DMC Global (NASDAQ: BOOM) (“DMC” or the “Company”) today provided

an update on its business conditions and revised its third quarter

financial guidance. The Company also commented on its strategic

review process and announced governance changes. DMC said third

quarter sales are expected to be approximately $152 million versus

prior guidance of $158 million to $168 million. The results reflect

weaker-than-expected sales at both Arcadia Products (“Arcadia”),

DMC’s architectural building products business, and DynaEnergetics,

DMC’s energy products business.

Adjusted EBITDA* is now expected to be

approximately $5 million versus prior guidance of $15 million to

$18 million. Third quarter results will include inventory and bad

debt charges at DynaEnergetics totaling approximately $5 million,

as well as lower fixed overhead absorption on reduced sales at both

Arcadia and DynaEnergetics.

The Company said its third quarter financial

results will include an approximate $142 million non-cash goodwill

impairment charge associated with DMC’s December 2021 acquisition

of a controlling interest in Arcadia. The charge reflects Arcadia’s

recent financial performance and near-term outlook. These factors,

combined with the significant decline in DMC’s market

capitalization, led the Company to conclude that the goodwill

impairment charge was appropriate at this time.

DMC president and CEO Michael Kuta, who is also

leading Arcadia on an interim basis, said, “Arcadia’s third quarter

performance was affected by weak commercial and high-end

residential construction activity, lower fixed overhead absorption,

and supply-chain disruptions that impacted product availability.

Results at DynaEnergetics were below expectations due to declining

North American well-completion activity, a higher mix of lower

margin customers in DynaEnergetics’ U.S. markets, and the

aforementioned inventory and bad debt charges. NobelClad, our

composite metals business, is expected to deliver another strong

quarter with sales and adjusted EBITDA results within or above our

forecasted range.

“Arcadia is a solid business with exceptional

employees and a respected brand, and we are focused on improving

its performance and delivering the value its customers have come to

expect. At DynaEnergetics, we expect the manufacturing automation

and product design initiatives we are implementing will strengthen

adjusted EBITDA margins beginning in 2025.”

Strategic Review ProcessDMC’s

Board of Directors (the “Board”) also announced it is no longer

actively marketing DynaEnergetics and NobelClad. Since announcing

strategic review processes for both businesses in January 2024, the

Company has reviewed and considered sales, mergers and other

strategic combinations. However, given the challenges of the last

several months for DMC, including macroeconomic factors such as

weakness and volatility in the energy market, the Board believes

that prioritizing stability, simplification and internal

improvement will better serve DMC’s stockholders than selling these

market-leading businesses at the present time.

Governance Changes DMC also

announced that director James O’Leary has agreed to serve as

executive chairman, director Ouma Sananikone has been appointed

lead independent director, and David Aldous has stepped down as

DMC’s independent chairman and as a member of the Board. In

addition, Peter Rose has decided not to stand for re-election at

the Company’s next annual meeting of stockholders. The Board wishes

to recognize and thank Mr. Aldous and Mr. Rose for their years of

service to DMC.

Mr. O’Leary joined the Board in November 2023

with nearly four decades of executive leadership, finance, capital

markets and board-level experience. He has extensive expertise in

the construction and industrial manufacturing industries and is on

the board of publicly traded Builders FirstSource, Inc., the

largest U.S. supplier of building products, prefabricated

components and value-added services to the professional market

segment for new residential construction and repair and

remodeling.

Mr. O’Leary was chairman of publicly traded BMC

Stock Holdings, Inc. prior to its merger with Builders FirstSource

in 2021. He was also chairman and CEO of Kaydon Corporation, Inc.,

a leading, publicly traded manufacturer of highly engineered

industrial products, which was sold to an industry peer in a

successful strategic transaction. He more recently served as

chairman and CEO of WireCo, a leading supplier of steel and

synthetic rope and electromechanical cable for global energy

markets. His experience also includes extensive work as a director

and senior advisor at several leading private equity firms.

Ms. Sananikone joined the Board in 2023 with

more than 30 years of experience in finance, capital markets,

mergers and acquisitions and investment management. She previously

served as managing director of corporate strategy and

development at BT Financial Group, a $50 billion asset management

firm that included BT Asset Management, Rothschild Asset Management

and Westpac Financial Services. She also served as CEO at

Australia-based Aberdeen Asset Management Ltd and Equitilink

Group. She was CEO at Equitilink when it was acquired by

Aberdeen, and played a key role in the integration of the two asset

management firms.

