false000160446400016044642025-03-072025-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 07, 2025 |

Atara Biotherapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36548 |

46-0920988 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1280 Rancho Conejo Blvd |

|

Thousand Oaks, California |

|

91320 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (805) 623-4211 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

ATRA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 7, 2025, the Company announced certain financial results for the fourth quarter and year ended December 31, 2024. A copy of the Company’s press release, titled “Atara Biotherapeutics Announces Fourth Quarter and Full Year 2024 Financial Results and Operational Progress” is furnished as Exhibit 99.1 hereto.

The information set forth in this Item 2.02 and in the press release included as Exhibit 99.1 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of Section 11 and 12(a)(2) of the Securities Act of 1933, as amended, and shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ATARA BIOTHERAPEUTICS, INC. |

|

|

|

|

Date: |

March 7, 2025 |

By: |

/s/ Eric Hyllengren |

|

|

|

Eric Hyllengren

Chief Financial Officer and Chief Operating Officer

(Duly Authorized Officer and Principal Financial and Accounting Officer) |

Atara Biotherapeutics Announces Fourth Quarter and Full Year 2024 Financial Results and Operational Progress

Atara is working closely with its partners and the FDA to lift clinical hold and support EBVALLO BLA resubmission in the U.S.

Atara remains focused on delivering on the future financial value of EBVALLO and has paused ATA3219 and ATA3431 CAR-T programs and implemented a workforce reduction of approximately 50% to preserve resources

Strategic review by financial advisor ongoing

THOUSAND OAKS, Calif.—March 7, 2025—Atara Biotherapeutics, Inc. (Nasdaq: ATRA), a leader in T-cell immunotherapy, leveraging its novel allogeneic Epstein-Barr virus (EBV) T-cell platform to develop transformative therapies for patients with cancer and autoimmune diseases, today reported financial results for the fourth quarter and full year 2024, business updates, and key upcoming milestones for 2025.

“We will further narrow our focus on the future financial value of EBVALLO for the benefit of all stakeholders. Atara continues to productively engage with our partner Pierre Fabre Laboratories and the FDA to help the third-party manufacturer adequately address the GMP compliance issues as we continue to work toward an expeditious path to release the clinical hold and resubmit the EBVALLO BLA,” said Cokey Nguyen, President and Chief Executive Officer of Atara. “With the focus on future EBVALLO value paramount, the Company has made the difficult decision to pause development of its allogeneic CAR-T cell programs and to discontinue all CAR-T operations including terminating the clinical trials evaluating ATA3219. The Company’s strategic review is ongoing.”

“I would like to convey our gratitude to the patients, investigators, and collaborators for their participation in our CAR-T development efforts. Through this work, we have made important progress and advanced an innovative allogeneic CAR-T platform to the clinical stage, which will serve the scientific community well with key learnings as the field progresses. I also wish to sincerely thank the Atara team members who worked tirelessly on this program, and our stockholders for their commitment to our Company,” added Dr. Nguyen.

Tabelecleucel (tab-cel® or EbvalloTM) for Post-Transplant Lymphoproliferative Disease (PTLD)

●In January 2025, the U.S. Food and Drug Administration (FDA) issued a Complete Response Letter (CRL) for the Biologics License Application (BLA) for EBVALLO as monotherapy treatment for adult and pediatric patients two years of age and older with Epstein-Barr virus positive post-transplant lymphoproliferative disease (EBV+ PTLD), who have received at least one prior therapy including an anti-CD20 containing regimen

●The CRL only cited findings that arose during a pre-license inspection of a third-party manufacturing facility for EBVALLO; it did not identify any deficiencies related to the manufacturing process, the clinical efficacy, or clinical safety data

●Atara received a clinical hold notice from FDA on EBVALLO studies linked to the CRL in January 2025

●Atara is currently undertaking efforts to support the third-party manufacturer in addressing the FDA’s requests in order to lift the hold and support BLA resubmission; the Company anticipates providing a regulatory update in the second quarter of 2025

●A second third-party manufacturer, FUJIFILM Diosynth Biotechnologies (FDB), has been approved to manufacture EBVALLO by the European Medicines Agency (EMA), and is positioned to play a primary role in ensuring reliable supply for the U.S. market over the long term following FDA approval

●Atara remains eligible for significant milestone payments from Pierre Fabre upon FDA approval of the EBVALLO BLA and related commercial sales of EBVALLO, as well as significant royalties as a percentage of net sales

ATA3219: Paused CD19 Program in Non-Hodgkin’s Lymphoma (NHL)

