false000165308700016530872024-11-142024-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 14, 2024 |

Alector, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38792 |

82-2933343 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

131 Oyster Point Blvd. Suite 600 |

|

South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (415) 231-5660 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

ALEC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 14, 2024 (the “Closing Date”), Alector, Inc., a Delaware corporation (the “Company”), and Alector LLC, a Delaware limited liability company, as co-borrower (together with the Company, the “Borrowers”), entered into a loan and security agreement (the “Loan Agreement”) by and among the Borrowers, the several banks and other financial institutions from time to time party thereto (the “Lenders”) and Hercules Capital, Inc., as administrative agent and collateral agent (in such capacity, the “Agent”). The Loan Agreement provides for a senior secured term loan facility in an aggregate principal amount of up to $50.0 million (collectively, the “Term Loans”), available in up to two tranches. The initial tranche of Term Loans in an aggregate principal amount of up to $25.0 million is available from the Closing Date through June 30, 2026, subject to the satisfaction of applicable conditions set forth in the Loan Agreement. The second tranche of Term Loans in an aggregate principal amount of up to $25.0 million is available at the sole discretion of the Lenders. The proceeds of the Term Loans may be used by the Company for working capital and general corporate purposes. The Borrowers borrowed $10.0 million of Term Loans on the Closing Date.

Borrowings under the Loan Agreement accrue interest at a rate equal to the greater of (A) the prime rate plus 1.05% and (B) 8.05%. The Term Loans are repayable in monthly interest-only payments until December 1, 2026 (the “Interest-Only Payment Period”). The Interest-Only Payment Period may be extended by up to twenty-four (24) months, subject to the achievement by the Borrowers of certain milestones as set forth in the Loan Agreement. After the expiration of the Interest-Only Payment Period, the Term Loans are repayable in equal monthly payments of principal and accrued interest until maturity. The Term Loans will mature on December 1, 2028 (the “Maturity Date”).

At the Borrowers’ option, the Borrowers may prepay all or a portion of the outstanding Term Loans, subject to a prepayment premium equal to (a) 2.0% of the Term Loans being prepaid if the prepayment occurs during the 12 months following the Closing Date; (b) 1.5% of the Term Loans being prepaid if the prepayment occurs after the 12 month anniversary of the Closing Date but on or prior to the 24 month anniversary of the Closing Date; and (c) 0.5% of the Term Loans being prepaid if the prepayment occurs after 24 months following the Closing Date and prior to the Maturity Date. In addition, the Borrowers will pay an end of term charge of (i) 2.45% if the Term Loans are prepaid or repaid within the first 24 months of the Closing Date; or (ii) 4.75% if the Term Loans are prepaid or repaid after 24 months from the Closing Date (including on the Maturity Date). The Borrowers paid an initial facility charge of $250,000 on the Closing Date, and thereafter, the Borrowers will pay a facility charge of 1.00% upon any draw of the Term Loans under the second tranche.

The Borrowers’ obligations under the Loan Agreement are secured by substantially all of the Borrowers’ assets, including intellectual property, subject to certain exceptions, including exceptions with respect to assets and intellectual property subject to the Borrowers’ existing agreements with each of AbbVie Biotechnology, Ltd., Adimab LLC and Glaxo Wellcome UK Limited.

The Loan Agreement contains customary affirmative and negative covenants, including covenants limiting the ability of the Borrowers and their subsidiaries to, among other things, dispose of assets, enter into certain licensing arrangements, effect certain mergers, incur debt, grant liens, pay dividends and distributions on their capital stock, make investments and acquisitions, and enter into transactions, in each case subject to customary exceptions for a loan facility of this size and type. The Loan Agreement also includes customary events of default, including, among others, payment defaults, material misrepresentations, breaches of covenants following any applicable cure period, cross defaults with certain other indebtedness or material agreements, bankruptcy and insolvency events, judgment defaults and the occurrence of certain events that could reasonably be expected to have a “material adverse effect.” The occurrence of an event of default could result in the acceleration of the Borrowers’ obligations under the Loan Agreement, the termination of the Lenders’ commitments, a 5% increase in the applicable rate of interest and the exercise by Agent of other rights and remedies provided for under the Loan Agreement.

The foregoing description of the Loan Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Loan Agreement, which the Company intends to file with the Securities and Exchange Commission as an exhibit to a subsequent periodic report.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information related to the Loan Agreement set forth in Item 1.01 above is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On November 14, 2024, the Company issued a press release announcing its entry into the Loan Agreement described above. A copy of the press release is attached as Exhibit 99.1 and incorporated herein by reference.

