0001817358FALSE00018173582024-09-102024-09-10

| | | | | | | | | | | | | | |

| | | | |

| | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | | | |

| | | | |

FORM 8-K |

| | | | |

| | | | |

| CURRENT REPORT |

| Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | | | |

Date of report (Date of earliest event reported): September 10, 2024 |

| | | | |

| | | | |

|

| | | | |

Academy Sports and Outdoors, Inc. |

(Exact name of registrant as specified in its charter) |

| | | | |

| | | | |

Delaware | 001-39589 | 85-1800912 |

(State or other jurisdiction of | (Commission | (I.R.S. Employer |

incorporation) | File No.) | Identification No.) |

| | | | |

| 1800 North Mason Road | |

| Katy, Texas 77449 | |

| (Address of principal executive offices, including Zip Code) | |

| | | | |

| (281) 646-5200 | |

| (Registrant’s telephone number, including area code) | |

| | | | |

| Not Applicable | |

| (Former name or former address, if changed since last report) | |

| | | | |

| | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | ASO | The Nasdaq Stock Market LLC |

| | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging Growth Company ☐ | | | |

| | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

| | | | |

Item 2.02 Results of Operations and Financial Condition.

On September 10, 2024, Academy Sports and Outdoors, Inc. (the “Company”) issued a press release announcing financial results for the quarter ended August 3, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated by reference herein.

The information in this Current Report on Form 8-K, including exhibits, is being furnished to the U.S. Securities and Exchange Commission (the “SEC”) pursuant to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the Company’s filings with the SEC under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On September 5, 2024, the Company’s Board of Directors declared a cash dividend with respect to the quarter ended August 3, 2024 of $0.11 per share of outstanding common stock of the Company, payable on October 17, 2024, to stockholders of record as of the close of business on September 19, 2024.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | Academy Sports and Outdoors, Inc. Press Release, dated September 10, 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

ACADEMY SPORTS AND OUTDOORS, INC. |

|

|

| | | | | | | | | | | | | | |

Date: September 10, 2024 | | By: | /s/ | Rene G. Casares |

| | Name: | Rene G. Casares |

| | Title: | Senior Vice President, General Counsel and Secretary |

| | | |

| | | | |

| | | | |

Exhibit 99.1

Academy Sports + Outdoors Reports Second Quarter 2024 Results

Net Sales Decline (2.2)%; Comparable Sales of (6.9)%

GAAP Diluted EPS of $1.95, or $2.03 Adjusted Diluted EPS

Year-to-Date Adjusted Free Cash Flow +60%; Utilized to Return $107 Million to Shareholders in Q2

Fiscal 2024 Guidance Revised; Reaffirming Gross Margin Rate Guidance

KATY, TEXAS (Globe Newswire — September 10, 2024) – Academy Sports and Outdoors, Inc. (Nasdaq: ASO) ("Academy" or the "Company") today announced its financial results for the second quarter ended August 3, 2024.

"Academy continues to make progress against our strategic initiatives demonstrated by the opening of nine new stores this upcoming quarter, new omni-channel enhancements, such as Door Dash, and leveraging customer excitement around the launch of our new loyalty program. In addition, our inventory discipline drove gross margin expansion of 50 basis points and a 5% reduction in units per store," said Steve Lawrence, Chief Executive Officer. “For the remainder of the year, we will focus on increasing traffic and conversion for our stores and website, by leveraging our improved targeted marketing capabilities, and expanding our new loyalty program. We will also continue to use our strong cash generation to fund the investments that will drive our long-term growth and increase shareholder value."

| | | | | | | | | | | | | | |

Second Quarter Operating Results ($ in millions, except per share data) | Thirteen Weeks Ended | Change |

| August 3, 2024 | July 29, 2023 | % |

| Net sales | $ | 1,549.0 | | $ | 1,583.1 | | (2.2)% |

Comparable sales (1) | (6.9) | % | (7.5) | % | |

| Income before income tax | $ | 186.5 | | $ | 203.3 | | (8.2)% |

| Net income | $ | 142.6 | | $ | 157.1 | | (9.2)% |

Adjusted net income (2) | $ | 148.6 | | $ | 163.6 | | (9.2)% |

| Earnings per common share, diluted | $ | 1.95 | | $ | 2.01 | | (3.0)% |

Adjusted earnings per common share, diluted (2) | $ | 2.03 | | $ | 2.09 | | (2.9)% |

(1) Fiscal 2023 had a 53rd week, so the Company is using a shifted comp sales calculation which compares weeks 14-26 in Q2 2024 to weeks 15-27

in fiscal 2023.

