0000738214

AEMETIS, INC

false

--12-31

Q1

2024

10

1,093

675

55

1,040

1,040

1,034

1,438

143

289

85,514

81,966

125

145

4,722

4,881

4,387

3,815

498

190

9

9

50

48

43,416

40,857

116,870

113,189

54

67

0.001

0.001

80,000

80,000

42,616

42,616

40,966

40,966

1,027

511

30

30

1.8

2

2

1

363,500

0.01

2

0.4

0.7

1.4

18

3

1

0.3

0.3

false

false

false

false

00007382142024-01-012024-03-31

xbrli:shares

00007382142024-04-30

thunderdome:item

iso4217:USD

0000738214us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-03-31

0000738214us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-31

00007382142024-03-31

00007382142023-12-31

0000738214us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberamtx:ConvertibleSeriesAPreferredStockSubjectToMandatoryRedemptionMember2024-03-31

0000738214us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberamtx:ConvertibleSeriesAPreferredStockSubjectToMandatoryRedemptionMember2023-12-31

0000738214amtx:ConvertibleSeriesAPreferredStockSubjectToMandatoryRedemptionMember2024-03-31

0000738214amtx:ConvertibleSeriesAPreferredStockSubjectToMandatoryRedemptionMember2023-12-31

iso4217:USDxbrli:shares

00007382142023-01-012023-03-31

00007382142022-12-31

00007382142023-03-31

0000738214us-gaap:PreferredStockMember2023-12-31

0000738214us-gaap:CommonStockMember2023-12-31

0000738214us-gaap:AdditionalPaidInCapitalMember2023-12-31

0000738214us-gaap:RetainedEarningsMember2023-12-31

0000738214us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31

0000738214us-gaap:PreferredStockMember2024-01-012024-03-31

0000738214us-gaap:CommonStockMember2024-01-012024-03-31

0000738214us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-31

0000738214us-gaap:RetainedEarningsMember2024-01-012024-03-31

0000738214us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-31

0000738214us-gaap:PreferredStockMember2024-03-31

0000738214us-gaap:CommonStockMember2024-03-31

0000738214us-gaap:AdditionalPaidInCapitalMember2024-03-31

0000738214us-gaap:RetainedEarningsMember2024-03-31

0000738214us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-31

0000738214us-gaap:PreferredStockMember2022-12-31

0000738214us-gaap:CommonStockMember2022-12-31

0000738214us-gaap:AdditionalPaidInCapitalMember2022-12-31

0000738214us-gaap:RetainedEarningsMember2022-12-31

0000738214us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0000738214us-gaap:PreferredStockMember2023-01-012023-03-31

0000738214us-gaap:CommonStockMember2023-01-012023-03-31

0000738214us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0000738214us-gaap:RetainedEarningsMember2023-01-012023-03-31

0000738214us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

0000738214us-gaap:PreferredStockMember2023-03-31

0000738214us-gaap:CommonStockMember2023-03-31

0000738214us-gaap:AdditionalPaidInCapitalMember2023-03-31

0000738214us-gaap:RetainedEarningsMember2023-03-31

0000738214us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

0000738214amtx:AlternativeEnergyEthanolMemberamtx:CaliforniaEthanolMember2024-01-012024-03-31

0000738214amtx:AlternativeEnergyEthanolMemberamtx:CaliforniaEthanolMember2023-01-012023-03-31

0000738214amtx:WetDistillersGrainsMemberamtx:CaliforniaEthanolMember2024-01-012024-03-31

0000738214amtx:WetDistillersGrainsMemberamtx:CaliforniaEthanolMember2023-01-012023-03-31

0000738214us-gaap:ProductAndServiceOtherMemberamtx:CaliforniaEthanolMember2024-01-012024-03-31

0000738214us-gaap:ProductAndServiceOtherMemberamtx:CaliforniaEthanolMember2023-01-012023-03-31

0000738214amtx:CaliforniaEthanolMember2024-01-012024-03-31

0000738214amtx:CaliforniaEthanolMember2023-01-012023-03-31

0000738214amtx:GasMoleculesAndRINCreditsMemberamtx:CaliforniaDairyRenewableNaturalGasMember2024-01-012024-03-31

0000738214amtx:GasMoleculesAndRINCreditsMemberamtx:CaliforniaDairyRenewableNaturalGasMember2023-01-012023-03-31

0000738214amtx:RenewableEnergyBiodieselMemberamtx:IndiaBiodieselMember2024-01-012024-03-31

0000738214amtx:RenewableEnergyBiodieselMemberamtx:IndiaBiodieselMember2023-01-012023-03-31

0000738214us-gaap:ProductAndServiceOtherMemberamtx:IndiaBiodieselMember2024-01-012024-03-31

0000738214us-gaap:ProductAndServiceOtherMemberamtx:IndiaBiodieselMember2023-01-012023-03-31

0000738214amtx:IndiaBiodieselMember2024-01-012024-03-31

0000738214amtx:IndiaBiodieselMember2023-01-012023-03-31

0000738214us-gaap:OtherCurrentAssetsMember2024-03-31

0000738214us-gaap:OtherCurrentAssetsMember2023-12-31

0000738214us-gaap:OtherAssetsMember2024-03-31

0000738214us-gaap:OtherAssetsMember2023-12-31

0000738214amtx:SeriesBConvertiblePreferredStockMember2024-01-012024-03-31

0000738214amtx:SeriesBConvertiblePreferredStockMember2023-01-012023-03-31

0000738214amtx:CommonStockOptionsAndWarrantsMember2024-01-012024-03-31

0000738214amtx:CommonStockOptionsAndWarrantsMember2023-01-012023-03-31

0000738214amtx:DebtWithConversionFeatureMember2024-03-31

0000738214amtx:DebtWithConversionFeatureMember2023-03-31

0000738214amtx:DebtWithConversionFeatureMember2024-01-012024-03-31

0000738214amtx:DebtWithConversionFeatureMember2023-01-012023-03-31

00007382142023-01-012023-12-31

utr:Y

0000738214us-gaap:BuildingMembersrt:MinimumMember2024-03-31

0000738214us-gaap:BuildingMembersrt:MaximumMember2024-03-31

0000738214us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2024-03-31

0000738214us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2024-03-31

0000738214us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2024-03-31

0000738214us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2024-03-31

0000738214amtx:ThirdEyeCapitalTermNotesMember2024-03-31

0000738214amtx:ThirdEyeCapitalTermNotesMember2023-12-31

0000738214amtx:ThirdEyeCapitalRevolvingCreditFacilityMember2024-03-31

0000738214amtx:ThirdEyeCapitalRevolvingCreditFacilityMember2023-12-31

0000738214amtx:RevolvingNotesSeriesBMember2024-03-31

0000738214amtx:RevolvingNotesSeriesBMember2023-12-31

0000738214amtx:ThirdEyeCapitalRevenueParticipationTermNotesMember2024-03-31

0000738214amtx:ThirdEyeCapitalRevenueParticipationTermNotesMember2023-12-31

0000738214amtx:ThirdEyeCapitalAcquisitionTermNotesMember2024-03-31

0000738214amtx:ThirdEyeCapitalAcquisitionTermNotesMember2023-12-31

0000738214amtx:ThirdEyeCapitalFuelsRevolvingLineMember2024-03-31

0000738214amtx:ThirdEyeCapitalFuelsRevolvingLineMember2023-12-31

0000738214amtx:ThirdEyeCapitalCarbonRevolvingLineMember2024-03-31

0000738214amtx:ThirdEyeCapitalCarbonRevolvingLineMember2023-12-31

0000738214amtx:ConstructionLoanAgreementMember2024-03-31

0000738214amtx:ConstructionLoanAgreementMember2023-12-31

0000738214amtx:CilionShareholderSellerNotesPayableMember2024-03-31

0000738214amtx:CilionShareholderSellerNotesPayableMember2023-12-31

0000738214amtx:SubordinatedNotes1Member2024-03-31

0000738214amtx:SubordinatedNotes1Member2023-12-31

0000738214amtx:EB5PromissoryNotesMember2024-03-31

0000738214amtx:EB5PromissoryNotesMember2023-12-31

0000738214amtx:WorkingCapitalLoanMember2024-03-31

0000738214amtx:WorkingCapitalLoanMember2023-12-31

0000738214amtx:TermLoanOnEquipmentPurchaseMember2024-03-31

0000738214amtx:TermLoanOnEquipmentPurchaseMember2023-12-31

0000738214amtx:TermLoanMemberamtx:ThirdEyeCapitalMember2012-07-06

0000738214us-gaap:RevolvingCreditFacilityMemberamtx:ThirdEyeCapitalMember2012-07-06

