0001031308FALSE00010313082024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

___________________________________

BENTLEY SYSTEMS, INCORPORATED

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware | 001-39548 | 95-3936623 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

685 Stockton Drive | | |

Exton, Pennsylvania | | 19341 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (610) 458-5000

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class B Common Stock, $0.01 Par Value | | BSY | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, Bentley Systems, Incorporated (the “Company”) issued a press release announcing its financial results for the three and nine months ended September 30, 2024. A copy of the release is furnished as Exhibit 99.1 and incorporated by reference herein. Exhibit 99.2 sets forth the reasons the Company believes that presentation of the non-GAAP financial measures contained in the press release provides useful information to investors regarding the Company’s results of operations and financial condition. To the extent material, Exhibit 99.2 also discloses the additional purposes, if any, for which the Company’s management uses these non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP financial measures are included in the press release itself.

The information in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Bentley Systems, Incorporated |

| | | |

Date: November 7, 2024 | | By: | /s/ WERNER ANDRE |

| | Name: | Werner Andre |

| | Title: | Chief Financial Officer |

Exhibit 99.1

Bentley Systems Announces Third Quarter 2024 Results

EXTON, PA – November 7, 2024 – Bentley Systems, Incorporated (Nasdaq: BSY), the infrastructure engineering software company, today announced results for the quarter ended September 30, 2024.

Third Quarter 2024 Results

•Total revenues were $335.2 million, up 9.3% or 9.1% on a constant currency basis, year-over-year;

•Subscriptions revenues were $303.2 million, up 12.0% or 11.8% on a constant currency basis, year-over-year;

•Annualized Recurring Revenues (“ARR”) was $1,270.7 million as of September 30, 2024, compared to $1,124.8 million as of September 30, 2023, representing a constant currency ARR growth rate of 12%;

•Last twelve-month recurring revenues dollar-based net retention rate was 109%, compared to 110% for the same period last year;

•Operating income margin was 20.5%, compared to 24.0% for the same period last year;

•Adjusted operating income inclusive of stock-based compensation expense (“Adjusted OI w/SBC”) margin was 26.7%, compared to 28.2% for the same period last year;

•Net income per diluted share was $0.13, compared to $0.16 for the same period last year;

•Adjusted net income per diluted share (“Adjusted EPS”) was $0.24, compared to $0.22 for the same period last year; and

•Cash flows from operations was $86.1 million, compared to $72.8 million for the same period last year.

Nine Months Ended September 30, 2024 Results

•Total revenues were $1,003.3 million, up 9.3% or 9.3% on a constant currency basis, year-over-year;

•Subscriptions revenues were $907.8 million, up 12.4% or 12.4% on a constant currency basis, year-over-year;

•Operating income margin was 24.0%, compared to 21.0% for the same period last year;

•Adjusted OI w/SBC margin was 29.6%, compared to 27.2% for the same period last year;

•Net income per diluted share was $0.57, compared to $0.46 for the same period last year;

•Adjusted EPS was $0.86, compared to $0.72 for the same period last year; and

•Cash flows from operations was $353.7 million, compared to $329.6 million for the same period last year.

Executive Chair Greg Bentley said, “The impressive inaugural quarter since completing our generational succession underscores my confidence in raising our sights broadly. The Company’s execution is sustaining progress towards our annual ramp in ARR growth. The Year in Infrastructure 2024 Conference showcased advancements in going digital that are ever more effectively surmounting the infrastructure engineering resource capacity gap. And our strategically significant acquisition of Cesium, with the other strategic initiatives Nicholas and his team have unveiled, exemplifies our reinvigorated prioritization of compelling new growth ambitions.”

CEO Nicholas Cumins said, “During my first 100 days as CEO, we unveiled ambitious strategic moves that will help propel our future growth: the acquisition of 3D geospatial company Cesium; a strategic partnership with Google to integrate their geospatial content; a new product portfolio for asset analytics and a new generation of engineering applications, both leveraging AI and digital twin technologies to improve the way infrastructure is designed, built, and operated. At the same time, we delivered strong quarterly operating results. Our year-over-year ARR growth on a constant currency basis accelerated to 12% in 24Q3 (12.5% excluding China). Strength was broad based across geographies and sectors as we continued to operate at a high level of performance, with favorable end-market conditions for the foreseeable future.”

