0001653087false00016530872024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 06, 2024 |

Alector, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38792 |

82-2933343 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

131 Oyster Point Blvd. Suite 600 |

|

South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (415) 231-5660 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

ALEC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2024, Alector, Inc. (the “Company”) announced its financial results for the quarter ended September 30, 2024. A press release announcing these results, which is attached hereto as Exhibit 99.1, is incorporated herein by reference.

All of the information furnished in Item 2.02 and Item 9.01 (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ALECTOR, INC. |

|

|

|

|

Date: |

November 6, 2024 |

By: |

/s/ Arnon Rosenthal |

|

|

|

Arnon Rosenthal, Ph.D.

Co-founder and Chief Executive Officer |

Alector Reports Third Quarter 2024 Financial Results and Provides Business Update

Data from INVOKE-2, evaluating TREM2 agonist candidate AL002 in patients with early Alzheimer’s disease (AD), on track for 2024

Participant baseline characteristics in pivotal INFRONT-3 Phase 3 trial suggest a representative study population for testing the effects of latozinemab in frontotemporal dementia with a progranulin gene mutation (FTD-GRN)

$457.2 million in cash, cash equivalents and investments provide runway through 2026

South San Francisco, Calif., November 6, 2024 -- Alector, Inc. (Nasdaq: ALEC), a clinical-stage biotechnology company pioneering immuno-neurology, today reported third quarter 2024 financial results and recent portfolio and business updates. As of September 30, 2024, Alector’s cash, cash equivalents, and investments totaled $457.2 million.

“We continue to make meaningful progress advancing our innovative pipeline of product candidates and remain on track to report data in 2024 from the INVOKE-2 Phase 2 trial of AL002, the most advanced TREM2 candidate in clinical development for early Alzheimer’s disease,” said Arnon Rosenthal, Ph.D., Chief Executive Officer of Alector. “We believe that increased TREM2 signaling via AL002 may recruit disease-fighting microglia to broadly counteract the progression of Alzheimer’s disease. INVOKE-2 is designed to provide meaningful insights into AL002’s potential benefits across a combination of clinical and functional endpoints, as well as imaging and fluid biomarkers. We also believe that the broad mechanism of AL002 may have the potential to deliver potent and durable therapeutic benefits, both as a standalone therapy and in combination with anti-amyloid beta antibodies.”

Dr. Rosenthal continued, “For our progranulin franchise, we recently reported the patient baseline characteristics for our INFRONT-3 Phase 3 clinical trial of latozinemab in frontotemporal dementia with a progranulin gene mutation, suggesting a representative study population in this indication. We are approaching a top-line data readout for INFRONT-3 in late 2025/early 2026. Additionally, PROGRESS-AD, the Phase 2 trial of AL101/GSK4527226 in early Alzheimer’s disease, has reached more than one-third of its target enrollment. It is an exciting time at Alector, and we are well positioned to advance our proprietary pipeline of novel immuno-neurology drugs.”

Sara Kenkare-Mitra, Ph.D., President and Head of Research and Development at Alector, added, “We are actively advancing our Alector Brain Carrier, ABC, a proprietary versatile blood-brain barrier technology, and we are strategically leveraging this platform across our portfolio. We believe our ABC technology may advance treatment of neurodegenerative diseases by potentially enabling improved delivery of our therapeutics to the brain.”

3Q24 Earnings Release Page 2

Recent Clinical Updates

Immuno-Neurology Portfolio

TREM2 Program (AL002) Being Developed in Collaboration with AbbVie

•The results of the INVOKE-2 Phase 2 clinical trial of AL002 are expected in 2024. INVOKE-2, a randomized, double-blind, placebo-controlled, dose-ranging study, is designed to assess the efficacy and safety of AL002 in slowing disease progression in individuals with early Alzheimer’s disease (AD). AL002 is a novel investigational humanized monoclonal antibody (mAb) that is designed to bind to TREM2 to increase TREM2 signaling and, thereby, is hypothesized to improve the functionality of microglia. It is the most advanced TREM2 agonist product candidate in clinical development worldwide.

•98% of eligible participants who completed the planned treatment period of INVOKE-2 have elected to participate in the long-term extension (LTE) study.

•In October 2024, Alector published a manuscript titled “Preclinical and first-in-human evaluation of AL002, a novel TREM2 agonistic antibody for Alzheimer’s disease” in Alzheimer’s Research & Therapy. The publication outlines preclinical and INVOKE-1 Phase 1 study results, demonstrating that AL002 engaged TREM2, and induced pharmacodynamic biomarker changes associated with microglial proliferation, survival, and phagocytic activity in a dose-dependent manner.