(2) Adjusted net income and Adjusted earnings per common share, diluted are non-GAAP measures. See "Non-GAAP Measures" and

"Reconciliations of GAAP to Non-GAAP Financial Measures" below for reconciliations of non-GAAP financial measures to their most directly

comparable GAAP financial measures.

| | | | | | | | | | | | | | |

Year-to-Date Operating Results ($ in millions, except per share data) | Twenty-Six Weeks Ended | Change |

| August 3, 2024 | July 29, 2023 | % |

| Net sales | $ | 2,913.2 | | $ | 2,966.7 | | (1.8)% |

| Comparable sales | (6.4) | % | (7.4) | % | |

| Income before income tax | $ | 284.2 | | $ | 322.0 | | (11.7)% |

| Net Income | $ | 219.1 | | $ | 251.0 | | (12.7)% |

Adjusted net income (1) | $ | 230.3 | | $ | 266.6 | | (13.6)% |

| Earnings per common share, diluted | $ | 2.93 | | $ | 3.19 | | (8.2)% |

Adjusted earnings per common share, diluted (1) | $ | 3.08 | | $ | 3.39 | | (9.1)% |

| | | | |

(1) Adjusted net income and Adjusted earnings per common share, diluted, are non-GAAP measures. See "Non-GAAP Measures" and "Reconciliations of GAAP to Non-GAAP Financial Measures" below for reconciliations of non-GAAP financial measures to their most directly comparable GAAP financial measures. |

| | | | | | | | | | | | | | |

| | As of | Change |

Balance Sheet ($ in millions) | August 3, 2024 | July 29, 2023 | % |

| Cash and cash equivalents | $ | 324.6 | | $ | 311.3 | | 4.3% |

| Merchandise inventories, net | $ | 1,366.6 | | $ | 1,309.0 | | 4.4% |

| Long-term debt, net | $ | 483.6 | | $ | 583.7 | | (17.1)% |

| | | | | | | | | | | | | | |

| | Twenty-Six Weeks Ended | Change |

Capital Allocation ($ in millions) | August 3, 2024 | July 29, 2023 | % |

| Share repurchases | $ | 222.3 | | $ | 157.6 | | 41.1% |

| Dividends paid | $ | 16.1 | | $ | 13.8 | | 16.7% |

Subsequent to the end of the second quarter, on September 5, 2024, Academy's Board of Directors declared a quarterly cash dividend of $0.11 per share of common stock. The dividend is payable on October 17, 2024, to stockholders of record as of the close of business on September 19, 2024.

New Store Openings

Academy opened one new store during the second quarter. The Company has opened three stores through the first two fiscal quarters and plans to open a total of 15 to 17 stores in 2024.

2024 Outlook

"Sales for the second quarter were more challenging than expected, impacted by a tough economy, a temporary distribution center backlog related to going live with a new warehouse management system and by a very active storm season across key portions of our footprint. Based on the results of the first half of the year and the expectations for the remainder of fiscal 2024, we are revising our full year guidance, while maintaining our gross margin rate range," said Carl Ford, Chief Financial Officer. "We will continue to manage expenses and inventory levels as we focus on driving topline growth. We have a very healthy balance sheet and top quartile cash flow generation, which we will deploy towards our capital allocation strategy."

