Earnings Release Highlights

- GAAP net income of $0.64 per share and Adjusted (non-GAAP)

operating earnings of $0.64 per share for the fourth quarter of

2024, resulting in full-year GAAP net income of $2.45 per share and

Adjusted (non-GAAP) operating earnings of $2.50 per share

- Introducing 2025 Adjusted (non-GAAP) operating earnings

guidance range of $2.64-$2.74 per share

- Declaring quarterly dividend of $0.40 per share for the first

quarter of 2025, implying an expected total 2025 dividend that

represents an approximate 60% payout of Adjusted (non-GAAP)

operating earnings per share

- Projecting to invest $38 billion of capital expenditures over

the next four years, an increase of 10% versus the prior plan to

support customer needs and grid reliability, resulting in expected

rate base growth of 7.4% and operating EPS compounded annual growth

of 5-7% from 2024 to 2028

- Updating 4-year financing plan to include $1.4 billion of

additional equity to fund approximately 40% of $3.5 billion of

incremental capital expenditures, in line with a balanced funding

strategy and resulting in implied total annual equity needs of $700

million per year from 2025 through 2028

- All utilities sustained top quartile or better performance in

reliability and safety, and all gas utilities sustained top decile

performance in gas odor response

- Close to 90% of Exelon’s rate base is now covered by

established mechanisms outlining cost recovery through 2026 or

2027, with final orders issued in the fourth quarter for Pepco’s

multi-year rate plan in DC, PECO’s electric and gas rate cases, and

ComEd’s Refiled Grid Plan

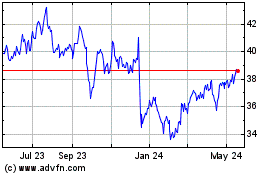

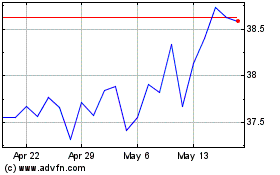

Exelon Corporation (Nasdaq: EXC) today reported its financial

results for the fourth quarter and full year 2024.

"I am pleased to announce Exelon has delivered against our

financial goals for the third straight year since becoming a

transmission and delivery-only company, and we delivered top

quartile performance across all our local energy companies, with

ComEd and Pepco Holdings in the top decile," said Exelon President

and Chief Executive Officer Calvin Butler. "Our commitment to our

customers, grid reliability, community investment and being an

economic engine in the regions we serve has positioned us as a

leader in the energy transformation. As we celebrate Exelon's 25th

anniversary in 2025, we are excited to continue our journey of

innovation and excellence, ensuring that we meet and exceed the

evolving needs of our customers and communities."

"Exelon's financial performance in 2024 exceeded expectations,

with earnings of $0.64 per share (GAAP and non-GAAP) in the last

quarter of 2024 and full-earnings of $2.45 per share on a GAAP

basis and $2.50 per share on a non-GAAP basis," said Exelon Chief

Financial Officer Jeanne Jones. "With growth in our four-year

capital plan driven by investment needs across our regions, we

continue to expect 5-7% annualized earning growth through 2028. Our

focus on industry-leading operations, cost management, a broad

suite of customer saving solutions, and advocacy for fair and

equitable energy policies will ensure our customers are receiving

premium value for the investments we make."

Fourth Quarter 2024

Exelon's GAAP net income for the fourth quarter of 2024

increased to $0.64 per share from $0.62 per share in the fourth

quarter of 2023. Adjusted (non-GAAP) operating earnings for the

fourth quarter of 2024 increased to $0.64 per share from $0.60 per

share in the fourth quarter of 2023. For the reconciliations of

GAAP net income to Adjusted (non-GAAP) operating earnings, refer to

the tables beginning on page 5.

GAAP net income and Adjusted (non-GAAP) operating earnings in

the fourth quarter of 2024 primarily reflect:

- Higher utility earnings primarily due to distribution rates at

BGE, distribution and transmission rate increases at PHI, a tax

repairs deduction at PECO, lower contracting costs at PHI, lower

storm costs at PECO and PHI, and a higher distribution rate base as

well as a higher return on regulatory assets primarily due to an

increase in asset balances at ComEd. This was partially offset by

MYP reconciliation impacts at BGE; timing of distribution earnings,

lower allowed ROE, the absence of a return on the pension asset

within distribution earnings, and lower carrying costs related to

the CMC regulatory asset at ComEd; and higher depreciation and

amortization and interest expense at BGE and PHI. Note that rate

increases are associated with updated recovery rates for costs and

investments to serve customers.

- Lower costs at the Exelon holding company primarily due an

absence of realized losses from hedging activity.

Full Year 2024

Exelon's GAAP net income for 2024 increased to $2.45 per share

from $2.34 per share in 2023. Adjusted (non-GAAP) operating

earnings for 2024 increased to $2.50 per share from $2.38 per share

in 2023.

GAAP net income and Adjusted (non-GAAP) operating earnings for

the full year 2024 primarily reflect:

- Higher utility earnings primarily due to distribution rates at

BGE, distribution and transmission rate increases at PHI, less

unfavorable weather at PECO, a higher return on regulatory assets

primarily due to an increase in asset balances and higher

transmission peak load at ComEd, lower contracting costs at PHI, a

tax repairs deduction at PECO, and favorable impacts of the

multi-year plan reconciliations at Pepco. This was partially offset

by higher interest expense at PECO, BGE, and PHI; lower impacts of

the MYP reconciliations at BGE; higher depreciation and

amortization expense at PECO, BGE, and PHI; lower allowed ROE, the

absence of a return on the pension asset within distribution

earnings, and lower carrying costs related to the CMC regulatory

asset at ComEd; and higher credit loss expense at PECO and BGE.

Note that rate increases are associated with updated recovery rates

for costs and investments to serve customers.

- Higher costs at the Exelon holding company due to higher

interest expense. This was partially offset by an absence of

realized losses from hedging activity.

Operating Company Results1

ComEd

ComEd's fourth quarter of 2024 GAAP net income decreased to $243

million from $268 million in the fourth quarter of 2023. ComEd's

Adjusted (non-GAAP) operating earnings for the fourth quarter of

2024 decreased to $243 million from $269 million in the fourth

quarter of 2023, primarily due to timing of distribution earnings,

lower allowed distribution ROE, the absence of a return on the

pension asset within distribution earnings, and lower carrying cost

recovery related to the CMC regulatory asset, partially offset by

higher distribution rate base, and higher return on regulatory

assets primarily due to an increase in asset balances. Due to

revenue decoupling, ComEd's distribution earnings are not intended

to be affected by actual weather or customer usage patterns.

PECO

PECO’s fourth quarter of 2024 GAAP net income increased to $195

million from $153 million in the fourth quarter of 2023. PECO's

Adjusted (non-GAAP) operating earnings for the fourth quarter of

2024 increased to $196 million from $154 million in the fourth

quarter of 2023, primarily due to higher tax repair deductions and

lower storm costs.

BGE

BGE’s fourth quarter of 2024 GAAP net income decreased to $175

million from $199 million in the fourth quarter of 2023. BGE's

Adjusted (non-GAAP) operating earnings for the fourth quarter of

2024 decreased to $175 million from $199 million in the fourth

quarter of 2023, primarily due to lower impacts of multi-year plans

reconciliations, higher depreciation and amortization expense, and

higher interest expense, partially offset by distribution rates.

Due to revenue decoupling, BGE's distribution earnings are not

intended to be affected by actual weather or customer usage

patterns.

