Dime Community Bancshares, Inc. (Nasdaq: DCOM) (“Dime” or the

“Company”), the parent company of Dime Community Bank, announced

the pricing of a public offering of 3,906,250 shares of its common

stock, $0.01 par value (the “Common Stock”), at a public offering

price of $32.00 per share, for aggregate gross proceeds of $125

million.

In addition, the Company has granted the underwriters a 30-day

option to purchase up to an additional 585,937 shares of Common

Stock at the public offering price, less underwriting discounts and

commissions. The Company expects to close the offering, subject to

customary conditions, on or about November 13, 2024.

Dime expects to use the net proceeds from this offering for

general corporate purposes to support its continued organic growth,

which may include, among other things, working capital, investments

in its bank subsidiary, and potential balance sheet optimization

strategies.

Raymond James & Associates, Inc. and Keefe, Bruyette &

Woods, Inc., A Stifel Company are acting as joint book-running

managers for the offering. Luse Gorman, PC is serving as legal

counsel to the joint book-running managers. Squire Patton Boggs LLP

is serving as legal counsel to Dime.

The Common Stock will be issued pursuant to an effective shelf

registration statement (File No. 333-264390) (including base

prospectus) and a preliminary prospectus supplement filed with the

Securities and Exchange Commission (the “SEC”), and a final

prospectus supplement to be filed with the SEC. Prospective

investors should read the preliminary prospectus supplement and

accompanying base prospectus in the registration statement and

other documents the Company has filed or will file with the SEC for

more complete information about the Company and the offering.

Copies of the preliminary prospectus supplement and the

accompanying base prospectus relating to the Common Stock offering

can be obtained without charge by visiting the SEC’s website at

www.sec.gov, or by emailing Raymond James & Associates, Inc. at

prospectus@raymondjames.com or by emailing Keefe, Bruyette &

Woods, A Stifel Company, at SyndProspectus@stifel.com.

This press release is for informational purposes only and does

not constitute an offer to sell or a solicitation of an offer to

buy any securities, nor shall there be any sale of the securities

in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

Any offering of the Common Stock is being made only by means of a

written prospectus meeting the requirements of Section 10 of the

Securities Act of 1933, as amended. The securities being offered

have not been approved or disapproved by any regulatory authority,

nor has any such authority passed upon the accuracy or adequacy of

the prospectus supplement or the shelf registration statement or

prospectus relating thereto.ABOUT DIME COMMUNITY

BANCSHARES, INC.

Dime Community Bancshares, Inc. is the holding

company for Dime Community Bank, a New York State-chartered trust

company with over $13.7 billion in assets and the number one

deposit market share among community banks on Greater Long Island

(1).

(¹) Aggregate deposit market share for Kings, Queens,

Nassau & Suffolk counties for community banks with less than

$20 billion in assets.

Forward-Looking Statements

This press release contains a number of forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). These statements may be

identified by use of words such as “anticipate,” “believe,”

“continue,” “could,” “expect,” “may,” “potential,” “should,”

“will,” “to be,” “would” and similar terms and phrases, including

references to assumptions.

Forward-looking statements are based upon various assumptions

and analyses made by the Company in light of management’s

experience and its perception of historical trends, current

conditions and expected future developments, as well as other

factors it believes are appropriate under the circumstances. These

statements are not guarantees of future performance and are subject

to risks, uncertainties, and other factors (many of which are

beyond the Company’s control) that could cause actual conditions or

results to differ materially from those expressed or implied by

such forward-looking statements. Accordingly, you should not place

undue reliance on such statements. Factors that could affect our

results include, without limitation, the following: increases in

competitive pressure among financial institutions or from

non-financial institutions; inflation and fluctuation in market

interest rates, which may affect demand for our products, interest

margins and the fair value of financial instruments; changes in

deposit flows or composition, loan demand or real estate values;

changes in the quality and composition of the Company’s loan or

investment portfolios or unanticipated or significant increases in

loan losses; changes in accounting principles, policies or

guidelines; changes in corporate and/or individual income tax laws

or policies; general socio-economic conditions or events, including

conditions caused by public health emergencies, international

conflict, inflation, and recessionary pressures, either nationally

or locally in some or all areas in which the Company conducts

business, or conditions in the securities markets or the banking

industry; legislation, regulatory or policy changes; technological

changes; failures or breaches of information technology security

systems; success or consummation of new business initiatives or the

integration of an acquired entities may be more difficult or

expensive than the Company anticipates; and litigation or other

matters before regulatory agencies.

For discussion of these and other risks that may cause actual

results to differ from expectations, please refer to the sections

entitled “Forward-Looking Statements” and “Risk Factors” in the

Company’s most recent Annual Report on Form 10-K and subsequent

updates set forth in the Company’s Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K.

Dime Community Bancshares, Inc.Investor

Relations Contact:Avinash ReddySenior Executive Vice President –

Chief Financial OfficerPhone: 718-782-6200; Ext.

5909Email: avinash.reddy@dime.com

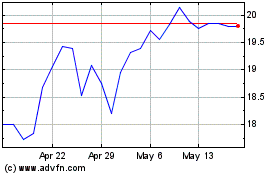

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dime Community Bancshares (NASDAQ:DCOM)

Historical Stock Chart

From Nov 2023 to Nov 2024