•AbbVie has an exclusive option to globally develop and commercialize AL002. Alector will deliver a data package resulting from the INVOKE-2 study to AbbVie for their evaluation. AbbVie’s exercise of its option would prompt a $250 million payment to Alector.

Progranulin Programs (latozinemab (AL001) and AL101/GSK4527226) Being Developed in Collaboration with GSK

•The pivotal, randomized, double-blind, placebo-controlled INFRONT-3 Phase 3 clinical trial of latozinemab targeting frontotemporal dementia with a progranulin gene mutation (FTD-GRN) is ongoing and on track, with enrollment completed in October 2023 and a treatment duration of 96 weeks. Latozinemab is a novel investigational human mAb that aims to increase progranulin (PGRN) levels by inhibiting sortilin and is the most advanced PGRN-elevating candidate in development for the treatment of FTD-GRN.

•In September 2024, Alector presented a poster highlighting the patient baseline characteristics for INFRONT-3 at the 14th International Conference on Frontotemporal Dementias (ISFTD 2024). Notably, the baseline characteristics of symptomatic INFRONT-3 participants, including age, Clinical Dementia Rating scale plus National Alzheimer’s Disease Coordinating Center Frontotemporal Lobar Degeneration Sum of Boxes (CDR® plus NACC FTLD-SB) score and neurofilament light chain (NfL) levels, were representative of the broader FTD-GRN registry population, based on available registry data. Additionally, Alector shared findings from the FTD Caregiver Survey and FTD Insights Survey, highlighting the challenges faced by caregivers of individuals living with FTD.

3Q24 Earnings Release Page 3

•PROGRESS-AD, a global, randomized, double-blind, placebo-controlled Phase 2 clinical study evaluating AL101/GSK4527226 in early AD has reached more than one-third of its target enrollment of 282 participants, with dosing initiated in February 2024. AL101 is an investigational human mAb designed to block and downregulate the sortilin receptor to elevate the level of PGRN in the brain in a manner that is similar to investigational latozinemab but with different pharmacokinetic and pharmacodynamic properties.

Early Research Pipeline

•Alector continues to advance its Alector Brain Carrier (ABC), a proprietary, versatile blood-brain barrier technology platform, which is being applied selectively to the company’s next-generation product candidates and research pipeline. The technology platform enables customization of affinity, valency, and format to optimize effector function and half-life in preclinical models. Alector is applying its ABC technology, combined with its expertise in immuno-neurology, to work on novel targets and develop first or best-in-class therapeutics.

Third Quarter 2024 Financial Results

Revenue. Collaboration revenue for the quarter ended September 30, 2024, was $15.3 million, compared to $9.1 million for the same period in 2023. The increase was mainly due to an increase in revenue recognized for the AL002 program.

R&D Expenses. Total research and development expenses for the quarter ended September 30, 2024, were $48.0 million, compared to $46.3 million for the quarter ended September 30, 2023. The increase was mainly driven by the increase in research and development expenses for the AL101 programs resulting from the initiation of the PROGRESS-AD Phase 2 clinical trial in 2024.

G&A Expenses. Total general and administrative expenses for the quarter ended September 30, 2024, were $15.8 million, compared to $13.4 million for the quarter ended September 30, 2023. The increase was mainly due to the impairment of the right-of-use asset and the leasehold improvements as the Company transitioned operations from its laboratory and office space in Newark to its South San Francisco headquarters.

Net Loss. For the quarter ended September 30, 2024, Alector reported a net loss of $42.2 million, or $0.43 per share, compared to a net loss of $44.5 million, or $0.53 per share, for the same period in 2023.

Cash Position. Cash, cash equivalents, and investments were $ 457.2 million as of September 30, 2024. Management expects that this will be sufficient to fund current operations through 2026.

3Q24 Earnings Release Page 4

2024 Guidance. The Company continues to anticipate collaboration revenue to be between $60 million and $70 million, total research and development expenses to be between $210 million and $220 million, and total general and administrative expenses to be between $60 million and $70 million.