Academy is revising its previous guidance for fiscal 2024 as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Updated Guidance | | Previous Guidance |

| (in millions, except per share data) | Low end | | High end | | Low end | | High end |

| Net sales | $ | 5,895.0 | | | $ | 6,075.0 | | | $ | 6,070.0 | | | $ | 6,350.0 | |

| Sales growth | (4.3) | % | | (1.4) | % | | (1.5) | % | | 3.0 | % |

| | | | | | | |

| Comparable sales | (6.0) | % | | (3.0) | % | | (4.0) | % | | 1.0 | % |

| | | | | | | |

| Gross margin rate | 34.3 | % | | 34.7 | % | | 34.3 | % | | 34.7 | % |

| | | | | | | |

| GAAP net income | $ | 400.0 | | $ | 460.0 | | $ | 455.0 | | | $ | 530.0 | |

| | | | | | | |

Adjusted net income (1) | $ | 420.0 | | $ | 480.0 | | - | | - |

| | | | | | | |

| GAAP earnings per common share, diluted | $ | 5.45 | | $ | 6.20 | | $ | 6.05 | | | $ | 7.05 | |

| | | | | | | |

Adjusted earnings per common share, diluted (1) | $ | 5.75 | | $ | 6.50 | | - | | - |

| | | | | | | |

| Diluted weighted average common shares outstanding | 73.5 | | 73.5 | | ~75 | | ~75 |

| | | | | | | |

| Capital expenditures | $ | 175 | | $ | 225 | | $ | 225 | | $ | 275 |

| | | | | | | |

Adjusted free cash flow (2) | $ | 290 | | $ | 340 | | $ | 290 | | $ | 375 |

| | | | | | | |

| (1) The Company did not provide guidance for Adjusted net income and Adjusted earnings per share prior to this release. See "Non-GAAP Measures" and "Reconciliations of GAAP to Non-GAAP Financial Measures" below for reconciliations of non-GAAP financial measures to their most directly comparable GAAP financial measures. |

| (2) Adjusted free cash flow is a non-GAAP measure. We have not reconciled it to the most comparable GAAP measure because it is not possible to do so without unreasonable efforts given the uncertainty and potential variability of reconciling items, which are dependent on future events and often outside of management's control and could be significant; therefore, we are unable to provide an estimate of the most closely comparable GAAP measure at this time. |

| Note: Fiscal 2023 included 53 weeks compared to 52 weeks in fiscal 2024. |

The earnings per common share guidance reflects a tax rate of approximately 23.0% and does not include any potential future share repurchases using the $476 million remaining authorization.

Conference Call Info

Academy will host a conference call today at 10:00 a.m. Eastern Time to discuss its financial results. The call will be webcast at investors.academy.com. The following information is provided for those who would like to participate in the conference call:

U.S. callers 1-877-407-3982

International callers 1-201-493-6780

Passcode 13748429

A replay of the conference call will be available for approximately 30 days on the Company's website.

About Academy Sports + Outdoors

Academy is a leading full-line sporting goods and outdoor recreation retailer in the United States. Originally founded in 1938 as a family business in Texas, Academy has grown to 285 stores across 19 states as of the end of the quarter. Academy’s mission is to provide “Fun for All” and Academy fulfills this mission with a localized merchandising strategy and value proposition that strongly connects with a broad range of consumers. Academy’s product assortment focuses on key categories of outdoor, apparel, footwear and sports & recreation through both leading national brands and a portfolio of private label brands.

Non-GAAP Measures

Adjusted EBITDA, Adjusted EBIT, Adjusted Net Income, Adjusted Earnings per Common Share, and Adjusted Free Cash Flow have been presented in this press release as supplemental measures of financial performance that are not required by, or presented in accordance with, generally accepted accounting principles (“GAAP”). The Company believes that the presentation of these non-GAAP measures is useful to investors as it provides additional information on comparisons between periods by excluding certain items that affect overall comparability. The Company uses these non-GAAP financial measures for business planning purposes, to consider underlying trends of its business, and in measuring its performance relative to others in the market, and believes presenting these measures also provides information to investors and others for understanding and evaluating trends in the Company’s operating results or measuring performance in the same manner as the Company’s management. Non-GAAP financial measures should be considered in addition to, and not as an alternative for, the Company’s reported results prepared in accordance with GAAP. The calculation of these non-GAAP financial measures may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. For additional information on these non-GAAP financial measures, please see our Annual Report for the fiscal year ended February 3, 2024 (the "Annual Report"), and our most recent Quarterly Report, which may be updated from time to time in our periodic filings with the Securities and Exchange Commission (the "SEC"), which are accessible on the SEC's website at www.sec.gov.

