BTCS Utilizes Rocket Pool to Drive Revenue Growth and Enhance Margins

January 15 2025 - 7:05AM

BTCS Inc. (Nasdaq: BTCS) (“BTCS” or the “Company”), a leader in

blockchain infrastructure and technology, today announced the

deployment of its Scaled Validator Implementation Plan. This

strategic initiative is designed to drive revenue growth and

improve margins, aligning with BTCS’s commitment to innovation and

operational efficiency in the blockchain sector.

Over the past five months, BTCS has conducted an

extensive due diligence process on Rocket Pool, a decentralized

Ethereum-based liquid staking protocol. This evaluation included a

thorough assessment of auditability, compliance, cybersecurity,

infrastructure integrity, and potential business risks and rewards

to ensure a secure and scalable validator implementation. As part

of this comprehensive review, BTCS completed a pilot program and

has now expanded to 320 validators participating in Rocket Pool’s

liquid staking pool, marking a significant step in expanding the

company’s validator node operations.

Potential Revenue Impact

According to internal analysis, BTCS projects

vertically integrated validator revenue increases of up to 10%,

boosting its position in the sector. This approach is designed to

optimize the number of active validators and increase total

revenue, reinforcing BTCS’s commitment to scaling operations

efficiently and maximizing profitability.

Commitment to Diversification and

Growth

BTCS plans to broaden its validator partnerships

and diversify its technology providers to support long-term,

scalable revenue growth. “This initiative represents a pivotal step

toward our goal of scaling blockchain infrastructure to drive

revenue growth,” said Charles Allen, CEO of BTCS. “Our

comprehensive approach ensures we prioritize security, compliance,

and performance at every stage. This initiative underscores our

dedication to enhancing our operations while delivering value to

our shareholders.”

About BTCS:

BTCS Inc. (Nasdaq: BTCS) is a U.S.-based

blockchain infrastructure technology company currently focused on

driving scalable revenue growth through its Ethereum blockchain

infrastructure operations. BTCS has honed its expertise in Ethereum

network operations, particularly in block building and validator

node management. Its branded block-building operation, Builder+,

leverages advanced algorithms to optimize block construction for

on-chain validation, thus maximizing gas fee revenues. BTCS also

supports other blockchain networks by operating validator nodes and

staking its crypto assets across multiple proof-of-stake networks,

allowing crypto holders to delegate assets to BTCS-managed nodes.

In addition, the Company has developed ChainQ, an AI-powered

blockchain data analytics platform, which enhances user access and

engagement within the blockchain ecosystem. Committed to innovation

and adaptability, BTCS is strategically positioned to expand its

blockchain operations and infrastructure beyond Ethereum as the

ecosystem evolves. Explore how BTCS is revolutionizing

blockchain infrastructure in the public markets by

visiting www.btcs.com.

Forward-Looking Statements:

Certain statements in this press release

constitute “forward-looking statements” within the meaning of the

federal securities laws, including statements regarding our ability

to increase validator revenue by 10% and improve margins, increase

total revenue, and deliver value to our shareholders. Words such as

“may,” “might,” “will,” “should,” “believe,” “expect,”

“anticipate,” “estimate,” “continue,” “predict,” “forecast,”

“project,” “plan,” “intend” or similar expressions, or statements

regarding intent, belief, or current expectations, are

forward-looking statements. While the Company believes these

forward-looking statements are reasonable, undue reliance should

not be placed on any such forward-looking statements, which are

based on information available to us on the date of this release.

These forward-looking statements are based upon assumptions and are

subject to various risks and uncertainties, including without

limitation regulatory issues, unexpected issues with Builder+,

unexpected issues with ChainQ, and the reluctance of validators to

try or utilize our Builder+ product, as well as risks set forth in

the Company’s filings with the Securities and Exchange Commission

including its Form 10-K for the year ended December 31, 2023 which

was filed on March 21, 2024. Thus, actual results could be

materially different. The Company expressly disclaims any

obligation to update or alter statements, whether as a result of

new information, future events, or otherwise, except as required by

law.

Investor Relations:Charles Allen – CEOX (formerly Twitter):

@Charles_BTCSEmail: ir@btcs.com

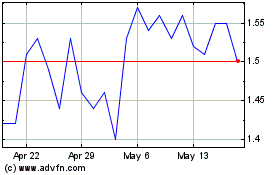

BTCS (NASDAQ:BTCS)

Historical Stock Chart

From Feb 2025 to Mar 2025

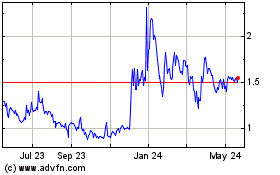

BTCS (NASDAQ:BTCS)

Historical Stock Chart

From Mar 2024 to Mar 2025