PHI

PHI’s fourth quarter of 2024 GAAP net income increased to $138

million from $101 million in the fourth quarter of 2023. PHI’s

Adjusted (non-GAAP) operating earnings for the fourth quarter of

2024 increased to $132 million from $102 million in the fourth

quarter of 2023, primarily due to distribution and transmission

rate increases and a decrease in contracting and storm costs,

partially offset by increases depreciation and amortization and

interest expense. Due to revenue decoupling, PHI's distribution

earnings related to Pepco Maryland, DPL Maryland, Pepco District of

Columbia, and ACE are not intended to be affected by actual weather

or customer usage patterns.

___________

1Exelon’s four business units include

ComEd, which consists of electricity transmission and distribution

operations in northern Illinois; PECO, which consists of

electricity transmission and distribution operations and retail

natural gas distribution operations in southeastern Pennsylvania;

BGE, which consists of electricity transmission and distribution

operations and retail natural gas distribution operations in

central Maryland; and PHI, which consists of electricity

transmission and distribution operations in the District of

Columbia and portions of Maryland, Delaware, and New Jersey and

retail natural gas distribution operations in northern

Delaware.

Initiates Annual Guidance for 2025

Exelon introduced a guidance range for 2025 Adjusted (non-GAAP)

operating earnings of $2.64-$2.74 per share. There are no

adjustments between 2025 projected GAAP earnings and Adjusted

(non-GAAP) operating earnings currently.

Recent Developments and Fourth Quarter Highlights

- Dividend: On February 12, 2025, Exelon’s Board of

Directors declared a regular quarterly dividend of $0.40 per share

on Exelon’s common stock. The dividend is payable on March 14,

2025, Exelon shareholders of record as of the close of business on

February 24, 2025.

- Rate Case Developments:

- ComEd Distribution Formula Rate Reconciliation: On

October 31, 2024, the Illinois Commerce Commission (ICC) issued a

final order under Rider Delivery Service Pricing Reconciliation.

The ICC approved a total requested revenue requirement increase of

$623 million, reflecting an ROE of 9.89%. The 2024 filing

reconciled the delivery service rates in effect in 2023 with the

actual delivery service costs incurred in 2023.

- ComEd Refiled Grid Plan and Multi-Year Rate Plan (MRP):

On December 19, 2024, the ICC approved the Refiled Grid Plan and

adjusted the approved MRP with rates effective on January 1, 2025.

The final order is inclusive of rate increases of approximately

$752 million in 2024, $80 million in 2025, $102 million in 2026,

and $111 million in 2027, reflecting an ROE of 8.905%.

- Pepco District of Columbia Electric Distribution Base Rate

Case: On November 26, 2024, the Public Service Commission of

the District of Columbia (DCPSC) approved Pepco’s multi-year plan

for January 1, 2025 through December 31, 2026. The DCPSC awarded

Pepco electric incremental revenue requirement increases of $99

million and $24 million for 2025 and 2026, respectively, reflecting

an ROE of 9.5%.

- PECO Pennsylvania Electric Distribution Rate Cases: On

December 12, 2024 the Pennsylvania Public Utility Commission

(PAPUC) issued a final order approving a $354 million increase in

PECO's annual electric rates. The rate increase was resolved

through a settlement agreement, which did not specify an approved

ROE. The rates are effective on January 1, 2025.

- PECO Pennsylvania Natural Gas Distribution Rate Case: On

December 12, 2024 the PAPUC issued a final order approving a $78

million increase in PECO's annual natural gas rates. The rate

increase was resolved through a settlement agreement, which did not

specify an approved ROE. The rates are effective on January 1,

2025.

- Financing Activities:

- There were no financing activities in the fourth quarter.

Adjusted (non-GAAP) Operating Earnings Reconciliation

Adjusted (non-GAAP) operating earnings for the fourth quarter of

2024 do not include the following items (after tax) that were

included in reported GAAP net income:

(in millions, except per share

amounts)

Exelon Earnings per

Diluted Share

Exelon

ComEd

PECO

BGE

PHI

2024 GAAP net income

$

0.64

$

647

$

243

$

195

$

175

$

138

Environmental costs (net of taxes of

$5)

(0.01

)

(12

)

—

—

—

(12

)

Asset retirement obligation (net of taxes

of $3)

0.01

8

—

—

—

8

Cost management charge (net of taxes of

$1, $0, and $1, respectively)

—

2

—

1

—

1

Income tax-related adjustments (entire

amount represents tax expense)

—

(3

)

—

—

—

(3

)

2024 Adjusted (non-GAAP) operating

earnings

$

0.64

$

642

$

243

$

196

$

175

$

132

Adjusted (non-GAAP) operating earnings for the fourth quarter of

2023 do not include the following items (after tax) that were

included in reported GAAP net income:

(in millions, except per share

amounts)

Exelon Earnings per

Diluted Share

Exelon

ComEd

PECO

BGE

PHI

2023 GAAP net income

$

0.62

$

617

$

268

$

153

$

199

$

101

Mark-to-market impact of economic hedging

activities (net of taxes of $6)

(0.02

)

(17

)

—

—

—

—

Separation costs (net of taxes of $1, $1,

$0, $0, and $0, respectively)

—

3

1

1

1

1

2023 Adjusted (non-GAAP) operating

earnings

$

0.60

$

603

$

269

$

154

$

199

$

102

Adjusted (non-GAAP) operating earnings for the full year of 2024

do not include the following items (after tax) that were included

in reported GAAP net income:

(in millions, except per share

amounts)

Exelon Earnings per

Diluted Share

Exelon

ComEd

PECO

BGE

PHI

2024 GAAP net income

$

2.45

$

2,460

$

1,066

$

551

$

527

$

741

Environmental costs (net of taxes of

$5)

(0.01

)

(13

)

—

—

—

(13

)

Asset retirement obligations (net of taxes

of $3)

0.01

8

—

—

—

8

Change in FERC audit liability (net of

taxes of $13)

0.04

42

40

—

—

—

Cost management charge (net of taxes of

$4, $0, $2, $0, and $2, respectively)

0.01

13

—

5

1

6

Income tax-related adjustments (entire

amount represents tax expense)

—

(3

)

—

—

—

(3

)

2024 Adjusted (non-GAAP) operating

earnings

$

2.50

$

2,507

$

1,106

$

556

$

529

$

739

Adjusted (non-GAAP) operating earnings for the full year of 2023

do not include the following items (after tax) that were included

in reported GAAP net income:

(in millions, except per share

amounts)

Exelon Earnings per

Diluted Share

Exelon

ComEd

PECO

BGE

PHI

2023 GAAP net income

$

2.34

$

2,328

$

1,090

$

563

$

485

$

590

Mark-to-market impact of economic hedging

activities (net of taxes of $1)

—

(4

)

—

—

—

—

Environmental costs (net of taxes of

$8)

0.03

29

—

—

—

29

Asset retirement obligations (net of taxes

of $1)

—

(1

)

—

—

—

(1

)

SEC matter loss contingency (net of taxes

of $0)

0.05

46

—

—

—

—

Separation costs (net of taxes of $7, $3,

$1, $1, and $2, respectively)

0.02

22

8

4

4

6

Change in FERC audit liability (net of

taxes of $4)

0.01

11

11

—

—

—

Income tax-related adjustments (entire

amount represents tax expense)

(0.05

)

(54

)

—

—

—

—

2023 Adjusted (non-GAAP) operating

earnings

$

2.38

$

2,377

$

1,108

$

566

$

489

$

624

___________

Note:

Amounts may not sum due to rounding.