0000738214amtx:RevenueParticipationTermNotesMemberamtx:ThirdEyeCapitalMember2012-07-06

0000738214amtx:AcquisitionTermNotesMemberamtx:ThirdEyeCapitalMember2012-07-06

0000738214amtx:AmendmentNo28Memberamtx:ThirdEyeCapitalMember2024-03-25

0000738214amtx:TermNotesMemberamtx:ThirdEyeCapitalMember2024-03-31

xbrli:pure

0000738214us-gaap:RevolvingCreditFacilityMemberamtx:ThirdEyeCapitalMemberus-gaap:PrimeRateMember2012-07-062012-07-06

0000738214us-gaap:RevolvingCreditFacilityMemberamtx:ThirdEyeCapitalMemberus-gaap:PrimeRateMember2024-03-31

0000738214us-gaap:RevolvingCreditFacilityMemberamtx:ThirdEyeCapitalMember2024-03-31

0000738214amtx:RevolvingNotesSeriesBMemberamtx:ThirdEyeCapitalMemberus-gaap:PrimeRateMember2023-05-162023-05-16

0000738214amtx:RevolvingNotesSeriesBMemberamtx:ThirdEyeCapitalMemberus-gaap:PrimeRateMember2024-03-31

0000738214amtx:RevolvingNotesSeriesBMemberamtx:ThirdEyeCapitalMember2024-03-31

0000738214amtx:RevenueParticipationTermNotesMemberamtx:ThirdEyeCapitalMember2024-03-31

0000738214amtx:AAFKMemberamtx:RevenueParticipationTermNotesMemberamtx:ThirdEyeCapitalMember2024-03-31

0000738214amtx:AcquisitionTermNotesMemberamtx:ThirdEyeCapitalMemberus-gaap:PrimeRateMember2012-07-062012-07-06

0000738214amtx:AcquisitionTermNotesMemberamtx:ThirdEyeCapitalMemberus-gaap:PrimeRateMember2024-03-31

0000738214amtx:AcquisitionTermNotesMemberamtx:ThirdEyeCapitalMember2024-03-31

0000738214amtx:AemetisFacilityKeyesIncMemberamtx:AcquisitionTermNotesMemberamtx:ThirdEyeCapitalMember2024-03-31

0000738214amtx:MrMcafeeMemberamtx:ThirdEyeCapitalMember2024-03-31

0000738214amtx:ReserveLiquidityFacilityMemberamtx:ThirdEyeCapitalMember2020-03-06

0000738214amtx:ReserveLiquidityFacilityPaidMonthlyInArrearsMemberamtx:ThirdEyeCapitalMember2020-03-06

0000738214amtx:ReserveLiquidityFacilityIfEventOfDefaultOccurredAndContinuesMemberamtx:ThirdEyeCapitalMember2020-03-06

0000738214amtx:ReserveLiquidityFacilityMemberamtx:ThirdEyeCapitalMember2024-03-31

0000738214amtx:GafiAndAcciMemberamtx:CapitalRevolvingCreditFacilityFuelsAndCarbonLinesMember2022-03-02

0000738214amtx:GafiMemberamtx:FuelsRevolvingLineMember2022-03-02

0000738214amtx:AcciMemberamtx:CarbonRevolvingLineMember2022-03-02

0000738214amtx:GafiMemberamtx:FuelsRevolvingLineMemberus-gaap:PrimeRateMember2022-03-022022-03-02

0000738214amtx:GafiMemberamtx:FuelsRevolvingLineMember2022-03-02

0000738214amtx:AcciMemberamtx:CarbonRevolvingLineMemberus-gaap:PrimeRateMember2022-03-022022-03-02

0000738214amtx:AcciMemberamtx:CarbonRevolvingLineMember2022-03-02

0000738214amtx:GafiMemberamtx:FuelsRevolvingLineMember2024-03-31

0000738214amtx:AcciMemberamtx:CarbonRevolvingLineMember2024-03-31

0000738214amtx:CilionShareholderSellerNotesPayableMember2012-07-06

0000738214amtx:AAFKMemberamtx:SubordinatedNotesMember2012-01-09

0000738214amtx:WarrantsInConnectionWithSubordinatedNotesMemberamtx:AAFKMember2012-01-09

0000738214amtx:AAFKMemberamtx:SubordinatedNotesMember2024-01-01

0000738214amtx:WarrantsInConnectionWithSubordinatedNotesMemberamtx:AAFKMember2023-01-012023-01-01

0000738214amtx:WarrantsInConnectionWithSubordinatedNotesMemberamtx:AAFKMember2023-01-01

0000738214amtx:AAFKMemberamtx:SubordinatedNotesMember2024-03-31

0000738214amtx:AAFKMemberamtx:SubordinatedNotesMember2023-12-31

0000738214amtx:EB5PhaseINotesMember2011-03-04

0000738214amtx:Eb5PhaseIFundingMembersrt:MaximumMember2011-03-04

0000738214amtx:EB5PhaseINotesMember2019-02-27

0000738214amtx:EB5PhaseINotesMember2024-03-31

0000738214amtx:EB5PhaseINotesMember2023-12-31

0000738214amtx:EB5PhaseINotesMember2016-10-172024-03-31

0000738214amtx:EB5PhaseINotesMembersrt:MaximumMember2024-03-31

0000738214amtx:EB5PhaseINotesMembersrt:MinimumMember2020-05-01

0000738214amtx:EB5PhaseINotesMembersrt:MinimumMember2023-03-31

0000738214amtx:EB5PhaseIINotesMember2024-03-31

0000738214amtx:EB5PhaseIINotesMember2023-12-31

0000738214amtx:SecunderabadOilsMember2022-07-26

0000738214amtx:LeoEdiblesFatsLimitedMember2022-08-01

0000738214amtx:SecunderabadOilsMember2024-03-31

0000738214amtx:SecunderabadOilsMember2023-12-31

0000738214amtx:ConstructionLoanAgreementMember2022-10-04

0000738214amtx:ConstructionLoanAgreementMemberus-gaap:UsTreasuryUstInterestRateMember2022-10-042022-10-04

0000738214amtx:ConstructionLoanAgreement2Member2023-07-28

0000738214amtx:ConstructionLoanAgreement2Memberus-gaap:UsTreasuryUstInterestRateMember2023-07-282023-07-28

0000738214amtx:ConstructionLoanAgreement2Member2024-03-31

0000738214amtx:ConstructionLoanAgreement2Member2023-12-31

0000738214amtx:FinancingAgreementForCapitalExpendituresMember2024-03-31

0000738214srt:MinimumMember2024-01-012024-03-31

0000738214srt:MaximumMember2024-01-012024-03-31

0000738214us-gaap:OtherCurrentLiabilitiesMember2024-03-31

0000738214us-gaap:OtherCurrentLiabilitiesMember2023-12-31

0000738214us-gaap:OtherNoncurrentLiabilitiesMember2024-03-31

0000738214us-gaap:OtherNoncurrentLiabilitiesMember2023-12-31

0000738214us-gaap:PropertyPlantAndEquipmentMember2024-03-31

0000738214us-gaap:PropertyPlantAndEquipmentMember2023-12-31

0000738214amtx:PreferredUnitsSeriesAMember2018-12-202018-12-20

0000738214amtx:PreferredUnitsSeriesAMember2018-12-20

0000738214amtx:SeriesAPreferredStocksMember2018-12-202018-12-20

0000738214amtx:CommonUnitsMember2018-12-202018-12-20

0000738214amtx:CommonUnitsMember2018-12-20

0000738214amtx:SecondTrancheMemberamtx:PreferredUnitsSeriesAMember2022-12-31

0000738214amtx:SecondTrancheMemberamtx:PreferredUnitsSeriesAMember2022-01-012022-12-31

0000738214amtx:SecondTrancheMemberamtx:PreferredUnitsSeriesAMember2018-12-212022-08-08

0000738214amtx:PupaFifthAmendmentMember2024-02-082024-02-08

0000738214amtx:PupaFifthAmendmentMemberus-gaap:PrimeRateMember2024-02-08

0000738214amtx:PupaFifthAmendmentMember2024-02-08

0000738214amtx:The2019StockPlanMember2019-04-252019-04-25

0000738214amtx:The2019StockPlanMember2021-07-01

0000738214amtx:The2019StockPlanMember2021-08-262021-08-26

0000738214amtx:The2019StockPlanMember2021-08-26

0000738214amtx:The2019StockPlanMember2023-12-31

0000738214amtx:The2019StockPlanMember2024-01-012024-03-31

0000738214us-gaap:RestrictedStockMemberamtx:The2019StockPlanMember2024-01-012024-03-31

