false

0001603454

0001603454

2024-11-14

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 14, 2024

Celcuity

Inc.

(Exact

name of Registrant as Specified in its Charter)

| Delaware |

|

001-38207 |

|

82-2863566 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

16305

36th Avenue North; Suite 100

Minneapolis, Minnesota 55446

(Address

of Principal Executive Offices and Zip Code)

(763)

392-0767

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.001 par

value per share |

|

CELC |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On

November 14, 2024, Celcuity Inc. (the “Company”) issued a press release regarding the Company’s financial results for

the third quarter ended September 30, 2024. A copy of the Company’s press release is furnished as Exhibit 99.1 to this report and

is incorporated herein by reference.

The

information in this Item 2.02, including the accompanying exhibit, is being furnished and shall not be deemed “filed” for

the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that Section. The information in this Item 2.02 shall not be incorporated by referenced into any filing pursuant

to the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

November 14, 2024

| |

CELCUITY

INC. |

| |

|

| |

By: |

/s/

Brian F. Sullivan |

| |

|

Brian F. Sullivan |

| |

|

Chief Executive Officer |

Exhibit

99.1

Celcuity

Inc. Reports Third Quarter Financial Results and Provides Corporate Update

| - | The

PIK3CA wild-type cohort of the Phase 3 VIKTORIA-1 trial is 100% enrolled; expect to report

topline data for this cohort in late Q1 2025 or Q2 2025 |

| | | |

| - | Approximately

$264 million in cash, cash equivalents and investments at end of Q3 2024 expected to fund

current clinical development program activities through 2026 |

| | | |

| - | Management

to host webcast and conference call today, November 14, 2024, at 4:30 p.m. ET |

MINNEAPOLIS,

November 14, 2024 — Celcuity Inc. (Nasdaq: CELC), a clinical-stage biotechnology company pursuing development of targeted therapies

for oncology, today announced financial results for the third quarter ended September 30, 2024 and other recent business developments.

“Enrollment

in our VIKTORIA-1 study remains robust and on-track. The PIK3CA wild-type cohort is 100% enrolled, and enrollment in the PIK3CA

mutant cohort is on plan,” said Brian Sullivan, CEO and co-founder of Celcuity. “Based on our current forecast of reaching

the event thresholds that will trigger primary analysis in both the PIK3CA wild-type and mutant cohorts, we expect to report topline

data for the PIK3CA wild-type cohort sometime in late Q1 2025 or during Q2 2025 and to report topline data for the PIK3CA

mutant cohort in the second half of 2025.”

Third

Quarter 2024 Business Highlights and Other Recent Developments

| ● | The

VIKTORIA-1 Phase 3 clinical trial expects to provide topline data for the PIK3CA wild-type

cohort in late Q1 2025 or during Q2 2025 and for the PIK3CA mutant cohort in the second

half of 2025. |

| ○ | VIKTORIA-1

is evaluating gedatolisib in combination with fulvestrant with and without palbociclib in

adults with HR+, HER2- advanced breast cancer who have received prior treatment with a CDK4/6

inhibitor. |

| ○ | The

PIK3CA wild-type cohort is 100% enrolled and enrollment of the PIK3CA mutant

cohort is on-track relative to plan. |

| ● | The

VIKTORIA-2 Phase 3 clinical trial remains on track to enroll its first patient in Q2 2025. |

| ○ | The

VIKTORIA-2 study is a global Phase 3 open-label randomized clinical trial evaluating the

efficacy and safety of gedatolisib in combination with fulvestrant plus a CDK4/6 inhibitor,

either ribociclib or palbociclib, in comparison to fulvestrant plus a CDK4/6 inhibitor as

a first-line treatment for patients with HR+/HER2- advanced breast cancer who are endocrine

therapy resistant. |

| ○ | Prior

to the initiation of the Phase 3 portion of the trial, a safety run-in study will be conducted

in 12-36 participants to assess the safety profile of gedatolisib in combination with ribociclib

and fulvestrant. |

| ○ | Site

qualification activities to support activation of up to 200 sites across North America, Europe,

Latin America, and Asia are on track. |

| ● | The

Phase 1b/2 clinical trial, evaluating gedatolisib in combination with darolutamide for the

treatment of patients with metastatic castration resistant prostate cancer (mCRPC), is ongoing

and expected to report preliminary data in Q2 2025. |

| ● | Overall

survival data from the B2151009 Phase 1b clinical trial will be presented at the San Antonio

Breast Cancer Symposium (SABCS), taking place December 10-13, 2024. Details of the poster

presentation are as follows: |

| ○ | Abstract

Title: Overall survival in patients with HR+/HER2- advanced breast cancer treated in a phase

