to obtain

reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error,

and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute

assurance and therefore is not a guarantee that an audit conducted in accordance with generally accepted auditing standards will always

detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for

one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal

control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would

influence the judgment made by a reasonable user based on the financial statements.

In

performing an audit in accordance with generally accepted auditing standards, we:

| ● | Exercise

professional judgment and maintain professional skepticism throughout the audit. |

| ● | Identify

and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit

procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures

in the financial statements. |

| ● | Obtain

an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances,

but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion

is expressed. |

| ● | Evaluate

the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well

as evaluate the overall presentation of the financial statements. |

| ● | Conclude

whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s

ability to continue as a going concern for a reasonable period of time. |

We

are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of

the audit, significant audit findings, and certain internal control related matters that we identified during the audit.

GuzmanGray

Costa Mesa, CA

February

21, 2025

DOUBLE OR NOTHING, LLC

BALANCE

SHEETS

AS OF DECEMBER 31, 2023 and 2022

| | |

2023 | | |

2022 | |

| ASSETS | |

| | |

| |

| Current assets | |

| | |

| |

| Cash | |

$ | 53,466 | | |

$ | 43,613 | |

| Accounts receivable | |

| 187,181 | | |

| 48,753 | |

| Inventory | |

| 139,388 | | |

| 21,883 | |

| Prepaid insurance | |

| 3,775 | | |

| - | |

| Total current assets | |

| 383,810 | | |

| 114,249 | |

| | |

| | | |

| | |

| Total assets | |

$ | 383,810 | | |

$ | 114,249 | |

| | |

| | | |

| | |

| LIABILITIES AND MEMBERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | - | | |

$ | 32,811 | |

| Accrued expenses | |

| 60,691 | | |

| 17,742 | |

| Total current liabilities | |

| 60,691 | | |

| 50,553 | |

| | |

| | | |

| | |

| Total liabilities | |

| 60,691 | | |

| 50,553 | |

| | |

| | | |

| | |

| Members’ capital | |

| 1,129,345 | | |

| 661,437 | |

| Accumulated deficit | |

| (806,226 | ) | |

| (597,741 | ) |

| Total members’ equity | |

| 323,119 | | |

| 63,696 | |

| | |

| | | |

| | |

| Total liabilities and members’ equity | |

$ | 383,810 | | |

$ | 114,249 | |

The accompanying notes are an integral

part of these financial statements.

DOUBLE

OR NOTHING, LLC

STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 31, 2023

AND 2022

| | |

2023 | | |

2022 | |

| Revenue | |

$ | 466,846 | | |

$ | 82,014 | |

| Cost of goods sold | |

| 600,722 | | |

| 323,757 | |

| Gross loss | |

| (133,876 | ) | |

| (241,743 | ) |

| | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 74,609 | | |

| 169,844 | |

| | |

| | | |

| | |

| Net loss | |

$ | (208,485 | ) | |

$ | (411,587 | ) |

The accompanying notes are an integral part of these financial

statements.

DOUBLE OR NOTHING, LLC

STATEMENTS

OF CHANGES IN MEMBERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022

| | |

Members’

Capital | | |

Accumulated

Deficit | | |

Members’

Equity | |

| Balance as of December 31, 2021 | |

$ | 224,351 | | |

$ | (186,154 | ) | |

$ | 38,197 | |

| Contributions | |

| 437,086 | | |

| - | | |

| 437,086 | |

| Net loss | |

| - | | |

| (411,587 | ) | |

| (411,587 | ) |

| Balance as of December 31, 2022 | |

| 661,437 | | |

| (597,741 | ) | |

| 63,696 | |

| Contributions | |

| 467,908 | | |

| - | | |

| 467,908 | |

| Net loss | |

| - | | |

| (208,485 | ) | |

| (208,485 | ) |

| Balance as of December 31, 2023 | |

$ | 1,129,345 | | |

$ | (806,226 | ) | |

$ | 323,119 | |

The accompanying notes are an integral part of these financial

statements.

DOUBLE OR NOTHING, LLC

STATEMENTS

OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2023

AND 2022

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | |

| |

| Net loss | |

$ | (208,485 | ) | |

$ | (411,587 | ) |

| Changes in assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (138,428 | ) | |

| (48,753 | ) |

| Inventory | |

| (117,505 | ) | |

| 16,314 | |

| Prepaid insurance | |

| (3,775 | ) | |

| - | |

| Accounts payable | |

| (32,811 | ) | |

| 32,811 | |

| Accrued expenses | |

| 42,949 | | |

| 17,742 | |

| Net cash used by operating activities | |

| (458,055 | ) | |

| (393,473 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Equity contributions | |

| 467,908 | | |

| 437,086 | |

| Net cash provided by financing activities | |

| 467,908 | | |

| 437,086 | |

| | |

| | | |

| | |

| Net change in cash | |

| 9,853 | | |

| 43,613 | |

| | |

| | | |

| | |

| Cash at beginning of year | |

| 43,613 | | |

| - | |

| | |

| | | |

| | |

| Cash at end of year | |

$ | 53,466 | | |

$ | 43,613 | |

The accompanying notes are an integral

part of these financial statements.

DOUBLE OR NOTHING, LLC

NOTES

TO THE FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022

NOTE 1 – NATURE OF OPERATIONS

Double or Nothing, LLC (the “Company”)

is headquartered in St. Helena, California. The Company’s products include premium hemp-derived THC margarita flavored beverages.

The Company utilizes manufacturing partners for production of its products which are sold in select markets in the United States and Canada.

NOTE 2 SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Basis

of Presentation: These financial statements were prepared in accordance with accounting principles generally accepted in the

United States (“US GAAP”).