0000738214amtx:The2019StockPlanMember2024-03-31

0000738214amtx:InducementEquityPlanOptionsMember2016-03-31

0000738214amtx:The2019StockPlanMember2023-01-012023-03-31

0000738214amtx:The2019StockPlanMember2023-03-31

0000738214us-gaap:RestrictedStockMemberamtx:The2019StockPlanMember2023-01-012023-03-31

0000738214amtx:WarrantsToPurchaseCommonStockMember2024-03-31

0000738214us-gaap:MeasurementInputExpectedDividendRateMember2024-03-31

0000738214us-gaap:MeasurementInputExpectedDividendRateMember2023-03-31

0000738214us-gaap:MeasurementInputRiskFreeInterestRateMember2024-03-31

0000738214us-gaap:MeasurementInputRiskFreeInterestRateMember2023-03-31

0000738214us-gaap:MeasurementInputPriceVolatilityMember2024-03-31

0000738214us-gaap:MeasurementInputPriceVolatilityMember2023-03-31

0000738214us-gaap:MeasurementInputExpectedTermMember2024-03-31

0000738214us-gaap:MeasurementInputExpectedTermMember2023-03-31

0000738214us-gaap:MeasurementInputExercisePriceMember2024-03-31

0000738214us-gaap:MeasurementInputExercisePriceMember2023-03-31

0000738214us-gaap:MeasurementInputSharePriceMember2024-03-31

0000738214us-gaap:MeasurementInputSharePriceMember2023-03-31

0000738214amtx:FairValuePerWarrantOnGrantDateMember2024-03-31

0000738214amtx:FairValuePerWarrantOnGrantDateMember2023-03-31

0000738214amtx:JDHeiskellMemberamtx:EthanolSalesMember2024-01-012024-03-31

0000738214amtx:JDHeiskellMemberamtx:EthanolSalesMember2023-01-012023-03-31

0000738214amtx:JDHeiskellMemberamtx:WetDistillersGrainsSalesMember2024-01-012024-03-31

0000738214amtx:JDHeiskellMemberamtx:WetDistillersGrainsSalesMember2023-01-012023-03-31

0000738214amtx:JDHeiskellMemberamtx:CornOilSalesMember2024-01-012024-03-31

0000738214amtx:JDHeiskellMemberamtx:CornOilSalesMember2023-01-012023-03-31

0000738214amtx:JDHeiskellMemberamtx:CdsSalesMember2024-01-012024-03-31

0000738214amtx:JDHeiskellMemberamtx:CdsSalesMember2023-01-012023-03-31

0000738214amtx:JDHeiskellMemberamtx:CornPurchasesMember2024-01-012024-03-31

0000738214amtx:JDHeiskellMemberamtx:CornPurchasesMember2023-01-012023-03-31

0000738214amtx:JDHeiskellMember2024-03-31

0000738214amtx:JDHeiskellMember2023-12-31

0000738214amtx:OperatingAgreementWithGeminiEdiblesAndFatsIndiaPrivateLimitedMember2022-07-01

0000738214amtx:OperatingAgreementWithGeminiEdiblesAndFatsIndiaPrivateLimitedMember2024-03-31

0000738214amtx:OperatingAgreementWithGeminiEdiblesAndFatsIndiaPrivateLimitedMember2023-12-31

0000738214amtx:ForwardSalesCommitmentsMember2024-03-31

utr:gal

0000738214amtx:CaliforniaDairyRenewableNaturalGasMember2024-01-012024-03-31

0000738214us-gaap:AllOtherSegmentsMember2024-01-012024-03-31

0000738214amtx:CaliforniaDairyRenewableNaturalGasMember2023-01-012023-03-31

0000738214us-gaap:AllOtherSegmentsMember2023-01-012023-03-31

0000738214us-gaap:SalesRevenueSegmentMemberus-gaap:CustomerConcentrationRiskMemberamtx:EthanolSalesWetDistillersGrainAndCornOilSalesMemberamtx:CaliforniaEthanolMember2024-01-012024-03-31

0000738214us-gaap:SalesRevenueSegmentMemberus-gaap:CustomerConcentrationRiskMemberamtx:CustomerOneMemberamtx:EthanolSalesWetDistillersGrainAndCornOilSalesMemberamtx:CaliforniaEthanolMember2024-01-012024-03-31

0000738214us-gaap:SalesRevenueSegmentMemberus-gaap:CustomerConcentrationRiskMemberamtx:EthanolSalesWetDistillersGrainAndCornOilSalesMemberamtx:CaliforniaEthanolMember2023-01-012023-03-31

0000738214us-gaap:SalesRevenueSegmentMemberus-gaap:CustomerConcentrationRiskMemberamtx:CustomerOneMemberamtx:EthanolSalesWetDistillersGrainAndCornOilSalesMemberamtx:CaliforniaEthanolMember2023-01-012023-03-31

0000738214us-gaap:SalesRevenueSegmentMemberus-gaap:CustomerConcentrationRiskMemberamtx:CustomerOneMemberamtx:BiodieselSalesMemberamtx:IndiaBiodieselMember2024-01-012024-03-31

0000738214us-gaap:SalesRevenueSegmentMemberus-gaap:CustomerConcentrationRiskMemberamtx:CustomerTwoMemberamtx:BiodieselSalesMemberamtx:IndiaBiodieselMember2024-01-012024-03-31

0000738214us-gaap:SalesRevenueSegmentMemberus-gaap:CustomerConcentrationRiskMemberamtx:CustomerThreeMemberamtx:BiodieselSalesMemberamtx:IndiaBiodieselMember2024-01-012024-03-31

0000738214us-gaap:SalesRevenueSegmentMemberus-gaap:CustomerConcentrationRiskMemberamtx:CustomerOneMemberamtx:BiodieselSalesMemberamtx:IndiaBiodieselMember2023-01-012023-03-31

0000738214amtx:CaliforniaEthanolMember2024-03-31

0000738214amtx:CaliforniaEthanolMember2023-12-31

0000738214amtx:CaliforniaDairyRenewableNaturalGasMember2024-03-31

0000738214amtx:CaliforniaDairyRenewableNaturalGasMember2023-12-31

0000738214amtx:IndiaBiodieselMember2024-03-31

0000738214amtx:IndiaBiodieselMember2023-12-31

0000738214us-gaap:AllOtherSegmentsMember2024-03-31

0000738214us-gaap:AllOtherSegmentsMember2023-12-31

0000738214amtx:EmploymentAgreementsAndExpenseReimbursementsMemberamtx:MrMcafeeMember2023-01-012023-03-31

0000738214amtx:MrMcafeeMember2024-03-31

0000738214amtx:BoardCompensationFeesMemberamtx:VariousBoardMembersMember2023-01-012023-12-31

0000738214amtx:BoardCompensationFeesMemberamtx:VariousBoardMembersMember2024-01-012024-03-31

0000738214amtx:VariousBoardMembersMember2024-01-012024-03-31

0000738214amtx:VariousBoardMembersMember2023-01-012023-03-31

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36475

Aemetis, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 26-1407544 |

| (State or other jurisdiction | (I.R.S. Employer |

| of incorporation or organization) | Identification No.) |

20400 Stevens Creek Blvd., Suite 700

Cupertino, CA 95014

(408) 213-0940

(Address and telephone number of principal executive offices)

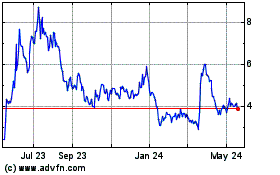

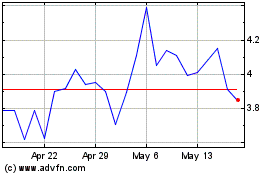

| Title of each class of registered securities | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.001 par value | AMTX | NASDAQ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☑ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The number of shares outstanding of the registrant’s Common Stock on April 30, 2024 was44,397,833 shares.

AEMETIS, INC.

