Coca‑Cola Consolidated, Inc. (NASDAQ: COKE) today reported

operating results for the third quarter ended September 27,

2024 and the first nine months of fiscal 2024.

“Our third quarter results reflect our steady focus on the

operating fundamentals of our business. Strong commercial execution

against our world class beverage portfolio, disciplined expense

management and building on our purpose-driven culture are at the

core of what we do every day,” said J. Frank Harrison, III,

Chairman and Chief Executive Officer. “Our continued solid growth

is a testament to the dedication of our teammates and our

commitment to reinvest in our business to build long-term

value.”

“While we are pleased with our operating results, our teammates

and the communities we serve in Western North Carolina and Eastern

Tennessee have suffered incredible loss as a result of Hurricane

Helene,” Mr. Harrison continued. “Supporting our local communities

is foundational to our culture and our Company. We are actively

supporting the impacted areas as we partner with relief

organizations to help our teammates, customers and communities

recover from the destruction.”

Net sales increased 3.1% to $1.8 billion in the third

quarter of 2024 and increased 2.6% to $5.2 billion in the first

nine months of 2024. Sparkling and Still net sales increased 5.8%

and 1.7%, respectively, compared to the third quarter of 2023. The

net sales improvement was driven by Sparkling volume growth and

pricing actions taken during the first quarter of 2024.

Standard physical case volume was down 2.1% in the third quarter

of 2024 and down 1.3% in the first nine months of the year. For the

first nine months of 2024, comparable(b) standard physical case

volume decreased 0.9% compared to the first nine months of 2023,

which included one additional selling day. Sparkling category

volume increased 0.8% during the third quarter with continued

strong performance of multi-serve can packages sold in larger

retail stores. Still category physical case volume declined 9.7%

during the third quarter of 2024.

As noted in our second quarter 2024 results, we have shifted the

distribution of casepack Dasani water sold in Walmart stores to a

non-direct store delivery (DSD) method of distribution. As a

result, these cases are not included in our 2024 reported case

sales. The 2024 impact of this distribution change reduced our

reported case sales by 1.8% during the third quarter and 0.9%

during the first nine months.

“Our third quarter results reflect the power of Sparkling volume

growth, margin improvement and continued strong commercial

execution,” said Dave Katz, President and Chief Operating Officer.

“Our Sparkling revenue grew nearly 6% this quarter reflecting the

strength of our brands and the success of our price and package

strategy. While we have opportunities to improve the performance of

our Dasani and BodyArmor brands, we’re excited about upcoming Still

category offerings designed to strengthen this segment of our

business.”

Gross profit in the third quarter of 2024 was

$698.0 million, an increase of $36.5 million or 5.5%.

Gross margin improved 90 basis points to 39.5%. Pricing

actions taken during the first quarter of 2024 along with stable

commodity prices contributed to the overall improvement in gross

margin. Additionally, our product mix shifted towards Sparkling

beverages, which typically carry higher gross margins, during the

third quarter of 2024. Gross profit in the first nine months of

2024 was $2.1 billion, an increase of $98.1 million or 5.0%.

“Our strong, consistent cash flow has allowed us to continue to

reinvest in the business, strengthening our supply chain and

supporting the Company’s overall growth,” Mr. Katz continued.

“During the quarter, we completed the purchase of our leased

production facility in Nashville, Tennessee for $56 million.

We now own all of our production facilities, which we believe to be

strategic assets in our operations.”

Selling, delivery and administrative (“SD&A”) expenses in

the third quarter of 2024 increased $25.7 million, or 5.8%.

SD&A expenses as a percentage of net sales increased

70 basis points to 26.7% in the third quarter of 2024. The

increase in SD&A expenses as compared to the third quarter of

2023 was primarily driven by an increase in labor costs, mostly

related to annual wage adjustments and increased incentive

compensation accruals reflecting the strong operating performance

in 2024. SD&A expenses in the first nine months of 2024

increased $52.5 million or 4.0%. SD&A expenses as a percentage

of net sales in the first nine months of 2024 increased 40 basis

points to 26.3% as compared to the first nine months of 2023.