CFO Werner Andre said, “24Q3’s upward inflection in year-over-year ARR growth is directionally consistent with our expectations for this year’s second half, more than compensating for attrition prevailing stubbornly in China. Growth in subscriptions revenues (now 91% of total revenues) remains robust at 12.4% year-to-date in constant currency, although total revenue growth for 2024 is expected at the lower end of our annual outlook range due to continued declines in Cohesive professional services for Maximo. Profitability and cash flow in the quarter position us well in relation to our profitability outlook and an increased cash flow outlook for the year. In October we entered into a new five-year $1.3 billion bank credit facility with a further $500 million ‘accordion’ feature.”

Recent Developments

•On October 18, 2024, we entered into a new five-year senior secured credit agreement, which provides us with a $1.3 billion revolving credit facility, as well as an incremental $500 million “accordion” feature to increase the facility in the form of both revolving indebtedness and incremental term loans. We used borrowings under the revolving credit facility to repay all indebtedness outstanding under our previous credit facility, including our outstanding term loan;

•On October 9, 2024, we announced a strategic partnership with Google to integrate Google's high-quality geospatial content with Bentley's infrastructure engineering software and digital twin platform to improve the ways infrastructure is designed, built, and operated “in context”; and

•On September 6, 2024, we announced the acquisition of 3D geospatial company Cesium. Cesium is recognized as the foundational open platform for creating immersive 3D geospatial environments, and its 3D Tiles open standard has been widely adopted by leading enterprises, governments, and tens of thousands of application developer teams globally.

Call Details

Bentley Systems will host a live Zoom video webinar on November 7, 2024 at 8:15 a.m. EST to discuss results for its third quarter ended September 30, 2024.

Those wishing to participate should access the live Zoom video webinar of the event through a direct registration link at https://us06web.zoom.us/webinar/register/WN_ZlTBingnQoKzZgcRVSRB8w#/registration. Alternatively, the event can be accessed from the Events & Presentations page on Bentley Systems’ Investor Relations website at https://investors.bentley.com. In addition, a replay and transcript will be available after the conclusion of the live event on Bentley Systems’ Investor Relations website for one year.

Non-GAAP Financial Measures

In this press release, we sometimes refer to financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”). Certain of these measures are considered non-GAAP financial measures under the United States Securities and Exchange Commission (“SEC”) regulations. Those rules require the supplemental explanations and reconciliations that are in Bentley Systems’ Form 8-K (Quarterly Earnings Release) furnished to the SEC.

Forward-Looking Statements

This press release includes forward-looking statements regarding the future results of operations and financial condition, business strategy, and plans and objectives for future operations of Bentley Systems, Incorporated (the “Company,” “we,” “us,” and words of similar import). All such statements contained in this press release, other than statements of historical facts, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations, projections, and assumptions about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, and there are a significant number of factors that could cause actual results to differ materially from statements made in this press release including: adverse changes in global economic and/or political conditions; the impact of current and future sanctions, embargoes and other similar laws at the state and/or federal level that impose restrictions on our counterparties or upon our ability to operate our business within the subject jurisdictions; political, economic, regulatory and public health and safety risks and uncertainties in the countries and regions in which we operate; failure to retain personnel necessary for the operation of our business or those that we acquire; failure to effectively manage succession; changes in the industries in which our accounts operate; the competitive environment in which we operate; the quality of our products; our ability to develop and market new products to address our accounts’ rapidly changing technological needs; changes in capital markets and our ability to access financing on terms satisfactory to us or at all; the impact of changing or uncertain interest rates on us and on the industries we serve; our ability to integrate acquired businesses successfully; and our ability to identify and consummate future investments and/or acquisitions on terms satisfactory to us or at all.

Further information on potential factors that could affect the financial results of the Company are included in the Company’s Form 10‑K and subsequent Form 10‑Qs, which are on file with the SEC. The Company disclaims any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made.