1b trial evaluating gedatolisib in combination with palbociclib and endocrine therapy (SESS-1510) |

| ○ | Presentation

Number: P4-08-25 |

| ○ | Date/Time:

Thursday, December 12, 5:30 PM CST |

| ● | Additional

nonclinical data further characterizing the mechanism of action of gedatolisib and its effect

on breast cancer cell metabolic functions will also be presented at the SABCS. |

| ○ | Abstract

Title: Mechanism of action of gedatolisib in combination with fulvestrant and/or palbociclib

in estrogen receptor positive breast cancer models (SESS-989) |

| ○ | Abstract

Title: Different effects of gedatolisib versus single-node PI3K/AKT/mTOR pathway inhibitors

on breast cancer cell metabolic functions (SESS-997) |

| ● | In

October, Cancers published results of nonclinical studies in gynecological cancer

cell line models highlighting the differences between single-node inhibitors of the PI3K/AKT/mTOR

pathway and gedatolisib. The published manuscript is available online and on the publications

section of Celcuity’s website. |

Third

Quarter 2024 Financial Results

Unless

otherwise stated, all comparisons are for the third quarter ended September 30, 2024, compared to the third quarter ended September 30,

2023.

Total

operating expenses were $30.1 million for the third quarter of 2024, compared to $18.9 million for the third quarter of 2023.

Research

and development (R&D) expenses were $27.6 million for the third quarter of 2024, compared to $17.5 million for the prior-year period.

Of the approximately $10.1 million increase in R&D expenses, $6.3 million primarily related to activities supporting the VIKTORIA-1

Phase 3 trial, the Phase 1b/2 trial and the initiation of the VIKTORIA-2 Phase 3 trial, and $3.8 million was related to increased employee

and consulting expenses.

General

and administrative (G&A) expenses were $2.5 million for the third quarter of 2024, compared to $1.4 million for the prior-year period.

Employee and consulting related expenses accounted for $0.9 million of the increase. Professional fees and other administrative expenses

accounted for the remaining increase of approximately $0.2 million.

Net

loss for the third quarter of 2024 was $29.8 million, or $0.70 loss per share, compared to a net loss of $18.4 million, or $0.83 loss

per share, for the third quarter of 2023. Non-GAAP adjusted net loss for the third quarter of 2024 was $27.6 million, or $0.65 loss per

share, compared to non-GAAP adjusted net loss of $17.3 million, or $0.78 loss per share, for the third quarter of 2023. Non-GAAP adjusted

net loss excludes stock-based compensation expense, non-cash interest expense, and non-cash interest income. Because these items have

no impact on Celcuity’s cash position, management believes non-GAAP adjusted net loss better enables Celcuity to focus on cash

used in operations. For a reconciliation of financial measures calculated in accordance with generally accepted accounting principles

in the United States (GAAP) to non-GAAP financial measures, please see the financial tables at the end of this press release.

Net

cash used in operating activities for the third quarter of 2024 was $20.6 million, compared to $12.7 million for the third quarter of

2023.

At

September 30, 2024, Celcuity reported cash, cash equivalents and short-term investments of $264.1 million.

Webcast

and Conference Call Information

The

Celcuity management team will host a webcast/conference call at 4:30 p.m. ET today to discuss the third quarter 2024 financial results

and provide a corporate update. To participate in the teleconference, domestic callers should dial 1-800-717-1738 or 1-646-307-1865.

A live webcast presentation can also be accessed using this weblink: https://viavid.webcasts.com/starthere.jsp?ei=1688854&tp_key=0b14db1255.

A replay of the webcast will be available on the Celcuity website following the live event.

About

Celcuity

Celcuity

is a clinical-stage biotechnology company focused on development of targeted therapies for treatment of multiple solid tumor indications.

The company’s lead therapeutic candidate is gedatolisib, a potent, pan-PI3K and mTOR inhibitor. Its mechanism of action and pharmacokinetic

properties are highly differentiated from other currently approved and investigational therapies that target PI3K or mTOR alone or together.

A Phase 3 clinical trial, VIKTORIA-1, evaluating gedatolisib in combination with fulvestrant with or without palbociclib in patients

with HR+/HER2- advanced breast cancer is currently enrolling patients. More detailed information about the VIKTORIA-1 study can be found

at ClinicalTrials.gov. A Phase 1b/2 clinical trial, CELC-G-201, evaluating gedatolisib in combination with darolutamide in patients

with metastatic castration resistant prostate cancer, is enrolling patients. A Phase 3 clinical trial, VIKTORIA-2, evaluating gedatolisib

plus a CDK4/6 inhibitor and fulvestrant as first-line treatment for patients with HR+/HER2- advanced breast cancer is expected to begin

enrolling patients in the second quarter of 2025. Celcuity is headquartered in Minneapolis. Further information about Celcuity can be

found at www.celcuity.com. Follow us on LinkedIn and Twitter.