Income from operations in the third quarter of 2024 was

$227.1 million, compared to $216.3 million in the third

quarter of 2023, an increase of 5.0%. For the first nine months of

2024, income from operations increased $45.6 million to

$701.6 million, an increase of 7.0%. Operating margin for the

first nine months of 2024 was 13.6% as compared to 13.1% for the

first nine months of 2023, an increase of 50 basis points.

Net income in the third quarter of 2024 was $115.6 million,

compared to $92.1 million in the third quarter of 2023, an

improvement of $23.5 million. Net income for the third quarter

of 2024 and the third quarter of 2023 was adversely impacted by

routine, non-cash fair value adjustments to our acquisition related

contingent consideration liability, driven by increases in the

future cash flow projections and changes to the discount rate used

to compute the fair value of the liability.

Net income in the first nine months of 2024 was

$454.2 million, compared to $332.5 million in the first

nine months of 2023, an increase of $121.6 million. On an

adjusted(b) basis, net income in the first nine months of 2024 was

$521.9 million, compared to $488.3 million in the first

nine months of 2023, an increase of $33.6 million. Net income

for the first nine months of 2023 was adversely impacted by the

settlement of our primary pension plan benefit liabilities during

the prior year, which resulted in a non-cash charge of

$117.1 million. Income tax expense for the first nine months

of 2024 was $156.4 million, compared to $112.4 million

for the first nine months of 2023, resulting in an effective income

tax rate of 25.6% and 25.3% for the first nine months of 2024 and

2023, respectively.

Cash flows provided by operations for the first nine months of

2024 were $707.9 million, compared to $644.5 million for

the first nine months of 2023. Cash flows from operations reflected

our strong operating performance during the first nine months of

2024. In the first nine months of 2024, we invested

$287 million in capital expenditures as we continue to enhance

our supply chain and invest for future growth. During the quarter,

we purchased our leased Nashville, Tennessee production facility

for approximately $56.0 million. For the full year of 2024, we

expect capital expenditures to total approximately

$350 million.

(a) All comparisons are to the corresponding period in the prior

year unless specified otherwise.(b) The discussion of the operating

results for the third quarter ended September 27, 2024 and the

first nine months of fiscal 2024 includes selected non-GAAP

financial information, such as “comparable” and “adjusted” results.

The schedules in this news release reconcile such non-GAAP

financial measures to the most directly comparable GAAP financial

measures.

|

CONTACTS: |

|

|

|

Brian K. Little (Media) |

|

Scott Anthony (Investors) |

| Vice

President, Corporate Communications Officer |

|

Executive Vice President & Chief Financial Officer |

| (980) 378-5537 |

|

(704) 557-4633 |

|

Brian.Little@cokeconsolidated.com |

|

Scott.Anthony@cokeconsolidated.com |

| |

A PDF accompanying this release is available

at: http://ml.globenewswire.com/Resource/Download/45b47614-4499-4af7-9d22-6ad5e5781d95

About Coca-Cola Consolidated, Inc.

Headquartered in Charlotte, N.C., Coca‑Cola Consolidated

(NASDAQ: COKE) is the largest Coca‑Cola bottler in the United

States. We make, sell and distribute beverages of

The Coca‑Cola Company and other partner companies in more

than 300 brands and flavors across 14 states and the

District of Columbia, to approximately 60 million consumers.

For over 122 years, we have been deeply committed to the

consumers, customers and communities we serve and passionate about

the broad portfolio of beverages and services we offer. Our Purpose

is to honor God in all we do, to serve others, to pursue excellence

and to grow profitably.

More information about the Company is available at

www.cokeconsolidated.com. Follow Coca‑Cola Consolidated on

Facebook, X, Instagram and LinkedIn.

