0001701605false00017016052024-10-222024-10-220001701605bkr:A5.125SeniorNotesDue2040OfBakerHughesHoldingsLLCAndBakerHughesCoObligorInc.Domain2024-10-222024-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 22, 2024

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 1-38143 | | 81-4403168 |

| (State of Incorporation) | | (Commission File No.) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

575 N. Dairy Ashford Rd., Suite 100 | |

| Houston, | Texas | 77079-1121 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 439-8600

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | BKR | The Nasdaq Stock Market LLC |

5.125% Senior Notes due 2040 of Baker Hughes Holdings LLC and Baker Hughes Co-Obligor, Inc. | BKR40 | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 22, 2024, Baker Hughes Company (the “Company”) issued a news release announcing its financial results for the quarter ended September 30, 2024, a copy of which is furnished with this Form 8-K as Exhibit 99.1 and incorporated herein by reference. In accordance with General Instructions B.2. of Form 8-K, the information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), except as shall be expressly set forth by specific reference in such a filing.

Following the issuance of the news release and the filing of this current report on Form 8-K, the Company will hold a conference call on Wednesday, October 23, 2024 at 9:30 a.m. Eastern Time, 8:30 a.m. Central Time, to discuss the earnings announcement. This scheduled conference call was previously announced on September 12, 2024. The conference call will broadcast live via a webcast that can be accessed by visiting the Company's website at: www.investors.bakerhughes.com. An archived version of the webcast will be available on the Company's website for one month following the webcast.

In addition to financial results determined in accordance with Generally Accepted Accounting Principles ("GAAP") that were included in the news release, certain information discussed in the news release and to be discussed on the conference call could be considered non-GAAP financial measures (as defined under the Securities and Exchange Commission's ("SEC") Regulation G). Any non-GAAP financial measures should be considered in addition to, and not as an alternative for, or superior to, net income (loss), operating income (loss), cash flows or other measures of financial performance prepared in accordance with GAAP as more fully discussed in the Company’s financial statements and filings with the SEC. Reconciliations of such non-GAAP information to the closest GAAP measures are included in the news release.

Item 7.01 Regulation FD Disclosure.

On October 22, 2024, the Company issued a news release, a copy of which is furnished with this Form 8-K as Exhibit 99.1 and incorporated into this Item 7.01 by reference. In accordance with General Instructions B.2. of Form 8-K, the information shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any filing under the Securities Act, except as shall be expressly set forth by specific reference in such a filing.

See Item 2.02, “Results of Operations and Financial Condition.”

Item 9.01 Financial Statements and Exhibits. (Information furnished in this Item 9.01 is furnished pursuant to Item 9.01.)

(d) Exhibits. | | | | | |

| |

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Page 2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | BAKER HUGHES COMPANY |

| | |

Dated: October 22, 2024 | | By: | | /s/ Fernando Contreras |

| | | | Fernando Contreras

Vice President, Legal Governance and Corporate Secretary |

Baker Hughes Company Announces Third-Quarter 2024 Results Third-quarter highlights

•Orders of $6.7 billion, including $2.9 billion of IET orders.

•RPO of $33.4 billion, including record IET RPO of $30.2 billion.

•Revenue of $6.9 billion, up 4% year-over-year.

•Attributable net income of $766 million.

•GAAP diluted EPS of $0.77 and adjusted diluted EPS* of $0.67.

•Adjusted EBITDA* of $1,208 million, up 23% year-over-year.

•Cash flows from operating activities of $1,010 million and free cash flow* of $754 million.

•Returns to shareholders of $361 million, including $152 million of share repurchases.

HOUSTON & LONDON (October 22, 2024) – Baker Hughes Company (Nasdaq: BKR) ("Baker Hughes" or the "Company") announced results today for the third quarter of 2024.

"We delivered another quarter of record EBITDA, highlighted by exceptional operational performance across both segments. Our margins continue to improve at an accelerated pace, with total company EBITDA margins increasing to 17.5%. This marks the highest margin quarter since the company was formed. On the back of our solid third-quarter results and stable outlook, we remain confident in achieving our full-year EBITDA guidance midpoint," said Lorenzo Simonelli, Baker Hughes Chairman and Chief Executive Officer.

"Orders remain at solid levels, with IET orders of $2.9 billion marking the eighth consecutive quarter at or above these levels. IET continued to demonstrate strong order momentum for gas infrastructure and FPSOs, booking the largest ever ICL compressor award from Dubai Petroleum Establishment for the Margham Gas storage facility and two FPSO awards with separate offshore operators."

"Overall, our segments continue to make strong progress on their journey toward 20% EBITDA margins, with both segments achieving high-teen margins during the quarter. Our operational discipline and rigor continue to gain traction."

"We are also benefiting from the life-cycle attributes of our service offerings and the breadth of our portfolio. With significant recurring IET service revenue, strong production-levered businesses, untapped market opportunities, and improved cost structure, we are becoming less cyclical and capable of generating more durable earnings and free cash flow across cycles."

"We are successfully executing our strategy, and this is a testament to the strength of our people and the culture we are building," concluded Simonelli.