Unless otherwise noted, the income tax

impact of each reconciling item between GAAP net income and

Adjusted (non-GAAP) operating earnings is based on the marginal

statutory federal and state income tax rates for each Registrant,

taking into account whether the income or expense item is taxable

or deductible, respectively, in whole or in part. For all items,

the marginal statutory income tax rates for 2024 and 2023 ranged

from 24.0% to 29.0%.

Webcast Information

Exelon will discuss fourth quarter 2024 earnings in a conference

call scheduled for today at 9 a.m. Central Time (10 a.m. Eastern

Time). The webcast and associated materials can be accessed at

www.exeloncorp.com/investor-relations.

About Exelon

Exelon (Nasdaq: EXC) is a Fortune 200 company and the nation’s

largest utility company, serving more than 10.7 million customers

through six fully regulated transmission and distribution utilities

— Atlantic City Electric (ACE), Baltimore Gas and Electric (BGE),

Commonwealth Edison (ComEd), Delmarva Power & Light (DPL), PECO

Energy Company (PECO), and Potomac Electric Power Company (Pepco).

Exelon's 20,000 employees dedicate their time and expertise to

supporting our communities through reliable, affordable and

efficient energy delivery, workforce development, equity, economic

development and volunteerism. Follow @Exelon on Twitter | X.

Non-GAAP Financial Measures

In addition to net income as determined under generally accepted

accounting principles in the United States (GAAP), Exelon evaluates

its operating performance using the measure of Adjusted (non-GAAP)

operating earnings because management believes it represents

earnings directly related to the ongoing operations of the

business. Adjusted (non-GAAP) operating earnings exclude certain

costs, expenses, gains and losses, and other specified items. This

measure is intended to enhance an investor’s overall understanding

of period over period operating results and provide an indication

of Exelon’s baseline operating performance excluding items that are

considered by management to be not directly related to the ongoing

operations of the business. In addition, this measure is among the

primary indicators management uses as a basis for evaluating

performance, allocating resources, setting incentive compensation

targets, and planning and forecasting of future periods. Adjusted

(non-GAAP) operating earnings is not a presentation defined under

GAAP and may not be comparable to other companies’ presentation.

Exelon has provided the non-GAAP financial measure as supplemental

information and in addition to the financial measures that are

calculated and presented in accordance with GAAP. Adjusted

(non-GAAP) operating earnings should not be deemed more useful

than, a substitute for, or an alternative to the most comparable

GAAP net income measures provided in this earnings release and

attachments. This press release and earnings release attachments

provide reconciliations of Adjusted (non-GAAP) operating earnings

to the most directly comparable financial measures calculated and

presented in accordance with GAAP, are posted on Exelon’s website:

https://investors.exeloncorp.com, and have been furnished to the

Securities and Exchange Commission on Form 8-K on Feb. 12,

2025.

Cautionary Statements Regarding Forward-Looking

Information

This press release contains certain forward-looking statements

within the meaning of federal securities laws that are subject to

risks and uncertainties. Words such as “could,” “may,” “expects,”

“anticipates,” “will,” “targets,” “goals,” “projects,” “intends,”

“plans,” “believes,” “seeks,” “estimates,” “predicts,” “should,”

and variations on such words, and similar expressions that reflect

our current views with respect to future events and operational,

economic, and financial performance, are intended to identify such

forward-looking statements. Accordingly, any such statements are

qualified in their entirety by reference to, and are accompanied

by, the following important factors that may cause our actual

results or outcomes to differ materially from those contained in

our forward-looking statements, including, but not limited to:

unfavorable legislative and/or regulatory actions; uncertainty as

to outcomes and timing of regulatory approval proceedings and/or

negotiated settlements thereof; environmental liabilities and

remediation costs; state and federal legislation requiring use of

low-emission, renewable, and/or alternate fuel sources and/or

mandating implementation of energy conservation programs requiring

implementation of new technologies; challenges to tax positions

taken, tax law changes, and difficulty in quantifying potential tax

effects of business decisions; negative outcomes in legal

proceedings; adverse impact of the activities associated with the

past deferred prosecution agreement (DPA) and now-resolved SEC

investigation on Exelon’s and ComEd’s reputation and relationships

with legislators, regulators, and customers; physical security and

cybersecurity risks; extreme weather events, natural disasters,

operational accidents such as wildfires or natural, gas explosions,

war, acts and threats of terrorism, public health crises,

epidemics, pandemics, or other significant events; lack of

sufficient capacity to meet actual or forecasted demand or

disruptions at power generation facilities owned by third parties;

emerging technologies that could affect or transform the energy

industry; instability in capital and credit markets; a downgrade of

any Registrant’s credit ratings or other failure to satisfy the

credit standards in the Registrants’ agreements or regulatory

financial requirements; significant economic downturns or increases

in customer rates; impacts of climate change and weather on energy

usage and maintenance and capital costs; and impairment of

long-lived assets, goodwill, and other assets.

New factors emerge from time to time, and it is impossible for

us to predict all of such factors, nor can we assess the impact of

each such factor on the business or the extent to which any factor,

or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements.

For more information, see those factors discussed with respect to

Exelon Corporation, Commonwealth Edison Company, PECO Energy

Company, Baltimore Gas and Electric Company, Pepco Holdings LLC,

Potomac Electric Power Company, Delmarva Power & Light Company,

and Atlantic City Electric Company (Registrants) in the

Registrants' most recent Annual Report on Form 10-K, including in

Part I, ITEM 1A, any subsequent Quarterly Reports on Form 10-Q, and

in other reports filed by the Registrants from time to time with

the SEC.

Investors are cautioned not to place undue reliance on these

forward-looking statements, whether written or oral, which apply

only as of the date of this press release. None of the Registrants

undertakes any obligation to publicly release any revision to its

forward-looking statements to reflect events or circumstances after

the date of this press release.

Exelon uses its corporate website, www.exeloncorp.com, investor

relations website, investors.exeloncorp.com, and social media

channels to communicate with Exelon's investors and the public

about the Registrants and other matters. Exelon's posts through

these channels may be deemed material. Accordingly, Exelon

encourages investors and others interested in the Registrants to

routinely monitor these channels, in addition to following the

Registrants' press releases, Securities and Exchange Commission

filings and public conference calls and webcasts. The contents of

Exelon's websites and social media channels are not, however,

incorporated by reference into this press release.