Forward-Looking

Statements

This

press release contains statements that constitute “forward-looking statements” including, but not limited to, the design

of our clinical trials; the timing of initiating and enrolling patients in, and receiving results and data from, our clinical trials;

the costs and expected results from any ongoing or planned clinical trials; the market opportunity for gedatolisib; revenue expectations;

our strategy, marketing and commercialization plans, including the benefits of strategic decisions regarding studies and trials; other

expectations with respect to Celcuity’s lead product candidate, gedatolisib, and its CELsignia platform; our anticipated use of

cash; and the strength of our balance sheet. In some cases, you can identify forward-looking statements by terminology such as “may,”

“should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “potential,” “intends” or “continue,” and other similar expressions that

are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. Forward-looking

statements are subject to numerous risks, uncertainties, and conditions, many of which are beyond the control of Celcuity. These include,

but are not limited to, unforeseen delays in our clinical trials, our ability to obtain and maintain regulatory approvals to commercialize

our products, and the market acceptance of such products, the development of therapies and tools competitive with our products, our ability

to access capital upon favorable terms or at all, and those risks set forth in the Risk Factors section in Celcuity’s Annual Report

on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission on March 27, 2024. Readers are cautioned

not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Celcuity undertakes no obligation

to update these statements for revisions or changes after the date of this press release, except as required by law.

View

source version of release on GlobeNewswire.com

Contacts:

Celcuity

Inc.

Brian Sullivan, bsullivan@celcuity.com

Vicky Hahne, vhahne@celcuity.com

(763) 392-0123

ICR

Healthcare

Patti

Bank, patti.bank@icrhealthcare.com

(415)

513-1284

Celcuity Inc.

Condensed

Balance Sheets

| | |

September 30, 2024 | | |

December 31, 2023 | |

| | |

(unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 12,603,289 | | |

$ | 30,662,774 | |

| Investments | |

| 251,455,468 | | |

| 149,919,974 | |

| Other current assets | |

| 8,379,682 | | |

| 10,007,849 | |

| Total current assets | |

| 272,438,439 | | |

| 190,590,597 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 338,787 | | |

| 228,782 | |

| Operating lease right-of-use assets | |

| 259,744 | | |

| 400,019 | |

| Total Assets | |

$ | 273,036,970 | | |

$ | 191,219,398 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’ Equity: | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 9,158,778 | | |

$ | 5,076,699 | |

| Operating lease liabilities | |

| 175,226 | | |

| 184,950 | |

| Accrued expenses | |

| 16,974,725 | | |

| 8,927,094 | |

| Total current liabilities | |

| 26,308,729 | | |

| 14,188,743 | |

| Operating lease liabilities | |

| 95,699 | | |

| 225,922 | |

| Note payable, non-current | |

| 96,923,914 | | |

| 37,035,411 | |

| Total Liabilities | |

| 123,328,342 | | |

| 51,450,076 | |

| Total Stockholders’ Equity | |

| 149,708,628 | | |

| 139,769,322 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 273,036,970 | | |

$ | 191,219,398 | |

Celcuity Inc.

Condensed Statements of Operations

(unaudited)

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

$ | 27,587,483 | | |

$ | 17,488,236 | | |

$ | 70,732,017 | | |

$ | 42,512,811 | |

| General and administrative | |

| 2,472,416 | | |

| 1,409,801 | | |

| 6,104,803 | | |

| 3,988,248 | |

| Total operating expenses | |

| 30,059,899 | | |

| 18,898,037 | | |

| 76,836,820 | | |

| 46,501,059 | |

| Loss from operations | |

| (30,059,899 | ) | |

| (18,898,037 | ) | |

| (76,836,820 | ) | |

| (46,501,059 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other (expense) income | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (3,343,989 | ) | |

| (1,372,132 | ) | |

| (7,005,284 | ) | |

| (3,929,140 | ) |

| Interest income | |

| 3,612,099 | | |

| 1,865,629 | | |

| 8,716,040 | | |

| 5,499,555 | |

| Other income, net | |

| 268,110 | | |

| 493,497 | | |

| 1,710,756 | | |

| 1,570,415 | |

| Net loss before income taxes | |

| (29,791,789 | ) | |

| (18,404,540 | ) | |

| (75,126,064 | ) | |

| (44,930,644 | ) |

| Income tax benefits | |

| - | | |

| - | | |

| - | | |

| - | |

| Net loss | |

$ | (29,791,789 | ) | |

$ | (18,404,540 | ) | |

$ | (75,126,064 | ) | |

$ | (44,930,644 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share, basic and diluted | |