* Non-GAAP measure. See reconciliations in the section titled "Reconciliation of GAAP to non-GAAP Financial Measures."

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Variance |

(in millions except per share amounts) | September 30, 2024 | June 30, 2024 | September 30, 2023 | | Sequential | Year-over-year |

| Orders | $ | 6,676 | | $ | 7,526 | | $ | 8,512 | | | (11 | %) | (22 | %) |

| Revenue | 6,908 | | 7,139 | | 6,641 | | | (3 | %) | 4 | % |

Net income attributable to Baker Hughes | 766 | | 579 | | 518 | | | 32 | % | 48 | % |

Adjusted net income attributable to Baker Hughes* | 666 | | 568 | | 427 | | | 17 | % | 56 | % |

Operating income | 930 | | 833 | | 714 | | | 12 | % | 30 | % |

Adjusted operating income* | 930 | | 847 | | 716 | | | 10 | % | 30 | % |

Adjusted EBITDA* | 1,208 | | 1,130 | | 983 | | | 7 | % | 23 | % |

| Diluted earnings per share (EPS) | 0.77 | | 0.58 | | 0.51 | | | 33 | % | 51 | % |

Adjusted diluted EPS* | 0.67 | | 0.57 | | 0.42 | | | 18 | % | 59 | % |

Cash flow from operating activities | 1,010 | | 348 | | 811 | | | F | 25 | % |

Free cash flow* | 754 | | 106 | | 592 | | | F | 27 | % |

* Non-GAAP measure. See reconciliations in the section titled "Reconciliation of GAAP to non-GAAP Financial Measures."

"F" is used when variance is above 100%. Additionally, "U" is used when variance is below (100)%.

Certain columns and rows in our tables and financial statements may not sum up due to the use of rounded numbers.

Quarter Highlights

Industrial & Energy Technology ("IET") experienced a strong quarter for its Integrated Compressor Line ("ICL") technology. In its largest ICL award to-date, and booked under Climate Technology Solutions ("CTS"), Baker Hughes will supply 10 units to Dubai Petroleum Establishment for the Margham Gas storage facility. These ICL units will support gas infrastructure, providing stability to Dubai's energy supply by strengthening the system's ability to switch between natural gas and solar power.

IET's Gas Technology Equipment ("GTE") was also awarded a significant contract to supply advanced compression solutions to Saipem for TotalEnergies' all-electric Kaminho Floating Production Storage and Offloading ("FPSO") project in Angola. Baker Hughes' centrifugal BCL compressor and ICL technology were selected because of the capability to minimize greenhouse emissions and eliminate routine flaring by reinjecting associated gas into the reservoir for storage. Separately, IET was selected to provide electric motor-driven process compressors for an FPSO project in Latin America.

IET's Gas Technology Services ("GTS") secured a multi-decade agreement for an LNG facility in the Middle East. The scope encompasses extensive maintenance services and digital solutions, leveraging Baker Hughes' iCenter™ Remote Monitoring and Diagnostics capabilities.

Oilfield Services & Equipment ("OFSE") strengthened the Company's relationship with Petrobras, receiving contracts to supply 43 miles of flexible pipe systems in Brazil's Santos Basin. A significant portion of these risers and flowlines will be manufactured in-country at Baker Hughes' Niteroi plant. The contracts, awarded through an open tender, include multi-year service agreements to support maintenance activities through the life of the project and demonstrate Baker Hughes' dedication to providing equipment and services critical to help Petrobras achieve its strategic plan to expand operations.

In OFSE, mature assets solutions ("MAS") delivered a strong order quarter, illustrating confidence in the Company's full range of workflows and solutions to accelerate production and total recovery. OFSE won a MAS award to supply Santos Energy's strategic and historic Cooper Basin Development in Australia with drilling fluids and wireline services, marking Baker Hughes' return to the basin. Additionally, OFSE signed a multi-year contract extension with a customer in the Middle East for completions and well intervention.

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

Baker Hughes saw increased adoption of Leucipa™, the Company's intelligent automated field production digital solution. A major global operator expanded the use of Leucipa across multiple fields in the Permian Basin, enabling the customer to optimize production through real-time field orchestration to generate lower-carbon, short-cycle barrels. Additionally, a new strategic collaboration was established early in the fourth quarter with Repsol, a major customer of Leucipa, to develop and deploy next-generation artificial intelligence capabilities for this digital solution. The companies will share knowledge and expertise to optimize and enhance production across Repsol's global portfolio while creating new commercial opportunities for Baker Hughes.

Baker Hughes continues to innovate new digital technologies to support customers on their decarbonization journey. The Company launched CarbonEdge™, powered by Cordant™, an end-to-end, risk-based digital solution that delivers precise, real-time data and alerts on carbon dioxide (CO2) flows across CCUS infrastructure from subsurface to surface. This solution enables operators to mitigate risk, improve decision-making, enhance operational efficiency, and simplify regulatory reporting across the entire project lifecycle.