Use

of Estimates: The preparation of the Company’s financial statements requires the use of estimates and assumptions that

affect the reported amounts of assets, liabilities, revenue, and expenses. Significant estimates include the valuation of inventory. Although

these estimates are based on the Company’s knowledge of current events and expectations of future outcomes, actual results may differ.

Cash:

The Company maintains its cash in a bank deposit account, which at times may exceed federally insured limits. The Company has not experienced

any losses in such accounts. The Company believes it is not exposed to any significant credit risk on its cash.

Accounts

Receivable: Accounts receivable as of December 31, 2023, and 2022, totaled $187,181 and $48,753, respectively. As of

December 31, 2023, 84% of the Company’s accounts receivable balance was due from one customer. This customer is the

Company’s primary manufacturing partner, that purchases inventory from the Company for sale to beverage distributors. As of

December 31, 2022, the entire accounts receivable balance was attributable to the Company’s primary manufacturing partner.

Based on management’s assessment, the Company determined that no allowance for credit losses was necessary as of December 31,

2023 and 2022.

Inventory:

Inventory is valued at the lower of cost or net realizable value, using the specific identification method. Inventory consists of raw

materials and finished goods in the form of bottled beverages. The Company adjusts the carrying value of inventory if it is determined

that it does not meet the criteria for sale to customers.

Prepaid

Insurance: Prepaid insurance represents the unexpired portion of insurance premiums paid in advance. These amounts are amortized

over the respective policy periods which are less than one year.

Accounts

Payable: Accounts payable represent amounts owed to vendors and service providers for goods received and services rendered,

for which invoices have been received. These balances reflect obligations directly attributable to the Company’s operations. As

of December 31, 2022, the entire balance of accounts payable was due to the Company’s primary manufacturing partner.

Accrued

Expenses: Accrued expenses represent expenses incurred but not yet paid. These liabilities are directly attributable to the

Company’s operations.

Revenue:

Revenue is recognized in accordance with Accounting Standards Update 2014-09, Revenue

from Contracts with Customers (Topic 606), which reflects the transfer of control of goods to customers in amounts that represent

the consideration the Company expects to receive. Revenue is primarily derived from sales of beverages and is recognized at a point in

time, typically upon transfer of ownership to customers. The majority of the Company’s revenue is related to one customer, the Company’s

primary manufacturing partner, that purchase inventory for resale to beverage distributors in Canada. This customer accounted for 95%

and 100% of revenue in the years ended December 31, 2023 and 2022, respectively.

DOUBLE OR NOTHING, LLC

NOTES

TO THE FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2023 AND 2022

Cost

of Goods Sold: Cost of goods sold reflects all direct expenses incurred in producing the Company’s beverages. This includes

costs for raw materials, manufacturing services, and other professional services related to production.

Income

Taxes: The Company is a Limited Liability Company and has elected to be treated as a Partnership under the provisions of the

Internal Revenue Code, whereby income is passed through to the individual members and reported on each members personal income tax return.

Under the election, the Company does not pay any federal or state income taxes. Accordingly, no provisions for income taxes have been

made in the accompanying financial statements. If it is probable that an uncertain tax position will result in a material liability and

the amount of the liability can be estimated, then the estimated liability is accrued. If the Company were to incur any income tax liability

in the future, interest on any income tax liability would be reported as interest expense, and penalties on any income tax would be reported

as income tax expense. As of December 31, 2023 and 2022, management believes there were no uncertain tax positions.

NOTE 3 – INVENTORY

Inventory is composed of the following

as of December 31:

| | |

2023 | | |

2022 | |

| Raw materials | |

$ | 21,127 | | |

$ | 10,654 | |

| Finished goods | |

| 118,261 | | |

| 11,229 | |

| Total inventory | |

$ | 139,388 | | |

$ | 21,883 | |

NOTE 4 – COMMITMENTS AND CONTINGENCIES

The Company has no material commitments

or contingencies as of December 31, 2023 and 2022, beyond normal operating obligations.

The Company has evaluated legal

and contractual obligations, including any potential litigation, long-term purchase commitments, and guarantees, and determined that no

additional disclosures or liabilities are required. The Company operates in a regulated industry and actively monitors compliance with

applicable laws and regulations and to ensure proper recognition and disclosure.

NOTE 5 –

SUBSEQUENT EVENTS

The Company has evaluated subsequent

events through February 21, 2025, the date these financial statements were available to be issued.

On December 6, 2024, the Company

executed a promissory note with Agrify Corporation (“Agrify”). The promissory note allowed for draws up to $1.0 million and

charged an interest rate of approximately 4% with all principal and interest due on March 31, 2025. The amount drawn on this promissory

note was $0.4 million as of December 12, 2024. On December 12, 2024, certain assets of the Company including intellectual property and

inventory were acquired by Agrify in exchange for 97, 300 shares of Agrify common stock and 432,700 pre-funded warrants with a fair value

of approximately $18.8 million and $0.4 million of assumed liabilities in the form of the promissory note balance outstanding.

8

Exhibit 99.2

DOUBLE

OR NOTHING, LLC

INTERIM FINANCIAL STATEMENTS

SEPTEMBER 30, 2024 AND 2023

DOUBLE

OR NOTHING, LLC

INTERIM FINANCIAL STATEMENTS

SEPTEMBER 30, 2024 AND 2023

TABLE OF CONTENTS

|

|

| |

CERTIFIED

PUBLIC ACCOUNTANTS |

INDEPENDENT ACCOUNTANT’S

REVIEW REPORT

To the Members of

Double or Nothing, LLC

St. Helena,

CA

We

have reviewed the accompanying financial statements of Double or Nothing, LLC (a California corporation) (hereinafter referred to as the

“Company”) which comprise the balance sheets as of September 30, 2024 and 2023, and the related statements of operations,

changes in members’ equity and cash flows for the nine months ended September 30, 2024 and 2023, and the related notes to the financial

statements. A review includes primarily applying analytical procedures to management’s financial data and making inquiries of management.