FORM 10-Q

Quarterly Period Ended March 31, 2024

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make forward-looking statements in this Quarterly Report on Form 10-Q, including statements regarding our assumptions, projections, expectations, targets, intentions, or beliefs about future events or other statements that are not historical facts. Forward-looking statements in this Quarterly Report on Form 10-Q include, without limitation, statements regarding management’s plans; trends in market conditions with respect to prices for inputs for our products and prices for our products; our ability to leverage approved feedstock pathways; our ability to leverage our location and infrastructure; our ability to incorporate lower-cost, non-food advanced biofuels feedstock at the Keyes plant; our ability to expand into alternative markets for biodiesel and its byproducts, including continuing to expand our sales into international markets; our ability to maintain and expand strategic relationships with suppliers; our ability to access governmental carbon reduction incentives; our ability to supply gas into transportation markets; our ability to continue to develop, maintain, and protect new and existing intellectual property rights; our ability to adopt, develop and commercialize new technologies; our ability to extend or refinance our senior debt on terms reasonably acceptable to us or at all; our ability to continue to fund operations and our future sources of liquidity and capital resources; our ability to fund, develop, build, maintain and operate digesters, facilities and pipelines for our California Dairy Renewable Natural Gas segment; our ability to fund, develop and operate our carbon capture sequestration projects, including obtaining required permits; our ability to receive awarded grants by meeting all of the required conditions, including meeting the minimum contributions; our ability to obtain additional financing under the EB-5 program; our ability to generate and sell or utilize various credits, including LCFS, D3 RINs, production tax credits, and investment tax credits; our ability to improve margins; and our ability to raise additional debt and equity funding at the parent, subsidiary, or project level. Words or phrases such as “anticipates,” “may,” “will,” “should,” “could,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “targets,” “will likely result,” “will continue” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on current assumptions and predictions and are subject to numerous risks and uncertainties. Actual results or events could differ materially from those set forth or implied by such forward-looking statements and related assumptions due to certain factors, including, without limitation, the risks set forth under the caption “Risk Factors” below, which are incorporated herein by reference, as well as those business risks and factors described elsewhere in this report and in our other filings with the Securities and Exchange Commission (the “SEC”), including without limitation, our most recent Annual Report on Form 10-K. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

PART I - FINANCIAL INFORMATION

Item 1 - Financial Statements

AEMETIS, INC.

CONSOLIDATED CONDENSED BALANCE SHEETS

(Unaudited, In thousands except for par value)

| | | March 31, 2024 | | | December 31, 2023 | |

| Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents ($10 and $1,093 respectively from VIE) | | $ | 1,629 | | | $ | 2,667 | |

| Accounts receivable ($675 and $55 respectively from VIE) | | | 8,867 | | | | 8,633 | |

| Inventories, net of allowance for excess and obsolete inventory of $1,040 as of March 31, 2024 and December 31, 2023, respectively | | | 16,011 | | | | 18,291 | |

| Prepaid expenses ($1,034 and $1,438 respectively from VIE) | | | 2,418 | | | | 3,347 | |

| Other current assets ($143 and $289 respectively from VIE) | | | 4,027 | | | | 3,462 | |

| Total current assets | | | 32,952 | | | | 36,400 | |

| | | | | | | | | |

| Property, plant and equipment, net ($85,514 and $81,966 respectively from VIE) | | | 197,737 | | | | 195,108 | |

| Operating lease right-of-use assets ($125 and $145 respectively from VIE) | | | 1,951 | | | | 2,056 | |

| Other assets ($4,722 and $4,881 respectively from VIE) | | | 9,599 | | | | 9,842 | |

| Total assets | | $ | 242,239 | | | $ | 243,406 | |

| | | | | | | | | |

| Liabilities and stockholders' deficit | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable ($4,387 and $3,815 respectively from VIE) | | $ | 29,789 | | | $ | 32,132 | |

| Current portion of long term debt ($498 and $190 respectively from VIE) | | | 48,870 | | | | 13,585 | |

| Short term borrowings ($9 and $9 respectively from VIE) | | | 23,937 | | | | 23,443 | |

| Other current liabilities ($50 and $48 respectively from VIE) | | | 15,322 | | | | 15,229 | |

| Total current liabilities | | | 117,918 | | | | 84,389 | |

| Long term liabilities: | | | | | | | | |

| Senior secured notes and revolving notes | | | 150,830 | | | | 176,476 | |

| EB-5 notes | | | 29,500 | | | | 29,500 | |

| Other long term debt ($43,416 and $40,857 respectively from VIE) | | | 54,087 | | | | 51,717 | |

| Series A preferred units ($116,870 and $113,189 respectively from VIE) | | | 116,870 | | | | 113,189 | |

| Other long term liabilities ($54 and $67 respectively from VIE) | | | 5,175 | | | | 5,112 | |

| Total long term liabilities | | | 356,462 | | | | 375,994 | |

| | | | | | | | | |

| Stockholders' deficit: | | | | | | | | |

| | | | | | | | | |

| Common stock, $0.001 par value per share; 80,000 shares authorized; 42,616 and 40,966 shares issued and outstanding each period, respectively | | | 43 | | | | 41 | |

| Additional paid-in capital | | | 273,167 | | | | 264,058 | |

| Accumulated deficit | | | (499,636 | ) | | | (475,405 | ) |

| Accumulated other comprehensive loss | | | (5,715 | ) | | | (5,671 | ) |

| Total stockholders' deficit | | | (232,141 | ) | | | (216,977 | ) |

| Total liabilities and stockholders' deficit | | $ | 242,239 | | | $ | 243,406 | |

| | | | | | | | | |

The accompanying notes are an integral part of the financial statements.

AEMETIS, INC.

CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited, in thousands except for loss per share)

| |

|

For the three months ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Revenues |

|

$ |

72,634 |

|

|

$ |

2,151 |

|

| Cost of goods sold |

|

$ |

73,246 |

|

|

|

3,446 |

|

| Gross loss |

|

|

(612 |

) |

|

|

(1,295 |

) |

| |

|

|

|

|

|

|

|

|

| Selling, general and administrative and R&D expenses |

|

|

8,850 |

|

|

|

10,828 |

|

| Operating loss |

|

|

(9,462 |

) |

|

|

(12,123 |

) |

| |

|

|

|

|

|

|

|

|

| Other expense (income): |

|

|

|

|

|

|

|

|

| Interest expense |

|

|

|

|

|

|

|

|

| Interest rate expense |

|

|

9,092 |

|

|

|

7,078 |

|

| Debt related fees and amortization expense |

|

|

1,421 |

|

|

|

1,969 |

|

| Accretion and other expenses of Series A preferred units |

|

|

3,311 |

|

|

|

5,564 |

|

| Other (income) expense |

|

|

67 |

|

|

|

(76 |

) |

| Loss before income taxes |

|

|

(23,353 |

) |

|

|

(26,658 |

) |

| Income tax expense (benefit) |

|

|

878 |

|

|

|

(248 |

) |

| Net loss |

|

$ |

(24,231 |

) |

|

$ |

(26,410 |

) |

| |

|

|

|

|

|

|

|

|

| Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

| Foreign currency translation (loss) income |

|

|

(44 |

) |

|

|

117 |

|

| Comprehensive loss |

|

$ |

(24,275 |

) |

|

$ |

(26,293 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss per common share |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.58 |

) |

|

$ |

(0.73 |

) |

| Diluted |

|

$ |

(0.58 |

) |

|

$ |

(0.73 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average shares outstanding |

|

|

|

|

|

|

|

|

| Basic |

|

|

41,889 |

|

|

|

36,425 |

|

| Diluted |

|

|

41,889 |

|

|

|

36,425 |

|

The accompanying notes are an integral part of the financial statements.

AEMETIS, INC.

CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

| | | For the three months ended March 31, | |

| | | 2024 | | | 2023 | |

| Operating activities: | | | | | | | | |

| Net loss | | $ | (24,231 | ) | | $ | (26,410 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| Share-based compensation | | | 2,969 | | | | 2,662 | |

| Depreciation | | | 1,798 | | | | 1,790 | |

| Debt related fees and amortization expense | | | 1,421 | | | | 1,969 | |

| Intangibles and other amortization expense | | | 12 | | | | 12 | |

| Accretion and other expenses of Series A preferred units | | | 3,311 | | | | 5,564 | |

| Deferred tax benefit | | | - | | | | (262 | ) |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | (245 | ) | | | 1,005 | |

| Inventories | | | 2,259 | | | | (7,942 | ) |

| Prepaid expenses | | | 929 | | | | 2,315 | |

| Other assets | | | (544 | ) | | | 460 | |

| Accounts payable | | | (3,236 | ) | | | 3,002 | |

| Accrued interest expense and fees | | | 5,500 | | | | 5,356 | |

| Other liabilities | | | (221 | ) | | | (779 | ) |

| Net cash used in operating activities | | | (10,278 | ) | | | (11,258 | ) |

| | | | | | | | | |

| Investing activities: | | | | | | | | |

| Capital expenditures | | | (3,583 | ) | | | (7,616 | ) |

| Grant proceeds and other reimbursements received for capital expenditures | | | 1,900 | | | | 6,757 | |