About Alector

Alector is a clinical-stage biotechnology company pioneering immuno-neurology, a novel therapeutic approach for the treatment of neurodegenerative diseases. Immuno-neurology targets immune dysfunction as a root cause of multiple pathologies that are drivers of degenerative brain disorders. Alector has discovered and is developing a broad portfolio of innate immune system programs, designed to functionally repair genetic mutations that cause dysfunction of the brain’s immune system and enable rejuvenated immune cells to counteract emerging brain pathologies. Alector’s immuno-neurology product candidates are supported by biomarkers and seek to treat indications, including Alzheimer’s disease and genetically defined frontotemporal dementia patient populations. Alector is headquartered in South San Francisco, California. For additional information, please visit www.alector.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this press release include, but are not limited to, statements regarding our business plans, business strategy, product candidates, blood-brain barrier technology platform, planned and ongoing preclinical studies and clinical trials, anticipated timing of and detail regarding release of data for INVOKE-2 and INFRONT-3, expected milestones, expectations of our collaborations, expectations of our interactions with regulatory authorities, and financial and cash guidance. Such statements are subject to numerous risks and uncertainties, including but not limited to risks and uncertainties as set forth in Alector’s Quarterly Report on Form 10-Q filed on November 6, 2024, with the Securities and Exchange Commission (“SEC”), as well as the other documents Alector files from time to time with the SEC. These documents contain and identify important factors that could cause the actual results for Alector to differ materially from those contained in Alector’s forward-looking statements. Any forward-looking statements contained in this press release speak only as of the date hereof, and Alector specifically disclaims any obligation to update any forward-looking statement, except as required by law.

3Q24 Earnings Release Page 5

Selected Consolidated Balance Sheet Data

(in thousands)

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

2024 |

|

2023 |

Cash, cash equivalents, and marketable securities |

|

$ |

457,202 |

|

$ |

548,861 |

Total assets |

|

|

516,023 |

|

|

621,827 |

Total current liabilities (excluding deferred revenue) |

|

|

87,098 |

|

|

94,973 |

Deferred revenue (including current portion) |

|

|

248,202 |

|

|

293,820 |

Total liabilities |

|

|

397,090 |

|

|

487,669 |

Total stockholders’ equity |

|

|

118,933 |

|

|

134,158 |

Consolidated Statement of Operations Data

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

Collaboration revenue |

|

$ |

15,342 |

|

|

$ |

9,109 |

|

|

$ |

46,318 |

|

|

$ |

81,872 |

Operating expense: |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

47,998 |

|

|

|

46,328 |

|

|

|

139,479 |

|

|

|

144,392 |

General and administrative |

|

|

15,778 |

|

|

|

13,364 |

|

|

|

44,587 |

|

|

|

41,767 |

Total operating expenses |

|

|

63,776 |

|

|

|

59,692 |

|

|

|

184,066 |

|

|

|

186,159 |

Loss from operations |

|

|

(48,434) |

|

|

|

(50,583) |

|

|

|

(137,748 |

) |

|

|

(104,287) |

Other income, net |

|

|

6,214 |

|

|

|

7,360 |

|

|

|

20,853 |

|

|

|

18,876 |

Net loss before income tax |

|

|

(42,220) |

|

|

|

(43,223) |

|

|

|

(116,895 |

) |

|

|

(85,411) |

Income tax expense |

|

|

— |

|

|

|

1,252 |

|

|

|

80 |

|

|

|

3,546 |

Net loss |

|

$ |

(42,220) |

|

|

$ |

(44,475) |

|

|

$ |

(116,975 |

) |

|

$ |

(88,957) |

Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.43) |

|

|

$ |

(0.53) |

|

|

$ |

(1.22 |

) |

|

$ |

(1.07) |

Shares used in computing net loss per share basic and diluted |

|

|

97,519,595 |

|

|

|

83,927,961 |

|

|

|

96,007,105 |

|

|

|

83,513,954 |

3Q24 Earnings Release Page 6

Alector Contacts:

Alector

Katie Hogan

202-549-0557

katie.hogan@alector.com

1AB (media)

Dan Budwick

973-271-6085

dan@1abmedia.com

Argot Partners (investors)

Laura Perry

212-600-1902

alector@argotpartners.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

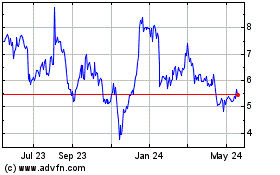

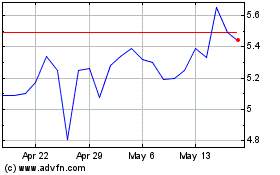

Alector (NASDAQ:ALEC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Alector (NASDAQ:ALEC)

Historical Stock Chart

From Dec 2023 to Dec 2024