A review is substantially less in scope than an audit, the objective of which is the expression of an opinion regarding the financial

statements as a whole. Accordingly, we do not express such an opinion.

Management’s Responsibility for the Financial

Statements

Management is responsible for

the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the

United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and

fair presentation of financial statements that are free from material misstatement whether due to fraud or error.

Accountant’s Responsibility

Our responsibility is to conduct

the review engagements in accordance with Statements on Standards for Accounting and Review Services promulgated by the Accounting and

Review Services Committee of the AICPA. Those standards require us to perform procedures to obtain limited assurance as a basis for reporting

whether we are aware of any material modifications that should be made to the financial statements for them to be in accordance with accounting

principles generally accepted in the United States of America. We believe that the results of our procedures provide a reasonable basis

for our conclusion.

We are required to be independent

of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements related to our review.

Accountant’s Conclusion

Based on our reviews, we are

not aware of any material modifications that should be made to the accompanying financial statements in order for them to be in accordance

with accounting principles generally accepted in the United States of America.

| /s/ GuzmanGray |

|

| GuzmanGray |

|

| Costa Mesa, CA |

|

| February 21, 2025 |

|

| 1 |

| 3200 Bristol Street, Suite 640, Costa Mesa, CA 92626 |

DOUBLE OR NOTHING, LLC

BALANCE SHEETS

AS OF SEPTEMBER 30, 2024 AND 2023

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| Current assets | |

| | |

| |

| Cash | |

$ | 51,775 | | |

$ | 84,768 | |

| Accounts receivable | |

| 256,926 | | |

| 141,381 | |

| Inventory | |

| 360,337 | | |

| 116,428 | |

| Prepaid insurance | |

| 4,345 | | |

| 5,191 | |

| Total current assets | |

| 673,383 | | |

| 347,768 | |

| | |

| | | |

| | |

| Total assets | |

$ | 673,383 | | |

$ | 347,768 | |

| | |

| | | |

| | |

| LIABILITIES AND MEMBERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accrued expenses | |

$ | 65,744 | | |

$ | 11,870 | |

| Total current liabilities | |

| 65,744 | | |

| 11,870 | |

| | |

| | | |

| | |

| Total liabilities | |

| 65,744 | | |

| 11,870 | |

| | |

| | | |

| | |

| Members’ capital | |

| 1,358,345 | | |

| 1,128,344 | |

| Accumulated deficit | |

| (750,706 | ) | |

| (792,446 | ) |

| Total members’ equity | |

| 607,639 | | |

| 335,898 | |

| | |

| | | |

| | |

| Total liabilities and members’ equity | |

$ | 673,383 | | |

$ | 347,768 | |

See accompanying notes to financial statements and independent accountant’s review report.

DOUBLE

OR NOTHING, LLC

STATEMENTS OF OPERATIONS

FOR THE NINE MONTHS ENDED SEPTEMBER

30, 2024 AND 2023

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Revenue | |

$ | 803,523 | | |

$ | 350,559 | |

| Cost of goods sold | |

| 662,003 | | |

| 478,353 | |

| Gross profit (loss) | |

| 141,520 | | |

| (127,794 | ) |

| | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 86,000 | | |

| 66,911 | |

| | |

| | | |

| | |

| Net income (loss) | |

$ | 55,520 | | |

$ | (194,705 | ) |

See accompanying notes to financial statements and independent

accountant’s review report.

DOUBLE OR NOTHING, LLC

STATEMENTS

OF CHANGES IN MEMBERS’ EQUITY

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2024 AND 2023

| | |

Members’

Capital | | |

Accumulated

Deficit | | |

Members’

Equity | |

| Balance as of December 31, 2023 | |

$ | 1,129,345 | | |

$ | (806,226 | ) | |

$ | 323,119 | |

| Contributions | |

| 229,000 | | |

| | | |

| 229,000 | |

| Net income | |

| | | |

| 55,520 | | |

| 55,520 | |

| Balance as of September 30, 2024 | |

$ | 1,358,345 | | |

$ | (750,706 | ) | |

$ | 607,639 | |

| Balance as of December 31, 2022 | |

$ | 661,437 | | |

$ | (597,741 | ) | |

$ | 63,696 | |

| Contributions | |

| 466,907 | | |

| | | |

| 466,907 | |

| Net loss | |

| | | |

| (194,705 | ) | |

| (194,705 | ) |

| Balance as of September 30, 2023 | |

$ | 1,128,344 | | |

$ | (792,446 | ) | |

$ | 335,898 | |

See accompanying notes to financial statements and independent

accountant’s review report.

