Form SC14D9C - Written communication relating to third party tender offer

January 27 2025 - 4:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

(Rule 14d-101)

Solicitation/Recommendation Statement

Under Section 14(d)(4) of the Securities Exchange Act of 1934

ASPEN TECHNOLOGY, INC.

(Name of Subject Company)

ASPEN TECHNOLOGY, INC.

(Name of Persons Filing Statement)

Common stock, $0.0001 par value per share

(Title of Class of Securities)

29109X106

(CUSIP Number of Class of Securities)

Christopher A. Cooper

Senior Vice President, Chief Legal Officer and Secretary

20 Crosby Drive

Bedford, MA 01730

(781) 221-6400

(Name, address, and telephone numbers of person authorized to receive notices and communications

on behalf of the persons filing statement)

|

With copies to:

|

|

Graham Robinson

Chadé Severin

Skadden, Arps, Slate, Meagher & Flom LLP

500 Boylston Street, 23rd Floor

Boston, Massachusetts 02116

(617) 573-4800

|

|

☒

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

This Schedule 14D-9 filing relates solely to preliminary communications made before the commencement of a planned tender offer (the “Offer”) by Emersub CXV, Inc. (“Purchaser”), a Delaware corporation and a wholly owned subsidiary of Emerson

Electric Co. (“Parent”), for all of the outstanding shares of common stock, par value $0.0001 per share (the “Shares”) of Aspen Technology, Inc. (the “Company”) (other than the Shares owned by the Company, Purchaser or Emerson or any of their

respective subsidiaries), to be commenced pursuant to the Agreement and Plan of Merger, dated as of January 26, 2025, among the Company, Parent and Purchaser. If successful, the Offer will be followed by a merger of Purchaser with and into the

Company, with the Company surviving as a wholly owned subsidiary of Parent (the “Merger”).

This Schedule 14D-9 filing consists of the following documents relating to the proposed Offer and Merger:

|

|

Form of email distributed to employees

|

|

|

Form of letter sent to customers

|

|

|

Form of letter sent to business partners

|

Additional Information and Where to Find it

No tender offer for the shares of the Company has commenced at this time. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of the Company, nor is it a

substitute for the tender offer materials that Emerson will file with the U.S. Securities and Exchange Commission (the “SEC”) upon the commencement of the offer. A solicitation and offer to buy outstanding shares of the Company will only be made

pursuant to the tender offer materials that Emerson intends to file with the SEC. At the time the tender offer is commenced, Emerson will file tender offer materials on Schedule TO and the Company will file a Solicitation/Recommendation Statement on

Schedule 14D-9 and a transaction statement on Schedule 13E-3 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS), THE

SOLICITATION/RECOMMENDATION STATEMENT AND THE SCHEDULE 13E-3 WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE

(AND EACH AS IT MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS OF THE COMPANY SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES OF COMMON STOCK IN THE

TENDER OFFER. The tender offer materials (including the Offer to Purchase and the related Letter of Transmittal), the Solicitation/Recommendation Statement and the Schedule 13E-3 will be made available for free at the SEC’s website at www.sec.gov. In

addition, free copies of these materials (if and when they become available) will be made available by the Company by mail to Aspen Technology, Inc., 20 Crosby Dr., Bedford, MA 01730, Attn: Investor Relations, by email at IR@aspentech.com or on the

Company’s internet website at https://ir.aspentech.com.

Forward Looking Statements

This communication contains forward-looking statements related to the Company, Emerson and the proposed acquisition by Emerson of the outstanding shares of common stock of the Company that Emerson does not already own (the “Transaction”), which

involve substantial risks and uncertainties. Forward-looking statements include any statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “goal,” “may,” “might,” “plan,” “predict,” “project,” “seek,” “target,”

“potential,” “will,” “would,” “could,” “should,” “continue” and similar expressions.