See “Reconciliations of GAAP to Non-GAAP Financial Measures” below for reconciliations of non-GAAP financial measures used in this press release to their most directly comparable GAAP financial measures.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on Academy’s current expectations and are not guarantees of future performance. Forward-looking statements may incorporate words such as “believe,” “expect,” “forward,” “ahead,” “opportunities,” “plans,” “priorities,” “goals,” “future,” “short/long term,” “will,” “should,” or the negative version of these words or other comparable words. The forward-looking statements include, among other things, statements regarding the Company’s fiscal 2024 outlook, the Company’s strategic plans and financial objectives, including the implementation of such plans, the growth of the Company’s business and operations, including the opening of new stores and the expansion into new markets, the rollout of new warehouse management and other systems, the Company’s payment of dividends and declaration of future dividends, including the timing and amount thereof, share repurchases by the Company, the Company's expectations regarding its future performance and future financial condition, and other such matters, and are subject to various risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Actual results may differ materially from these expectations due to changes in global, regional, or local economic, business, competitive, market, regulatory, environmental, and other factors that could affect overall consumer spending or our industry, including the possible effects of ongoing macroeconomic challenges, inflation and increases in interest rates, or changes to the financial health of our customers, many of which are beyond Academy's control. These and other important factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in Academy's filings with the SEC, including the Annual Report and the Quarterly Report, under the caption "Risk Factors," as may be updated from time to time in our periodic filings with the SEC. Any forward-looking statement in this press release speaks only as of the date of this release. Academy undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable securities laws.

| | | | | | | | |

Investor Contact | | Media Contact |

| Matt Hodges | | Allan Rojas |

| VP, Investor Relations | | Director, Communications |

| 281-646-5362 | | 281-944-6048 |

| matt.hodges@academy.com | | allan.rojas@academy.com |

ACADEMY SPORTS AND OUTDOORS, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

(Amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Thirteen Weeks Ended |

| August 3, 2024 | | Percentage of Sales (1) | | July 29, 2023 | | Percentage of Sales (1) |

| Net sales | $ | 1,548,980 | | | 100.0 | % | | $ | 1,583,077 | | | 100.0 | % |

| Cost of goods sold | 990,255 | | | 63.9 | % | | 1,019,631 | | 64.4 | % |

| Gross margin | 558,725 | | | 36.1 | % | | 563,446 | | 35.6 | % |

| Selling, general and administrative expenses | 368,639 | | | 23.8 | % | | 352,483 | | 22.3 | % |

| Operating income | 190,086 | | | 12.3 | % | | 210,963 | | | 13.3 | % |

| Interest expense, net | 9,071 | | | 0.6 | % | | 11,313 | | | 0.7 | % |

| Write off of deferred loan costs | — | | | 0.0 | % | | — | | | 0.0 | % |

| Other (income), net | (5,531) | | | (0.4) | % | | (3,623) | | | (0.2) | % |

| Income before income taxes | 186,546 | | | 12.0 | % | | 203,273 | | | 12.8 | % |

| Income tax expense | 43,958 | | | 2.8 | % | | 46,198 | | | 2.9 | % |

| Net income | $ | 142,588 | | | 9.2 | % | | $ | 157,075 | | | 9.9 | % |

| | | | | | | |

| Earnings Per Common Share: | | | | | | | |

| Basic | $ | 1.99 | | | | | $ | 2.06 | | | |

| Diluted | $ | 1.95 | | | | | $ | 2.01 | | | |

| | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | |

| Basic | 71,829 | | | | | 76,104 | | | |

| Diluted | 73,289 | | | | | 78,091 | | | |

| | | | | | | |

(1) Column may not add due to rounding

ACADEMY SPORTS AND OUTDOORS, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

(Amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Twenty-Six Weeks Ended |

| August 3, 2024 | | Percentage of Sales (1) | | July 29, 2023 | | Percentage of Sales (1) |

| Net sales | $ | 2,913,200 | | | 100.0 | % | | $ | 2,966,686 | | | 100.0 | % |

| Cost of goods sold | 1,898,681 | | | 65.2 | % | | 1,936,125 | | 65.3 | % |

| Gross margin | 1,014,519 | | | 34.8 | % | | 1,030,561 | | 34.7 | % |

| Selling, general and administrative expenses | 722,050 | | | 24.8 | % | | 693,402 | | 23.4 | % |

| Operating income | 292,469 | | | 10.0 | % | | 337,159 | | | 11.4 | % |

| Interest expense, net | 18,557 | | | 0.6 | % | | 22,543 | | | 0.8 | % |

| Write off of deferred loan costs | 449 | | | — | % | | — | | | 0.0 | % |

| Other (income), net | (10,735) | | | (0.4) | % | | (7,336) | | | (0.2) | % |

| Income before income taxes | 284,198 | | | 9.8 | % | | 321,952 | | | 10.9 | % |

| Income tax expense | 65,145 | | | 2.2 | % | | 70,907 | | 2.4 | % |

| Net income | $ | 219,053 | | | 7.5 | % | | $ | 251,045 | | | 8.5 | % |

| | | | | | | |

| Earnings Per Common Share: | | | | | | | |

| Basic | $ | 3.00 | | | | | $ | 3.28 | | | |

| Diluted | $ | 2.93 | | | | | $ | 3.19 | | | |

| | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | |

| Basic | 72,911 | | | | | 76,483 | | | |

| Diluted | 74,651 | | | | | 78,735 | | | |

| | | | | | | |

(1) Column may not add due to rounding

ACADEMY SPORTS AND OUTDOORS, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(Amounts in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | August 3, 2024 | | February 3, 2024 | | July 29, 2023 |

| ASSETS | | | | | | |

| CURRENT ASSETS: | | | | | | |

| Cash and cash equivalents | | $ | 324,568 | | | $ | 347,920 | | | $ | 311,336 | |

| Accounts receivable - less allowance for doubtful accounts of $2,080, $2,217 and $2,534, respectively | | 12,812 | | | 19,371 | | | 14,625 | |

| Merchandise inventories, net | | 1,366,616 | | | 1,194,159 | | | 1,309,033 | |

| Prepaid expenses and other current assets | | 108,392 | | | 83,450 | | | 80,490 | |

| | | | | | |

| Total current assets | | 1,812,388 | | | 1,644,900 | | | 1,715,484 | |

| | | | | | |

| PROPERTY AND EQUIPMENT, NET | | 470,752 | | | 445,209 | | | 404,967 | |

| RIGHT-OF-USE ASSETS | | 1,103,242 | | | 1,111,237 | | | 1,091,145 | |

| TRADE NAME | | 578,550 | | | 578,236 | | | 577,929 | |

| GOODWILL | | 861,920 | | | 861,920 | | | 861,920 | |

| | | | | | |

| OTHER NONCURRENT ASSETS | | 47,506 | | | 35,211 | | | 23,971 | |

| Total assets | | $ | 4,874,358 | | | $ | 4,676,713 | | | $ | 4,675,416 | |

| | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | | | |

| CURRENT LIABILITIES: | | | | | | |

| Accounts payable | | $ | 704,578 | | | $ | 541,077 | | | $ | 669,832 | |

| Accrued expenses and other current liabilities | | 259,069 | | | 217,932 | | | 234,011 | |