DOUBLE OR NOTHING, LLC

STATEMENTS OF CASH

FLOWS

FOR THE NINE MONTHS ENDED SEPTEMBER

30, 2024 AND 2023

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | |

| |

| Net income (loss) | |

$ | 55,520 | | |

$ | (194,705 | ) |

| Changes in assets and liabilities | |

| | | |

| | |

| Accounts receivable | |

| (69,745 | ) | |

| (92,627 | ) |

| Inventory | |

| (220,949 | ) | |

| (94,544 | ) |

| Prepaid insurance | |

| (570 | ) | |

| (5,191 | ) |

| Accounts payable | |

| - | | |

| (32,811 | ) |

| Accrued expenses | |

| 5,053 | | |

| (5,874 | ) |

| Net cash used by operating activities | |

| (230,691 | ) | |

| (425,752 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Equity contributions | |

| 229,000 | | |

| 466,907 | |

| Net cash provided by financing activities | |

| 229,000 | | |

| 466,907 | |

| | |

| | | |

| | |

| Net change in cash | |

| (1,691 | ) | |

| 41,155 | |

| | |

| | | |

| | |

| Cash at beginning of period | |

| 53,466 | | |

| 43,613 | |

| | |

| | | |

| | |

| Cash at end of period | |

$ | 51,775 | | |

$ | 84,768 | |

See accompanying notes to financial statements and independent

accountant’s review report.

DOUBLE OR NOTHING, LLC

NOTES

TO THE FINANCIAL STATEMENTS

AS OF AND FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2024

AND 2023

NOTE 1 – NATURE OF OPERATIONS

Double or Nothing, LLC (the “Company”)

is headquartered in St. Helena, California. The Company’s products include premium hemp-derived THC margarita flavored beverages.

The Company utilizes manufacturing partners for production of its products which are sold in select markets in the United States and Canada.

NOTE 2 SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Basis

of Presentation: These financial statements were prepared in accordance with accounting principles generally accepted in the

United States (“US GAAP”).

Use

of Estimates: The preparation of the Company’s financial statements requires the use of estimates and assumptions that

affect the reported amounts of assets, liabilities, revenue, and expenses. Significant estimates include the valuation of inventory. Although

these estimates are based on the Company’s knowledge of current events and expectations of future outcomes, actual results may differ.

Cash:

The Company maintains its cash in a bank deposit account, which at times may exceed federally insured limits. The Company has not experienced

any losses in such accounts. The Company believes it is not exposed to any significant credit risk on its cash.

Accounts

Receivable: Accounts receivable as of September 30, 2024 and 2023, totaled $256,926 and $141,381, respectively. As of

September 30, 2024, 29% of the Company’s accounts receivable balance was due from one customer. This customer is the

Company’s primary manufacturing partner, that purchases inventory from the Company for sale to beverage distributors. As of

September 30, 2024, three other customers represented at least 10% of the Company’s accounts receivable. As of September 30,

2023, 91% of the Company’s accounts receivable balance was attributable to the Company’s primary manufacturing partner.

Based on management’s assessment, the Company determined that no allowance for credit losses was necessary as of September 30,

2024 and 2023.

Inventory:

Inventory is valued at the lower of cost or net realizable value, using the specific identification method. Inventory consists of raw

materials and finished goods in the form of bottled beverages. The Company adjusts the carrying value of inventory if it is determined

that it does not meet the criteria for sale to customers.

Prepaid

Insurance: Prepaid insurance represents the unexpired portion of insurance premiums paid in advance. These amounts are amortized

over the respective policy periods which are less than one year.

Accounts

Payable: Accounts payable represent amounts owed to vendors and service providers for goods received and services rendered,

for which invoices have been received. These balances reflect obligations directly attributable to the Company’s operations.

Accrued

Expenses: Accrued expenses represent expenses incurred but not yet paid. These liabilities are directly attributable to the

Company’s operations.

Revenue:

Revenue is recognized in accordance with Accounting Standards Update 2014-09, Revenue

from Contracts with Customers (Topic 606), which reflects the transfer of control of goods to customers in amounts that represent

the consideration the Company expects to receive. Revenue is primarily derived from sales of beverages and is recognized at a point in

time, typically upon transfer of ownership to customers. The majority of the Company’s revenue is related to one customer, the Company’s

primary manufacturing partner, that purchase inventory for resale to beverage distributors in Canada. This customer accounted for 62%

and 90% of revenue in the nine months ended September 30, 2024 and 2023, respectively.

DOUBLE OR NOTHING, LLC

NOTES

TO THE FINANCIAL STATEMENTS

AS OF AND FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2024

AND 2023

Cost

of Goods Sold: Cost of goods sold reflects all direct expenses incurred in producing the Company’s beverages. This includes

costs for raw materials, manufacturing services, and other professional services related to production.

Income

Taxes: The Company is a Limited Liability Company and has elected to be treated as a Partnership under the provisions of the

Internal Revenue Code, whereby income is passed through to the individual members and reported on each members personal income tax return.

Under the election, the Company does not pay any federal or state income taxes. Accordingly, no provisions for income taxes have been

made in the accompanying financial statements. If it is probable that an uncertain tax position will result in a material liability and

the amount of the liability can be estimated, then the estimated liability is accrued. If the Company were to incur any income tax liability

in the future, interest on any income tax liability would be reported as interest expense, and penalties on any income tax would be reported

as income tax expense. As of September 30, 2024 and 2023, management believes there were no uncertain tax positions.

NOTE 3 – INVENTORY

Inventory is composed of the following as of:

| | |

2024 | | |

2023 | |

| Raw materials | |

$ | 81,366 | | |

$ | 36,615 | |

| Finished goods | |

| 278,971 | | |

| 79,813 | |

| Total inventory | |

$ | 360,337 | | |

$ | 116,428 | |

NOTE 4 – COMMITMENTS AND

CONTINGENCIES

The Company has no material

commitments or contingencies as of September 30, 2024 and 2023, beyond normal operating obligations.

The Company has evaluated legal

and contractual obligations, including any potential litigation, long-term purchase commitments, and guarantees, and determined that no

additional disclosures or liabilities are required. The Company operates in a regulated industry and actively monitors compliance with

applicable laws and regulations and to ensure proper recognition and disclosure.