Forward-looking statements reflect current beliefs and expectations; however, these statements involve inherent risks and uncertainties, including with respect to consummating the Transaction and any competing offers or acquisition proposals for

the Company, uncertainties as to how many of the Company’s stockholders will tender their stock in the tender offer, the effects of the Transaction (or the announcement thereof) on the Company’s stock price, relationships with key third parties or

governmental entities, transaction costs, risks that the Transaction disrupts current plans and operations or adversely affects employee retention, potentially diverting management’s attention from the Company’s ongoing business operations, changes

in the Company’s business during the period between announcement and closing of the Transaction, and any legal proceedings that may be instituted related to the Transaction. Actual results could differ materially due to various factors, risks and

uncertainties. Among other things, there can be no guarantee that the Transaction will be completed in the anticipated timeframe or at all, that the conditions required to complete the Transaction will be met, that any event, change or other

circumstance that could give rise to the termination of the definitive agreement for the Transaction will not occur or that Emerson will realize the expected benefits of the Transaction; and other risks listed under the heading “Risk Factors” in the

Company’s periodic reports filed with the SEC, including Current Reports on Form 8-K, Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, as well as the Schedule 14D-9 and Schedule 13E-3 that may be filed by the Company and the Schedule TO

and related tender offer documents that may be filed by Emerson. You should not place undue reliance on these statements. All forward-looking statements are based on information currently available to the Company, and the Company disclaims any

obligation to update the information contained in this communication as new information becomes available.

Exhibit 99.1

Agreement Between AspenTech and Emerson

Today, AspenTech and Emerson jointly announced an agreement under which Emerson will acquire all outstanding shares of common stock of AspenTech not already owned by Emerson. Upon the

closing of the transaction, AspenTech will become a wholly owned subsidiary of Emerson. The press release detailing this news can be found here.

This agreement was reached following a unanimous recommendation from the Special Committee of AspenTech’s board, which conducted a diligent and independent process to evaluate Emerson’s proposal from November 2024. This included extensive

discussions with Emerson and listening to feedback from our minority shareholders.

I am excited about this progression in our relationship with Emerson and believe this will position AspenTech as an even stronger partner for our customers as well as an employer of choice for top talent. This is a significant milestone in bringing

our two companies together. Emerson understands our business and the criticality of AspenTech’s proven software and recognizes the value of our unmatched domain expertise and continuous innovation, all of which have successfully positioned

AspenTech as an industrial software leader. We want to thank you all for your contributions and dedication in getting us here.

This agreement is subject to a non-waivable condition that requires at least a majority of the AspenTech common stock held by minority stockholders be tendered and not withdrawn. Until the transaction is completed, which we expect will occur in the

first half of calendar year 2025, we will remain separate companies and it will be business as usual.

Our Q2 All Employee call will be held on February 6 and we will review our Q2 results and focus for the second half of FY25. I am limited in what I am able to communicate regarding the AspenTech and Emerson agreement but will provide as much

information as possible, as the process moves forward.

It is likely that our customers and partners will have questions related to this announcement. As was advised in November, it is important to reassure our customers and partners that we

remain committed to our continued relationships and the execution of our innovation and strategic priorities. In this regard, on Tuesday January 28, we will issue letters to customers and partners updating them on the announcement. Separately, if

you receive any media inquiries, please pass their information on to Aimee Rhone in Corporate Communications.

Thank you for your hard work and continued commitment to AspenTech. The driving force behind our success has always been the passion and dedication of our people and what we have created together over the past 40+ years. It is the exceptional work

by everyone across the company that makes AspenTech the industrial software leader it is today.

Let’s stay focused on executing in the second half of FY25 and continuing to deliver value to our customers.

Antonio

Additional Information and Where to Find it

No tender offer for the shares of Aspen Technology, Inc. (the “Company”) has commenced at this time. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of the

Company, nor is it a substitute for the tender offer materials that Emerson Electric Co. (together with its applicable subsidiaries, “Emerson”) will file with the U.S. Securities and Exchange Commission (the “SEC”) upon the commencement of the

offer. A solicitation and offer to buy outstanding shares of the Company will only be made pursuant to the tender offer materials that Emerson intends to file with the SEC. At the time the tender offer is commenced, Emerson will file tender offer

materials on Schedule TO and the Company will file a Solicitation/Recommendation Statement on Schedule 14D-9 and a transaction statement on Schedule 13E-3 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER

TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS), THE SOLICITATION/RECOMMENDATION STATEMENT AND THE SCHEDULE 13E-3 WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO.

STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE (AND EACH AS IT MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS OF THE COMPANY

SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES OF COMMON STOCK IN THE TENDER OFFER.

The tender offer materials (including the Offer to Purchase and the related Letter of Transmittal), the Solicitation/Recommendation Statement and the Schedule 13E-3 will be made available for free at the SEC’s website at www.sec.gov. In addition,

free copies of these materials (if and when they become available) will be made available by the Company by mail to Aspen Technology, Inc., 20 Crosby Dr., Bedford, MA 01730, Attn: Investor Relations, by email at IR@aspentech.com or on the Company’s

internet website at https://ir.aspentech.com.

Forward Looking Statements

This communication contains forward-looking statements related to the Company, Emerson and the proposed acquisition by Emerson of the outstanding shares of common stock of the Company that Emerson does not already own (the “Transaction”), which

involve substantial risks and uncertainties. Forward-looking statements include any statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “goal,” “may,” “might,” “plan,” “predict,” “project,” “seek,” “target,”

“potential,” “will,” “would,” “could,” “should,” “continue” and similar expressions.

Forward-looking statements reflect current beliefs and expectations; however, these statements involve inherent risks and uncertainties, including with respect to consummating the Transaction and any competing offers or acquisition proposals for

the Company, uncertainties as to how many of the Company’s stockholders will tender their stock in the tender offer, the effects of the Transaction (or the announcement thereof) on the Company’s stock price, relationships with key third parties or

governmental entities, transaction costs, risks that the Transaction disrupts current plans and operations or adversely affects employee retention, potentially diverting management’s attention from the Company’s ongoing business operations, changes

in the Company’s business during the period between announcement and closing of the Transaction, and any legal proceedings that may be instituted related to the Transaction. Actual results could differ materially due to various factors, risks and

uncertainties. Among other things, there can be no guarantee that the Transaction will be completed in the anticipated timeframe or at all, that the conditions required to complete the Transaction will be met, that any event, change or other

circumstance that could give rise to the termination of the definitive agreement for the Transaction will not occur or that Emerson will realize the expected benefits of the Transaction; and other risks listed under the heading “Risk Factors” in

the Company’s periodic reports filed with the SEC, including Current Reports on Form 8-K, Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, as well as the Schedule 14D-9 and Schedule 13E-3 that may be filed by the Company and the

Schedule TO and related tender offer documents that may be filed by Emerson. You should not place undue reliance on these statements. All forward-looking statements are based on information currently available to the Company, and the Company

disclaims any obligation to update the information contained in this communication as new information becomes available.

Exhibit 99.2

Re: Agreement with Emerson to Acquire Remaining Outstanding Shares of AspenTech

Dear Valued Customer,

On January 27, 2025, AspenTech and Emerson jointly announced an agreement under which Emerson will acquire all outstanding shares of common stock of AspenTech not already owned by Emerson. Upon the closing of the

transaction, AspenTech will become a wholly owned subsidiary of Emerson. The joint press release can be found

here.

As we move through this process, I wanted to personally reach out to emphasize our continued commitment to you, as your valued partner. AspenTech has always been focused on helping our customers solve their most

complex challenges through the combination of domain expertise and innovation. I am excited about this progression in our long-standing relationship between AspenTech and Emerson, which will further enable us to help improve your performance,

resiliency, and sustainability.

Until the transaction closes, it is business as usual for AspenTech and your existing relationship with AspenTech will continue through your same points of contact.

As always, thank you for your ongoing partnership and the trust you place in AspenTech. We remain highly focused on ensuring each customer derives the utmost value from our solutions and look forward to continuing

our journey together.

Sincerely,

Antonio Pietri

President and CEO

Aspen Technology, Inc.