Consolidated Revenue and Operating Income by Reporting Segment

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three Months Ended | | Variance |

| September 30, 2024 | June 30, 2024 | September 30, 2023 | | Sequential | Year-over-year |

| Oilfield Services & Equipment | $ | 3,963 | | $ | 4,011 | | $ | 3,951 | | | (1 | %) | — | % |

| Industrial & Energy Technology | 2,945 | | 3,128 | | 2,691 | | | (6 | %) | 9 | % |

Segment revenue | 6,908 | | 7,139 | | 6,641 | | | (3 | %) | 4 | % |

| | | | | | |

| Oilfield Services & Equipment | 547 | | 493 | | 465 | | | 11 | % | 18 | % |

| Industrial & Energy Technology | 474 | | 442 | | 346 | | | 7 | % | 37 | % |

| | | | | | |

Corporate (1) | (91) | | (88) | | (95) | | | (3 | %) | 4 | % |

| | | | | | |

| | | | | | |

| Restructuring, impairment & other | — | | (14) | | (2) | | | F | F |

Operating income | 930 | | 833 | | 714 | | | 12 | % | 30 | % |

Adjusted operating income* | 930 | | 847 | | 716 | | | 10 | % | 30 | % |

| Depreciation & amortization | 278 | | 283 | | 267 | | | (2 | %) | 4 | % |

| Adjusted EBITDA* | $ | 1,208 | | $ | 1,130 | | $ | 983 | | | 7 | % | 23 | % |

* Non-GAAP measure. See reconciliations in the section titled "Reconciliation of GAAP to non-GAAP Financial Measures."

"F" is used when variance is above 100%. Additionally, "U" is used when variance is below (100)%.

(1)Corporate costs are primarily reported in "Selling, general and administrative" in the condensed consolidated statements of income (loss).

Revenue for the quarter was $6,908 million, a decrease of 3% sequentially and an increase of 4% year-over-year. The increase in revenue year-over-year was driven by IET.

The Company's total book-to-bill ratio in the quarter was 1.0; the IET book-to-bill ratio in the quarter was also 1.0.

Operating income as determined in accordance with accounting principles generally accepted in the United States of America ("GAAP"), for the third quarter of 2024 was $930 million. Operating income increased $97 million sequentially and increased $216 million year-over-year.

Adjusted operating income (a non-GAAP financial measure) for the third quarter of 2024 was $930 million. There were no adjustments to operating income in the third quarter. A list of the adjusting items and associated reconciliation from GAAP has been provided in Table 1a in the section titled "Reconciliation of GAAP to non-GAAP Financial Measures." Adjusted operating income for the third quarter of 2024 was up 10% sequentially and up 30% year-over-year.

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

Depreciation and amortization for the third quarter of 2024 was $278 million.

Adjusted EBITDA (a non-GAAP financial measure) for the third quarter of 2024 was $1,208 million. There were no adjustments to EBITDA in the third quarter. See Table 1b in the section titled "Reconciliation of GAAP to non-GAAP Financial Measures." Adjusted EBITDA for the third quarter was up 7% sequentially and up 23% year-over-year.

The sequential increase in adjusted operating income and adjusted EBITDA was driven by higher pricing in both segments and structural cost-out initiatives, partially offset by lower volume in both segments. The year-over-year increase in adjusted operating income and adjusted EBITDA was driven by higher pricing in both segments, higher volume in IET, and structural cost-out initiatives, partially offset by cost inflation in IET and unfavorable business mix in both segments.

Other Financial Items

Remaining Performance Obligations ("RPO") in the third quarter ended at $33.4 billion, a decrease of $0.1 billion from the second quarter of 2024. OFSE RPO was $3.2 billion, down 5% sequentially, while IET RPO was $30.2 billion, up $44 million sequentially. Within IET RPO, GTE RPO was $11.9 billion and GTS RPO was $14.8 billion.

Income tax expense in the third quarter of 2024 was $235 million.

Other non-operating income in the third quarter of 2024 was $134 million. Included in other non-operating income were net mark-to-market gains in fair value for certain equity investments of $99 million.

GAAP diluted earnings per share was $0.77. Adjusted diluted earnings per share (a non-GAAP financial measure) was $0.67. Excluded from adjusted diluted earnings per share were all items listed in Table 1c in the section titled "Reconciliation of GAAP to non-GAAP Financial Measures."

Cash flow from operating activities was $1,010 million for the third quarter of 2024. Free cash flow (a non-GAAP financial measure) for the quarter was $754 million. A reconciliation from GAAP has been provided in Table 1d in the section titled "Reconciliation of GAAP to non-GAAP Financial Measures."

Capital expenditures, net of proceeds from disposal of assets, were $256 million for the third quarter of 2024, of which $182 million for OFSE and $62 million for IET.

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

Results by Reporting Segment

The following segment discussions and variance explanations are intended to reflect management's view of the relevant comparisons of financial results on a sequential or year-over-year basis, depending on the business dynamics of the reporting segments.