NOTE 5 –

SUBSEQUENT EVENTS

The Company has evaluated subsequent

events through February 21, 2025, the date these financial statements were available to be issued.

On December 6, 2024, the Company

executed a promissory note with Agrify Corporation (“Agrify”). The promissory note allowed for draws up to $1.0 million and

charged an interest rate of approximately 4% with all principal and interest due on March 31, 2025. The amount drawn on this promissory

note was $0.4 million as of December 12, 2024. On December 12, 2024, certain assets of the Company including intellectual property and

inventory were acquired by Agrify in exchange for 97,300 shares of Agrify common stock and 432,700 pre-funded warrants with a fair value

of approximately $18.8 million and $0.4 million of assumed liabilities in the form of the promissory note balance outstanding.

Exhibit 99.3

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL

INFORMATION OF AGRIFY AND DOUBLE OR NOTHING

On December 12, 2024, Agrify Corporation (“Agrify”)

completed its acquisition of substantially all of the assets of Double or Nothing, LLC (“Double or Nothing”) pursuant to an

Asset Purchase Agreement (the “Purchase Agreement”) and (the “Transaction”). Pursuant to the terms of the Purchase

Agreement, the consideration exchanged consisted of 97,300 shares of Agrify common stock as well as pre-funded warrants to acquire up

to 432,700 shares of Agrify common stock, (collectively the “Shares”), and forgiveness of $0.4 million in debt for total consideration

of approximately $19.2 million. The fair value of the Shares was based on the closing price of Agrify’s common stock as traded on

NASDAQ at the date of the transaction. Double or Nothing is the owner and creator of the Senorita brand of hemp-derived THC (“HD9”)

drinks and the purchase of these assets are part of the Company’s strategic plan to reposition itself as a distributor of hemp-derived

THC beverages (and similar products).

The following unaudited pro forma condensed combined financial

statements (the “pro forma financial statements”) are based on the historical consolidated financial statements of Agrify

and Double or Nothing, as adjusted to give effect to the Transaction which closed on December 12, 2024. The unaudited pro forma condensed

combined balance sheet as of September 30, 2024 (the “pro forma balance sheet”) gives effect to the Transaction as if it had

occurred on September 30, 2024. The unaudited pro forma condensed combined statements of operations and comprehensive loss for the nine

months ended September 30, 2024 and for the year ended December 31, 2023 (the “pro forma statements of operations”) give effect

to the Transaction as if it had occurred on January 1, 2023.

The unaudited pro forma financial information was prepared

in accordance with Article 11 of Regulation S-X. The pro forma adjustments are based on available information and assumptions that we

believe are reasonable. Included in the pro forma financial information is an estimate of the consideration exchanged for substantially

all of the assets of Double or Nothing which is based on known information and preliminary estimates of fair value for certain equity

instruments. While this is our best estimate at this time, the valuation of these amounts is still in progress and subject to change.

All estimates and assumptions included in these pro forma statements could change significantly as we finalize our assessment of the allocation

and fair value of the net tangible and intangible assets acquired, most of which are dependent on the completion of valuations being performed

by independent valuation specialists and expected to change significantly as these valuations are completed and recorded. The unaudited

pro forma financial information does not include adjustments to reflect any synergies or dis-synergies, any future operating efficiencies,

associated costs savings or any possible integration costs that may occur related to the Transaction. Actual results may be materially

different than the pro forma information presented herein.

The pro forma financial statements do not necessarily reflect

what the combined company’s financial condition or results of operations would have been had the Transaction occurred on the dates

indicated. They also may not be useful in predicting the future financial condition and results of operations of the combined company.

The actual financial condition and results of operations of the combined company may differ significantly from the pro forma amounts reflected

herein due to a variety of factors, including differences in accounting policies, elections, and estimates, which while accounted for

to the extent known, are still in process of being determined.

Agrify Corporation

Acquisition of Substantially All Assets

of Double or Nothing

Pro Forma Balance Sheet as of September

30, 2024

(Unaudited)

(In thousands, except share amounts)

| | |

Historical Agrify

(as reported) | | |

Double or

Nothing, LLC. | | |

Pro Forma

Adjustments | | |

Ref | |

Pro Forma

Combined | |

| Assets | |

| | |

| | |

| | |

| |

| |

| | |

| | |

| | |

| | |

| |

| |

| Current assets: | |

| | |

| | |

| | |

| |

| |

| Cash and cash equivalents | |

$ | 263 | | |

$ | 52 | | |

$ | (52 | ) | |

(a) | |

$ | 263 | |

| Marketable securities | |

| 4 | | |

| - | | |

| - | | |

| |

| 4 | |

| Accounts receivable, net | |

| 328 | | |

| 257 | | |

| (257 | ) | |

(a) | |

| 328 | |

| Inventories, net | |

| 18,085 | | |

| 360 | | |

| 42 | | |

(a), (b) | |

| 18,487 | |

| Loans receivable, current | |

| 1,680 | | |

| - | | |

| - | | |

| |

| 1,680 | |

| Prepaid expenses and other current assets | |

| 410 | | |

| 4 | | |

| (4 | ) | |

(a) | |

| 410 | |

| Total current assets | |

| 20,770 | | |

| 673 | | |

| (271 | ) | |

| |

$ | 21,172 | |

| Loans receivable, net | |

| 9,903 | | |

| - | | |

| - | | |

| |

| 9,903 | |

| Property and equipment, net | |

| 6,596 | | |

| - | | |

| - | | |

| |

| 6,596 | |

| Operating lease right-of-use assets | |

| 1,573 | | |

| - | | |

| - | | |

| |

| 1,573 | |

| Tradenames and proprietary recipes | |

| - | | |

| - | | |

| 6,100 | | |

(c) | |

| 6,100 | |

| Customer relationships | |

| - | | |

| - | | |

| 2,800 | | |

(c) | |

| 2,800 | |

| Other non-current assets | |

| 110 | | |

| - | | |

| - | | |

| |

| 110 | |

| Total assets | |

$ | 38,952 | | |

$ | 673 | | |

$ | 8,629 | | |

| |

$ | 48,254 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Liabilities and Equity | |