Earnings Release

Attachments

Table of Contents

Consolidating Statement of Operations

1

Consolidated Balance Sheets

3

Consolidated Statements of Cash Flows

5

Reconciliation of GAAP Net Income (Loss)

to Adjusted (non-GAAP) Operating Earnings and Analysis of

Earnings

6

Statistics

ComEd

10

PECO

11

BGE

13

Pepco

15

DPL

16

ACE

18

Consolidating Statements of

Operations

(unaudited)

(in millions)

ComEd

PECO

BGE

PHI

Other (a)

Exelon

Three Months Ended December 31,

2024

Operating revenues

$

1,816

$

998

$

1,157

$

1,509

$

(9

)

$

5,471

Operating expenses

Purchased power and fuel

538

363

423

574

1

1,899

Operating and maintenance

426

245

240

322

(49

)

1,184

Depreciation and amortization

390

110

164

232

17

913

Taxes other than income taxes

89

54

91

133

10

377

Total operating expenses

1,443

772

918

1,261

(21

)

4,373

Gain on sales of assets

—

—

—

(1

)

—

(1

)

Operating income

373

226

239

247

12

1,097

Other income and (deductions)

Interest expense, net

(126

)

(62

)

(56

)

(97

)

(126

)

(467

)

Other, net

27

10

10

19

—

66

Total other income and

(deductions)

(99

)

(52

)

(46

)

(78

)

(126

)

(401

)

Income (loss) before income

taxes

274

174

193

169

(114

)

696

Income taxes

31

(21

)

18

31

(10

)

49

Net income (loss) attributable to

common shareholders

$

243

$

195

$

175

$

138

$

(104

)

$

647

Three Months Ended December 31,

2023

Operating revenues

$

2,008

$

917

$

1,041

$

1,411

$

(9

)

$

5,368

Operating expenses

Purchased power and fuel

748

347

387

544

—

2,026

Operating and maintenance

373

217

109

336

(11

)

1,024

Depreciation and amortization

358

100

167

249

16

890

Taxes other than income taxes

87

46

80

121

11

345

Total operating expenses

1,566

710

743

1,250

16

4,285

Gain on sale of assets

—

—

—

9

—

9

Operating income (loss)

442

207

298

170

(25

)

1,092

Other income and (deductions)

Interest expense, net

(120

)

(53

)

(47

)

(84

)

(148

)

(452

)

Other, net

24

10

5

28

10

77

Total other income and

(deductions)

(96

)

(43

)

(42

)

(56

)

(138

)

(375

)

Income (loss) before income

taxes

346

164

256

114

(163

)

717

Income taxes

78

11

57

13

(59

)

100

Net income (loss) attributable to

common shareholders

$

268

$

153

$

199

$

101

$

(104

)

$

617

Change in net income (loss) from 2023

to 2024

$

(25

)

$

42

$

(24

)

$

37

$

—

$

30

Consolidating Statements of

Operations

(unaudited)

(in millions)

ComEd

PECO

BGE

PHI

Other (a)

Exelon

Twelve Months Ended December 31,

2024

Operating revenues

$

8,219

$

3,973

$

4,426

$

6,448

$

(38

)

$

23,028

Operating expenses

Purchased power and fuel

3,042

1,477

1,651

2,513

—

8,683

Operating and maintenance

1,703

1,120

1,036

1,250

(169

)

4,940

Depreciation and amortization

1,514

428

638

947

67

3,594

Taxes other than income taxes

376

218

345

528

37

1,504

Total operating expenses

6,635

3,243

3,670

5,238

(65

)

18,721

Gain on sales of assets

5

4

—

(1

)

4

12

Operating income

1,589

734

756

1,209

31

4,319

Other income and (deductions)

Interest expense, net

(501

)

(232

)

(216

)

(376

)

(589

)

(1,914

)

Other, net

94

37

36

97

(2

)

262

Total other income and

(deductions)

(407

)

(195

)

(180

)

(279

)

(591

)

(1,652

)

Income (loss) before income

taxes

1,182

539

576

930

(560

)

2,667

Income taxes

116

(12

)

49

189

(135

)

207

Net income (loss) attributable to

common shareholders

$

1,066

$

551

$

527

$

741

$

(425

)

$

2,460

Twelve Months Ended December 31,

2023

Operating revenues

$

7,844

$

3,894

$

4,027

$

6,026

$

(64

)

$

21,727

Operating expenses

Purchased power and fuel

2,816

1,544

1,531

2,348

2

8,241

Operating and maintenance

1,450

1,003

741

1,289

76

4,559

Depreciation and amortization

1,403

397

654

990

62

3,506

Taxes other than income taxes

369

202

319

487

31

1,408

Total operating expenses

6,038

3,146

3,245

5,114

171

17,714

Gain on sales of assets

—

—

—

9

1

10

Operating income (loss)

1,806

748

782

921

(234

)

4,023

Other income and (deductions)

Interest expense, net

(477

)

(201

)

(182

)

(323

)

(546

)

(1,729

)

Other, net

75

36

18

108

171

408

Total other income and

(deductions)

(402

)

(165

)

(164

)

(215

)

(375

)

(1,321

)

Income (loss) before income

taxes

1,404

583

618

706

(609

)

2,702

Income taxes

314

20

133

116

(209

)

374

Net income (loss) attributable to

common shareholders

$

1,090

$

563

$

485

$

590

$

(400

)

$

2,328

Change in net income (loss) 2023 to

2024

$

(24

)

$

(12

)

$

42

$

151

$

(25

)

$

132

__________

(a)

Other primarily includes

eliminating and consolidating adjustments, Exelon’s corporate

operations, shared service entities, and other financing and

investment activities.

Exelon

Consolidated Balance

Sheets

(unaudited)

(in millions)

December 31, 2024

December 31, 2023

Assets

Current assets

Cash and cash equivalents

$

357

$

445

Restricted cash and cash equivalents

541

482

Accounts receivable

Customer accounts receivable

3,144

2,659

Customer allowance for credit losses

(406

)

(317

)

Customer accounts receivable, net

2,738

2,342

Other accounts receivable

1,123

1,101

Other allowance for credit losses

(107

)

(82

)

Other accounts receivable, net

1,016

1,019

Inventories, net

Fossil fuel

72

94

Materials and supplies

781

707

Regulatory assets

1,940

2,215

Prepaid renewable energy credits

494

413

Other

445

370

Total current assets

8,384

8,087

Property, plant, and equipment,

net

78,182

73,593

Deferred debits and other

assets

Regulatory assets

8,710

8,698

Goodwill

6,630

6,630

Receivable related to Regulatory Agreement

Units

4,026

3,232

Investments

290

251

Other

1,562

1,365

Total deferred debits and other

assets

21,218

20,176

Total assets

$

107,784

$

101,856

Liabilities and

Shareholders' Equity

Current liabilities

Short-term borrowings

$

1,859

$

2,523

Long-term debt due within one year

1,453

1,403

Accounts payable

2,994

2,846

Accrued expenses

1,468

1,375

Payables to affiliates

5

5

Customer deposits

446

411

Regulatory liabilities

411

389

Mark-to-market derivative liabilities

29

74

Unamortized energy contract

liabilities

5

8

Renewable energy credit obligations

429

348

Other

512

519

Total current liabilities

9,611

9,901

Long-term debt

42,947

39,692

Long-term debt to financing

trusts

390

390

Deferred credits and other

liabilities

Deferred income taxes and unamortized

investment tax credits

12,793

11,956

Regulatory liabilities

10,198

9,576

Pension obligations

1,745

1,571

Non-pension postretirement benefit

obligations

472

527

Asset retirement obligations

301

267

Mark-to-market derivative liabilities

103

106

Unamortized energy contract

liabilities

21

27

Other

2,282

2,088

Total deferred credits and other

liabilities

27,915

26,118

Total liabilities

80,863

76,101

Commitments and contingencies

Shareholders’ equity

Common stock

21,338

21,114

Treasury stock, at cost

(123

)

(123

)

Retained earnings

6,426

5,490

Accumulated other comprehensive loss,

net

(720

)

(726

)

Total shareholders’ equity

26,921

25,755

Total liabilities and shareholders'

equity

$

107,784

$

101,856

Exelon

Consolidated Statements of

Cash Flows

(unaudited)

(in millions)

Twelve Months Ended December

31,

2024

2023

Cash flows from operating

activities

Net income

$

2,460

$

2,328

Adjustments to reconcile net income to net

cash flows provided by operating activities:

Depreciation, amortization, and accretion,

including nuclear fuel and energy contract amortization

3,596

3,506

Gain on sales of assets and businesses

(12

)

(10

)

Deferred income taxes and amortization of

investment tax credits

128

319

Net fair value changes related to

derivatives

—

22

Other non-cash operating activities

592

(335

)

Changes in assets and liabilities:

Accounts receivable

(644

)

(37

)

Inventories

(56

)

(45

)

Accounts payable and accrued expenses

(37

)

(191

)

Collateral received (paid), net

33

(146

)

Income taxes

(4

)

48

Regulatory assets and liabilities, net

(50

)

(439

)

Pension and non-pension postretirement

benefit contributions

(180

)

(129

)

Other assets and liabilities

(257

)

(188

)

Net cash flows provided by operating

activities

5,569

4,703

Cash flows from investing

activities

Capital expenditures

(7,097

)

(7,408

)

Proceeds from sales of assets and

businesses

38

25

Other investing activities

17

8

Net cash flows used in investing

activities

(7,042

)

(7,375

)

Cash flows from financing

activities

Changes in short-term borrowings

(265

)

(313

)

Proceeds from short-term borrowings with

maturities greater than 90 days

150

400

Repayments on short-term borrowings with

maturities greater than 90 days

(549

)

(150

)

Issuance of long-term debt

4,974

5,825

Retirement of long-term debt

(1,557

)

(1,713

)

Issuance of common stock

148

140

Dividends paid on common stock

(1,524

)

(1,433

)

Proceeds from employee stock plans

43

41

Other financing activities

(109

)

(114

)

Net cash flows provided by financing

activities

1,311

2,683

(Decrease) increase in cash, restricted

cash, and cash equivalents

(162

)

11

Cash, restricted cash, and cash

equivalents at beginning of period

1,101

1,090

Cash, restricted cash, and cash

equivalents at end of period

$

939

$

1,101

Exelon

Reconciliation of GAAP Net

Income (Loss) to Adjusted (non-GAAP) Operating Earnings and

Analysis of Earnings

Three Months Ended December 31,

2024 and 2023

(unaudited)

(in millions, except per share

data)

Exelon Earnings per

Diluted Share

ComEd

PECO

BGE

PHI

Other (a)

Exelon

2023 GAAP net income (loss)

$

0.62

$

268

$

153

$

199

$

101

$

(104

)

$

617

Mark-to-market impact of economic hedging

activities (net of taxes of $6)

(0.02

)

—

—

—

—

(17

)

(17

)

Separation costs (net of taxes of $1, $0,

$0, $0, $0, and $1, respectively) (1)

—

1

1

1

1

(1

)

3

2023 Adjusted (non-GAAP) operating

earnings (loss)

$

0.60

$

269

$

154

$

199

$

102

$

(121

)

$

603

Year over year effects on Adjusted

(non-GAAP) operating earnings:

Weather

$

—

$

—

(b)

$

5

$

—

(b)

$

(1

)

(b)

$

—

$

4

Load

—

—

(b)

—

—

(b)

5

(b)

—

5

Distribution and transmission rates

(2)

0.13

(9

)

(c)

14

(c)

69

(c)

41

(c)

17

132

Other energy delivery (3)

0.08

49

(c)

31

(c)

(4

)

(c)

2

(c)

—

78

Operating and maintenance expense (4)

(0.08

)

(36

)

(21

)

(71

)

14

30

(84

)

Pension and non-pension postretirement

benefits

(0.01

)

(4

)

(2

)

—

1

(6

)

(11

)

Depreciation and amortization expense

(5)

(0.03

)

(23

)

(8

)

(6

)

6

(2

)

(33

)

Interest expense and other (6)

(0.05

)

(3

)

23

(12

)

(38

)

(22

)

(52

)

Total year over year effects on

Adjusted (non-GAAP) operating earnings

$

0.04

$

(26

)

$

42

$

(24

)

$

30

$

17

$

39

2024 GAAP net income (loss)

$

0.64

$

243

$

195

$

175

$

138

$

(104

)

$

647

Environmental costs (net of taxes of

$5)

(0.01

)

—

—

—

(12

)

—

(12

)

Asset retirement obligation (net of taxes

of $3)

0.01

—

—

—

8

—

8

Cost management charge (net of taxes of

$0, $1, and $1, respectively) (7)

—

—

1

—

1

—

2

Income tax-related adjustments (entire

amount represents tax expense) (8)

—

—

—

—

(3

)

—

(3

)

2024 Adjusted (non-GAAP) operating

earnings (loss)

$

0.64

$

243

$

196

$

175

$

132

$

(104

)

$

642

Note:

Amounts may not sum due to rounding.

Unless otherwise noted, the income tax

impact of each reconciling item between GAAP net income and

Adjusted (non-GAAP) operating earnings is based on the marginal

statutory federal and state income tax rates for each Registrant,

taking into account whether the income or expense item is taxable

or deductible, respectively, in whole or in part. For all items,

the marginal statutory income tax rates for 2024 and 2023 ranged

from 24.0% to 29.0%.

(a)

Other primarily includes

eliminating and consolidating adjustments, Exelon’s corporate

operations, shared service entities, and other financing and

investment activities.

(b)

For ComEd, BGE, Pepco, DPL

Maryland, and ACE, customer rates are adjusted to eliminate the

impacts of weather and customer usage on distribution volumes.

(c)

ComEd's distribution rate

revenues increase or decrease as fully recoverable costs fluctuate.

For regulatory recovery mechanisms, including transmission formula

rates and riders across the utilities, revenues increase and

decrease i) as fully recoverable costs fluctuate (with no impact on

net earnings), and ii) pursuant to changes in rate base, capital

structure and ROE (which impact net earnings).

(1)

Represents costs related to the

separation primarily comprised of system-related costs, third-party

costs paid to advisors, consultants, lawyers, and other experts

assisting in the separation, and employee-related severance costs,

which are recorded in Operating and maintenance expense.

(2)

For ComEd, reflects decreased

electric distribution revenues due to lower allowed electric

distribution ROE and absence of a return on the pension asset,

partially offset by higher rate base. For PECO, reflects increased

Distribution System Improvement Charges (DSIC) revenue due to

higher electric DSIC rates. For BGE, reflects increased

distribution revenue due to higher rates. For PHI, reflects

increased distribution and transmission revenue primarily due to

higher rates. For Corporate, reflects an absence of realized losses

from hedging activity.

(3)

For ComEd, reflects increased

electric distribution and energy efficiency revenues due to higher

fully recoverable costs and higher return on regulatory assets,

partially offset by lower carrying cost recovery related to the CMC

regulatory asset. For PECO, reflects increased energy efficiency

revenues due to required regulatory programs.

(4)

Represents Operating and

maintenance expense, excluding pension and non-pension

postretirement benefits. For ComEd, primarily reflects an updated

rate of capitalization of certain overhead costs. For PECO,

reflects increased program costs related to regulatory required

programs, partially offset by favorable storm costs. For BGE,

primarily reflects lower impacts from the multi-year plans

reconciliations, partially offset by a decrease in credit loss

expense. For PHI, primarily reflects an absence of contracting

costs due to the ACE employee strike and a decrease in storm costs.

For Corporate, reflects a decrease in Operating and maintenance

expense with an offsetting decrease in other income for costs

billed to Constellation for services provided by Exelon through the

Transition Services Agreement (TSA).

(5)

Reflects ongoing capital

expenditures across all utilities.