| Current lease liabilities | | 124,628 | | | 117,849 | | | 112,936 | |

| Current maturities of long-term debt | | 3,000 | | | 3,000 | | | 3,000 | |

| Total current liabilities | | 1,091,275 | | | 879,858 | | | 1,019,779 | |

| | | | | | |

| LONG-TERM DEBT, NET | | 483,617 | | | 484,551 | | | 583,729 | |

| LONG-TERM LEASE LIABILITIES | | 1,083,390 | | | 1,091,294 | | | 1,060,996 | |

| DEFERRED TAX LIABILITIES, NET | | 252,919 | | | 254,796 | | | 260,909 | |

| OTHER LONG-TERM LIABILITIES | | 10,763 | | | 11,564 | | | 11,964 | |

| Total liabilities | | 2,921,964 | | | 2,722,063 | | | 2,937,377 | |

| | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

STOCKHOLDERS' EQUITY : | | | | | | |

| Preferred stock, $0.01 par value, authorized 50,000,000 shares; none issued and outstanding | | — | | | — | | | — | |

| | | | | | |

| Common stock, $0.01 par value, authorized 300,000,000 shares; 70,915,916, 74,349,927, and 74,845,563 issued and outstanding as of August 3, 2024, February 3, 2024, and July 29, 2023, respectively. | | 709 | | | 743 | | | 748 | |

| Additional paid-in capital | | 244,584 | | | 242,098 | | | 236,789 | |

| Retained earnings | | 1,707,101 | | | 1,711,809 | | | 1,500,502 | |

| | | | | | |

| Stockholders' equity | | 1,952,394 | | | 1,954,650 | | | 1,738,039 | |

| Total liabilities and stockholders' equity | | $ | 4,874,358 | | | $ | 4,676,713 | | | $ | 4,675,416 | |

ACADEMY SPORTS AND OUTDOORS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Amounts in thousands)

| | | | | | | | | | | | | | |

| | Twenty-Six Weeks Ended |

| | August 3, 2024 | | July 29, 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| Net income | | $ | 219,053 | | | $ | 251,045 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 57,771 | | | 52,021 | |

| Non-cash lease expense | | 7,271 | | | 1,604 | |

| Equity compensation | | 14,093 | | | 19,883 | |

| Amortization of deferred loan and other costs | | 1,279 | | | 1,348 | |

| | | | |

| Deferred income taxes | | (1,876) | | | 1,866 | |

| Write off of deferred loan costs | | 449 | | | — | |

| Gain on disposal of property and equipment | | — | | | (361) | |

| | | | |

| | | | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable, net | | 6,559 | | | 1,878 | |

| Merchandise inventories, net | | (172,457) | | | (25,516) | |

| Prepaid expenses and other current assets | | (24,943) | | | (37,559) | |

| Other noncurrent assets | | (7,462) | | | (6,924) | |

| Accounts payable | | 153,613 | | | (12,446) | |

| Accrued expenses and other current liabilities | | 19,073 | | | (3,316) | |

| Income taxes payable | | 19,801 | | | 805 | |

| | | | |

| Other long-term liabilities | | (1,201) | | | (762) | |

| Net cash provided by operating activities | | 291,023 | | | 243,566 | |

| | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | |

| Capital expenditures | | (73,425) | | | (109,759) | |

| Purchases of intangible assets | | (314) | | | (213) | |

| Proceeds from the sale of property and equipment | | — | | | 2,126 | |

| | | | |

| Net cash used in investing activities | | (73,739) | | | (107,846) | |

| | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from Revolving Credit Facilities | | 3,900 | | | — | |

| Repayment of Revolving Credit Facilities | | (3,900) | | | — | |

| Repayment of Term Loan | | (1,500) | | | (1,500) | |

| Debt issuance fees | | (5,690) | | | — | |

| | | | |

| | | | |

| | | | |

| Repurchase of common stock for retirement | | (220,325) | | | (156,447) | |

| Proceeds from exercise of stock options | | 3,575 | | | 11,639 | |

| Proceeds from issuance of common stock under employee stock purchase program | | 2,819 | | | 2,887 | |

| Taxes paid related to net share settlement of equity awards | | (3,412) | | | (4,283) | |

| | | | |

| Dividends paid | | (16,103) | | | (13,825) | |

| Net cash used in financing activities | | (240,636) | | | (161,529) | |

| | | | |

| NET DECREASE IN CASH AND CASH EQUIVALENTS | | (23,352) | | | (25,809) | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | | 347,920 | | | 337,145 | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | | $ | 324,568 | | | $ | 311,336 | |

ACADEMY SPORTS AND OUTDOORS, INC.