| | | |

| | | |

| | | |

| |

| | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Current liabilities: | |

| | | |

| | | |

| | | |

| |

| | |

| Accounts payable | |

$ | 12,034 | | |

$ | - | | |

$ | - | | |

| |

$ | 12,034 | |

| Accrued expenses and other liabilities | |

| 7,473 | | |

| 66 | | |

| 190 | | |

(a), (d) | |

| 7,729 | |

| Operating lease liabilities, current | |

| 666 | | |

| - | | |

| - | | |

| |

| 666 | |

| Long-term debt, current | |

| 525 | | |

| - | | |

| - | | |

| |

| 525 | |

| Related party debt, current | |

| 2,344 | | |

| - | | |

| - | | |

| |

| 2,344 | |

| Contract liabilities | |

| 4,724 | | |

| - | | |

| - | | |

| |

| 4,724 | |

| Total current liabilities | |

| 27,766 | | |

| 66 | | |

| 190 | | |

| |

| 28,022 | |

| Warrant liabilities | |

| 277 | | |

| - | | |

| - | | |

| |

| 277 | |

| Operating lease liabilities, net of current | |

| 1,090 | | |

| - | | |

| - | | |

| |

| 1,090 | |

| Related party debt, net of current | |

| 4,360 | | |

| - | | |

| - | | |

| |

| 4,360 | |

| Long-term debt, net of current | |

| 2 | | |

| - | | |

| - | | |

| |

| 2 | |

| Total liabilities | |

$ | 33,495 | | |

$ | 66 | | |

$ | 190 | | |

| |

$ | 33,751 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Commitments and contingencies | |

| | | |

| | | |

| | | |

| |

| | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Equity | |

| 5,457 | | |

| 607 | | |

| 8,439 | | |

(e) | |

| 14,503 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Total liabilities and equity | |

$ | 38,952 | | |

$ | 673 | | |

$ | 8,629 | | |

| |

$ | 48,254 | |

See accompanying notes to unaudited

pro forma condensed combined financial statements.

Agrify Corporation

Acquisition of Substantially All Assets of Double

or Nothing

Pro Forma Income Statement as of September 30,

2024

(Unaudited)

(In thousands, except share amounts)

| | |

Historical Agrify

(as reported) | | |

Double or

Nothing, LLC. | | |

Pro Forma

Adjustments | | |

Notes | |

Pro Forma

Combined | |

| Revenue | |

$ | 7,526 | | |

$ | 804 | | |

$ | (70 | ) | |

(f) | |

$ | 8,260 | |

| Cost of goods sold | |

| 6,009 | | |

| 662 | | |

| (70 | ) | |

(f) | |

| 6,601 | |

| Gross profit | |

| 1,517 | | |

| 142 | | |

| - | | |

| |

| 1,659 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Selling, general and administrative | |

| 10,930 | | |

| 86 | | |

| 1,125 | | |

(g) | |

| 12,141 | |

| Research and development | |

| 628 | | |

| - | | |

| - | | |

| |

| 628 | |

| Gain on settlement of contingent liabilities | |

| (5,935 | ) | |

| - | | |

| - | | |

| |

| (5,935 | ) |

| Gain on early termination of lease | |

| (39 | ) | |

| - | | |

| - | | |

| |

| (39 | ) |

| Loss on disposal of property and equipment | |

| 1 | | |

| - | | |

| - | | |

| |

| 1 | |

| Change in contingent consideration | |

| (2,180 | ) | |

| - | | |

| - | | |

| |

| (2,180 | ) |

| Total operating expenses | |

| 3,405 | | |

| 86 | | |

| 1,125 | | |

| |

| 4,616 | |

| Operating loss | |

| (1,888 | ) | |

| 56 | | |

| (1,125 | ) | |

| |

| (2,957 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Interest expense | |

| (166 | ) | |

| | | |

| | | |

| |

| (166 | ) |

| Change in fair value of warrant liabilities | |

| (15,502 | ) | |

| - | | |

| - | | |

| |

| (15,502 | ) |

| Other income | |

| 169 | | |

| | | |

| - | | |

| |

| 169 | |

| Total other income (expense), net | |

| (15,499 | ) | |

| - | | |

| - | | |

| |

| (15,499 | ) |

| Net loss | |

| (17,387 | ) | |

| 56 | | |

| (1,125 | ) | |

| |

| (18,456 | ) |

| Loss attributable to non-controlling interest | |

| - | | |

| - | | |

| - | | |

| |

| - | |

| Net loss attributable to shareholders | |

$ | (17,387 | ) | |

$ | 56 | | |

$ | (1,125 | ) | |

| |

$ | (18,456 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Net loss per share attributable to shareholders - basic and diluted | |

$ | (16.82 | ) | |

| | | |

| | | |

| |

$ | (16.32 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Weighted average shares outstanding - basic and diluted | |

| 1,033,582 | | |

| | | |

| 97,300 | | |

(h) | |

| 1,130,882 | |

See accompanying notes to unaudited pro forma condensed

combined financial statements.