(6)

For PECO, primarily reflects

lower income tax expense due to an increase in tax repairs

deduction. For BGE, primarily reflects an increase in interest

expense. For PHI, reflects higher income tax expense due to certain

EDIT benefits being fully amortized and passed through to

customers, with an offsetting increase in Other energy delivery.

For Corporate, reflects an absence of other income for costs billed

to Constellation for services provided by Exelon through the TSA

with an offsetting decrease in Operating and maintenance expense

and partially offset by a gain on open market repurchase of a

portion of Exelon's Senior unsecured notes.

(7)

Primarily represents severance

and reorganization costs related to cost management.

(8)

Reflects the adjustment to state

deferred income taxes due to change in DPL's Delaware net operating

loss valuation allowance.

Exelon

Reconciliation of GAAP Net

Income (Loss) to Adjusted (non-GAAP) Operating Earnings and

Analysis of Earnings

Twelve Months Ended December 31,

2024 and 2023

(unaudited)

(in millions, except per share

data)

Exelon Earnings

per Diluted Share

ComEd

PECO

BGE

PHI

Other (a)

Exelon

2023 GAAP net income (loss)

$

2.34

$

1,090

$

563

$

485

$

590

$

(400

)

$

2,328

Mark-to-market impact of economic hedging

activities (net of taxes of $1)

—

—

—

—

—

(4

)

(4

)

Environmental costs (net of taxes of

$8)

0.03

—

—

—

29

—

29

Asset retirement obligations (net of taxes

of $1)

—

—

—

—

(1

)

—

(1

)

SEC matter loss contingency (net of taxes

of $0)

0.05

—

—

—

—

46

46

Separation costs (net of taxes of $3, $1,

$1, $2, and $7, respectively) (1)

0.02

8

4

4

6

—

22

Change in FERC audit liability (net of

taxes of $4)

0.01

11

—

—

—

—

11

Income tax-related adjustments (entire

amount represents tax expense) (2)

(0.05

)

—

—

—

—

(54

)

(54

)

2023 Adjusted (non-GAAP) operating

earnings (loss)

$

2.38

$

1,108

$

566

$

489

$

624

$

(410

)

$

2,377

Year over year effects on Adjusted

(non-GAAP) operating earnings:

Weather

$

0.06

$

—

(b)

$

58

$

—

(b)

$

6

(b)

$

—

$

64

Load

0.01

—

(b)

8

—

(b)

6

(b)

—

14

Distribution and transmission rates

(3)

0.37

(46

)

(c)

23

(c)

237

(c)

136

(c)

21

371

Other energy delivery (4)

0.31

269

(c)

23

(c)

(24

)

(c)

40

(c)

—

308

Operating and maintenance expense (5)

(0.18

)

(131

)

(82

)

(130

)

27

133

(183

)

Pension and non-pension postretirement

benefits

(0.02

)

(17

)

(5

)

—

2

2

(18

)

Depreciation and amortization expense

(6)

(0.13

)

(80

)

(23

)

(22

)

(4

)

(3

)

(132

)

Interest expense and other (7)

(0.29

)

3

(12

)

(21

)

(98

)

(166

)

(294

)

Total year over year effects on

Adjusted (non-GAAP) operating earnings

$

0.12

$

(2

)

$

(10

)

$

40

$

115

$

(13

)

$

130

2024 GAAP net income (loss)

$

2.45

$

1,066

$

551

$

527

$

741

$

(425

)

$

2,460

Environmental costs (net of taxes of

$5)

(0.01

)

—

—

—

(13

)

—

(13

)

Asset retirement obligations (net of taxes

of $3)

0.01

—

—

—

8

—

8

Change in FERC audit liability (net of

taxes of $13)

0.04

40

—

—

—

2

42

Cost management charge (net of taxes of

$2, $0, $2, $0, and $4, respectively) (8)

0.01

—

5

1

6

1

13

Income tax-related adjustments (entire

amount represents tax expense) (2)

—

—

—

—

(3

)

—

(3

)

2024 Adjusted (non-GAAP) operating

earnings (loss)

$

2.50

$

1,106

$

556

$

529

$

739

$

(423

)

$

2,507

Note:

Amounts may not sum due to rounding.

Unless otherwise noted, the income tax

impact of each reconciling item between GAAP net income and

Adjusted (non-GAAP) operating earnings is based on the marginal

statutory federal and state income tax rates for each Registrant,

taking into account whether the income or expense item is taxable

or deductible, respectively, in whole or in part. For all items,

the marginal statutory income tax rates for 2024 and 2023 ranged

from 24.0% to 29.0%.

(a)

Other primarily includes

eliminating and consolidating adjustments, Exelon’s corporate

operations, shared service entities, and other financing and

investment activities.

(b)

For ComEd, BGE, Pepco, DPL

Maryland, and ACE, customer rates are adjusted to eliminate the

impacts of weather and customer usage on distribution volumes.

(c)

ComEd's distribution rate

revenues increase or decrease as fully recoverable costs fluctuate.

For regulatory recovery mechanisms, including transmission formula

rates and riders across the utilities, revenues increase and

decrease i) as fully recoverable costs fluctuate (with no impact on

net earnings), and ii) pursuant to changes in rate base, capital

structure and ROE (which impact net earnings).

(1)

Represents costs related to the

separation primarily comprised of system-related costs, third-party

costs paid to advisors, consultants, lawyers, and other experts

assisting in the separation, and employee-related severance costs,

which are recorded in Operating and maintenance expense and Other,

net.

(2)

In 2023, reflects the adjustment

to state deferred income taxes due to changes in forecasted

apportionment. In 2024, reflects the adjustment to state deferred

income taxes due to change in DPL's Delaware net operating loss

valuation allowance.

(3)

For ComEd, reflects decreased

electric distribution revenues due to lower allowed electric

distribution ROE and absence of a return on the pension asset,

partially offset by higher rate base. For PECO, reflects increased

DSIC revenue due to higher electric DSIC rates. For BGE, reflects

increased distribution revenue due to higher rates. For PHI,

reflects increased distribution and transmission revenue due to

higher rates. For Corporate, reflects an absence of realized losses

from hedging activity.

(4)

For ComEd, reflects increased

electric distribution, transmission, and energy efficiency revenues

due to higher fully recoverable costs, higher return on regulatory

assets, and higher transmission peak load, partially offset by

lower carrying cost recovery related to the CMC regulatory asset.

For PECO, reflects increased energy efficiency revenues due to

regulatory required programs. For PHI, reflects higher distribution

and transmission revenues due to higher fully recoverable

costs.

(5)

Represents Operating and

maintenance expense, excluding pension and non-pension

postretirement benefits. For ComEd, reflects an updated rate of

capitalization of certain overhead costs. For PECO, primarily

reflects increased credit loss expense and program costs related to

regulatory required programs. For BGE, reflects lower impacts of

the multi-year plans reconciliations and increased storm costs and

credit loss expense. For PHI, primarily reflects an absence of

contracting costs due to the ACE employee strike. For Corporate,

reflects an absence of costs for DPA related matters and a decrease

in Operating and maintenance expense with an offsetting decrease in

other income for costs billed to Constellation for services

provided by Exelon through the TSA.

(6)

Reflects ongoing capital

expenditures across all utilities.