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Unaudited)

Adjusted EBITDA and Adjusted EBIT

We define “Adjusted EBITDA” as net income (loss) before interest expense, net, income tax expense and depreciation, amortization, and impairment, and other adjustments included in the table below. We define “Adjusted EBIT” as Adjusted EBITDA less depreciation and amortization. We describe these adjustments reconciling net income (loss) to Adjusted EBITDA and Adjusted EBIT in the following table (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Thirteen Weeks Ended | | Twenty-Six Weeks Ended |

| | | | | August 3, 2024 | | July 29, 2023 | | August 3, 2024 | | July 29, 2023 |

| Net income | | | | | $ | 142,588 | | | $ | 157,075 | | | $ | 219,053 | | | $ | 251,045 | |

| Interest expense, net | | | | | 9,071 | | | 11,313 | | | 18,557 | | | 22,543 | |

| Income tax expense | | | | | 43,958 | | | 46,198 | | | 65,145 | | | 70,907 | |

| Depreciation and amortization | | | | | 28,918 | | | 25,760 | | | 57,771 | | | 52,021 | |

| Equity compensation (a) | | | | | 7,955 | | | 8,501 | | | 14,093 | | | 19,883 | |

| Write off of deferred loan costs | | | | | — | | | — | | | 449 | | | — | |

| | | | | | | | | | | |

| Adjusted EBITDA | | | | | $ | 232,490 | | | $ | 248,847 | | | $ | 375,068 | | | $ | 416,399 | |

| Less: Depreciation and amortization | | | | | (28,918) | | | (25,760) | | | (57,771) | | | (52,021) | |

| Adjusted EBIT | | | | | $ | 203,572 | | | $ | 223,087 | | | $ | 317,297 | | | $ | 364,378 | |

| | | | | | | | | | | | |

| (a) Represents non-cash charges related to equity-based compensation, which vary from period to period depending on certain factors such as timing and valuation of awards, achievement of performance targets and equity award forfeitures. |

Adjusted Net Income and Adjusted Earnings Per Common Share

We define “Adjusted Net Income” as net income (loss) plus other adjustments included in the table below, less the tax effect of these adjustments. We define “Adjusted Earnings per Common Share, Basic” as Adjusted Net Income divided by the basic weighted average common shares outstanding during the period and “Adjusted Earnings per Common Share, Diluted” as Adjusted Net Income divided by the diluted weighted average common shares outstanding during the period. We describe these adjustments reconciling net income (loss) to Adjusted Net Income, and Adjusted Earnings Per Common Share in the following table (amounts in thousands, except per share data):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Thirteen Weeks Ended | | Twenty-Six Weeks Ended |

| | | | | | | August 3, 2024 | | July 29, 2023 | | August 3, 2024 | | July 29, 2023 |

| Net income | | | | | | $ | 142,588 | | | $ | 157,075 | | | $ | 219,053 | | | $ | 251,045 | |

| Equity compensation (a) | | | | | | 7,955 | | | 8,501 | | | 14,093 | | | 19,883 | |

| Write off of deferred loan costs | | | | | | — | | | — | | | 449 | | | — | |

| Tax effects of these adjustments (b) | | | | | | (1,901) | | | (2,008) | | | (3,333) | | | (4,378) | |

| Adjusted Net Income | | | | | | $ | 148,642 | | | $ | 163,568 | | | $ | 230,262 | | | $ | 266,550 | |