Agrify Corporation

Acquisition of Substantially All Assets of Double

or Nothing

Pro Forma Income Statement as of December 31,

2023

(Unaudited)

(In thousands, except share amounts)

| | |

Historical Agrify

(as reported) | | |

Double or

Nothing, LLC. | | |

Pro Forma Adjustments | | |

Notes | |

Pro Forma Combined | |

| | |

| | |

| | |

| | |

| |

| |

| Revenue | |

$ | 16,868 | | |

$ | 467 | | |

$ | (47 | ) | |

(f) | |

$ | 17,288 | |

| Cost of goods sold | |

| 11,590 | | |

| 601 | | |

| (45 | ) | |

(f) | |

| 12,146 | |

| Gross profit | |

| 5,278 | | |

| (134 | ) | |

| (2 | ) | |

| |

| 5,142 | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Selling, general and administrative | |

| 23,139 | | |

| 74 | | |

| 1,500 | | |

(g) | |

| 24,713 | |

| Research and development | |

| 2,295 | | |

| - | | |

| | | |

| |

| 2,295 | |

| Change in contingent consideration | |

| (1,322 | ) | |

| - | | |

| - | | |

| |

| (1,322 | ) |

| Gain on disposal of property and equipment | |

| 144 | | |

| - | | |

| - | | |

| |

| 144 | |

| Total operating expenses | |

| 24,256 | | |

| 74 | | |

| 1,500 | | |

| |

| 25,830 | |

| Operating loss | |

| (18,978 | ) | |

| (208 | ) | |

| (1,502 | ) | |

| |

| (20,688 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Interest expense, net | |

| (1,853 | ) | |

| - | | |

| - | | |

| |

| (1,853 | ) |

| Change in fair value of warrant liabilities | |

| 4,695 | | |

| - | | |

| - | | |

| |

| 4,695 | |

| Loss on extinguishment of long-term debt, net | |

| (4,311 | ) | |

| - | | |

| - | | |

| |

| (4,311 | ) |

| Other income, net | |

| 1,799 | | |

| - | | |

| - | | |

| |

| 1,799 | |

| Total other income (expense), net | |

| 330 | | |

| - | | |

| - | | |

| |

| 330 | |

| Net loss before income tax | |

| (18,648 | ) | |

| (208 | ) | |

| (1,502 | ) | |

| |

| (20,358 | ) |

| Income tax expense | |

| (2 | ) | |

| - | | |

| - | | |

| |

| (2 | ) |

| Net loss before income tax | |

| (18,650 | ) | |

| (208 | ) | |

| (1,502 | ) | |

| |

| (20,360 | ) |

| Income attributable to non-controlling interest | |

| 1 | | |

| - | | |

| - | | |

| |

| 1 | |

| Net loss attributable to shareholders | |

$ | (18,649 | ) | |

$ | (208 | ) | |

$ | (1,502 | ) | |

| |

$ | (20,359 | ) |

| Net loss attributable to Agrify Corporation | |

| | | |

| | | |

| | | |

| |

| | |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Net loss per share attributable to shareholders - basic and diluted | |

$ | (12.51 | ) | |

| | | |

| | | |

| |

$ | (12.82 | ) |

| | |

| | | |

| | | |

| | | |

| |

| | |

| Weighted average shares outstanding - basic and diluted | |

| 1,490,871 | | |

| | | |

| 97,300 | | |

(h) | |

| 1,588,171 | |

See accompanying notes to unaudited pro forma condensed

combined financial statements.

NOTES TO THE UNAUDITED

PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

1. Basis of Presentation

The pro forma financial statements represent the combined

company’s (Agrify and Double or Nothing) unaudited pro forma condensed combined balance sheet as of September 30, 2024, and unaudited

pro forma statements of operations for the nine months ended September 30, 2024 and the year ended December 31, 2023. The pro forma financial

statements are based on the historical financial statements of Agrify and Double or Nothing, adjusted to give effect to the Transaction,

and should be read in conjunction with the historical financial statements from which they are derived.

The pro forma financial statements are presented in United

States dollars (“USD”) and prepared in accordance with U.S. GAAP.

The pro forma balance sheet gives effect to the Transaction

as if it had occurred on September 30, 2024. The pro forma statements of operations give effect to the Transaction as if it had occurred

on January 1, 2023.

In preparing the unaudited pro forma balance sheet and

statements of operations in accordance with U.S. GAAP, the following historical information was used:

| ● | Agrify’s Quarterly Report filed on Form 10-Q as of and for the period ended September 30, 2024; |

| ● | Agrify’s Annual Report filed on Form 10-K as of and for the year ended December 31, 2023; |

| ● | Double of Nothing’s unaudited financial statements as of and for the nine months ended September 30, 2024: |

| ● | Double or Nothing’s audited financial statements as of and for the year ended December 31, 2023. |

The unaudited pro forma balance sheet and statements of

operations should be read in conjunction with the historical financial statements including the notes thereto, as listed above, which

are incorporated by reference.

The pro forma financial statements have been prepared for

illustrative purposes only and may not be indicative of the operating results or financial condition that would have been achieved if

the Transaction had been completed on the dates or for the periods presented, nor do they purport to project the results of operations

or financial position for any future period or as of any future date. The actual financial position and results of operations may differ

materially from the pro forma amounts reflected herein due to a variety of factors.

The unaudited pro forma financial statements do not reflect

operational and administrative cost savings that may be achieved as a result of the Transaction.

2. Pro forma Adjustments

Balance Sheet Adjustments

The following adjustments have been

made to the pro forma balance sheet. These adjustments reflect only preliminary purchase accounting estimates as of September 30, 2024.