•First patient successfully completed dosing in the Phase I dose escalation study, evaluating the safety and efficacy of ATA3219

•The Phase 1 study was a multi-center, open label dose escalation trial aimed at treating patients with NHL. The study and associated clinical operations are being discontinued

•The administration of two infusions of ATA3219 was well tolerated with no evidence of graft versus host disease or other safety events. B-cell depletion was observed up to 28 days after initial treatment with levels of key pro-inflammatory cytokines—IFN-γ, IL-8, MCP-1, and IL-18— peaking by Day 7 with no detection of IL-6

Corporate Updates

Strategic Option Evaluation: As previously communicated, Atara engaged a well known financial advisor to support a comprehensive process to explore and assess a range of potential strategic options for the Company. Alternatives may include, but are not limited to, an acquisition, merger, reverse merger, other business combinations, sale of assets, or other strategic transactions. This process is ongoing. It is possible that Atara may not pursue a strategic alternative or transaction or that any strategic alternative or transaction, if pursued, will not be completed on attractive terms, or that a strategic alternative or transaction, may not ultimately be consummated.

Organizational Restructuring: Atara has implemented a strategic restructuring to sharpen the Company’s focus on addressing the issues at a third party manufacturing facility outlined in the CRL, lifting the clinical hold, and resubmitting the EBVALLO BLA. This restructuring resulted in a company-wide workforce reduction of approximately 50% of our remaining workforce, retaining approximately 35 personnel essential to execute on its remaining transition responsibilities under the EBVALLO collaboration with Pierre Fabre Laboratories, including as the BLA holder until approval, and certain wind-down activities for the CAR-T programs.

EBVALLO Transition Activities: Atara is in active discussions with Pierre Fabre on accelerating the transfer of all operational activities related to EBVALLO, except the BLA sponsorship, to be completed as early as the end of the first quarter of 2025.

Financial Update: As previously announced, Atara has entered into a non-binding term sheet with Redmile Group to provide up to $15 million in funding through an equity line of credit, which Atara believes is sufficient to fund the ongoing activities required to achieve BLA approval, assuming a successful transition of operational activities related to EBVALLO to Pierre Fabre. Atara is also exploring alternative financing options.

Fourth Quarter and Full Year 2024 Financial Results

●Cash, cash equivalents and short-term investments as of December 31, 2024 totaled $42.5 million, as compared to $51.7 million as of December 31, 2023

●Net cash used in operating activities was $24.5 million and $68.7 million for the fourth quarter and fiscal year 2024, as compared to $50.4 million and $193.0 million in the same periods in 2023

●Atara reported net losses of $12.7 million, or $1.19 per share, and $85.4 million, or $11.41 per share, for the fourth quarter and fiscal year 2024, respectively, as compared to $60.5 million, or $14.00 per share, and $276.1 million, or $65.19 per share, for the same periods in 2023

●Total costs and operating expenses include non-cash stock-based compensation, depreciation and amortization expenses of $6.9 million and $32.1 million for the fourth quarter and fiscal year 2024, respectively, as compared to $11.1 million and $50.2 million for the same periods in 2023

●Total costs and operating expenses include restructuring expense of $0.0 million and $5.1 million for the fourth quarter and fiscal year 2024 related to the reduction in force Atara announced in

January 2024 and which reduced its headcount at that time by approximately 25%. This reduction in force was substantially completed in March 2024. In the comparative periods, total costs and operating expenses include restructuring expense of $6.7 million for the fourth quarter and fiscal year 2023 related to the reduction in force Atara announced in November 2023 and which reduced its headcount at that time by approximately 30%. This reduction in force was substantially completed in December 2023.

●Research and development expenses were $28.3 million and $151.5 million for the fourth quarter and fiscal year 2024, respectively, as compared to $49.6 million and $224.8 million for the same periods in 2023

○Research and development expenses include $2.6 million and $13.5 million of non-cash stock-based compensation expenses for the fourth quarter and fiscal year 2024, respectively, as compared to $5.8 million and $26.5 million for the same periods in 2023

●General and administrative expenses were $9.4 million and $39.9 million for the fourth quarter and fiscal year 2024, respectively, as compared to $11.5 million and $50.9 million for the same periods in 2023

○General and administrative expenses include $3.3 million and $13.5 million of non-cash stock-based compensation expenses for the fourth quarter and fiscal year 2024, respectively, as compared to $4.1 million and $18.9 million for the same periods in 2023

About Atara Biotherapeutics, Inc.