Ms. Sananikone currently serves on the boards of

IA Financial Group, an insurance group with operations in Canada

and the USA; Innergex Renewable Energy, a producer of renewable

energy with operations in Canada, the USA, Chile and France; and

Gecina, a Paris-based real estate company.

DMC expects to report third quarter financial

results after the market closes on Monday, November 4, 2024, when

it will discuss detailed operations performance and profitability

improvement initiatives underway. Details for participating in the

call will be issued in the coming days.

*Use of Non-GAAP Financial

MeasuresIn addition to disclosing financial results that

are determined in accordance with generally accepted accounting

principles in the United States (GAAP), the Company also discloses

certain non-GAAP financial measures that we use in operational and

financial decision making. Non-GAAP financial measures include the

following:

-

EBITDA: defined as net income (loss) plus net

interest, taxes, depreciation and amortization.

- Adjusted EBITDA: excludes from EBITDA

stock-based compensation, restructuring expenses and asset

impairment charges (if applicable) and, when appropriate,

nonrecurring items that management does not utilize in assessing

DMC’s operating performance.

Management believes providing these additional

financial measures is useful to investors in understanding the

Company’s operating performance, including the effects of

restructuring, impairment, and other nonrecurring charges, as well

as its liquidity. Management typically monitors the business

utilizing non-GAAP measures, in addition to GAAP results, to

understand and compare operating results across accounting periods,

and certain management incentive awards are based, in part, on

these measures. The presence of non-GAAP financial measures in this

report is not intended to suggest that such measures be considered

in isolation or as a substitute for, or as superior to, DMC’s GAAP

information, and investors are cautioned that the non-GAAP

financial measures are limited in their usefulness.

Because not all companies use identical

calculations, DMC’s presentation of non-GAAP financial measures may

not be comparable to other similarly titled measures of other

companies. However, these measures can still be useful in

evaluating the company’s performance against its peer companies

because management believes the measures provide users with

valuable insight into key components of GAAP financial disclosures.

For example, a company with greater GAAP net income may not be as

appealing to investors if its net income is more heavily comprised

of gains on asset sales. Likewise, eliminating the effects of

interest income and expense moderates the impact of a company’s

capital structure on its performance.

About DMC GlobalDMC Global is

an owner and operator of innovative, asset-light manufacturing

businesses that provide unique, highly engineered products and

differentiated solutions. DMC’s businesses have established

leadership positions in their respective markets and consist of:

Arcadia, a leading supplier of architectural building products;

DynaEnergetics, which serves the global energy industry; and

NobelClad, which addresses the global industrial infrastructure and

transportation sectors. Based in Broomfield, Colorado, DMC trades

on Nasdaq under the symbol “BOOM.” For more information, visit:

http://www.dmcglobal.com.

Safe Harbor Language This news

release contains certain forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

including, but not limited to, third quarter 2024 guidance on sales

and Adjusted EBITDA. All of these statements are based on

management’s expectations as well as estimates and assumptions

prepared by management that, although they believe to be

reasonable, are inherently uncertain. These statements involve

risks and uncertainties, including, but not limited to, economic,

competitive, governmental and other factors outside of the

Company’s control that may cause its business, industry, strategy,

financing activities or actual results to differ materially. More

information on potential factors that could affect the Company and

its financial results is available in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections within the Company’s Annual Report

on Form 10-K for the year ended December 31, 2023, and in other

documents that the Company has filed with, or furnished to, the

U.S. Securities and Exchange Commission. The Company does not

undertake any obligation to release public revisions to any

forward-looking statement, including, without limitation, to

reflect events or circumstances after the date of this news

release, or to reflect the occurrence of unanticipated events,

except as may be required under applicable securities laws.

CONTACT:Investors:Geoff

HighVice President of Investor Relations303-604-3924

Media:Riyaz Lalani or Dan GagnierGagnier

Communications416-305-1459DMCGLOBAL@GAGNIERFC.COM

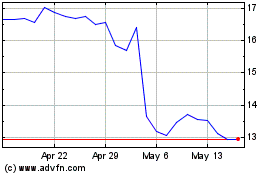

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Oct 2024 to Nov 2024

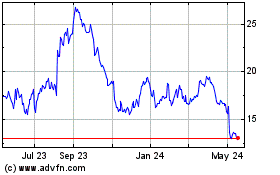

DMC Global (NASDAQ:BOOM)

Historical Stock Chart

From Nov 2023 to Nov 2024