Cautionary Note Regarding Forward-Looking

Statements

Certain statements contained in this news release are

“forward-looking statements” that involve risks and uncertainties

which we expect will or may occur in the future and may impact our

business, financial condition and results of operations. The words

“anticipate,” “believe,” “expect,” “intend,” “project,” “may,”

“will,” “should,” “could” and similar expressions are intended to

identify those forward-looking statements. These forward-looking

statements reflect the Company’s best judgment based on current

information, and, although we base these statements on

circumstances that we believe to be reasonable when made, there can

be no assurance that future events will not affect the accuracy of

such forward-looking information. As such, the forward-looking

statements are not guarantees of future performance, and actual

results may vary materially from the projected results and

expectations discussed in this news release. Factors that might

cause the Company’s actual results to differ materially from those

anticipated in forward-looking statements include, but are not

limited to: increased costs (including due to inflation),

disruption of supply or unavailability or shortages of raw

materials, fuel and other supplies; the reliance on purchased

finished products from external sources; changes in public and

consumer perception and preferences, including concerns related to

product safety and sustainability, artificial ingredients, brand

reputation and obesity; changes in government regulations related

to nonalcoholic beverages, including regulations related to

obesity, public health, artificial ingredients and product safety

and sustainability; decreases from historic levels of marketing

funding support provided to us by The Coca‑Cola Company

and other beverage companies; material changes in the performance

requirements for marketing funding support or our inability to meet

such requirements; decreases from historic levels of advertising,

marketing and product innovation spending by

The Coca‑Cola Company and other beverage companies, or

advertising campaigns that are negatively perceived by the public;

any failure of the several Coca‑Cola system governance entities of

which we are a participant to function efficiently or on our best

behalf and any failure or delay of ours to receive anticipated

benefits from these governance entities; provisions in our beverage

distribution and manufacturing agreements with

The Coca‑Cola Company that could delay or prevent a

change in control of us or a sale of our Coca‑Cola distribution or

manufacturing businesses; the concentration of our capital stock

ownership; our inability to meet requirements under our beverage

distribution and manufacturing agreements; changes in the inputs

used to calculate our acquisition related contingent consideration

liability; technology failures or cyberattacks on our information

technology systems or our effective response to technology failures

or cyberattacks on our customers’, suppliers’ or other third

parties’ information technology systems; unfavorable changes in the

general economy; the concentration risks among our customers and

suppliers; lower than expected net pricing of our products

resulting from continued and increased customer and competitor

consolidations and marketplace competition; the effect of changes

in our level of debt, borrowing costs and credit ratings on our

access to capital and credit markets, operating flexibility and

ability to obtain additional financing to fund future needs; the

failure to attract, train and retain qualified employees while

controlling labor costs, and other labor issues; the failure to

maintain productive relationships with our employees covered by

collective bargaining agreements, including failing to renegotiate

collective bargaining agreements; changes in accounting standards;

our use of estimates and assumptions; changes in tax laws,

disagreements with tax authorities or additional tax liabilities;

changes in legal contingencies; natural disasters, changing weather

patterns and unfavorable weather; climate change or legislative or

regulatory responses to such change; and the impact of any pandemic

or public health situation. These and other factors are discussed

in the Company’s regulatory filings with the United States

Securities and Exchange Commission, including those in “Item 1A.

Risk Factors” of the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023. The forward-looking

statements contained in this news release speak only as of this

date, and the Company does not assume any obligation to update

them, except as may be required by applicable law.