| Net cash used in investing activities | | | (1,683 | ) | | | (859 | ) |

| | | | | | | | | |

| Financing activities: | | | | | | | | |

| Proceeds from borrowings | | | 6,223 | | | | 11,583 | |

| Repayments of borrowings | | | (411 | ) | | | (2,724 | ) |

| Lender debt renewal and waiver fee payments | | | (750 | ) | | | - | |

| Payments on finance leases | | | (8 | ) | | | (83 | ) |

| Proceeds from sales of common stock | | | 5,513 | | | | 2,617 | |

| Proceeds from exercise of stock options | | | 36 | | | | - | |

| Net cash provided by financing activities | | | 10,603 | | | | 11,393 | |

| | | | | | | | | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | | | 15 | | | | (56 | ) |

| Net change in cash, cash equivalents, and restricted cash for period | | | (1,343 | ) | | | (780 | ) |

| Cash, cash equivalents, and restricted cash at beginning of period | | | 6,280 | | | | 6,999 | |

| Cash, cash equivalents and restricted cash at end of period | | $ | 4,937 | | | $ | 6,219 | |

| | | | | | | | | |

| Supplemental disclosures of cash flow information, cash paid: | | | | | | | | |

| Cash paid for interest | | $ | 2,963 | | | $ | 1,515 | |

| Income taxes paid | | | 878 | | | | 14 | |

| Supplemental disclosures of cash flow information, non-cash transactions: | | | | | | | | |

| Subordinated debt extension fees added to debt | | | 340 | | | | 340 | |

| Debt fees added to revolving lines | | | - | | | | 423 | |

| Fair value of warrants issued to subordinated debt holders | | | 593 | | | | 448 | |

| Lender debt extension, waiver, and other fees added to debt | | | 595 | | | | 384 | |

| Cumulative capital expenditures in accounts payable, including net increase (decrease) of $1,027 and ($511), respectively | | | 8,927 | | | | 14,900 | |

The accompanying notes are an integral part of the financial statements.

AEMETIS, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

(Unaudited, in thousands)

| For the three months ended March 31, 2024 |

|

| |

|

Series B Preferred Stock |

|

|

Common Stock |

|

|

Additional |

|

|

|

|

|

|

Accumulated Other |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid-in |

|

|

Accumulated |

|

|

Comprehensive |

|

|

Stockholders' |

|

| Description |

|

Shares |

|

|

Dollars |

|

|

Shares |

|

|

Dollars |

|

|

Capital |

|

|

Deficit |

|

|

Gain (Loss) |

|

|

deficit |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2023 |

|

|

- |

|

|

$ |

- |

|

|

|

40,966 |

|

|

$ |

41 |

|

|

$ |

264,058 |

|

|

$ |

(475,405 |

) |

|

$ |

(5,671 |

) |

|

|

(216,977 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock |

|

|

- |

|

|

|

- |

|

|

|

1,523 |

|

|

|

2 |

|

|

|

5,511 |

|

|

|

- |

|

|

|

- |

|

|

|

5,513 |

|

| Stock options exercised |

|

|

- |

|

|

|

- |

|

|

|

14 |

|

|

|

- |

|

|

|

36 |

|

|

|

- |

|

|

|

- |

|

|

|

36 |

|

| Stock-based compensation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,969 |

|

|

|

- |

|

|

|

- |

|

|

|

2,969 |

|

| Issuance and exercise of warrants |

|

|

- |

|

|

|

- |

|

|

|

113 |

|

|

|

- |

|

|

|

593 |

|

|

|

- |

|

|

|

- |

|

|

|

593 |

|

| Foreign currency translation gain |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(44 |

) |

|

|

(44 |

) |

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(24,231 |

) |

|

|

- |

|

|

|

(24,231 |

) |

| Balance at March 31, 2024 |

|

|

- |

|

|

$ |

- |

|

|

|

42,616 |

|

|

$ |

43 |

|

|

$ |

273,167 |

|

|

$ |

(499,636 |

) |

|

$ |

(5,715 |

) |

|

$ |

(232,141 |

) |

| For the three months ended March 31, 2023 |

|

| |

|

Series B Preferred Stock |

|

|

Common Stock |

|

|

Additional |

|

|

|

|

|

|

Accumulated Other |

|

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid-in |

|

|

Accumulated |

|

|

Comprehensive |

|

|

Stockholders' |

|

| Description |

|

Shares |

|

|

Dollars |

|

|

Shares |

|

|

Dollars |

|

|

Capital |

|

|

Deficit |

|

|

Loss |

|

|

deficit |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2022 |

|

|

1,270 |

|

|

$ |

1 |

|

|

|

35,869 |

|

|

$ |

36 |

|

|

$ |

232,546 |

|

|

$ |

(428,985 |

) |

|

$ |

(5,452 |

) |

|

$ |

(201,854 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of common stock |

|

|

- |

|

|

|

- |

|

|

|

668 |

|

|

|

1 |

|

|

|

2,616 |

|

|

|

- |

|

|

|

- |

|

|

|

2,617 |

|

| Series B conversion to common stock |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Stock options exercised |

|

|

- |

|

|

|

- |

|

|

|

40 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Stock-based compensation |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

2,662 |

|

|

|

- |

|

|

|

- |

|

|

|

2,662 |

|

| Issuance and exercise of warrants |

|

|

- |

|

|

|

- |

|

|

|

113 |

|

|

|

- |

|

|

|

448 |

|

|

|

- |

|

|

|

- |

|

|

|

448 |

|

| Foreign currency translation gain |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

117 |

|

|

|

117 |

|

| Net loss |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(26,410 |

) |

|

|

- |

|

|

|

(26,410 |

) |

| Balance at March 31, 2023 |

|

|

1,270 |

|

|

$ |

1 |

|

|

|

36,690 |

|

|

$ |

37 |

|

|

$ |

238,272 |

|

|

$ |

(455,395 |

) |

|

$ |

(5,335 |

) |

|

$ |

(222,420 |

) |

The accompanying notes are an integral part of the financial statements.

(Tabular data in thousands, except par value and per share data)

1. Summary of Significant Accounting Policies

Nature of Activities

Founded in 2006 and headquartered in Cupertino, California, Aemetis, Inc. (collectively with its subsidiaries on a consolidated basis referred to herein as “Aemetis,” the “Company,” “we,” “our” or “us”) is an international renewable natural gas and renewable fuels company focused on the operation, acquisition, development, and commercialization of innovative technologies to produce low and negative carbon intensity renewable fuels that replace fossil-based products. We do this by building a local circular bioeconomy using agricultural products and waste to produce low carbon, advanced renewable fuels that reduce greenhouse gas ("GHG") emissions and improve air quality. Our current operations include:

► California Ethanol - We own and operate a 65 million gallon per year capacity ethanol production facility in Keyes, California (the “Keyes Plant”). In addition to low carbon renewable fuel ethanol, the Keyes Plant produces Wet Distillers Grains (“WDG”), Distillers Corn Oil (“DCO”), and Condensed Distillers Solubles (“CDS”), all of which are sold as animal feed to local dairies and feedlots. The Keyes Plant also sells CO₂ to Messer Gas who converts it to liquid and sells it to food, beverage, and industrial customers. We are implementing several energy efficiency initiatives at the Keyes Plant focused on reducing operating costs and lowering the carbon intensity of our fuel.

► California Dairy Renewable Natural Gas - We produce Renewable Natural Gas (RNG) in central California. Our facilities consist of eight anaerobic digesters that produce biogas from dairy waste, a 36-mile biogas collection pipeline leading to a central upgrading hub, and an interconnect to inject the RNG into the utility natural gas pipeline for delivery to customers for use as transportation fuel. We are actively expanding our RNG production dairies, with several additional digesters under construction, agreements with a total of 43 dairies, and environmental review completed for an additional 24 miles of pipeline. We are also building our own RNG dispensing station, which is planned to begin operating in 2024.

► India Biodiesel - We own and operate a plant in Kakinada, India (“Kakinada Plant”) with a capacity to produce about 60 million gallons per year of high-quality distilled biodiesel from a variety of vegetable oil and animal waste feedstocks. The Kakinada Plant is one of the largest biodiesel production facilities in India. The Kakinada Plant can also distill the crude glycerin byproduct from the biodiesel refining process into refined glycerin, which is sold to the pharmaceutical, personal care, paint, adhesive, and other industries.