$ | (0.70 | ) | |

$ | (0.83 | ) | |

$ | (1.96 | ) | |

$ | (2.05 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding, basic and diluted | |

| 42,793,047 | | |

| 22,117,626 | | |

| 38,299,548 | | |

| 21,920,147 | |

Cautionary

Statement Regarding Non-GAAP Financial Measures

This

press release contains references to non-GAAP adjusted net loss and non-GAAP adjusted net loss per share. Management believes these non-GAAP

financial measures are useful supplemental measures for planning, monitoring, and evaluating operational performance, as they exclude

stock-based compensation expense, non-cash interest expense, and non-cash interest income from net loss and net loss per share. Management

excludes these items because they do not impact Celcuity’s cash position, which management believes better enables Celcuity to

focus on cash used in operations. However, non-GAAP adjusted net loss and non-GAAP adjusted net loss per share are not recognized measures

under GAAP and do not have a standardized meaning prescribed by GAAP. As a result, management’s method of calculating non-GAAP

adjusted net loss and non-GAAP adjusted net loss per share may differ materially from the method used by other companies. Therefore,

non-GAAP adjusted net loss and non-GAAP adjusted net loss per share may not be comparable to similarly titled measures presented by other

companies. Investors are cautioned that non-GAAP adjusted net loss and non-GAAP adjusted net loss per share should not be construed as

alternatives to net loss, net loss per share or other statements of operations data (which are determined in accordance with GAAP) as

an indicator of Celcuity’s performance or as a measure of liquidity and cash flows.

Celcuity Inc.

Reconciliation of GAAP Net Loss to Non-GAAP Adjusted Net Loss and

GAAP Net Loss Per Share to Non-GAAP Adjusted Net Loss Per Share

| | |

Three Months Ended

September 30, | | |

Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| GAAP net loss | |

$ | (29,791,789 | ) | |

$ | (18,404,540 | ) | |

$ | (75,126,064 | ) | |

$ | (44,930,644 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Stock-based compensation | |

| | | |

| | | |

| | | |

| | |

| Research and development (1) | |

| 1,190,424 | | |

| 660,706 | | |

| 3,000,641 | | |

| 1,954,689 | |

| General and administrative (2) | |

| 740,777 | | |

| 447,931 | | |

| 1,672,418 | | |

| 1,704,213 | |

| Non-cash interest expense (3) | |

| 730,741 | | |

| 520,794 | | |

| 1,891,139 | | |

| 1,523,699 | |

| Non-cash interest income (4) | |

| (473,584 | ) | |

| (480,520 | ) | |

| (1,112,420 | ) | |

| (439,331 | ) |

| Non-GAAP adjusted net loss | |

$ | (27,603,431 | ) | |

$ | (17,255,629 | ) | |

$ | (69,674,286 | ) | |

$ | (40,187,374 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| GAAP net loss per share - basic and diluted | |

$ | (0.70 | ) | |

$ | (0.83 | ) | |

$ | (1.96 | ) | |

$ | (2.05 | ) |

| Adjustment to net loss (as detailed above) | |

| 0.05 | | |

| 0.05 | | |

| 0.14 | | |

| 0.22 | |

| Non-GAAP adjusted net loss per share | |

$ | (0.65 | ) | |

$ | (0.78 | ) | |

$ | (1.82 | ) | |

$ | (1.83 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding, basic and diluted | |

| 42,793,047 | | |

| 22,117,626 | | |

| 38,299,548 | | |

| 21,920,147 | |

| (1) |

To reflect a non-cash charge to operating expense for Research

and Development stock-based compensation. |

| (2) |

To reflect a non-cash charge to operating expense for General

and Administrative stock-based compensation. |

| (3) |

To reflect a non-cash charge to other expense for amortization

of debt issuance and discount costs and PIK interest related to the issuance of a note payable. |

| (4) |

To reflect a non-cash adjustment to other income for accretion

on investments. |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

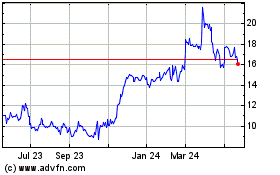

Celcuity (NASDAQ:CELC)

Historical Stock Chart

From Mar 2025 to Apr 2025

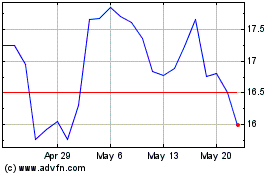

Celcuity (NASDAQ:CELC)

Historical Stock Chart

From Apr 2024 to Apr 2025