| |

| FINANCIAL

STATEMENTSCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED) |

| |

| |

|

Third Quarter |

|

First Nine Months |

|

(in thousands, except per share data) |

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

| Net sales |

|

$ |

1,765,652 |

|

$ |

1,712,428 |

|

|

$ |

5,153,221 |

|

|

$ |

5,022,902 |

| Cost of sales |

|

|

1,067,616 |

|

|

1,050,878 |

|

|

|

3,097,916 |

|

|

|

3,065,669 |

| Gross profit |

|

|

698,036 |

|

|

661,550 |

|

|

|

2,055,305 |

|

|

|

1,957,233 |

| Selling, delivery and

administrative expenses |

|

|

470,981 |

|

|

445,290 |

|

|

|

1,353,704 |

|

|

|

1,301,249 |

| Income from operations |

|

|

227,055 |

|

|

216,260 |

|

|

|

701,601 |

|

|

|

655,984 |

| Interest expense (income),

net |

|

|

2,187 |

|

|

(1,516 |

) |

|

|

(2,149 |

) |

|

|

2,766 |

| Pension plan settlement

expense |

|

|

— |

|

|

77,319 |

|

|

|

— |

|

|

|

117,096 |

| Other expense, net |

|

|

69,305 |

|

|

19,473 |

|

|

|

93,127 |

|

|

|

91,184 |

| Income before taxes |

|

|

155,563 |

|

|

120,984 |

|

|

|

610,623 |

|

|

|

444,938 |

| Income tax expense |

|

|

39,939 |

|

|

28,891 |

|

|

|

156,446 |

|

|

|

112,399 |

| Net

income |

|

$ |

115,624 |

|

$ |

92,093 |

|

|

$ |

454,177 |

|

|

$ |

332,539 |

| |

|

|

|

|

|

|

|

|

| Basic net income per

share: |

|

|

|

|

|

|

|

|

| Common Stock |

|

$ |

13.20 |

|

$ |

9.82 |

|

|

$ |

49.71 |

|

|

$ |

35.47 |

| Weighted average number of

Common Stock shares outstanding |

|

|

7,756 |

|

|

8,369 |

|

|

|

8,141 |

|

|

|

8,369 |

| |

|

|

|

|

|

|

|

|

| Class B Common Stock |

|

$ |

13.20 |

|

$ |

9.82 |

|

|

$ |

49.25 |

|

|

$ |

35.47 |

| Weighted average number of

Class B Common Stock shares outstanding |

|

|

1,005 |

|

|

1,005 |

|

|

|

1,005 |

|

|

|

1,005 |

| |

|

|

|

|

|

|

|

|

| Diluted net income per

share: |

|

|

|

|

|

|

|

|

| Common Stock |

|

$ |

13.18 |

|

$ |

9.80 |

|

|

$ |

49.59 |

|

|

$ |

35.38 |

| Weighted average number of

Common Stock shares outstanding – assuming dilution |

|

|

8,772 |

|

|

9,395 |

|

|

|

9,158 |

|

|

|

9,398 |

| |

|

|

|

|

|

|

|

|

| Class B Common Stock |

|

$ |

13.18 |

|

$ |

9.79 |

|

|

$ |

49.00 |

|

|

$ |

35.29 |

| Weighted average number of

Class B Common Stock shares outstanding – assuming dilution |

|

|

1,016 |

|

|

1,026 |

|

|

|

1,017 |

|

|

|

1,029 |

| |

| FINANCIAL

STATEMENTSCONDENSED CONSOLIDATED BALANCE

SHEETS(UNAUDITED) |

| |

| (in

thousands) |

|

September 27, 2024 |

|

|

December 31, 2023 |

| ASSETS |

|

|

|

|

|

| Current

Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,236,006 |

|

|

$ |

635,269 |

|

| Short-term investments |

|

|

215,044 |

|

|

|

— |

|

| Trade accounts receivable,

net |

|

|

556,701 |

|

|

|

539,873 |

|

| Other accounts receivable |

|

|

135,280 |

|

|

|

119,469 |

|

| Inventories |

|

|

334,681 |

|

|

|

321,932 |

|

| Prepaid expenses and other

current assets |

|

|

93,421 |

|

|

|

88,585 |

|

|

Total current assets |

|

|

2,571,133 |

|

|

|

1,705,128 |

|

| Property, plant and equipment,

net |

|

|

1,454,746 |

|

|

|

1,320,563 |

|

| Right-of-use assets -

operating leases |

|

|

102,330 |

|

|

|

122,708 |

|

| Leased property under

financing leases, net |

|

|

3,550 |

|

|

|

4,785 |

|

| Other assets |

|

|

170,304 |

|

|

|

145,213 |

|

| Goodwill |

|

|

165,903 |

|

|

|

165,903 |

|

| Other identifiable intangible