Oilfield Services & Equipment | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three Months Ended | | Variance |

| Segment results | September 30, 2024 | June 30, 2024 | September 30, 2023 | | Sequential | Year-over-year |

| Orders | $ | 3,807 | | $ | 4,068 | | $ | 4,178 | | | (6 | %) | (9 | %) |

| Revenue | $ | 3,963 | | $ | 4,011 | | $ | 3,951 | | | (1 | %) | — | % |

| Operating income | $ | 547 | | $ | 493 | | $ | 465 | | | 11 | % | 18 | % |

Operating margin | 13.8 | % | 12.3 | % | 11.8 | % | | 1.5pts | 2pts |

| Depreciation & amortization | $ | 218 | | $ | 223 | | $ | 206 | | | (2 | %) | 6 | % |

| EBITDA* | $ | 765 | | $ | 716 | | $ | 670 | | | 7 | % | 14 | % |

| EBITDA margin* | 19.3 | % | 17.8 | % | 17.0 | % | | 1.5pts | 2.3pts |

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three Months Ended | | Variance |

| Revenue by Product Line | September 30, 2024 | June 30, 2024 | September 30, 2023 | | Sequential | Year-over-year |

| Well Construction | $ | 1,050 | | $ | 1,090 | | $ | 1,128 | | | (4 | %) | (7 | %) |

| Completions, Intervention & Measurements | 1,009 | | 1,118 | | 1,085 | | | (10 | %) | (7 | %) |

| Production Solutions | 983 | | 958 | | 967 | | | 3 | % | 2 | % |

| Subsea & Surface Pressure Systems | 921 | | 845 | | 770 | | | 9 | % | 20 | % |

| Total Revenue | $ | 3,963 | | $ | 4,011 | | $ | 3,951 | | | (1 | %) | — | % |

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three Months Ended | | Variance |

| Revenue by Geographic Region | September 30, 2024 | June 30, 2024 | September 30, 2023 | | Sequential | Year-over-year |

| North America | $ | 971 | | $ | 1,023 | | $ | 1,064 | | | (5 | %) | (9 | %) |

| Latin America | 648 | | 663 | | 695 | | | (2 | %) | (7 | %) |

| Europe/CIS/Sub-Saharan Africa | 933 | | 827 | | 695 | | | 13 | % | 34 | % |

| Middle East/Asia | 1,411 | | 1,498 | | 1,497 | | | (6 | %) | (6 | %) |

| Total Revenue | $ | 3,963 | | $ | 4,011 | | $ | 3,951 | | | (1 | %) | — | % |

| | | | | | |

| North America | $ | 971 | | $ | 1,023 | | $ | 1,064 | | | (5 | %) | (9 | %) |

| International | 2,992 | | 2,988 | | 2,887 | | | — | % | 4 | % |

* Non-GAAP measure. See reconciliations in the section titled "Reconciliation of GAAP to non-GAAP Financial Measures." EBITDA margin is defined as EBITDA divided by revenue.

OFSE orders of $3,807 million for the third quarter decreased by $261 million sequentially. Subsea and Surface Pressure Systems orders were $776 million, down 13% sequentially, and down 23% year-over-year.

OFSE revenue of $3,963 million for the third quarter was down 1% sequentially, and up $12 million year-over-year.

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

North America revenue was $971 million, down 5% sequentially. International revenue was $2,992 million, an increase of $4 million sequentially, driven by growth in Europe/CIS/Sub-Saharan Africa regions partially offset by decline in Middle East/Asia.

Segment operating income for the third quarter was $547 million, an increase of $54 million, or 11%, sequentially. Segment EBITDA for the third quarter was $765 million, an increase of $49 million, or 7% sequentially. The sequential increase in segment operating income and EBITDA was driven by positive price and productivity, partially offset by pressure from negative business mix and lower volume.

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

Industrial & Energy Technology | | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three Months Ended | | Variance |

| Segment results | September 30, 2024 | June 30, 2024 | September 30, 2023 | | Sequential | Year-over-year |

| Orders | $ | 2,868 | | $ | 3,458 | | $ | 4,334 | | | (17 | %) | (34 | %) |

| Revenue | $ | 2,945 | | $ | 3,128 | | $ | 2,691 | | | (6 | %) | 9 | % |

| Operating income | $ | 474 | | $ | 442 | | $ | 346 | | | 7 | % | 37 | % |

Operating margin | 16.1 | % | 14.1 | % | 12.9 | % | | 2pts | 3.2pts |

| Depreciation & amortization | $ | 54 | | $ | 55 | | $ | 57 | | | (2 | %) | (6 | %) |

| EBITDA* | $ | 528 | | $ | 497 | | $ | 403 | | | 6 | % | 31 | % |

| EBITDA margin* | 17.9 | % | 15.9 | % | 15.0 | % | | 2pts | 2.9pts |

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three Months Ended | | Variance |

| Orders by Product Line | September 30, 2024 | June 30, 2024 | September 30, 2023 | | Sequential | Year-over-year |

Gas Technology Equipment | $ | 1,088 | | $ | 1,493 | | $ | 2,813 | | | (27 | %) | (61 | %) |