(7)

For PECO, primarily reflects an

increase in interest expense, partially offset by lower income tax

expense due to an increase in tax repairs deduction. For BGE,

primarily reflects an increase in interest expense. For PHI,

reflects an increase in interest expense and an increase in taxes

other than income. For Corporate, reflects an increase in interest

expense partially offset by a gain on open market repurchase of a

portion of Exelon's Senior unsecured notes, a decrease in other

income from an absence of DPA related derivative claims, and an

absence of other income for costs billed to Constellation for

services provided by Exelon through the TSA with an offsetting

decrease in Operating and maintenance expense.

(8)

Primarily represents severance

and reorganization costs related to cost management.

ComEd Statistics

Three

Months Ended December 31, 2024 and 2023

Electric Deliveries (in

GWhs)

Revenue (in millions)

2024

2023

% Change

Weather - Normal %

Change

2024

2023

% Change

Electric Deliveries and

Revenues(a)

Residential

5,656

5,806

(2.6

)%

(1.3

)%

$

793

$

821

(3.4

)%

Small commercial & industrial

6,780

6,852

(1.1

)%

(2.0

)%

504

494

2.0

%

Large commercial & industrial

7,293

6,607

10.4

%

9.1

%

270

271

(0.4

)%

Public authorities & electric

railroads

233

233

—

%

(2.0

)%

16

18

(11.1

)%

Other(b)

—

—

n/a

n/a

277

250

10.8

%

Total electric revenues(c)

19,962

19,498

2.4

%

1.9

%

1,860

1,854

0.3

%

Other Revenues(d)

(44

)

154

(128.6

)%

Total Electric Revenues

$

1,816

$

2,008

(9.6

)%

Purchased Power

$

538

$

748

(28.1

)%

% Change

Heating and Cooling Degree-Days

2024

2023

Normal

From 2023

From Normal

Heating Degree-Days

1,767

1,747

2,139

1.1

%

(17.4

)%

Cooling Degree-Days

39

56

14

(30.4

)%

178.6

%

Twelve

Months Ended December 31, 2024 and 2023

Electric Deliveries (in

GWhs)

Revenue (in millions)

2024

2023

% Change

Weather - Normal %

Change

2024

2023

% Change

Electric Deliveries and

Revenues(a)

Residential

27,274

26,023

4.8

%

2.1

%

$

3,809

$

3,565

6.8

%

Small commercial & industrial

28,367

28,706

(1.2

)%

(0.7

)%

2,259

1,857

21.6

%

Large commercial & industrial

27,870

26,708

4.4

%

4.1

%

1,145

824

39.0

%

Public authorities & electric

railroads

822

855

(3.9

)%

(4.6

)%

60

51

17.6

%

Other(b)

—

—

n/a

n/a

1,080

965

11.9

%

Total electric revenues(c)

84,333

82,292

2.5

%

1.7

%

8,353

7,262

15.0

%

Other Revenues(d)

(134

)

582

(123.0

)%

Total Electric Revenues

$

8,219

$

7,844

4.8

%

Purchased Power

$

3,042

$

2,816

8.0

%

% Change

Heating and Cooling Degree-Days

2024

2023

Normal

From 2023

From Normal

Heating Degree-Days

4,795

5,014

5,968

(4.4

)%

(19.7

)%

Cooling Degree-Days

1,215

1,145

1,002

6.1

%

21.3

%

Number of Electric Customers

2024

2023

Residential

3,727,097

3,744,213

Small commercial & industrial

396,797

391,675

Large commercial & industrial

2,283

1,877

Public authorities & electric

railroads

5,775

4,807

Total

4,131,952

4,142,572

__________

(a)

Reflects revenues from customers

purchasing electricity directly from ComEd and customers purchasing

electricity from a competitive electric generation supplier, as all

customers are assessed delivery charges. For customers purchasing

electricity from ComEd, revenues also reflect the cost of energy

and transmission.

(b)

Includes transmission revenue

from PJM, wholesale electric revenue, and mutual assistance

revenue.

(c)

Includes operating revenues from

affiliates totaling $2 million and $2 million for the three months

ended December 31, 2024 and 2023, respectively, and $8 million and

$16 million for the twelve months ended December 31, 2024 and 2023,

respectively.

(d)

Includes alternative revenue

programs and late payment charges.

PECO Statistics

Three

Months Ended December 31, 2024 and 2023

Electric and Natural Gas

Deliveries

Revenue (in millions)

2024

2023

% Change

Weather- Normal %

Change

2024

2023

% Change

Electric (in GWhs)

Electric Deliveries and

Revenues(a)

Residential

3,066

3,076

(0.3

)%

(1.7

)%

$

486

$

473

2.7

%

Small commercial & industrial

1,807

1,751

3.2

%

0.6

%

140

111

26.1

%

Large commercial & industrial

3,358

3,240

3.6

%

2.6

%

70

53

32.1

%

Public authorities & electric

railroads

143

142

0.7

%

1.2

%

8

7

14.3

%

Other(b)

—

—

n/a

n/a

75

79

(5.1

)%

Total electric revenues(c)

8,374

8,209

2.0

%

0.5

%

779

723

7.7

%

Other Revenues(d)

9

(5

)

(280.0

)%

Total Electric Revenues

788

718

9.7

%

Natural Gas (in mmcfs)

Natural Gas Deliveries and

Revenues(e)

Residential

12,549

12,145

3.3

%

(0.9

)%

145

138

5.1

%

Small commercial & industrial

7,164

6,801

5.3

%

7.8

%

51

49

4.1

%

Large commercial & industrial

—

12

(100.0

)%

(15.7

)%

—

—

n/a

Transportation

6,109

6,259

(2.4

)%

(1.5

)%

8

7

14.3

%

Other(f)

—

—

n/a

n/a

5

5

—

%

Total natural gas revenues(g)

25,822

25,217

2.4

%

1.1

%

209

199

5.0

%

Other Revenues(d)

1

—

n/a

Total Natural Gas Revenues

210

199

5.5

%

Total Electric and Natural Gas

Revenues

$

998

$

917

8.8

%

Purchased Power and Fuel

$

363

$

347

4.6

%

% Change

Heating and Cooling Degree-Days

2024

2023

Normal

From 2023

From Normal

Heating Degree-Days

1,345

1,351

1,528

(0.4

)%

(12.0

)%

Cooling Degree-Days

53

48

32

10.4

%

65.6

%

Twelve

Months Ended December 31, 2024 and 2023

Electric and Natural Gas

Deliveries

Revenue (in millions)

2024

2023

% Change

Weather- Normal %

Change

2024

2023

% Change

Electric (in GWhs)

Electric Deliveries and

Revenues(a)

Residential

13,963

13,262

5.3

%

0.2

%

$

2,169

$

2,090

3.8

%

Small commercial & industrial

7,683

7,367

4.3

%

1.3

%

547

526

4.0

%

Large commercial & industrial

13,889

13,638

1.8

%

0.6

%

261

249

4.8

%

Public authorities & electric

railroads

613

606

1.2

%

1.2

%

29

30

(3.3

)%

Other(b)

—

—

n/a

n/a

296

298

(0.7

)%

Total electric revenues(c)

36,148

34,873

3.7

%

0.6

%

3,302

3,193

3.4

%

Other Revenues(d)

23

9

155.6

%

Total Electric Revenues

3,325

3,202

3.8

%

Natural Gas (in mmcfs)

Natural Gas Deliveries and

Revenues(e)

Residential

38,328

35,842

6.9

%

0.7

%

445

473

(5.9

)%

Small commercial & industrial

21,906

21,182

3.4

%

0.1

%

157

172

(8.7

)%

Large commercial & industrial

17

51

(66.7

)%

(11.1

)%

—

1

(100.0

)%

Transportation

23,357

23,741

(1.6

)%

(2.6

)%

28

27

3.7

%

Other(f)