About Bentley Systems

Bentley Systems (Nasdaq: BSY) is the infrastructure engineering software company. We provide innovative software to advance the world’s infrastructure – sustaining both the global economy and environment. Our industry-leading software solutions are used by professionals, and organizations of every size, for the design, construction, and operations of roads and bridges, rail and transit, water and wastewater, public works and utilities, buildings and campuses, mining, and industrial facilities. Our offerings, powered by the iTwin Platform for infrastructure digital twins, include MicroStation and Bentley Open applications for modeling and simulation, Seequent’s software for geoprofessionals, and Bentley Infrastructure Cloud encompassing ProjectWise for project delivery, SYNCHRO for construction management, and AssetWise for asset operations. Bentley Systems’ 5,200 colleagues generate annual revenues of more than $1 billion in 194 countries.

© 2024 Bentley Systems, Incorporated. Bentley, the Bentley logo, 3D Tiles, AssetWise, Bentley Infrastructure Cloud, Bentley Open, Cesium, Cohesive, iTwin, MicroStation, ProjectWise, Seequent, and SYNCHRO are either registered or unregistered trademarks or service marks of Bentley Systems, Incorporated or one of its direct or indirect wholly owned subsidiaries. All other brands and product names are trademarks of their respective owners.

For more information, contact:

Investors: Eric Boyer, IR@bentley.com

BENTLEY SYSTEMS, INCORPORATED

Consolidated Balance Sheets

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | September 30, 2024 | | December 31, 2023 |

| | |

| | | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 72,175 | | | $ | 68,412 | |

| Accounts receivable | | 271,689 | | | 302,501 | |

| Allowance for doubtful accounts | | (8,846) | | | (8,965) | |

| Prepaid income taxes | | 15,846 | | | 12,812 | |

| Prepaid and other current assets | | 52,955 | | | 44,797 | |

| Total current assets | | 403,819 | | | 419,557 | |

| Property and equipment, net | | 34,533 | | | 40,100 | |

| Operating lease right-of-use assets | | 36,425 | | | 38,476 | |

| Intangible assets, net | | 225,788 | | | 248,787 | |

| Goodwill | | 2,390,392 | | | 2,269,336 | |

| Investments | | 24,724 | | | 23,480 | |

| Deferred income taxes | | 207,821 | | | 212,831 | |

| Other assets | | 72,985 | | | 67,283 | |

| Total assets | | $ | 3,396,487 | | | $ | 3,319,850 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 30,514 | | | $ | 18,094 | |

| Accruals and other current liabilities | | 494,911 | | | 457,348 | |

| Deferred revenues | | 225,291 | | | 253,785 | |

| Operating lease liabilities | | 12,079 | | | 11,645 | |

| Income taxes payable | | 19,434 | | | 9,491 | |

| Current portion of long-term debt | | — | | | 10,000 | |

| Total current liabilities | | 782,229 | | | 760,363 | |

| Long-term debt | | 1,418,870 | | | 1,518,403 | |

| Deferred compensation plan liabilities | | 97,932 | | | 88,181 | |

| Long-term operating lease liabilities | | 27,954 | | | 30,626 | |

| Deferred revenues | | 15,820 | | | 15,862 | |

| Deferred income taxes | | 11,815 | | | 9,718 | |

| Income taxes payable | | 3,615 | | | 7,337 | |

| Other liabilities | | 4,242 | | | 5,378 | |

| Total liabilities | | 2,362,477 | | | 2,435,868 | |

| Stockholders’ equity: | | | | |

Common stock | | 3,020 | | | 2,963 | |

| Additional paid-in capital | | 1,201,442 | | | 1,127,234 | |

Accumulated other comprehensive loss | | (82,959) | | | (84,987) | |

| Accumulated deficit | | (88,197) | | | (161,932) | |

| Non-controlling interest | | 704 | | | 704 | |

| Total stockholders’ equity | | 1,034,010 | | | 883,982 | |

Total liabilities and stockholders’ equity | | $ | 3,396,487 | | | $ | 3,319,850 | |