Fair value assessment and valuations have not yet been completed and alignment of accounting policies is still in progress and are therefore

not reflected herein.

| (a) | Represents the elimination of assets and liabilities that

were not acquired as part of the acquisition of substantially all of the assets of Double or Nothing. |

| (b) | Represents the pro forma purchase accounting adjustment to

record the estimated adjustment to reflect inventory acquired at fair value. |

| (c) | Reflects the pro forma purchase accounting adjustment to

record the estimated fair value of intangible assets acquired. |

| (d) | Reflects accrual of transaction expenses of approximately

$0.3 million. |

| (e) | Reflects issuance of 97,300 shares of acquirer’s common stock

as consideration for a fair value of $331 and the issuance of 432,700 pre-funded warrants to purchase acquirer’s common stock with a

fair value of $1,471. The estimated fair value of the shares and warrants on September 30, 2024 would have been $1.8 million at a $3.41

per share closing price. The actual closing stock price on December 12th, 2024 (the actual closing date), was $35.54 making the fair

value of the shares and warrants $18.8 million. The estimated fair value of assets on September 30, 2024 would have exceeded the fair

value of consideration on that date, generating a $7.5 million bargain purchase gain. Due to the substantial increase in the acquirer’s

stock price, no bargain purchase gain is expected to be recognized in the subsequent income statement after closing. These amounts are

offset by the elimination of Double or Nothing’s historical equity. |

Statements of Operations and Comprehensive Loss Adjustments

The following adjustments have been made to the pro forma

condensed combined statements of operations and comprehensive loss. These adjustments reflect only preliminary accounting policy and estimates

alignment. Fair value assessment and valuations have not yet been completed and alignment of accounting policies is still in progress

and are therefore not fully reflected here.

| (f) | Represents the elimination of revenues and expenses not attributable

to the assets and operations acquired from Double or Nothing. |

| (g) | Represents estimated amortization related to acquired intangible

assets. |

| (h) | Reflects shares issued as part of purchase consideration.

Periods presented have been adjusted to retroactively reflect the 1-for-20 reverse stock split on July 5, 2023, and for the 1-for-15

reverse stock split on October 8, 2024. Additional information regarding reverse stock splits may be found in Note 1 – Overview,

Basis of Presentation, and Significant Accounting Policies of the Company’s Form 10-Q for the quarterly period ended September

30, 2024 filed with the SEC on November 14, 2024. |

3. Pro forma Purchase Price Allocation

Agrify is the legal acquirer, and pursuant to the Purchase

Agreement consideration exchange consisted of 97,300 shares of Agrify common stock as well as 432,700 of pre-funded warrants. Acquisition

consideration also included forgiveness of $0.4 million in liabilities, which are not included in the pro forma consideration estimate

as the liability was not incurred until December 2024. Estimated pro forma consideration of $1.8 million is based on Agrify’s closing

share price of $3.41 on September 30, 2024 (the effective share price as if the transaction closed on September 30, 2024). On the transaction

date of December 12, 2024, the fair value of the consideration was $18.8 million for the shares and warrants (based on Agrify’s closing

share price of $35.54) as well as the forgiveness of liabilities for total fair value of consideration exchanged of $19.2 million.

The following table summarizes the calculation of the estimated

pro forma consideration (in thousands):

| 97,300 shares of Agrify common stock | |

$ | 331 | |

| 432,700 pre-funded warrants | |

$ | 1,471 | |

| Total estimated consideration | |

$ | 1,802 | |

Following is a

preliminary estimate of the purchase price allocation for the transaction. There are significant items not reflected herein as they are

still in process. These open items include fair value adjustments, further alignment of accounting principles, estimates and methodologies,

and evaluation of contingencies. Amounts are expected to change substantially in the final purchase price allocation.

| Consideration: | |

| |

| 97,300 shares of Agrify common stock | |

$ | 331 | |

| 432,700 pre-funded warrants | |

| 1,471 | |

| Estimated fair value of consideration exchanged | |

| 1,802 | |

| Recognized amounts of identifiable assets acquired: | |

| | |

| Inventory | |

$ | 402 | |

| Tradenames and propriety recipes | |

| 6,100 | |

| Customer relationships | |

| 2,800 | |

| Total assets acquired | |

$ | 9,302 | |

| Fair value of consideration in excess of identified assets acquired | |

$ | (7,500 | ) |

v3.25.0.1

Cover

|

Dec. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Amendment Description |

This Amendment No. 1 to a Current Report on Form 8-K/A (this “Amendment

No. 1”) is being filed by Agrify Corporation (the “Company”) for the purpose of amending Item 9.01 of that certain Current

Report on Form 8-K filed by the Company with the U.S. Securities and Exchange Commission (“SEC”) on December 16, 2024 (the

“Original Form 8-K”) in connection with the December 12, 2024 completion of the acquisition of substantially all of the assets

of Double or Nothing, LLC (“Double or Nothing”). As indicated in the Original Form 8-K, this Amendment is being filed to provide

the financial statements and pro forma financial information required by Items 9.01(a) and (b) of Form 8-K, which were not previously

filed with the Original Form 8-K as permitted by the rules of the SEC.

|

| Document Period End Date |

Dec. 12, 2024

|

| Entity File Number |

001-39946

|

| Entity Registrant Name |

AGRIFY CORPORATION

|

| Entity Central Index Key |

0001800637

|

| Entity Tax Identification Number |

30-0943453

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2468 Industrial Row Dr.

|

| Entity Address, City or Town |

Troy

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48084

|

| City Area Code |

617

|

| Local Phone Number |

896-5243

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

AGFY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

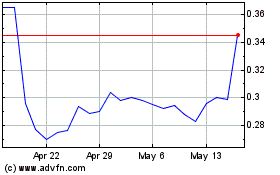

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From Feb 2024 to Feb 2025