Gas Technology Services | 778 | | 769 | | 724 | | | 1 | % | 7 | % |

| Total Gas Technology | 1,866 | | 2,261 | | 3,537 | | | (17 | %) | (47 | %) |

Industrial Products | 494 | | 524 | | 477 | | | (6 | %) | 4 | % |

| Industrial Solutions | 293 | | 281 | | 271 | | | 4 | % | 8 | % |

| | | | | | |

| Total Industrial Technology | 787 | | 805 | | 748 | | | (2 | %) | 5 | % |

Climate Technology Solutions | 215 | | 392 | | 49 | | | (45 | %) | F |

| Total Orders | $ | 2,868 | | $ | 3,458 | | $ | 4,334 | | | (17 | %) | (34 | %) |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| (in millions) | Three Months Ended | | Variance |

| Revenue by Product Line | September 30, 2024 | June 30, 2024 | September 30, 2023 | | Sequential | Year-over-year |

Gas Technology Equipment | $ | 1,281 | | $ | 1,539 | | $ | 1,227 | | | (17 | %) | 4 | % |

Gas Technology Services | 697 | | 691 | | 637 | | | 1 | % | 9 | % |

| Total Gas Technology | 1,978 | | 2,230 | | 1,865 | | | (11 | %) | 6 | % |

Industrial Products | 520 | | 509 | | 520 | | | 2 | % | — | % |

| Industrial Solutions | 257 | | 262 | | 243 | | | (2 | %) | 6 | % |

| | | | | | |

| Total Industrial Technology | 777 | | 770 | | 763 | | | 1 | % | 2 | % |

Climate Technology Solutions | 191 | | 128 | | 63 | | | 49 | % | F |

| Total Revenue | $ | 2,945 | | $ | 3,128 | | $ | 2,691 | | | (6 | %) | 9 | % |

* Non-GAAP measure. See reconciliations in the section titled "Reconciliation of GAAP to non-GAAP Financial Measures." EBITDA margin is defined as EBITDA divided by revenue.

"F" is used when variance is above 100%. Additionally, "U" is used when variance is below (100)%.

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

IET orders of $2,868 million for the third quarter decreased by $1,465 million, or 34% year-over-year. The decrease was driven primarily by GTE orders which were down $1,725 million or 61% year-over-year.

IET revenue of $2,945 million for the quarter increased $254 million, or 9% year-over-year. The increase was driven primarily by Climate Technology Solutions, up favorably year-over-year, and by Gas Technology, up 6% year-over-year.

Segment operating income for the quarter was $474 million, up 37% year-over-year. Segment EBITDA for the quarter was $528 million, up $125 million, or 31% year-over-year. The year-over-year increase in segment operating income and EBITDA was primarily driven by higher volume, pricing and productivity, partially offset by cost inflation.

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

Reconciliation of GAAP to non-GAAP Financial Measures

Management provides non-GAAP financial measures because it believes such measures are widely accepted financial indicators used by investors and analysts to analyze and compare companies on the basis of operating performance (including adjusted operating income; EBITDA; EBITDA margin; adjusted EBITDA; adjusted net income attributable to Baker Hughes; and adjusted diluted earnings per share) and liquidity (free cash flow) and that these measures may be used by investors to make informed investment decisions. Management believes that the exclusion of certain identified items from several key operating performance measures enables us to evaluate our operations more effectively, to identify underlying trends in the business, and to establish operational goals for certain management compensation purposes. Management also believes that free cash flow is an important supplemental measure of our cash performance but should not be considered as a measure of residual cash flow available for discretionary purposes, or as an alternative to cash flow from operating activities presented in accordance with GAAP.

Table 1a. Reconciliation of GAAP and Adjusted Operating Income

| | | | | | | | | | | |

| Three Months Ended |

| (in millions) | September 30, 2024 | June 30, 2024 | September 30, 2023 |

Operating income (GAAP) | $ | 930 | | $ | 833 | | $ | 714 | |

| | | |

| Restructuring, impairment & other | — | | 14 | | 2 | |

| | | |

| Total operating income adjustments | — | | 14 | | 2 | |

Adjusted operating income (non-GAAP) | $ | 930 | | $ | 847 | | $ | 716 | |

Table 1a reconciles operating income, which is the directly comparable financial result determined in accordance with GAAP, to adjusted operating income. Adjusted operating income excludes the impact of certain identified items.

Table 1b. Reconciliation of Net Income Attributable to Baker Hughes to EBITDA and Adjusted EBITDA

| | | | | | | | | | | |

| Three Months Ended |

| (in millions) | September 30, 2024 | June 30, 2024 | September 30, 2023 |

Net income attributable to Baker Hughes (GAAP) | $ | 766 | | $ | 579 | | $ | 518 | |

| Net income attributable to noncontrolling interests | 8 | | 2 | | 6 | |

| Provision for income taxes | 235 | | 243 | | 235 | |

| Interest expense, net | 55 | | 47 | | 49 | |

Other non-operating income, net | (134) | | (38) | | (94) | |

Operating income (GAAP) | 930 | | 833 | | 714 | |

| | | |

| Depreciation & amortization | 278 | | 283 | | 267 | |

| EBITDA (non-GAAP) | 1,208 | | 1,116 | | 981 | |

Total operating income adjustments (1) | — | | 14 | | 2 | |

| Adjusted EBITDA (non-GAAP) | $ | 1,208 | | $ | 1,130 | | $ | 983 | |

(1)See Table 1a for the identified adjustments to operating income.