BENTLEY SYSTEMS, INCORPORATED

Consolidated Statements of Operations

(in thousands, except share and per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | | |

| Subscriptions | | $ | 303,239 | | | $ | 270,751 | | | $ | 907,772 | | | $ | 807,839 | |

| Perpetual licenses | | 11,274 | | | 11,887 | | | 31,649 | | | 33,152 | |

| Subscriptions and licenses | | 314,513 | | | 282,638 | | | 939,421 | | | 840,991 | |

| Services | | 20,660 | | | 23,974 | | | 63,852 | | | 76,781 | |

| Total revenues | | 335,173 | | | 306,612 | | | 1,003,273 | | | 917,772 | |

| Cost of revenues: | | | | | | | | |

| Cost of subscriptions and licenses | | 44,220 | | | 42,088 | | | 126,870 | | | 124,175 | |

| Cost of services | | 20,612 | | | 22,588 | | | 62,985 | | | 74,111 | |

| Total cost of revenues | | 64,832 | | | 64,676 | | | 189,855 | | | 198,286 | |

| Gross profit | | 270,341 | | | 241,936 | | | 813,418 | | | 719,486 | |

Operating expense (income): | | | | | | | | |

| Research and development | | 70,068 | | | 65,465 | | | 204,148 | | | 203,382 | |

| Selling and marketing | | 64,940 | | | 53,757 | | | 176,455 | | | 160,262 | |

| General and administrative | | 51,359 | | | 42,678 | | | 152,695 | | | 128,743 | |

| Deferred compensation plan | | 6,983 | | | (3,160) | | | 13,665 | | | 4,763 | |

| Amortization of purchased intangibles | | 8,361 | | | 9,517 | | | 25,717 | | | 29,567 | |

| Total operating expenses | | 201,711 | | | 168,257 | | | 572,680 | | | 526,717 | |

Income from operations | | 68,630 | | | 73,679 | | | 240,738 | | | 192,769 | |

| Interest expense, net | | (4,669) | | | (10,047) | | | (16,289) | | | (30,623) | |

Other (expense) income, net | | (5,087) | | | 5,953 | | | 4,330 | | | 7,207 | |

Income before income taxes | | 58,874 | | | 69,585 | | | 228,779 | | | 169,353 | |

Provision for income taxes | | (16,522) | | | (16,514) | | | (44,099) | | | (22,107) | |

Equity in net (losses) income of investees, net of tax | | (14) | | | (44) | | | 14 | | | (44) | |

Net income | | $ | 42,338 | | | $ | 53,027 | | | $ | 184,694 | | | $ | 147,202 | |

| Per share information: | | | | | | | | |

Net income per share, basic | | $ | 0.13 | | | $ | 0.17 | | | $ | 0.59 | | | $ | 0.47 | |

Net income per share, diluted | | $ | 0.13 | | | $ | 0.16 | | | $ | 0.57 | | | $ | 0.46 | |

| Weighted average shares, basic | | 315,207,216 | | | 313,069,132 | | | 314,820,679 | | | 311,915,808 | |

| Weighted average shares, diluted | | 333,789,636 | | | 332,825,186 | | | 333,724,425 | | | 332,144,893 | |

| | | | | | | | |

BENTLEY SYSTEMS, INCORPORATED

Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | | |

Net income | | $ | 184,694 | | | $ | 147,202 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 48,397 | | | 52,787 | |

| Deferred income taxes | | 7,056 | | | (14,632) | |

| Stock-based compensation expense | | 57,856 | | | 56,092 | |

| Deferred compensation plan | | 13,665 | | | 4,763 | |

| Amortization of deferred debt issuance costs | | 5,554 | | | 5,469 | |

| Change in fair value of derivative | | 5,570 | | | (4,102) | |

Foreign currency remeasurement (gain) loss | | (126) | | | 3,198 | |

| Other | | (1,733) | | | 2,464 | |

| Changes in assets and liabilities, net of effect from acquisitions: | | | | |

| Accounts receivable | | 34,588 | | | 56,065 | |

| Prepaid and other assets | | (9,952) | | | (1,246) | |

| Accounts payable, accruals, and other liabilities | | 36,356 | | | 33,437 | |

| Deferred revenues | | (31,512) | | | (17,688) | |

| Income taxes payable, net of prepaid income taxes | | 3,247 | | | 5,834 | |

Net cash provided by operating activities | | 353,660 | | | 329,643 | |

| Cash flows from investing activities: | | | | |

| Purchases of property and equipment and investment in capitalized software | | (8,499) | | | (18,906) | |