assets, net |

|

|

804,758 |

|

|

|

824,642 |

|

|

Total assets |

|

$ |

5,272,724 |

|

|

$ |

4,288,942 |

|

| |

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

| Current portion of obligations

under operating leases |

|

$ |

22,323 |

|

|

$ |

26,194 |

|

| Current portion of obligations

under financing leases |

|

|

2,635 |

|

|

|

2,487 |

|

| Dividends payable |

|

|

21,902 |

|

|

|

154,666 |

|

| Accounts payable and accrued

expenses |

|

|

993,995 |

|

|

|

907,987 |

|

|

Total current liabilities |

|

|

1,040,855 |

|

|

|

1,091,334 |

|

| Deferred income taxes |

|

|

110,510 |

|

|

|

128,435 |

|

| Pension and postretirement

benefit obligations and other liabilities |

|

|

961,691 |

|

|

|

927,113 |

|

| Noncurrent portion of

obligations under operating leases |

|

|

85,863 |

|

|

|

102,271 |

|

| Noncurrent portion of

obligations under financing leases |

|

|

3,036 |

|

|

|

5,032 |

|

| Long-term debt |

|

|

1,785,782 |

|

|

|

599,159 |

|

|

Total liabilities |

|

|

3,987,737 |

|

|

|

2,853,344 |

|

| |

|

|

|

|

|

| Equity: |

|

|

|

|

|

| Stockholders’ equity |

|

|

1,284,987 |

|

|

|

1,435,598 |

|

|

Total liabilities and equity |

|

$ |

5,272,724 |

|

|

$ |

4,288,942 |

|

| |

| FINANCIAL

STATEMENTSCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(UNAUDITED) |

| |

| |

|

First Nine Months |

|

(in thousands) |

|

|

2024 |

|

|

|

2023 |

|

| Cash Flows from

Operating Activities: |

|

|

|

|

| Net income |

|

$ |

454,177 |

|

|

$ |

332,539 |

|

| Depreciation expense,

amortization of intangible assets and deferred proceeds, net |

|

|

143,179 |

|

|

|

131,296 |

|

| Fair value adjustment of

acquisition related contingent consideration |

|

|

90,877 |

|

|

|

86,038 |

|

| Deferred income taxes |

|

|

(18,030 |

) |

|

|

(34,881 |

) |

| Pension plan settlement

expense |

|

|

— |

|

|

|

117,096 |

|

| Change in current assets and

current liabilities |

|

|

55,763 |

|

|

|

35,791 |

|

| Change in noncurrent assets

and noncurrent liabilities |

|

|

(23,650 |

) |

|

|

(29,935 |

) |

| Other |

|

|

5,577 |

|

|

|

6,605 |

|

| Net cash provided by

operating activities |

|

$ |

707,893 |

|

|

$ |

644,549 |

|

| |

|

|

|

|

| Cash Flows from

Investing Activities: |

|

|

|

|

| Additions to property, plant

and equipment |

|

$ |

(287,333 |

) |

|

$ |

(152,260 |

) |

| Purchases and disposals of

short-term investments |

|

|

(211,256 |

) |

|

|

— |

|

| Other |

|

|

(9,369 |

) |

|

|

(8,603 |

) |

| Net cash used in

investing activities |

|

$ |

(507,958 |

) |

|

$ |

(160,863 |

) |

| |

|

|

|

|

| Cash Flows from

Financing Activities: |

|

|

|

|

| Proceeds from bond

issuance |

|

$ |

1,200,000 |

|

|

$ |

— |

|

| Payments related to share

repurchases |

|

|

(574,009 |

) |

|

|

— |

|

| Cash dividends paid |

|

|

(163,733 |

) |

|

|

(42,182 |

) |

| Payments of acquisition

related contingent consideration |

|

|

(44,243 |

) |

|

|

(20,979 |

) |

| Debt issuance fees |

|

|

(15,365 |

) |

|

|

(244 |

) |

| Other |

|

|

(1,848 |

) |

|

|

(1,712 |

) |

| Net cash provided by

(used in) financing activities |

|

$ |

400,802 |

|

|

$ |

(65,117 |

) |

| |

|

|

|

|

| Net increase in cash during

period |

|

$ |

600,737 |

|

|

$ |

418,569 |

|

| Cash at beginning of

period |

|

|

635,269 |

|

|

|

197,648 |

|

|

Cash at end of period |

|

$ |

1,236,006 |

|

|

$ |

616,217 |

|

| |

| |

|

COMPARABLE AND NON-GAAP FINANCIAL MEASURES(c)