Table 1b reconciles net income attributable to Baker Hughes, which is the directly comparable financial result determined in accordance with GAAP, to EBITDA. Adjusted EBITDA excludes the impact of certain identified items.

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

Table 1c. Reconciliation of Net Income Attributable to Baker Hughes to Adjusted Net Income Attributable to Baker Hughes | | | | | | | | | | | |

| Three Months Ended |

| (in millions, except per share amounts) | September 30, 2024 | June 30, 2024 | September 30, 2023 |

Net income attributable to Baker Hughes (GAAP) | $ | 766 | | $ | 579 | | $ | 518 | |

Total operating income adjustments (1) | — | | 14 | | 2 | |

Other adjustments (non-operating) (2) | (99) | | (19) | | (95) | |

Tax adjustments (3) | (1) | | (6) | | 2 | |

| Total adjustments, net of income tax | (100) | | (11) | | (91) | |

| Less: adjustments attributable to noncontrolling interests | — | | — | | — | |

| Adjustments attributable to Baker Hughes | (100) | | (11) | | (91) | |

| Adjusted net income attributable to Baker Hughes (non-GAAP) | $ | 666 | | $ | 568 | | $ | 427 | |

| | | |

| | | |

| Denominator: | | | |

| Weighted-average shares of Class A common stock outstanding diluted | 999 | | 1,001 | | 1,017 | |

Adjusted earnings per share - diluted (non-GAAP) | $ | 0.67 | | $ | 0.57 | | $ | 0.42 | |

(1)See Table 1a for the identified adjustments to operating income.

(2)All periods primarily reflect the net gain or loss on changes in fair value for certain equity investments.

(3)All periods reflect the tax associated with the other operating and non-operating adjustments.

Table 1c reconciles net income attributable to Baker Hughes, which is the directly comparable financial result determined in accordance with GAAP, to adjusted net income attributable to Baker Hughes. Adjusted net income attributable to Baker Hughes excludes the impact of certain identified items.

Table 1d. Reconciliation of Net Cash Flows From Operating Activities to Free Cash Flow | | | | | | | | | | | |

| Three Months Ended |

| (in millions) | September 30, 2024 | June 30, 2024 | September 30, 2023 |

Net cash flows from operating activities (GAAP) | $ | 1,010 | | $ | 348 | | $ | 811 | |

Add: cash used for capital expenditures, net of proceeds from disposal of assets | (256) | | (242) | | (219) | |

| Free cash flow (non-GAAP) | $ | 754 | | $ | 106 | | $ | 592 | |

Table 1d reconciles net cash flows from operating activities, which is the directly comparable financial result determined in accordance with GAAP, to free cash flow. Free cash flow is defined as net cash flows from operating activities less expenditures for capital assets plus proceeds from disposal of assets.

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

Financial Tables (GAAP)

Condensed Consolidated Statements of Income (Loss)

(Unaudited) | | | | | | | | | | | | | | |

| Three Months Ended September 30, | Nine Months Ended September 30, |

| (In millions, except per share amounts) | 2024 | 2023 | 2024 | 2023 |

| Revenue | $ | 6,908 | | $ | 6,641 | | $ | 20,465 | | $ | 18,671 | |

| Costs and expenses: | | | | |

| Cost of revenue | 5,366 | | 5,298 | | 16,155 | | 14,867 | |

| Selling, general and administrative | 612 | | 627 | | 1,873 | | 1,977 | |

| | | | |

| | | | |

| Restructuring, impairment and other | — | | 2 | | 21 | | 161 | |

| Total costs and expenses | 5,978 | | 5,927 | | 18,049 | | 17,005 | |

| Operating income | 930 | | 714 | | 2,416 | | 1,666 | |

Other non-operating income, net | 134 | | 94 | | 200 | | 638 | |

| Interest expense, net | (55) | | (49) | | (143) | | (171) | |

Income before income taxes | 1,009 | | 759 | | 2,473 | | 2,133 | |

| | | | |

| Provision for income taxes | (235) | | (235) | | (656) | | (614) | |

Net income | 774 | | 524 | | 1,817 | | 1,519 | |

| Less: Net income attributable to noncontrolling interests | 8 | | 6 | | 17 | | 16 | |

Net income attributable to Baker Hughes Company | $ | 766 | | $ | 518 | | $ | 1,800 | | $ | 1,503 | |

| | | | |

| Per share amounts: | | | |

Basic income per Class A common stock | $ | 0.77 | | $ | 0.51 | | $ | 1.81 | | $ | 1.49 | |