| Acquisitions, net of cash acquired | | (128,774) | | | (23,110) | |

| Purchases of investments | | (807) | | | (11,352) | |

| Proceeds from investments | | — | | | 2,123 | |

| Other | | 2,400 | | | — | |

Net cash used in investing activities | | (135,680) | | | (51,245) | |

| Cash flows from financing activities: | | | | |

| Proceeds from credit facilities | | 233,281 | | | 442,566 | |

| Payments of credit facilities | | (207,608) | | | (634,718) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Repayments of term loan | | (140,000) | | | (3,750) | |

| Payments of contingent and non-contingent consideration | | (3,022) | | | (3,039) | |

| Payments of dividends | | (53,985) | | | (43,992) | |

| Proceeds from stock purchases under employee stock purchase plan | | 11,228 | | | 9,988 | |

| Proceeds from exercise of stock options | | 4,007 | | | 10,590 | |

| Payments for shares acquired including shares withheld for taxes | | (11,199) | | | (57,527) | |

| Repurchases of Class B common stock under approved program | | (45,769) | | | — | |

| Other | | (151) | | | (137) | |

Net cash used in financing activities | | (213,218) | | | (280,019) | |

| Effect of exchange rate changes on cash and cash equivalents | | (999) | | | (3,100) | |

Increase (decrease) in cash and cash equivalents | | 3,763 | | | (4,721) | |

| Cash and cash equivalents, beginning of year | | 68,412 | | | 71,684 | |

Cash and cash equivalents, end of period | | $ | 72,175 | | | $ | 66,963 | |

BENTLEY SYSTEMS, INCORPORATED

Reconciliation of GAAP to Non-GAAP Financial Measures

(in thousands, except share and per share data)

(unaudited)

Reconciliation of operating income to Adjusted OI w/SBC and to Adjusted operating income:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Operating income | | $ | 68,630 | | | $ | 73,679 | | | $ | 240,738 | | | $ | 192,769 | |

| Amortization of purchased intangibles | | 11,448 | | | 12,678 | | | 35,159 | | | 39,038 | |

| Deferred compensation plan | | 6,983 | | | (3,160) | | | 13,665 | | | 4,763 | |

| Acquisition expenses | | 2,454 | | | 2,980 | | | 6,782 | | | 15,278 | |

Realignment expenses (income) | | 9 | | | 150 | | | 818 | | | (1,800) | |

| Adjusted OI w/SBC | | 89,524 | | | 86,327 | | | 297,162 | | | 250,048 | |

| Stock-based compensation expense | | 15,895 | | | 18,039 | | | 57,088 | | | 54,907 | |

| Adjusted operating income | | $ | 105,419 | | | $ | 104,366 | | | $ | 354,250 | | | $ | 304,955 | |

Reconciliation of net income to Adjusted net income:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| $ | | EPS(1) | | $ | | EPS(1) | | $ | | EPS(1) | | $ | | EPS(1) |

Net income | $ | 42,338 | | | $ | 0.13 | | | $ | 53,027 | | | $ | 0.16 | | | $ | 184,694 | | | $ | 0.57 | | | $ | 147,202 | | | $ | 0.46 | |

| Non-GAAP adjustments, prior to income taxes: | | | | | | | | | | | | | | | |

Amortization of purchased intangibles | 11,448 | | | 0.03 | | | 12,678 | | | 0.04 | | | 35,159 | | | 0.11 | | | 39,038 | | | 0.12 | |

Stock-based compensation expense | 15,895 | | | 0.05 | | | 18,039 | | | 0.05 | | | 57,088 | | | 0.17 | | | 54,907 | | | 0.17 | |

Deferred compensation plan | 6,983 | | | 0.02 | | | (3,160) | | | (0.01) | | | 13,665 | | | 0.04 | | | 4,763 | | | 0.01 | |

Acquisition expenses | 2,454 | | | 0.01 | | | 2,980 | | | 0.01 | | | 6,782 | | | 0.02 | | | 15,278 | | | 0.05 | |

Realignment expenses (income) | 9 | | | — | | | 150 | | | — | | | 818 | | | — | | | (1,800) | | | (0.01) | |