In addition, we are actively growing our business by seeking to develop or acquire new facilities, including the following key projects:

► Sustainable Aviation Fuel and Renewable Diesel – We are developing a sustainable aviation fuel and renewable diesel (“SAF/RD”) production plant to be located at the Riverbank Industrial Complex in Riverbank, CA. The plant is currently designed to produce an expected 90 million gallons per year of SAF/RD from renewable oil and fats obtained from the Company’s other biofuels plants and other sources. The plant will use low-carbon hydroelectric electricity and renewable hydrogen that is generated within the plant’s own processes using byproducts of the SAF/RD production. In 2023, we received approval of the Use Permit and CEQA for the development of the plant, and in March 2024, we received the Authority to Construct air permits for the plant. We are continuing with the engineering and other required development activities for the plant.

► Carbon Capture and Underground Sequestration – We are developing Carbon Capture and Underground Sequestration (“CCUS”) facilities that will inject carbon dioxide captured from air emissions deep into the ground for geologic storage to reduce emissions to the atmosphere of greenhouse gases that contribute to global warming. In May 2023, the Company received a permit from the State of California to build a geologic characterization well that will provide information for the permitting and design of a CCUS well to be located in Riverbank, California. The Company plans to construct the geologic characterization well in 2024 and is at the same time continuing engineering, permitting and other development activities for the sequestration well.

(Tabular data in thousands, except par value and per share data)

The Company’s current and planned businesses produce renewable fuels and reduce carbon emissions, while generating valuable Renewable Fuel Standard credits, California Low Carbon Fuel Standard credits, and federal tax credits.

Basis of Presentation and Consolidation

These consolidated financial statements include the accounts of Aemetis, Inc. and its subsidiaries. We consolidate all entities in which we have a controlling financial interest. A controlling financial interest is usually obtained through ownership of a majority of the voting interests. However, an enterprise must consolidate a variable interest entity (“VIE”) if the enterprise is the primary beneficiary of the VIE, even if the enterprise does not own a majority of the voting interests. The primary beneficiary is the party that has both the power to direct the activities of the VIE that most significantly impact the VIE’s economic performance, and the obligation to absorb losses or the right to receive benefits from the VIE that could potentially be significant to the VIE. We consider Aemetis Biogas LLC ("ABGL") to be a VIE because the Company owns all of the outstanding common units of ABGL and is the primary beneficiary of ABGL's operations; accordingly, the assets, liabilities, and operations of ABGL are consolidated in these financial statements.

All intercompany balances and transactions have been eliminated in consolidation.

The accompanying consolidated condensed balance sheet as of March 31, 2024, the consolidated condensed statements of operations and comprehensive loss for the three months ended March 31, 2024 and 2023, the consolidated condensed statements of cash flows for the three months ended March 31, 2024 and 2023, and the consolidated condensed statements of stockholders’ deficit for the three months ended March 31, 2024 and 2023 are unaudited. The consolidated condensed balance sheet as of December 31, 2023, was derived from the 2023 audited consolidated financial statements and notes thereto. The consolidated condensed financial statements in this report should be read in conjunction with the 2023 audited consolidated financial statements and notes thereto included in the Company’s annual report on Form 10-K for the year ended December 31, 2023. The accompanying consolidated condensed financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) and pursuant to the rules and regulations of the SEC. Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to such rules and regulations.

In the opinion of Company’s management, the unaudited interim consolidated condensed financial statements as of and for the three months ended March 31, 2024 and 2023 have been prepared on the same basis as the audited consolidated statements as of and for the year ended December 31, 2023 and reflect all adjustments, consisting primarily of normal recurring adjustments, necessary for the fair presentation of its statement of financial position, results of operations and cash flows. The results of operations for the three months ended March 31, 2024 are not necessarily indicative of the operating results for any subsequent quarter, for the full fiscal year or any future periods.

There have been no material changes to our significant accounting policies disclosed in Note 1 - Nature of Activities and Summary of Significant Accounting Policies of the Notes to the Consolidated Financial Statements included in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

(Tabular data in thousands, except par value and per share data)

2. Revenue

We derive revenue primarily from sales of ethanol and related co-products in California, renewable natural gas ("RNG") and related environmental attributes in California, and biodiesel and refined glycerin in India.

California Ethanol Revenues: Starting in the second quarter of 2023, we began selling all our ethanol to J.D. Heiskell Holdings, LLC ("J.D. Heiskell"), who sells it to customers designated by us, and we have designated Murex, LLC, who continues to market the product. J.D. Heiskell does not charge a fee for reselling the ethanol, but it receives the payments from the ultimate customer. We also buy our corn feedstock from J.D. Heiskell, and J.D. Heiskell pays us the net balance between ethanol and other product we sell to J.D. Heiskell and our corn purchases from J.D. Heiskell. Our accounting (i) treats us as the purchaser/customer for corn purchases from J.D. Heiskell and we record the full purchase cost in cost-of-good sold, and (ii) treats us as the seller for ethanol and other product sales, so we treat all sales as revenue.

Given the similarity of the individual sales transactions with J.D. Heiskell, we have assessed them as a portfolio of similar contracts. Prior to May 25, 2023, the performance obligation was satisfied by delivery of the physical product from our finished goods tank to our customer’s contracted trucks. Effective on May 25, 2023, the performance obligation is satisfied by delivery of the physical product to our finished goods tank leased by J.D. Heiskell. The transaction price is determined based on daily market prices and quarterly contract pricing negotiated by Murex for its customers for ethanol and based on dry distillers' market and local demand by our marketing partner A.L. Gilbert Company (“A.L. Gilbert”) for WDG. The transaction price is allocated to one performance obligation.

During the last two weeks of December 2022, we undertook an extended maintenance cycle and accelerated the implementation of several important ethanol plant energy efficiency upgrades. Our decision was partly driven by the high natural gas prices in California during the period. After monitoring natural gas pricing and margin profitability, we decided to extend the maintenance cycle into the first and second quarters of 2023 and restarted the plant at the end of May 2023, which accounts for lower revenue amounts shown in the table below for the period ending March 31, 2023.

The following table shows sales in our California Ethanol segment by product category:

| |

|

For the three months ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Ethanol sales |

|

$ |

25,385 |

|

|

$ |

368 |

|

| Wet distiller's grains sales |

|

|

9,213 |

|

|

|

- |

|

| Other sales |

|

|

1,491 |

|

|

|

107 |

|

| Total |

|

$ |

36,089 |

|

|

$ |

475 |

|

California Dairy Renewable Natural Gas Revenues: Our facilities as of March 31, 2024, consist of eight anaerobic digesters that process feedstock from dairies into biogas, a 36-mile collection pipeline leading to a central upgrading hub, and an interconnect to inject the RNG into the utility natural gas pipeline for delivery to customers for use as transportation fuel. In connection with dispensing the RNG, we generate sellable credits under the federal Renewable Fuel Standard (referred to as "D3 RINs") and the California Low Carbon Fuel Standard ("LCFS"). We began selling D3 RINs in the third quarter of 2023 and began selling LCFS credits in the first quarter of 2024. We recognize revenue from sales of RNG concurrent with our production and injection into the transportation pipeline. We recognize revenue from sales of D3 RINs and LCFS credits at the time we sell the credits.

| |

|

For the three months ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| RNG, LCFS and D3 RIN sales |

|

$ |

3,792 |

|

|

$ |

206 |

|

(Tabular data in thousands, except par value and per share data)

India Biodiesel Revenues:

The following table shows our sales in our India Biodiesel segment by product category:

| |

|

For the three months ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Biodiesel sales |

|

$ |

30,992 |

|

|

$ |

1,190 |

|

| Other sales |

|

|

1,761 |

|

|

|

280 |

|

| Total |

|

$ |

32,753 |

|

|

$ |

1,470 |

|

3. Cash and Cash Equivalents

The following table reconciles cash, cash equivalents, and restricted cash reported in the Consolidated Balance Sheet to the statement of cash flows:

| |

|

As of |

|

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Cash and cash equivalents |

|

$ |

1,629 |

|

|

$ |

2,667 |

|

| Restricted cash included in other current assets |

|

|

143 |

|

|

|

289 |

|

| Restricted cash included in other assets |

|

|

3,165 |

|

|

|

3,324 |

|

| Total cash, cash equivalents, and restricted cash shown in the statement of cash flows |

|

$ |

4,937 |

|

|

$ |

6,280 |

|

Restricted cash shown in the table above includes amounts required to be set aside by the Construction and Term Loan Agreement arranged by Greater Commercial Lending ("GCL") for financing reserves and construction contingencies.