Diluted income per Class A common stock | $ | 0.77 | | $ | 0.51 | | $ | 1.80 | | $ | 1.48 | |

| | | | |

| Weighted average shares: | | | | |

| Class A basic | 993 | | 1,009 | | 996 | | 1,010 | |

| Class A diluted | 999 | | 1,017 | | 1,001 | | 1,016 | |

| | | | |

| Cash dividend per Class A common stock | $ | 0.21 | | $ | 0.20 | | $ | 0.63 | | $ | 0.58 | |

| | | | |

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

Condensed Consolidated Statements of Financial Position

(Unaudited) | | | | | | | | |

(In millions) | September 30, 2024 | December 31, 2023 |

| ASSETS |

| Current Assets: | | |

| Cash and cash equivalents | $ | 2,664 | | $ | 2,646 | |

| Current receivables, net | 6,920 | | 7,075 | |

| Inventories, net | 5,254 | | 5,094 | |

| All other current assets | 1,730 | | 1,486 | |

| Total current assets | 16,568 | | 16,301 | |

| Property, plant and equipment, less accumulated depreciation | 5,150 | | 4,893 | |

| Goodwill | 6,167 | | 6,137 | |

| Other intangible assets, net | 3,995 | | 4,093 | |

| Contract and other deferred assets | 1,904 | | 1,756 | |

| All other assets | 3,746 | | 3,765 | |

| Total assets | $ | 37,530 | | $ | 36,945 | |

| LIABILITIES AND EQUITY |

| Current Liabilities: | | |

| Accounts payable | $ | 4,431 | | $ | 4,471 | |

| Short-term and current portion of long-term debt | 52 | | 148 | |

| Progress collections and deferred income | 5,685 | | 5,542 | |

| All other current liabilities | 2,622 | | 2,830 | |

| Total current liabilities | 12,790 | | 12,991 | |

| Long-term debt | 5,984 | | 5,872 | |

| Liabilities for pensions and other postretirement benefits | 991 | | 978 | |

| All other liabilities | 1,422 | | 1,585 | |

| Equity | 16,343 | | 15,519 | |

| Total liabilities and equity | $ | 37,530 | | $ | 36,945 | |

| | |

| Outstanding Baker Hughes Company shares: | | |

| Class A common stock | 989 | | 998 | |

| | |

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

Condensed Consolidated Statements of Cash Flows

(Unaudited) | | | | | | | | | | | |

| Three Months Ended September 30, | Nine Months Ended September 30, |

| (In millions) | 2024 | 2024 | 2023 |

| Cash flows from operating activities: | | | |

Net income | $ | 774 | | $ | 1,817 | | $ | 1,519 | |

Adjustments to reconcile net income to net cash flows from operating activities: | | | |

| Depreciation and amortization | 278 | | 844 | | 813 | |

| Stock-based compensation cost | 53 | | 154 | | 148 | |

Gain on equity securities | (99) | | (171) | | (639) | |

Provision for deferred income taxes | 2 | | 35 | | 68 | |

| | | |

| Other asset impairments | — | | — | | 43 | |

| | | |

| | | |

| Working capital | (21) | | (57) | | 19 | |

| Other operating items, net | 23 | | (480) | | 159 | |

Net cash flows provided by operating activities | 1,010 | | 2,142 | | 2,130 | |

| Cash flows from investing activities: | | | |

| Expenditures for capital assets | (300) | | (925) | | (868) | |

| Proceeds from disposal of assets | 44 | | 145 | | 150 | |

Proceeds from sale of equity securities | — | | 21 | | 372 | |

| Proceeds from business dispositions | — | | — | | 293 | |

| Net cash paid for acquisitions | — | | — | | (301) | |

| Other investing items, net | (13) | | (40) | | (149) | |

| Net cash flows used in investing activities | (269) | | (799) | | (503) | |

| Cash flows from financing activities: | | | |

Repayment of long-term debt | (9) | | (134) | | — | |

| | | |

| | | |

| Dividends paid | (209) | | (628) | | (586) | |

| | | |

| Repurchase of Class A common stock | (152) | | (476) | | (219) | |

| | | |

| | | |

| | | |

| Other financing items, net | 6 | | (55) | | (56) | |

| Net cash flows used in financing activities | (364) | | (1,293) | | (861) | |

| Effect of currency exchange rate changes on cash and cash equivalents | 3 | | (32) | | (53) | |

Increase in cash and cash equivalents | 380 | | 18 | | 713 | |

| Cash and cash equivalents, beginning of period | 2,284 | | 2,646 | | 2,488 | |

| Cash and cash equivalents, end of period | $ | 2,664 | | $ | 2,664 | | $ | 3,201 | |

| Supplemental cash flows disclosures: | | | |

| Income taxes paid, net of refunds | $ | 397 | | $ | 733 | | $ | 463 | |

| Interest paid | $ | 49 | | $ | 199 | | $ | 205 | |

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

Supplemental Financial Information

Supplemental financial information can be found on the Company's website at: investors.bakerhughes.com in the Financial Information section under Quarterly Results.