The following tables reconcile reported results (GAAP) to

comparable and adjusted results (non-GAAP): |

| |

| |

Third Quarter 2024 |

| (in

thousands, except per share data) |

|

Gross profit |

|

SD&A expenses |

|

Income from operations |

|

Income before taxes |

|

Net income |

|

Basic net income per share |

|

Reported results (GAAP) |

|

$ |

698,036 |

|

|

$ |

470,981 |

|

|

$ |

227,055 |

|

|

$ |

155,563 |

|

|

$ |

115,624 |

|

|

$ |

13.20 |

|

| Fair value adjustment of

acquisition related contingent consideration |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

68,592 |

|

|

|

51,652 |

|

|

|

5.68 |

|

| Fair value adjustments for

commodity derivative instruments |

|

|

(1,426 |

) |

|

|

(631 |

) |

|

|

(795 |

) |

|

|

(795 |

) |

|

|

(599 |

) |

|

|

(0.07 |

) |

| Total reconciling

items |

|

|

(1,426 |

) |

|

|

(631 |

) |

|

|

(795 |

) |

|

|

67,797 |

|

|

|

51,053 |

|

|

|

5.61 |

|

| Adjusted results

(non-GAAP) |

|

$ |

696,610 |

|

|

$ |

470,350 |

|

|

$ |

226,260 |

|

|

$ |

223,360 |

|

|

$ |

166,677 |

|

|

$ |

18.81 |

|

| |

|

Adjusted % Change vs. Third Quarter 2023 |

|

|

5.3 |

% |

|

|

5.5 |

% |

|

|

5.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

| |

Third Quarter 2023 |

| (in

thousands, except per share data) |

|

Gross profit |

|

SD&A expenses |

|

Income from operations |

|

Income before taxes |

|

Net income |

|

Basic net income per share |

|

Reported results (GAAP) |

|

$ |

661,550 |

|

|

$ |

445,290 |

|

|

$ |

216,260 |

|

|

$ |

120,984 |

|

|

$ |

92,093 |

|

|

$ |

9.82 |

|

| Fair value adjustment of

acquisition related contingent consideration |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

18,864 |

|

|

|

14,212 |

|

|

|

1.51 |

|

| Fair value adjustments for

commodity derivative instruments |

|

|

25 |

|

|

|

703 |

|

|

|

(678 |

) |

|

|

(678 |

) |

|

|

(510 |

) |

|

|

(0.05 |

) |

| Pension plan settlement

expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

77,319 |

|

|

|

58,225 |

|

|

|

6.22 |

|

| Total reconciling

items |

|

|

25 |

|

|

|

703 |

|

|

|

(678 |

) |

|

|

95,505 |

|

|

|

71,927 |

|

|

|

7.68 |

|

| Adjusted results

(non-GAAP) |

|

$ |

661,575 |

|

|

$ |

445,993 |

|

|

$ |

215,582 |

|

|

$ |

216,489 |

|

|

$ |

164,020 |

|

|

$ |

17.50 |

|

| |

Results for the first nine months of 2023 include one additional

selling day compared to the first nine months of 2024. For

comparison purposes, the estimated impact of the additional selling

day in the first nine months of 2023 has been excluded from our

comparable(b) volume results.

