EUROPE MARKETS: European Markets Drop As SocGen Warns On Q4 Revenues

January 17 2019 - 8:30AM

Dow Jones News

By Emily Horton

European indexes were in the red on Thursday, as French bank

Société Générale SA announced it expected its fourth-quarter

capital markets revenues to fall by around 20%.

In the U.K., Prime Minister Theresa May has survived a

no-confidence vote, freeing her to start cross-party discussions on

finding a way forward on Brexit.

What are markets doing?

All major European indexes were down on Thursday, with the Stoxx

Europe 600 dropping by 0.3% to 349.53, after ending up 0.5% on

Wednesday.

Germany's DAX (DAX) lost 0.5% to 10,877.02, Italy's FTSE MIB

dropped by 0.1% to 19,450.11 and France's CAC 40 was down by 0.6%

to 4,780.14. The U.K.'s FTSE 100 lost 0.7% to 6,814.35.

The euro rose slightly to $1.1397 from $1.1393 late Wednesday in

New York, while the British pound rose to $1.2913 from $1.2878.

What is driving the market?

Banks were driving down stocks after Société Générale SA warned

that its fourth quarter was affected by a challenging environment

in global capital market

(http://www.marketwatch.com/story/societe-generale-4q-hit-by-challenging-environment-2019-01-17)s

(http://www.marketwatch.com/story/societe-generale-4q-hit-by-challenging-environment-2019-01-17).

The French bank expects revenue in this business to fall by around

20% in the fourth quarter and by 10% for 2018.

In the U.K., May is hoping to find a parliamentary consensus on

Brexit that she can take back to Brussels for renegotiation, after

her previous withdrawal agreement was roundly dismissed by

politicians earlier in the week.

But the PM is likely to stick to the core outline of her failed

deal, a strategy that Michael Hewson, chief market analyst at CMC

Markets U.K., compared to "trying to resurrect a corpse".

In the U.S., House Speaker Nancy Pelosi has urged President

Donald Trump to delay his State of the Union address. Pelosi said

that because of the current government shutdown, unfunded security

agencies are ill-equipped to protect the government during the

speech, The Wall Street Journal reports

(https://www.wsj.com/articles/pelosi-asks-trump-to-delay-state-of-the-union-11547650192).

Which stocks were active?

French bank Société Générale (GLE.FR) lost 5% after its poor

revenue predictions. BNP Paribas SA (BNP.FR) fell close to 4% and

Deutsche Bank AG (DBK.XE) (DBK.XE) fell over 3%.

Austrian listed Voestalpine AG was down by nearly 6%, after the

company cut its guidance for the 2019 financial year

(http://www.marketwatch.com/story/voestalpine-cuts-fy19-view-after-weak-results-2019-01-17).

Auto stocks were also under pressure, with Germany's Volkswagen

AG (VOW.XE) down by nearly 2%.

Software company Sage Group PLC (SGE.LN) led the European

gainers, jumping 6%, as strong revenues

(http://www.marketwatch.com/story/sage-group-revenue-up-76-backs-guidance-2019-01-17)

pushed its stock up. Experian PLC (EXPN.LN) added 1% on the news

its revenues were up 9%

(http://www.marketwatch.com/story/experian-organic-revenue-up-9-2019-01-17),

while Associated British Foods PLC (ABF.LN) gained 5%.

(END) Dow Jones Newswires

January 17, 2019 09:15 ET (14:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

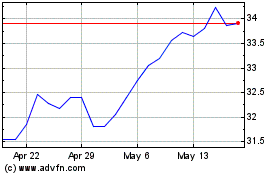

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

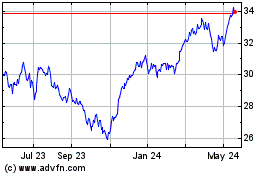

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024