The information contained under Item 7.01 of this Current Report (including Exhibit 99.1), shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as may be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. Description

99.1 Press Release, dated November 14, 2024.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ALECTOR, INC. |

|

|

|

|

Date: |

November 14, 2024 |

By: |

/s/ Arnon Rosenthal |

|

|

|

Arnon Rosenthal, Ph.D.

Co-founder and Chief Executive Officer |

Alector Secures Flexible Credit Facility for Up to $50 Million From Hercules Capital

South San Francisco, Calif., November 14, 2024 -- Alector, Inc. (Nasdaq: ALEC), a clinical-stage biotechnology company pioneering immuno-neurology, today announced that the Company has entered into a debt financing agreement with Hercules Capital, Inc. (NYSE: HTGC) for up to $50 million.

“Alector is in a strong cash position with more than $457 million in cash and investments. This credit facility further enhances our financial strength and provides the Company with increased strategic and operational flexibility,” said Marc Grasso, M.D., Chief Financial Officer of Alector. “We anticipate transformational data from both the AL002 INVOKE-2 Phase 2 trial and the latozinemab INFRONT-3 pivotal Phase 3 trial within our runway. This credit facility provides additional funding to advance our preclinical pipeline including our proprietary, versatile Alector Brain Carrier blood-brain barrier platform and programs.”

Under the terms of the agreement, Alector drew an initial $10 million at closing. An additional $15 million is available at the Company’s request through June 30, 2026, with an additional $25 million available upon lender approval. The Company is under no obligation to draw funds in the future. The credit facility carries a low double-digit cost of capital.

“Hercules is pleased to enter into a strategic relationship with Alector as it advances its portfolio of assets aimed at treating neurodegenerative diseases,” said Lake McGuire, Managing Director at Hercules Capital. “This capital commitment from Hercules seeks to help Alector deliver new therapeutic options to patients and further advance their novel and proprietary blood-brain barrier technology.”

Alector’s cash, cash equivalents and investments were $457.2 million as of September 30, 2024. Excluding this $50 million credit facility, the Company believes that its current cash, cash equivalents and investments will be sufficient to fund its operations through 2026.

About Alector

Alector is a clinical-stage biotechnology company pioneering immuno-neurology, a novel therapeutic approach for the treatment of neurodegenerative diseases. Immuno-neurology targets immune dysfunction as a root cause of multiple pathologies that are drivers of degenerative brain disorders. Alector has discovered and is developing a broad portfolio of innate immune system programs, designed to functionally repair genetic mutations that cause dysfunction of the brain’s immune system and enable rejuvenated immune cells to counteract emerging brain pathologies. Alector’s immuno-neurology product candidates are supported by biomarkers and seek to treat indications, including Alzheimer’s disease and genetically defined frontotemporal dementia patient populations. Alector is headquartered in South San Francisco, California. For additional information, please visit www.alector.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this press release include, but are not limited to, statements regarding our business plans, business strategy, product candidates, blood-brain barrier technology platform, planned and ongoing preclinical studies and clinical trials, anticipated timing of and detail regarding release of data for INVOKE-2 and INFRONT-3, expected milestones, expectations of our collaborations, expectations of our interactions with regulatory authorities, and financial and cash guidance. Such statements are subject to numerous risks and uncertainties, including but not limited to risks and uncertainties as set forth in Alector’s Quarterly Report on Form 10-Q filed on November 6, 2024, with the Securities and Exchange Commission (“SEC”), as well as the other documents Alector files from time to time with the SEC. These documents contain and identify important factors that could cause the actual results for Alector to differ materially from those contained in Alector’s forward-looking statements. Any forward-looking statements contained in this press release speak only as of the date hereof, and Alector specifically disclaims any obligation to update any forward-looking statement, except as required by law.

Alector Contacts:

Alector

Katie Hogan

202-549-0557

katie.hogan@alector.com

1AB (media)

Dan Budwick

973-271-6085

dan@1abmedia.com

Argot Partners (investors)

Laura Perry

212-600-1902

alector@argotpartners.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

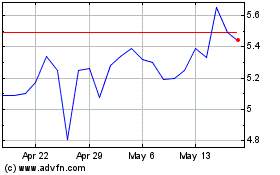

Alector (NASDAQ:ALEC)

Historical Stock Chart

From Oct 2024 to Nov 2024

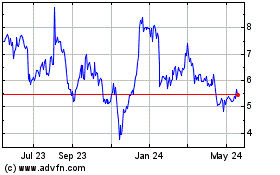

Alector (NASDAQ:ALEC)

Historical Stock Chart

From Nov 2023 to Nov 2024