Atara is harnessing the natural power of the immune system to develop off-the-shelf cell therapies for difficult-to-treat cancers and autoimmune conditions that can be rapidly delivered to patients from inventory. With cutting-edge science and differentiated approach, Atara is the first company in the world to receive regulatory approval of an allogeneic T-cell immunotherapy. Our advanced and versatile T-cell platform does not require T-cell receptor or HLA gene editing and forms the basis of a diverse portfolio of investigational therapies that target EBV, the root cause of certain diseases. Atara is headquartered in Southern California. For more information, visit atarabio.com and follow @Atarabio on X and LinkedIn.

Forward-Looking Statements

This press release contains or may imply "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. For example, forward-looking statements include statements regarding: (1) the development, timing and progress of tab-cel®, including the anticipated resubmission of the BLA to the FDA and lift of the FDA’s clinical hold, and the potential financial benefits to Atara as a result of the expanded global partnership with Pierre Fabre Laboratories, including any payments thereunder; (2) Atara’s cash runway, receipt of potential milestone payments, and operating expenses, including Atara’s ability to fund its planned operations; and (3) Atara’s fund raising needs and the sufficiency of additional funding to support operations, and the availability of such funding, including the amount of funding necessary to fund ongoing activities required to achieve BLA approval; (4) Atara’s planned transition of substantially all activities relating to EBVALLO to Pierre Fabre and the timing thereof; (5) Atara’s planned cost reduction strategies; and (6) Atara’s exploration of strategic alternatives and ability to consummate one or more strategic transactions. Because such statements deal with future events and are based on Atara’s current expectations, they are subject to various risks and uncertainties and actual results, performance or achievements of Atara could differ materially from those described in or implied by the statements in this press release. These forward-looking statements are subject to risks and uncertainties, including, without limitation, risks related with the timing of the transfer of all operational activities related to EBVALLO to Pierre Fabre, with any delay creating additional expenses and cash needs for Atara; uncertainties related to the ongoing discussions with Pierre Fabre, which, among other things, are expected to lead to a reduction in the amount of certain future potential regulatory and commercial milestone payments from Pierre Fabre; risks and uncertainties associated with the costly and time-consuming pharmaceutical product development process and the uncertainty of clinical success; risks related to FDA feedback and the ability of Atara and its third-party manufacturer to address issues identified in the CRL, our ability to access capital, and the sufficiency of Atara’s cash resources and access to additional capital on favorable terms or at all; risks and

uncertainties related to Atara’s financial close and audit procedures; the timing of the strategic review process; whether Atara will pursue any strategic alternatives; in the event Atara pursues a strategic alternative, that the strategic alternative may not be attractive or ultimately consummated; whether any strategic alternative will result in additional value for Atara and its stockholders; whether the process will have an adverse impact on Atara; and other risks and uncertainties affecting Atara, including those discussed in Atara’s filings with the Securities and Exchange Commission , including in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings and in the documents incorporated by reference therein. Except as otherwise required by law, Atara disclaims any intention or obligation to update or revise any forward-looking statements, which speak only as of the date hereof, whether as a result of new information, future events or circumstances or otherwise.

Financials

Atara Biotherapeutics, Inc.

Consolidated Balance Sheets

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

25,030 |

|

|

$ |

25,841 |

|

Short-term investments |

|

|

17,466 |

|

|

|

25,884 |

|

Restricted cash |

|

|

146 |

|

|

|

146 |

|

Accounts receivable |

|

|

1,482 |

|

|

|

34,108 |

|

Inventories |

|

|

10,655 |

|

|

|

9,706 |

|

Other current assets |

|

|

10,115 |

|

|

|

6,184 |

|

Total current assets |

|

|

64,894 |

|

|

|

101,869 |

|

Property and equipment, net |

|

|

1,294 |

|

|

|

3,856 |

|

Operating lease assets |

|

|

39,807 |

|

|

|

54,935 |

|

Other assets |

|

|

3,103 |

|

|

|

4,844 |

|

Total assets |

|

$ |

109,098 |

|

|

$ |

165,504 |

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity (deficit) |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,367 |