Other expense (income), net | 5,087 | | | 0.02 | | | (5,953) | | | (0.02) | | | (4,330) | | | (0.01) | | | (7,207) | | | (0.02) | |

| Total non-GAAP adjustments, prior to income taxes | 41,876 | | | 0.13 | | | 24,734 | | | 0.07 | | | 109,182 | | | 0.33 | | | 104,979 | | | 0.32 | |

| Income tax effect of non-GAAP adjustments | (6,756) | | | (0.02) | | | (5,306) | | | (0.02) | | | (11,600) | | | (0.03) | | | (19,303) | | | (0.06) | |

| | | | | | | | | | | | | | | |

Equity in net losses (income) of investees, net of tax | 14 | | | — | | | 44 | | | — | | | (14) | | | — | | | 44 | | | — | |

Adjusted net income(2) | $ | 77,472 | | | $ | 0.24 | | | $ | 72,499 | | | $ | 0.22 | | | $ | 282,262 | | | $ | 0.86 | | | $ | 232,922 | | | $ | 0.72 | |

| | | | | | | | | | | | | | | |

| Adjusted weighted average shares, diluted | 333,789,636 | | 332,825,186 | | 333,724,425 | | 332,144,893 |

(1)Adjusted EPS was computed independently for each reconciling item presented; therefore, the sum of Adjusted EPS for each line item may not equal total Adjusted EPS due to rounding.

(2)Adjusted EPS numerator includes $1,723 and $1,716 for the three months ended September 30, 2024 and 2023, respectively, and $5,164 and $5,157 for the nine months ended September 30, 2024 and 2023, respectively, related to interest expense, net of tax, attributable to the convertible senior notes using the if‑converted method.

Reconciliation of cash flow from operations to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flow from operations | $ | 86,105 | | | $ | 72,824 | | | $ | 353,660 | | | $ | 329,643 | |

| Cash interest | 3,424 | | | 9,988 | | | 12,130 | | | 29,370 | |

| Cash taxes | 10,176 | | | 10,704 | | | 33,023 | | | 28,703 | |

Cash deferred compensation plan distributions | — | | | — | | | 2,436 | | | 2,125 | |

| Cash acquisition expenses | 1,829 | | | 4,487 | | | 5,571 | | | 19,777 | |

| Cash realignment costs | 1,118 | | | — | | | 12,606 | | | — | |

| Changes in operating assets and liabilities | 9,801 | | | 13,504 | | | (44,718) | | | (84,494) | |

Other(1) | (2,452) | | | (2,336) | | | (7,220) | | | (6,420) | |

| Adjusted EBITDA | $ | 110,001 | | | $ | 109,171 | | | $ | 367,488 | | | $ | 318,704 | |

(1) Includes receipts related to interest rate swap.

Reconciliation of total revenues and subscriptions revenues to total revenues and subscriptions revenues in constant currency:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 | | Three Months Ended September 30, 2023 |

| Actual | | Impact of Foreign Exchange at 2023 Rates | | Constant Currency | | Actual | | Impact of Foreign Exchange at 2023 Rates | | Constant Currency |

| Total revenues | $ | 335,173 | | | $ | (1,319) | | | $ | 333,854 | | | $ | 306,612 | | | $ | (535) | | | $ | 306,077 | |

Subscriptions revenues | $ | 303,239 | | | $ | (1,100) | | | $ | 302,139 | | | $ | 270,751 | | | $ | (569) | | | $ | 270,182 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 | | Nine Months Ended September 30, 2023 |

| Actual | | Impact of Foreign Exchange at 2023 Rates | | Constant Currency | | Actual | | Impact of Foreign Exchange at 2023 Rates | | Constant Currency |

| Total revenues | $ | 1,003,273 | | | $ | (891) | | | $ | 1,002,382 | | | $ | 917,772 | | | $ | (1,014) | | | $ | 916,758 | |

Subscriptions revenues | $ | 907,772 | | | $ | (784) | | | $ | 906,988 | | | $ | 807,839 | | | $ | (1,042) | | | $ | 806,797 | |