4. Basic and Diluted Net Loss Per Share

Basic net loss per share is computed by dividing income or loss attributable to common stockholders by the weighted average number of shares of common stock outstanding for the period. Diluted net loss per share reflects the dilution of common stock equivalents such as options, convertible preferred stock, debt and warrants to the extent the impact is dilutive.

The following table shows the number of potentially dilutive shares excluded from the diluted net loss per share calculation as of March 31, 2024 and 2023:

| | | As of | |

| | | March 31, 2024 | | | March 31, 2023 | |

| Series B preferred (post split basis) | | | - | | | | 127 | |

| Common stock options and warrants | | | 7,743 | | | | 6,125 | |

| Debt with conversion feature at $30 per share of common stock | | | 1,270 | | | | 1,246 | |

| Total number of potentially dilutive shares | | | 9,013 | | | | 7,498 | |

(Tabular data in thousands, except par value and per share data)

5. Inventories

Inventories consist of the following:

| |

|

As of |

|

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| Raw materials |

|

$ |

9,564 |

|

|

$ |

9,907 |

|

| Work-in-progress |

|

|

1,657 |

|

|

|

1,682 |

|

| Finished goods |

|

|

4,790 |

|

|

|

6,702 |

|

| Total inventories |

|

$ |

16,011 |

|

|

$ |

18,291 |

|

As of

March 31, 2024

, and

December 31, 2023

, the Company recognized a lower of cost or net realizable value adjustment

of $109 thousand and $

58 thousand,

respectively, related to inventory.

6. Property, Plant and Equipment

Property, plant and equipment consist of the following:

| | | As of | |

| | | March 31, 2024 | | | December 31, 2023 | |

| Land | | $ | 7,344 | | | $ | 7,345 | |

| Plant and buildings | | | 136,750 | | | | 136,318 | |

| Furniture and fixtures | | | 2,529 | | | | 2,266 | |

| Machinery and equipment | | | 15,150 | | | | 14,982 | |

| Construction in progress | | | 76,609 | | | | 73,057 | |

| Property held for development | | | 15,431 | | | | 15,431 | |

| Finance lease right of use assets | | | 2,889 | | | | 2,889 | |

| Total gross property, plant & equipment | | | 256,702 | | | | 252,288 | |

| Less accumulated depreciation | | | (58,965 | ) | | | (57,180 | ) |

| Total net property, plant & equipment | | $ | 197,737 | | | $ | 195,108 | |

For the three months ended March 31, 2024 and 2023, interest capitalized in property, plant and equipment was $1.7 million and $1.8 million, respectively.

Construction in progress includes costs for the biogas construction projects (dairy digesters and pipeline), Riverbank projects (sustainable aviation fuel and renewable diesel plant as well as carbon capture characterization well), and energy efficiency projects at the Keyes Plant. Property held for development is the partially completed Goodland Plant which is not ready for operation. Depreciation will begin for each project when the project is finalized and placed into service. Depreciation on the components of property, plant and equipment is calculated using the straight-line method to allocate their depreciable amounts over their estimated useful lives as follows:

| | | Years | |

| Plant and buildings | | | 20 - 30 | |

| Machinery and equipment | | | 5 - 15 | |

| Furniture and fixtures | | | 3 - 5 | |

For the three months ended March 31, 2024 and 2023, the Company recorded depreciation expense of $1.8 million for each period.

(Tabular data in thousands, except par value and per share data)

7. Debt

Debt consists of the following:

| | | March 31, 2024 | | | December 31, 2023 | |

| Third Eye Capital term notes | | $ | 7,172 | | | $ | 7,159 | |

| Third Eye Capital revolving credit facility | | | 23,800 | | | | 20,922 | |

| Third Eye Capital revolving notes Series B | | | 57,694 | | | | 54,412 | |

| Third Eye Capital revenue participation term notes | | | 12,046 | | | | 12,011 | |

| Third Eye Capital acquisition term notes | | | 26,709 | | | | 26,655 | |

| Third Eye Capital Fuels Revolving Line | | | 35,168 | | | | 32,511 | |

| Third Eye Capital Carbon Revolving Line | | | 23,673 | | | | 23,486 | |

| Construction and term loans | | | 43,894 | | | | 41,024 | |

| Cilion shareholder purchase obligation | | | 7,081 | | | | 7,028 | |

| Subordinated notes | | | 17,747 | | | | 17,625 | |

| EB-5 promissory notes | | | 42,439 | | | | 42,211 | |

| Working capital loans | | | 3,954 | | | | 3,827 | |

| Term loans on capital expenditures | | | 5,847 | | | | 5,850 | |

| Total debt | | | 307,224 | | | | 294,721 | |

| Less current portion of debt | | | 72,807 | | | | 37,028 | |

| Total long term debt | | $ | 234,417 | | | $ | 257,693 | |

Third Eye Capital Note Purchase Agreement

On July 6, 2012, Aemetis, Inc. and Aemetis Advanced Fuels Keyes, Inc. (“AAFK”), entered into an Amended and Restated Note Purchase Agreement (the “Note Purchase Agreement”) with Third Eye Capital Corporation (“Third Eye Capital”). Pursuant to the Note Purchase Agreement, Third Eye Capital extended credit in the form of (i) senior secured term loans in an aggregate principal amount of approximately $7.2 million to replace existing notes held by Third Eye Capital (the “Term Notes”); (ii) senior secured revolving loans in an aggregate principal amount of $18.0 million (the “Revolving Credit Facility”); (iii) senior secured term loans in the principal amount of $10.0 million to convert the prior revenue participation agreement to a note (the “Revenue Participation Term Notes”); and (iv) senior secured term loans in an aggregate principal amount of $15.0 million (the “Acquisition Term Notes”) used to fund the cash portion of the acquisition of Cilion, Inc. (the Term Notes, Revolving Credit Facility, Revenue Participation Term Notes and Acquisition Term Notes are referred to herein collectively as the “Original Third Eye Capital Notes”).

The Original Third Eye Capital Notes have been amended several times. Most recently, on March 25, 2024, the Company and Third Eye Capital Corporation entered into a “Limited Waiver and Amendment No. 28 to Amended and Restated Note Purchase Agreement” (“Amendment No. 28”) that (i) revised the loan covenant related to Keyes plant note indebtedness to exclude certain draws on Third Eye credit facilities and to exclude the "Redemption Fee," as defined in the Amended and Restated Note Purchase Agreement, and (ii) changed the maximum ratio of Note Indebtedness to the Keyes Plant market value to 120%. As consideration for Amendment No. 28, the Company agreed to pay Third Eye Capital an amendment fee of $0.1 million. We evaluated the terms of Amendment No. 28 in accordance with ASC 470-50 Debt – Modification and Extinguishment and ASC 470-60 Troubled Debt Restructuring and applied modification accounting treatment.

(Tabular data in thousands, except par value and per share data)

Terms of Original Third Eye Capital Notes:

| A. | Term Notes. As of March 31, 2024, the Company had $7.3 million in principal and interest outstanding under the Term Notes and $104 thousand unamortized debt issuance costs. The Term Notes accrue interest at 14% per annum. The Term Notes mature on April 1, 2025. |

| B. | Revolving Credit Facility. The Revolving Credit Facility accrues interest at the prime rate plus 13.75% (22.25% as of March 31, 2024) payable monthly in arrears. The Revolving Credit Facility matures on April 1, 2025. As of March 31, 2024, AAFK had $24.8 million in principal and interest and waiver fees outstanding and $1.0 million unamortized debt issuance costs under the Revolving Credit Facility. |

| C. | Revolving Notes Series B. The Revolving Notes Series B accrues interest at the prime rate plus 13.75% (22.25% as of March 31, 2024) payable monthly in arrears. The Revolving Notes Series B matures on April 1, 2025. As of March 31, 2024, AAFK had $58.5 million in principal and interest and waiver fees outstanding and $0.8 million unamortized debt issuance costs under the Revolving Notes Series B. |

| D. | Revenue Participation Term Notes. The Revenue Participation Term Notes bear interest at 5% per annum and mature on April 1, 2025. As of March 31, 2024, AAFK had $12.2 million in principal and interest outstanding under the Revenue Participation Term Notes and $168 thousand unamortized debt issuance costs. |

| E. | Acquisition Term Notes. The Acquisition Term Notes accrue interest at the prime rate plus 10.75% (19.25% per annum as of March 31, 2024) and mature on April 1, 2025. As of March 31, 2024, Aemetis Facility Keyes, Inc. had $27.0 million in principal and interest and redemption fees outstanding under the Acquisition Term Notes and $325 thousand unamortized debt issuance costs. The outstanding principal balance includes $7.5 million in redemption fee on which interest is not charged. |

The Original Third Eye Capital Notes contain various covenants, including but not limited to, debt to plant value ratio, minimum production requirements, and restrictions on capital expenditures. The terms of the Notes allow the lender to accelerate the maturity in the event of any default that could reasonably be expected to have a material adverse effect on the Company, such as any change in the business, operations, or financial condition. The Company has evaluated the likelihood of such an acceleration event and determined such an event to not be probable in the next twelve months. The Notes allow interest to be added to the outstanding principal balance. The Original Third Eye Capital Notes are secured by first priority liens on all real and personal property of, and assignment of proceeds from all government grants and guarantees from the Company’s North American subsidiaries. The Original Third Eye Capital Notes all contain cross-collateral and cross-default provisions. McAfee Capital, LLC (“McAfee Capital”), owned by Eric McAfee, the Company’s Chair and CEO, provided a guaranty of payment and performance secured by all Company shares owned by McAfee Capital and additional assets. In addition, Eric McAfee has provided a personal guaranty of up to $10 million plus a pledge of his ownership interests in several personal assets.