Additional Information and Where to Find it

No tender offer for the shares of Aspen Technology, Inc. (the “Company”) has commenced at this time. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of the

Company, nor is it a substitute for the tender offer materials that Emerson Electric Co. (together with its applicable subsidiaries, “Emerson”) will file with the U.S. Securities and Exchange Commission (the “SEC”) upon the commencement of the

offer. A solicitation and offer to buy outstanding shares of the Company will only be made pursuant to the tender offer materials that Emerson intends to file with the SEC. At the time the tender offer is commenced, Emerson will file tender offer

materials on Schedule TO and the Company will file a Solicitation/Recommendation Statement on Schedule 14D-9 and a transaction statement on Schedule 13E-3 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN

OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS), THE SOLICITATION/RECOMMENDATION STATEMENT AND THE SCHEDULE 13E-3 WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES

THERETO. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE (AND EACH AS IT MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS OF THE

COMPANY SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES OF COMMON STOCK IN THE TENDER OFFER. The tender offer materials (including the Offer to Purchase and the related Letter of Transmittal), the

Solicitation/Recommendation Statement and the Schedule 13E-3 will be made available for free at the SEC’s website at www.sec.gov. In addition, free copies of these materials (if and when they become available) will be made available by the Company

by mail to Aspen Technology, Inc., 20 Crosby Dr., Bedford, MA 01730, Attn: Investor Relations, by email at IR@aspentech.com or on the Company’s internet website at https://ir.aspentech.com.

Forward Looking Statements

This communication contains forward-looking statements related to the Company, Emerson and the proposed acquisition by Emerson of the outstanding shares of common stock of the Company that Emerson does not already own (the “Transaction”), which

involve substantial risks and uncertainties. Forward-looking statements include any statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “goal,” “may,” “might,” “plan,” “predict,” “project,” “seek,” “target,”

“potential,” “will,” “would,” “could,” “should,” “continue” and similar expressions.

Forward-looking statements reflect current beliefs and expectations; however, these statements involve inherent risks and uncertainties, including with respect to consummating the Transaction and any competing offers or acquisition proposals for

the Company, uncertainties as to how many of the Company’s stockholders will tender their stock in the tender offer, the effects of the Transaction (or the announcement thereof) on the Company’s stock price, relationships with key third parties or

governmental entities, transaction costs, risks that the Transaction disrupts current plans and operations or adversely affects employee retention, potentially diverting management’s attention from the Company’s ongoing business operations, changes

in the Company’s business during the period between announcement and closing of the Transaction, and any legal proceedings that may be instituted related to the Transaction. Actual results could differ materially due to various factors, risks and

uncertainties. Among other things, there can be no guarantee that the Transaction will be completed in the anticipated timeframe or at all, that the conditions required to complete the Transaction will be met, that any event, change or other

circumstance that could give rise to the termination of the definitive agreement for the Transaction will not occur or that Emerson will realize the expected benefits of the Transaction; and other risks listed under the heading “Risk Factors” in

the Company’s periodic reports filed with the SEC, including Current Reports on Form 8-K, Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, as well as the Schedule 14D-9 and Schedule 13E-3 that may be filed by the Company and the

Schedule TO and related tender offer documents that may be filed by Emerson. You should not place undue reliance on these statements. All forward-looking statements are based on information currently available to the Company, and the Company

disclaims any obligation to update the information contained in this communication as new information becomes available.

2

Exhibit 99.3

Re: Agreement with Emerson to Acquire Remaining Outstanding Shares of AspenTech

Dear Valued Partner,

On January 27, 2025, AspenTech and Emerson jointly announced an agreement under which Emerson will acquire all outstanding shares of common stock of AspenTech not already owned by Emerson. Upon the closing of the

transaction, AspenTech will become a wholly owned subsidiary of Emerson. The joint press release can be found

here.

As we move through this process, I wanted to personally reach out to emphasize our continued commitment to you, as your valued partner. AspenTech has always been focused on helping our customers solve their most

complex challenges through the combination of domain expertise and innovation. I am excited about this progression in our long-standing relationship between AspenTech and Emerson, which will further enable us to help improve the performance,

resiliency, and sustainability of asset-intensive industries.

As a valued partner, you play an essential role in delivering AspenTech software and solutions. We look forward to your continued impact in ensuring value realization for our customers.

Until the transaction closes, it is business as usual for AspenTech and our existing relationship will continue through your same points of contact.