Exhibit 99.2

Explanation of Non-GAAP and Other Financial Measures

This Exhibit 99.2 to the accompanying Current Report on Form 8-K for Bentley Systems, Incorporated (“Bentley Systems,” the “Company,” “we,” “our,” and words of similar import) sets forth the reasons we believe that presentation of financial measures not in accordance with GAAP contained in this press release filed as Exhibit 99.1 to the Current Report on Form 8-K provides useful information to investors regarding our results of operations, financial condition, and liquidity. To the extent material, this Exhibit also discloses the additional purposes, if any, for which our management uses these non‑GAAP financial measures. Reconciliations between these non‑GAAP financial measures to their most directly comparable GAAP financial measures are included in this press release itself. Non‑GAAP financial information should be considered in addition to, not as a substitute for, or in isolation from, the financial information prepared in accordance with GAAP, including operating income, net income, net income per share, diluted, cash flow from operations or other measures of performance or liquidity, and should be read in conjunction with the financial statements included in our Quarterly Report on Form 10‑Q to be filed with the United States Securities and Exchange Commission.

Our non‑GAAP and other financial measures may vary significantly from period to period for reasons unrelated to our operating performance and may differ from similarly titled measures presented by other companies.

Constant currency

Constant currency and constant currency growth rates are non-GAAP financial measures that present our results of operations excluding the estimated effects of foreign currency exchange rate fluctuations. A significant amount of our operations is conducted in foreign currencies. As a result, the comparability of the financial results reported in U.S. dollars is affected by changes in foreign currency exchange rates. We use constant currency and constant currency growth rates to evaluate the underlying performance of the business, and we believe it is helpful for investors to present operating results on a comparable basis period over period to evaluate its underlying performance.

In reporting period‑over‑period results, except for ARR as discussed further below, we calculate the effects of foreign currency fluctuations and constant currency information by translating current and prior period results on a transactional basis to our reporting currency using prior period average foreign currency exchange rates in which the transactions occurred.

Recurring revenues

Recurring revenues are the basis for our other revenue-related key business metrics. We believe this measure is useful in evaluating our ability to consistently retain and grow our revenues from accounts with revenues in the prior period (“existing accounts”).

Recurring revenues are subscriptions revenues that recur monthly, quarterly, or annually with specific or automatic renewal clauses and professional services revenues in which the underlying contract is based on a fixed fee and contains automatic annual renewal provisions.

Annualized recurring revenues (“ARR”)

ARR is a key business metric that we believe is useful in evaluating the scale and growth of our business as well as to assist in the evaluation of underlying trends in our business. Furthermore, we believe ARR, considered in connection with our last twelve‑month recurring revenues dollar‑based net retention rate, is a leading indicator of revenue growth.

ARR is defined as the sum of the annualized value of our portfolio of contracts that produce recurring revenues as of the last day of the reporting period, and the annualized value of the last three months of recognized revenues for our contractually recurring consumption‑based software subscriptions with consumption measurement durations of less than one year, calculated using the spot foreign currency exchange rates. We believe that the last three months of recognized revenues, on an annualized basis, for our recurring software subscriptions with consumption measurement period durations of less than one year is a reasonable estimate of the annual revenues, given our consistently high retention rate and stability of usage under such subscriptions.

Constant currency ARR growth rate is the growth rate of ARR measured on a constant currency basis. In reporting period‑over‑period ARR growth rates in constant currency, we calculate constant currency growth rates by translating current and prior period ARR on a transactional basis to our reporting currency using current year budget exchange rates. Constant currency ARR growth rate from business performance excludes the ARR onboarding of our platform acquisitions and includes the impact from the ARR onboarding of programmatic acquisitions, which generally are immaterial, individually and in the aggregate. We believe these ARR growth rates are important metrics indicating the scale and growth of our business.

Last twelve‑month recurring revenues dollar‑based net retention rate

Last twelve‑month recurring revenues dollar‑based net retention rate is a key business metric that we believe is useful in evaluating our ability to consistently retain and grow our recurring revenues.

Last twelve‑month recurring revenues dollar‑based net retention rate is calculated, using the average exchange rates for the prior period, as follows: the recurring revenues for the current period, including any growth or reductions from existing accounts, but excluding recurring revenues from any new accounts added during the current period, divided by the total recurring revenues from all accounts during the prior period. A period is defined as any trailing twelve months. Related to our platform acquisitions, recurring revenues into new accounts will be captured as existing accounts starting with the second anniversary of the acquisition when such data conforms to the calculation methodology. This may cause variability in the comparison.