| |

| |

|

First Nine Months |

|

|

|

(in millions) |

|

2024 |

|

2023 |

|

|

Change |

| Standard physical case

volume |

|

263.4 |

|

266.8 |

|

|

(1.3) % |

| Volume related to extra day in

fiscal period |

|

— |

|

(0.9 |

) |

|

|

| Comparable standard

physical case volume |

|

263.4 |

|

265.9 |

|

|

(0.9) % |

| |

| |

| |

First Nine Months 2024 |

| (in

thousands, except per share data) |

|

Gross profit |

|

SD&A expenses |

|

Income from operations |

|

Income before taxes |

|

Net income |

|

Basic net income per share |

|

Reported results (GAAP) |

|

$ |

2,055,305 |

|

|

$ |

1,353,704 |

|

|

$ |

701,601 |

|

|

$ |

610,623 |

|

|

$ |

454,177 |

|

|

$ |

49.71 |

|

| Fair value adjustment of

acquisition related contingent consideration |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

90,877 |

|

|

|

68,430 |

|

|

|

7.48 |

|

| Fair value adjustments for

commodity derivative instruments |

|

|

(1,345 |

) |

|

|

(420 |

) |

|

|

(925 |

) |

|

|

(925 |

) |

|

|

(697 |

) |

|

|

(0.08 |

) |

| Total reconciling

items |

|

|

(1,345 |

) |

|

|

(420 |

) |

|

|

(925 |

) |

|

|

89,952 |

|

|

|

67,733 |

|

|

|

7.40 |

|

| Adjusted results

(non-GAAP) |

|

$ |

2,053,960 |

|

|

$ |

1,353,284 |

|

|

$ |

700,676 |

|

|

$ |

700,575 |

|

|

$ |

521,910 |

|

|

$ |

57.11 |

|

| |

|

Adjusted % Change vs. First Nine Months 2023 |

|

|

4.9 |

% |

|

|

4.2 |

% |

|

|

6.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

| |

| |

First Nine Months 2023 |

| (in

thousands, except per share data) |

|

Gross profit |

|

SD&A expenses |

|

Income from operations |

|

Income before taxes |

|

Net income |

|

Basic net income per share |

|

Reported results (GAAP) |

|

$ |

1,957,233 |

|

|

$ |

1,301,249 |

|

|

$ |

655,984 |

|

|

$ |

444,938 |

|

|

$ |

332,539 |

|

|

$ |

35.47 |

|

| Fair value adjustment of

acquisition related contingent consideration |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

86,038 |

|

|

|

64,787 |

|

|

|

6.91 |

|

| Fair value adjustments for

commodity derivative instruments |

|

|

1,517 |

|

|

|

(2,211 |

) |

|

|

3,728 |

|

|

|

3,728 |

|

|

|

2,807 |

|

|

|

0.30 |

|

| Pension plan settlement

expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

117,096 |

|

|

|

88,173 |

|

|

|

9.41 |

|

| Total reconciling

items |

|

|

1,517 |

|

|

|

(2,211 |

) |

|

|

3,728 |

|

|

|

206,862 |

|

|

|

155,767 |

|

|

|

16.62 |

|

| Adjusted results

(non-GAAP) |

|

$ |

1,958,750 |

|

|

$ |

1,299,038 |

|

|

$ |

659,712 |

|

|

$ |

651,800 |

|

|

$ |

488,306 |

|

|

$ |

52.09 |

|

| |

|

(c) |

The Company reports its financial results in accordance with

accounting principles generally accepted in the United States

(“GAAP”). However, management believes that certain non-GAAP

financial measures provide users of the financial statements with

additional, meaningful financial information that should be

considered, in addition to the measures reported in accordance with

GAAP, when assessing the Company’s ongoing performance.

Management also uses these non-GAAP financial measures in making

financial, operating and planning decisions and in evaluating the

Company’s performance. Non-GAAP financial measures should be

viewed in addition to, and not as an alternative for, the Company’s

reported results prepared in accordance with GAAP. The

Company’s non-GAAP financial information does not represent a

comprehensive basis of accounting. |

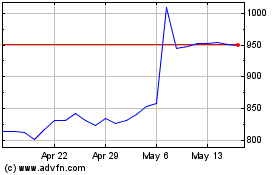

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

From Oct 2024 to Nov 2024

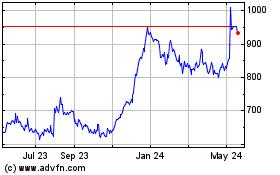

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

From Nov 2023 to Nov 2024