|

|

$ |

3,684 |

|

Accrued compensation |

|

|

6,589 |

|

|

|

11,519 |

|

Accrued research and development expenses |

|

|

7,984 |

|

|

|

17,364 |

|

Deferred revenue |

|

|

95,092 |

|

|

|

77,833 |

|

Other current liabilities |

|

|

20,542 |

|

|

|

31,826 |

|

Total current liabilities |

|

|

134,574 |

|

|

|

142,226 |

|

Deferred revenue - long-term |

|

|

— |

|

|

|

37,562 |

|

Operating lease liabilities - long-term |

|

|

29,914 |

|

|

|

45,693 |

|

Liability related to the sale of future revenues - long-term |

|

|

38,624 |

|

|

|

34,623 |

|

Other long-term liabilities |

|

|

3,269 |

|

|

|

4,631 |

|

Total liabilities |

|

$ |

206,381 |

|

|

$ |

264,735 |

|

|

|

|

|

|

|

|

|

|

Stockholders’ (deficit) equity: |

|

|

|

|

|

|

|

|

Common stock |

|

|

1 |

|

|

|

— |

|

Additional paid-in capital |

|

|

1,957,261 |

|

|

|

1,870,123 |

|

Accumulated other comprehensive loss |

|

|

8 |

|

|

|

(204 |

) |

Accumulated deficit |

|

|

(2,054,553 |

) |

|

|

(1,969,150 |

) |

Total stockholders’ (deficit) equity |

|

|

(97,283 |

) |

|

|

(99,231 |

) |

Total liabilities and stockholders’ (deficit) equity |

|

$ |

109,098 |

|

|

$ |

165,504 |

|

Atara Biotherapeutics, Inc.

Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Twelve Months Ended

December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Commercialization revenue |

|

$ |

32,753 |

|

|

$ |

4,189 |

|

|

$ |

128,940 |

|

|

$ |

7,886 |

|

|

License and collaboration revenue |

|

|

— |

|

|

|

63 |

|

|

|

— |

|

|

|

687 |

|

|

Total revenue |

|

|

32,753 |

|

|

|

4,252 |

|

|

|

128,940 |

|

|

|

8,573 |

|

|

Costs and operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of commercialization revenue |

|

|

6,795 |

|

|

|

3,160 |

|

|

|

21,009 |

|

|

|

8,886 |

|

|

Research and development expenses |

|

|

28,271 |

|

|

|

49,600 |

|

|

|

151,483 |

|

|

|

224,785 |

|

|

General and administrative expenses |

|

|

9,440 |

|

|

|

11,454 |

|

|

|

39,886 |

|

|

|

50,908 |

|

|

Total costs and operating expenses |

|

|

44,956 |

|

|

|

64,214 |

|

|

|

212,378 |

|

|

|

284,579 |

|

|

Loss from operations |

|

|

(12,203 |

) |

|

|

(59,962 |

) |

|

|

(83,438 |

) |

|

|

(276,006 |

) |

|

Interest and other income, net |

|

|

(509 |

) |

|

|

(477 |

) |

|

|

(1,977 |

) |

|

|

(105 |

) |

|

Total other income (expense), net |

|

|

(509 |

|

|

|

(477 |

) |

|

|

(1,977 |

) |

|

|

(105 |

) |

|

Loss before provision for income taxes |

|

|

(12,712 |

) |

|

|

(60,439 |

) |

|

|

(85,415 |

) |

|

|

(276,111 |

) |

|

Provision for income taxes |

|

|

(19 |

) |

|

|

11 |

|

|

|

(12 |

) |

|

|

15 |

|

|

Net loss |

|

$ |

(12,693 |

) |

|

$ |

(60,450 |

) |

|

$ |

(85,403 |

) |

|

$ |

(276,126 |

|

|

Other comprehensive gain (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on available-for-sale securities |

|

|

(14 |

) |

|

|

367 |

|

|

|

212 |

|

|

|

1,863 |

|

|

Comprehensive loss |

|

$ (12,707 |

) |

) |

$ (60,083 |

) |

|

$ (85,191 |

) |

|

$ (274,263 |

) |

) |

Basic and diluted net loss per common share |

|

$ |

(1.19 |

) |

|

$ |

(14.00 |

) |

|

$ |

(11.41 |

) |

|

$ |

(65.19 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted weighted-average shares outstanding |

|

|

10,690 |

|

|

|

4,325 |

|

|

|

7,488 |

|

|

|

4,236 |

|

|

Investor and Media Relations:

Jason Awe, Ph.D.

Head of Corporate Communications & Investor Relations

(805) 217-2287

jawe@atarabio.com

# # #

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

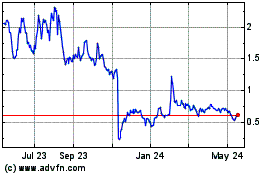

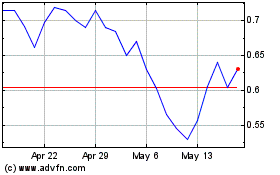

Atara Biotherapeutics (NASDAQ:ATRA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Atara Biotherapeutics (NASDAQ:ATRA)

Historical Stock Chart

From Mar 2024 to Mar 2025