Adjusted operating income inclusive of stock-based compensation expense (“Adjusted OI w/SBC”)

Adjusted OI w/SBC is a non-GAAP financial measure and is used to measure the operational strength and performance of our business, as well as to assist in the evaluation of underlying trends in our business.

Adjusted OI w/SBC is our primary performance measure, which excludes certain expenses and charges, including the non-cash amortization expense resulting from the acquisition of intangible assets, as we believe these may not be indicative of the Company’s core business operating results. We intentionally include stock-based compensation expense in this measure as we believe it better captures the economic costs of our business.

Management uses this non-GAAP financial measure to understand and compare operating results across accounting periods, for internal budgeting and forecasting purposes, to evaluate financial performance, and in our comparison of our financial results to those of other companies. It is also a significant performance measure in certain of our executive incentive compensation programs.

Adjusted OI w/SBC is defined as operating income adjusted for the following: amortization of purchased intangibles, expense (income) relating to deferred compensation plan liabilities, acquisition expenses, and realignment expenses (income), for the respective periods.

Adjusted OI w/SBC margin is calculated by dividing Adjusted OI w/SBC by total revenues.

Adjusted operating income

Adjusted operating income is a non-GAAP financial measure that we believe is useful to investors in making comparisons to other companies, although this measure may not be directly comparable to similar measures used by other companies.

Adjusted operating income is defined as operating income adjusted for the following: amortization of purchased intangibles, expense (income) relating to deferred compensation plan liabilities, acquisition expenses, realignment expenses (income), and stock‑based compensation expense, for the respective periods.

Adjusted net income and Adjusted EPS

Adjusted net income and Adjusted EPS are non-GAAP financial measures presenting the earnings generated by our ongoing operations that we believe is useful to investors in making meaningful comparisons to other companies, although these measures may not be directly comparable to similar measures used by other companies, and period-over-period comparisons.

Adjusted net income is defined as net income adjusted for the following: amortization of purchased intangibles, stock‑based compensation expense, expense (income) relating to deferred compensation plan liabilities, acquisition expenses, realignment expenses (income), other non‑operating (income) expense, net, the tax effect of the above adjustments to net income, and equity in net (income) losses of investees, net of tax, for the respective periods. The income tax effect of non‑GAAP adjustments was determined using the applicable rates in the taxing jurisdictions in which income or expense occurred, and represent both current and deferred income tax expense or benefit based on the nature of the non‑GAAP adjustments, including the tax effects of non‑cash stock‑based compensation expense.

Adjusted EPS is calculated as Adjusted net income, less net income attributable to participating securities, plus interest expense, net of tax, attributable to the convertible senior notes using the if‑converted method, if applicable, (numerator) divided by Adjusted weighted average shares, diluted (denominator). Adjusted weighted average shares, diluted is calculated by adding incremental shares related to the dilutive effect of convertible senior notes using the if‑converted method, if applicable, to weighted average shares, diluted.

Adjusted EBITDA

Adjusted EBITDA is our liquidity measure in the context of conversion of Adjusted EBITDA to cash flow from operations (i.e., the ratio of GAAP cash flow from operations to Adjusted EBITDA). We believe this non-GAAP financial measure provides a meaningful measure of liquidity and a useful basis for assessing our ability to repay debt, make strategic acquisitions and investments, and return capital to investors.

Adjusted EBITDA is defined as cash flow from operations adjusted for the following: cash interest, cash taxes, cash deferred compensation plan distributions, cash acquisition expenses, cash realignment costs, changes in operating assets and liabilities, and other cash items (such as those related to our interest rate swap). From time to time, we may exclude from Adjusted EBITDA the impact of certain cash receipts or payments that affect period-to-period comparability.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

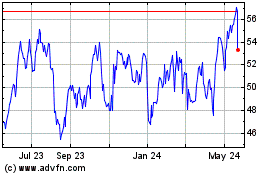

Bentley Systems (NASDAQ:BSY)

Historical Stock Chart

From Oct 2024 to Nov 2024

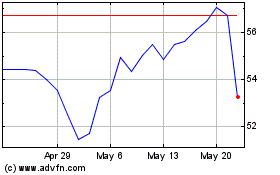

Bentley Systems (NASDAQ:BSY)

Historical Stock Chart

From Nov 2023 to Nov 2024