| | | | | | | | | | | | | |

| Earnings per common share: | | | | | | | | | | | | |

| Basic | | | | | | $ | 1.99 | | | $ | 2.06 | | | $ | 3.00 | | | $ | 3.28 | |

| Diluted | | | | | | $ | 1.95 | | | $ | 2.01 | | | $ | 2.93 | | | $ | 3.19 | |

| Adjusted earnings per common share: | | | | | | | | | | | | |

| Basic | | | | | | $ | 2.07 | | | $ | 2.15 | | | $ | 3.16 | | | $ | 3.49 | |

| Diluted | | | | | | $ | 2.03 | | | $ | 2.09 | | | $ | 3.08 | | | $ | 3.39 | |

| Weighted average common shares outstanding: | | | | | | | | | | | | |

| Basic | | | | | | 71,829 | | | 76,104 | | | 72,911 | | | 76,483 | |

| Diluted | | | | | | 73,289 | | | 78,091 | | | 74,651 | | | 78,735 | |

| | | | | | | | | | | | | |

| |

| |

| (a) Represents non-cash charges related to equity-based compensation, which vary from period to period depending on certain factors such as timing and valuation of awards, achievement of performance targets and equity award forfeitures. |

(b) For the thirteen and twenty-six weeks ended August 3, 2024 and July 29, 2023, this represents the estimated tax effect (by using the projected full year tax rates for the respective years) of the total adjustments made to arrive at Adjusted Net Income. |

Adjusted Net Income and Adjusted Earnings Per Common Share, Diluted, Guidance Reconciliation (amounts in millions, except per share data)

| | | | | | | | | | | | | | |

| | Low Range* | | High Range* |

| Fiscal Year Ending

February 1, 2025 | | Fiscal Year Ending

February 1, 2025 |

| Net Income | $ | 400.0 | | | $ | 460.0 | |

Equity compensation (a) | 27.0 | | | $ | 27.0 | |

Tax effects of these adjustments (a) | (7.0) | | | $ | (7.0) | |

| Adjusted Net Income | 420.0 | | | $ | 480.0 | |

| | | | |

| Earnings Per Common Share, Diluted | $ | 5.45 | | | $ | 6.20 | |

Equity compensation (a) | 0.40 | | | 0.40 |

Tax effects of these adjustments (a) | (0.10) | | | (0.10) | |

| Adjusted Earnings Per Common Share, Diluted | $ | 5.75 | | | $ | 6.50 | |

| | | | |

| | | | |

| * | Amounts presented have been rounded. | | | |

| (a) | Adjustments include non-cash charges related to equity-based compensation (as defined above), which may vary from period to period. The tax effect of these adjustments is determined by using the projected full year tax rate for the fiscal year. |

Adjusted Free Cash Flow

We define “Adjusted Free Cash Flow” as net cash provided by (used in) operating activities less net cash used in investing activities. We describe these adjustments reconciling net cash provided by operating activities to Adjusted Free Cash Flow in the following table (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Thirteen Weeks Ended | | Twenty-Six Weeks Ended |

| | | | | | August 3, 2024 | | July 29, 2023 | | August 3, 2024 | | July 29, 2023 |

| Net cash provided by operating activities | | | | | | $ | 91,346 | | | $ | 191,431 | | | $ | 291,023 | | | $ | 243,566 | |

| Net cash used in investing activities | | | | | | (41,384) | | | (67,299) | | | (73,739) | | | (107,846) | |

| Adjusted Free Cash Flow | | | | | | $ | 49,962 | | | $ | 124,132 | | | $ | 217,284 | | | $ | 135,720 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

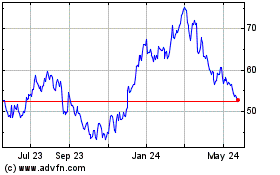

Academy Sports and Outdo... (NASDAQ:ASO)

Historical Stock Chart

From Nov 2024 to Dec 2024

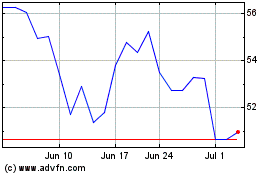

Academy Sports and Outdo... (NASDAQ:ASO)

Historical Stock Chart

From Dec 2023 to Dec 2024