As always, thank you for your ongoing partnership and the trust you place in AspenTech. We look forward to continuing our journey together and are excited for the possibilities that lie ahead.

Sincerely,

Antonio Pietri

President and CEO

Aspen Technology, Inc.

Additional Information and Where to Find it

No tender offer for the shares of Aspen Technology, Inc. (the “Company”) has commenced at this time. This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of the

Company, nor is it a substitute for the tender offer materials that Emerson Electric Co. (together with its applicable subsidiaries, “Emerson”) will file with the U.S. Securities and Exchange Commission (the “SEC”) upon the commencement of the

offer. A solicitation and offer to buy outstanding shares of the Company will only be made pursuant to the tender offer materials that Emerson intends to file with the SEC. At the time the tender offer is commenced, Emerson will file tender offer

materials on Schedule TO and the Company will file a Solicitation/Recommendation Statement on Schedule 14D-9 and a transaction statement on Schedule 13E-3 with the SEC with respect to the tender offer. THE TENDER OFFER MATERIALS (INCLUDING AN

OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS), THE SOLICITATION/RECOMMENDATION STATEMENT AND THE SCHEDULE 13E-3 WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES

THERETO. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE (AND EACH AS IT MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS OF THE

COMPANY SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES OF COMMON STOCK IN THE TENDER OFFER. The tender offer materials (including the Offer to Purchase and the related Letter of Transmittal), the

Solicitation/Recommendation Statement and the Schedule 13E-3 will be made available for free at the SEC’s website at www.sec.gov. In addition, free copies of these materials (if and when they become available) will be made available by the Company

by mail to Aspen Technology, Inc., 20 Crosby Dr., Bedford, MA 01730, Attn: Investor Relations, by email at IR@aspentech.com or on the Company’s internet website at https://ir.aspentech.com.

Forward Looking Statements

This communication contains forward-looking statements related to the Company, Emerson and the proposed acquisition by Emerson of the outstanding shares of common stock of the Company that Emerson does not already own (the “Transaction”), which

involve substantial risks and uncertainties. Forward-looking statements include any statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “goal,” “may,” “might,” “plan,” “predict,” “project,” “seek,” “target,”

“potential,” “will,” “would,” “could,” “should,” “continue” and similar expressions.

Forward-looking statements reflect current beliefs and expectations; however, these statements involve inherent risks and uncertainties, including with respect to consummating the Transaction and any competing offers or acquisition proposals for

the Company, uncertainties as to how many of the Company’s stockholders will tender their stock in the tender offer, the effects of the Transaction (or the announcement thereof) on the Company’s stock price, relationships with key third parties or

governmental entities, transaction costs, risks that the Transaction disrupts current plans and operations or adversely affects employee retention, potentially diverting management’s attention from the Company’s ongoing business operations, changes

in the Company’s business during the period between announcement and closing of the Transaction, and any legal proceedings that may be instituted related to the Transaction. Actual results could differ materially due to various factors, risks and

uncertainties. Among other things, there can be no guarantee that the Transaction will be completed in the anticipated timeframe or at all, that the conditions required to complete the Transaction will be met, that any event, change or other

circumstance that could give rise to the termination of the definitive agreement for the Transaction will not occur or that Emerson will realize the expected benefits of the Transaction; and other risks listed under the heading “Risk Factors” in

the Company’s periodic reports filed with the SEC, including Current Reports on Form 8-K, Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K, as well as the Schedule 14D-9 and Schedule 13E-3 that may be filed by the Company and the

Schedule TO and related tender offer documents that may be filed by Emerson. You should not place undue reliance on these statements. All forward-looking statements are based on information currently available to the Company, and the Company

disclaims any obligation to update the information contained in this communication as new information becomes available.

2

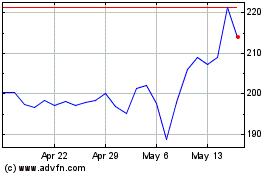

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Dec 2024 to Jan 2025

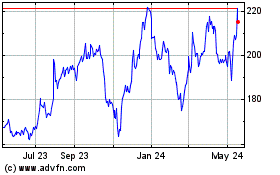

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Jan 2024 to Jan 2025