Conference Call and Webcast

The Company has scheduled an investor conference call to discuss management's outlook and the results reported in today's earnings announcement. The call will begin at 9:30 a.m. Eastern time, 8:30 a.m. Central time on Wednesday, October 23, 2024, the content of which is not part of this earnings release. The conference call will be broadcast live via a webcast and can be accessed by visiting the Events and Presentations page on the Company's website at: investors.bakerhughes.com. An archived version of the webcast will be available on the website for one month following the webcast.

Forward-Looking Statements

This news release (and oral statements made regarding the subjects of this release) may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, (each a "forward-looking statement"). Forward-looking statements concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words "may," "will," "should," "potential," "intend," "expect," "would," "seek," "anticipate," "estimate," "overestimate," "underestimate," "believe," "could," "project," "predict," "continue," "target", "goal" or other similar words or expressions. There are many risks and uncertainties that could cause actual results to differ materially from our forward-looking statements. These forward-looking statements are also affected by the risk factors described in the Company's annual report on Form 10-K for the annual period ended December 31, 2023 and those set forth from time to time in other filings with the Securities and Exchange Commission ("SEC"). The documents are available through the Company's website at: www.investors.bakerhughes.com or through the SEC's Electronic Data Gathering and Analysis Retrieval system at: www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements.

Our expectations regarding our business outlook and business plans; the business plans of our customers; oil and natural gas market conditions; cost and availability of resources; economic, legal and regulatory conditions, and other matters are only our forecasts regarding these matters.

These forward-looking statements, including forecasts, may be substantially different from actual results, which are affected by many risks, along with the following risk factors and the timing of any of these risk factors:

•Economic and political conditions - the impact of worldwide economic conditions and rising inflation; the effect that declines in credit availability may have on worldwide economic growth and demand for hydrocarbons; foreign currency exchange fluctuations and changes in the capital markets in locations where we operate; and the impact of government disruptions and sanctions.

•Orders and RPO - our ability to execute on orders and RPO in accordance with agreed specifications, terms and conditions and convert those orders and RPO to revenue and cash.

•Oil and gas market conditions - the level of petroleum industry exploration, development and production expenditures; the price of, volatility in pricing of, and the demand for crude oil and natural gas; drilling activity; drilling permits for and regulation of the shelf and the deepwater drilling; excess productive capacity; crude and product inventories; liquefied natural gas supply and demand; seasonal and other adverse weather conditions that affect the demand for energy; severe weather conditions, such as tornadoes and hurricanes, that affect exploration and production activities; Organization of Petroleum Exporting Countries ("OPEC") policy and the adherence by OPEC nations to their OPEC production quotas.

| | | | | |

| Baker Hughes Company News Release | |

Baker Hughes Company Announces Third-Quarter 2024 Results | |

•Terrorism and geopolitical risks - war, military action, terrorist activities or extended periods of international conflict, particularly involving any petroleum-producing or consuming regions, including Russia and Ukraine; and the recent conflict in the Middle East; labor disruptions, civil unrest or security conditions where we operate; potentially burdensome taxation, expropriation of assets by governmental action; cybersecurity risks and cyber incidents or attacks; epidemic outbreaks.

About Baker Hughes:

Baker Hughes (Nasdaq: BKR) is an energy technology company that provides solutions for energy and industrial customers worldwide. Built on a century of experience and conducting business in over 120 countries, our innovative technologies and services are taking energy forward - making it safer, cleaner and more efficient for people and the planet. Visit us at bakerhughes.com

# # #

For more information, please contact:

Investor Relations

Chase Mulvehill

+1 346-297-2561

investor.relations@bakerhughes.com

Media Relations

Adrienne Lynch

+1 713-906-8407

adrienne.lynch@bakerhughes.com

v3.24.3

Cover Page

|

Oct. 22, 2024 |

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 22, 2024

|

| Entity Registrant Name |

Baker Hughes Company

|

| Entity Central Index Key |

0001701605

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-38143

|

| Entity Tax Identification Number |

81-4403168

|

| Entity Address, Address Line One |

575 N. Dairy Ashford Rd.,

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Houston,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77079-1121

|

| City Area Code |

713

|

| Local Phone Number |

439-8600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Trading Symbol |

BKR

|

| Security Exchange Name |

NASDAQ

|

| 5.125 Senior Notes due 2040 of Baker Hughes Holdings LLC and Baker Hughes Co-Obligor, Inc. [Domain] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

5.125% Senior Notes due 2040 of Baker Hughes Holdings LLC and Baker Hughes Co-Obligor, Inc.

|

| Trading Symbol |

BKR40

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_LongtermDebtTypeAxis=bkr_A5.125SeniorNotesDue2040OfBakerHughesHoldingsLLCAndBakerHughesCoObligorInc.Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

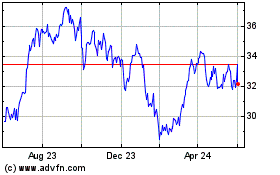

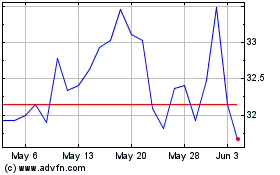

Baker Hughes (NASDAQ:BKR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Baker Hughes (NASDAQ:BKR)

Historical Stock Chart

From Jan 2024 to Jan 2025