—

—

n/a

n/a

16

17

(5.9

)%

Total natural gas revenues(g)

83,608

80,816

3.5

%

(0.4

)%

646

690

(6.4

)%

Other Revenues(d)

2

2

—

%

Total Natural Gas Revenues

648

692

(6.4

)%

Total Electric and Natural Gas

Revenues

$

3,973

$

3,894

2.0

%

Purchased Power and Fuel

$

1,477

$

1,544

(4.3

)%

% Change

Heating and Cooling Degree-Days

2024

2023

Normal

From 2023

From Normal

Heating Degree-Days

3,786

3,587

4,381

5.5

%

(13.6

)%

Cooling Degree-Days

1,652

1,345

1,462

22.8

%

13.0

%

Number of Electric Customers

2024

2023

Number of Natural Gas

Customers

2024

2023

Residential

1,533,443

1,535,927

Residential

508,224

507,197

Small commercial & industrial

155,164

156,248

Small commercial & industrial

44,846

45,001

Large commercial & industrial

3,150

3,127

Large commercial & industrial

7

9

Public authorities & electric

railroads

10,708

10,417

Transportation

644

627

Total

1,702,465

1,705,719

Total

553,721

552,834

__________

(a)

Reflects delivery volumes and

revenues from customers purchasing electricity directly from PECO

and customers purchasing electricity from a competitive electric

generation supplier as all customers are assessed distribution

charges. For customers purchasing electricity from PECO, revenues

also reflect the cost of energy and transmission.

(b)

Includes transmission revenue

from PJM, wholesale electric revenue, and mutual assistance

revenue.

(c)

Includes operating revenues from

affiliates totaling $2 million and $3 million for the three months

ended December 31, 2024 and 2023, respectively, and $7 million and

$7 million for the twelve months ended December 31, 2024 and 2023,

respectively.

(d)

Includes alternative revenue

programs and late payment charges.

(e)

Reflects delivery volumes and

revenues from customers purchasing natural gas directly from PECO

and customers purchasing natural gas from a competitive natural gas

supplier as all customers are assessed distribution charges. For

customers purchasing natural gas from PECO, revenue also reflects

the cost of natural gas.

(f)

Includes revenues primarily from

off-system sales.

(g)

Includes operating revenues from

affiliates totaling $1 million and less than $1 million for the

three months ended December 31, 2024 and 2023, respectively, and $3

million and $2 million for the twelve months ended December 31,

2024 and 2023, respectively.

BGE Statistics

Three

Months Ended December 31, 2024 and 2023

Electric and Natural Gas

Deliveries

Revenue (in millions)

2024

2023

% Change

Weather- Normal

% Change

2024

2023

% Change

Electric (in GWhs)

Electric Deliveries and

Revenues(a)

Residential

2,927

2,864

2.2

%

(1.9

)%

$

482

$

457

5.5

%

Small commercial & industrial

638

633

0.8

%

(0.4

)%

85

79

7.6

%

Large commercial & industrial

3,109

3,032

2.5

%

1.2

%

132

116

13.8

%

Public authorities & electric

railroads

48

51

(5.9

)%

(4.4

)%

8

7

14.3

%

Other(b)

—

—

n/a

n/a

112

98

14.3

%

Total electric revenues(c)

6,722

6,580

2.2

%

(0.4

)%

819

757

8.2

%

Other Revenues(d)

28

29

(3.4

)%

Total Electric Revenues

847

786

7.8

%

Natural Gas (in mmcfs)

Natural Gas Deliveries and

Revenues(e)

Residential

12,156

11,769

3.3

%

(5.2

)%

207

163

27.0

%

Small commercial & industrial

2,689

2,571

4.6

%

(2.8

)%

34

27

25.9

%

Large commercial & industrial

10,727

11,221

(4.4

)%

(7.1

)%

61

43

41.9

%

Other(f)

945

1,668

(43.3

)%

n/a

7

10

(30.0

)%

Total natural gas revenues(g)

26,517

27,229

(2.6

)%

(5.7

)%

309

243

27.2

%

Other Revenues(d)

1

12

(91.7

)%

Total Natural Gas Revenues

310

255

21.6

%

Total Electric and Natural Gas

Revenues

$

1,157

$

1,041

11.1

%

Purchased Power and Fuel

$

423

$

387

9.3

%

% Change

Heating and Cooling Degree-Days

2024

2023

Normal

From 2023

From Normal

Heating Degree-Days

1,544

1,395

1,629

10.7

%

(5.2

)%

Cooling Degree-Days

27

42

29

(35.7

)%

(6.9

)%

Twelve

Months Ended December 31, 2024 and 2023

Electric and Natural Gas

Deliveries

Revenue (in millions)

2024

2023

% Change

Weather- Normal

% Change

2024

2023

% Change

Electric (in GWhs)

Electric Deliveries and

Revenues(a)

Residential

12,682

12,026

5.5

%

0.3

%

$

2,038

$

1,765

15.5

%

Small commercial & industrial

2,716

2,638

3.0

%

0.3

%

360

331

8.8

%

Large commercial & industrial

13,170

12,844

2.5

%

1.2

%

557

528

5.5

%

Public authorities & electric

railroads

198

204

(2.9

)%

(2.8

)%

31

29

6.9

%

Other(b)

—

—

n/a

n/a

414

402

3.0

%

Total electric revenues(c)

28,766

27,712

3.8

%

0.7

%

3,400

3,055

11.3

%

Other Revenues(d)

36

54

(33.3

)%

Total Electric Revenues

3,436

3,109

10.5

%

Natural Gas (in mmcfs)

Natural Gas Deliveries and

Revenues(e)

Residential

36,645

34,724

5.5

%

(3.4

)%

625

568

10.0

%

Small commercial & industrial

8,682

8,276

4.9

%

(2.5

)%

110

100

10.0

%

Large commercial & industrial

39,618

40,006

(1.0

)%

(3.8

)%

204

161

26.7

%

Other(f)

2,268

3,361

(32.5

)%

n/a

18

37

(51.4

)%

Total natural gas revenues(g)

87,213

86,367

1.0

%

(3.5

)%

957

866

10.5

%

Other Revenues(d)

33

52

(36.5

)%

Total Natural Gas Revenues

990

918

7.8

%

Total Electric and Natural Gas

Revenues

$

4,426

$

4,027

9.9

%

Purchased Power and Fuel

$

1,651

$

1,531

7.8

%

% Change

Heating and Cooling Degree-Days

2024

2023

Normal

From 2023

From Normal

Heating Degree-Days

3,973

3,590

4,538

10.7

%

(12.5

)%

Cooling Degree-Days

1,066

960

914

11.0

%

16.6

%

Number of Electric Customers

2024

2023

Number of Natural Gas

Customers

2024

2023

Residential

1,216,614

1,211,889

Residential

658,776

657,823

Small commercial & industrial

115,010

115,787

Small commercial & industrial

37,874

37,993

Large commercial & industrial

13,266

13,072

Large commercial & industrial

6,369

6,309

Public authorities & electric

railroads

260

261

Total

703,019

702,125

Total

1,345,150

1,341,009

__________

(a)

Reflects revenues from customers

purchasing electricity directly from BGE and customers purchasing

electricity from a competitive electric generation supplier as all

customers are assessed distribution charges. For customers

purchasing electricity from BGE, revenues also reflect the cost of

energy and transmission.

(b)

Includes transmission revenue