Third Eye Capital Reserve Facility. On March 6, 2020, we entered into a reserve liquidity facility governed by a promissory note, payable to Third Eye Capital Corporation, in the principal amount of $18 million. The reserve liquidity facility has been amended several times. Most recently, on March 25, 2024, the Company and Third Eye Capital entered into a "Seventh Amended and Restated Promissory Note" that increased the amount available under the reserve liquidity facility to $85 million and extended the maturity date to April 1, 2025. Borrowings under the Note are available until maturity. Interest on borrowed amounts would accrue at a rate of 30% per annum, to be paid monthly in arrears, or 40% if an event of default has occurred and continues. Interest payments due may be capitalized into the principal balance of the Note. The Company pays a standby fee of 2% per annum of the difference between the aggregate principal outstanding under the Note and the commitment, payable monthly arrears in either cash or stock. The Note also requires the Company to pay a fee in the amount of $0.5 million in connection with a request for an advance on the Note, provided that such fee may be added to the principal amount of the Note. In addition, the Company would be required to make payments on the Note with funds received from the closing of certain new debt or equity financing or transactions, as described in the Note. The Note is secured by liens and security interests upon the property and assets of the Company. As of March 31, 2024, we have no borrowings outstanding under the Reserve Liquidity Note.

Third Eye Capital Revolving Credit Facility for Fuels and Carbon Lines. On March 2, 2022, Goodland Advanced Fuels, Inc. ("GAFI) and Aemetis Carbon Capture, Inc. (“ACCI”) entered into an Amended and Restated Credit Agreement (“Credit Agreement”) with Third Eye Capital, as administrative agent and collateral agent, and the lender party thereto (the “New Credit Facility”). The New Credit Facility provides for two credit lines with aggregate availability of up to $100 million, consisting of a revolving credit facility with GAFI for up to $50 million (the “Fuels Revolving Line”) and a revolving credit facility with ACCI for up to $50 million (the “Carbon Revolving Line” and together with the Fuels Revolving Line, the “Revolving Lines”). Loans received under the Fuels Revolving Line have a maturity date of March 1, 2025, and accrue interest per annum at a rate equal to the greater of (i) the prime rate plus 6.00% and (ii) ten percent (10.0%). Loans received under the Carbon Revolving Line have a maturity date of March 1, 2026 and accrue interest per annum at a rate equal to the greater of (i) the prime rate plus 4.00% and (ii) eight percent (8.0%). Loans under the Fuels Revolving Line are available for working capital purposes and loans made under the Carbon Revolving Line are available for projects that reduce, capture, use, or sequester carbon with the objective of reducing carbon dioxide emissions. As of March 31, 2024, GAFI had principal and interest outstanding of $35.1 million classified as current debt and $1.8 million unamortized debt issuance costs. As of March 31, 2024, ACCI had principal and interest outstanding of $0.3 million classified as current debt, $23.4 million classified as long-term debt, and $1.5 million in unamortized debt issuance costs.

(Tabular data in thousands, except par value and per share data)

Cilion Shareholder Purchase Obligation. In connection with the Company’s merger with Cilion, Inc. (“Cilion”), on July 6, 2012, the Company incurred a $5.0 million payment obligation to Cilion shareholders as merger compensation subordinated to the senior secured Third Eye Capital Notes. The liability bears interest at 3% per annum and is due and payable after the Third Eye Capital Notes have been paid in full. As of March 31, 2024, Aemetis Facility Keyes, Inc. had $7.0 million in principal and interest outstanding under the Cilion payment obligation under the merger agreement.

Subordinated Notes. On January 6 and January 9, 2012, AAFK entered into Note and Warrant Purchase Agreements with two accredited investors pursuant to which it issued $3.4 million in original notes to the investors (“Subordinated Notes”). The Subordinated Notes mature every six months. Upon maturity, the Subordinated Notes are renewable at the Company's election for six month periods with a fee of 10% added to the balance outstanding plus issuance of warrants exercisable at $0.01 with a two-year term. Interest accrues at 10% per annum and is due at maturity. Neither AAFK nor Aemetis may make any principal payments under the Subordinated Notes until all loans made by Third Eye Capital to AAFK are paid in full. On January 1, 2024, the maturity on the Subordinated Notes was extended to June 30, 2024. In connection with the extension, the Company paid a $340 thousand extension fee by adding the fee to the balance of the Subordinated Notes and issued warrants exercisable for 113 thousand shares of common stock with a term of two years and an exercise price of $0.01 per share. The Company evaluated the January 1, 2024, amendment and the refinancing terms of the notes and applied modification accounting treatment in accordance with ASC 470-50 Debt – Modification and Extinguishment. At March 31, 2024 and December 31, 2023, the Company had, in aggregate, $17.7 million and $17.6 million in principal and interest outstanding, respectively, under the Subordinated Notes.

EB-5 Promissory Notes. EB-5 is a U.S. government program authorized by the Immigration and Nationality Act designed to foster employment-based visa preference for immigrant investors to encourage the flow of capital into the U.S. economy and to promote employment of U.S. workers. The Company entered into a Note Purchase Agreement dated March 4, 2011 (as further amended on January 19, 2012 and July 24, 2012) with Advanced BioEnergy, LP, a California limited partnership authorized as a “Regional Center” to receive EB-5 investments, for the issuance of up to 72 subordinated convertible promissory notes (the “EB-5 Notes”) bearing interest at 2-3%. Advanced BioEnergy, LP arranged equity investments by foreign investors, and then Advanced BioEnergy used the invested equity to make loans to the Keyes Plant. Each note was issued in the principal amount of $0.5 million for a total aggregate principal amount of up to $36.0 million (the “EB-5 Phase I funding”). The original maturity date on the promissory notes has been extended. On February 27, 2019, Advanced BioEnergy, LP, and the Company entered into an Amendment to the EB-5 Notes which restated the original maturity date on the promissory notes with automatic six-month extensions as long as the Advanced Bioenergy investors’ immigration processes are in progress. Given the COVID-19 pandemic and processing delays for immigration process, Advanced BioEnergy, LP extended the maturity dates for debt repayment based on their projected processing timings as long as the investors do not give notice of withdrawal or an I-829 gets approved. Accordingly, the notes have been recognized as long-term debt while investor notes who obtained green card approval have been classified as current debt. The EB-5 Notes are convertible into Aemetis, Inc. common stock at a conversion price of $30 per share. As of March 31, 2024, $35.5 million has been released from the escrow amount to the Company, with $0.5 million remaining to be funded to escrow. As of March 31, 2024 and December 31, 2023, $38.0 million and $37.9 million was outstanding, respectively, on the EB-5 Notes.

On October 16, 2016, the Company launched its EB-5 Phase II funding (the “EB-5 Phase II Funding”) and entered into a Note Purchase Agreement with Advanced BioEnergy II, LP, a California limited partnership authorized as a Regional Center to receive EB-5 Phase II funding investments. The Company received $4.0 million in loan funds before certain changes to and expiration of the EB-5 program prevented further funding. The federal EB-5 program was recently reauthorized, and in March 2024, the U.S. Customs and Immigration Service approved the Company's project for up to $200 million of additional investment using EB-5 funds. Under the new rules, the minimum investment was raised from $0.5 million per investor to $0.8 million per investor. The terms of the EB-5 Phase II Funding are similar to the terms of the first round of EB-5 funding. As of March 31, 2024, and December 31, 2023, $4.4 million and $4.3 million were outstanding on the EB-5 Notes under the EB-5 Phase II funding, respectively.