Form 305B2 - Filing [Trust Indenture Act]

February 13 2025 - 7:46AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM T-1

STATEMENT OF ELIGIBILITY

UNDER THE TRUST INDENTURE ACT OF 1939 OF A

CORPORATION DESIGNATED TO ACT AS TRUSTEE

CHECK IF AN APPLICATION TO DETERMINE

ELIGIBILITY OF

A TRUSTEE PURSUANT TO SECTION 305(b)(2) ¨

THE

BANK OF NEW YORK MELLON

TRUST

COMPANY, N.A.

(Exact name of trustee as specified in its charter)

| |

95-3571558 |

| (Jurisdiction of incorporation |

(I.R.S. employer |

| if not a U.S. national bank) |

identification no.) |

| |

|

| 333 South Hope Street |

|

| Suite 2525 |

|

| Los Angeles, California |

90071 |

| (Address of principal executive offices) |

(Zip code) |

Exelon Corporation

(Exact name of obligor as specified in its charter)

| Pennsylvania |

23-2990190 |

| (State or other jurisdiction of |

(I.R.S. employer |

| incorporation or organization) |

identification no.) |

| |

|

| 10 South Dearborn Street |

|

| P.O. Box 805379 |

|

| Chicago, Illinois |

60680-5379 |

| (Address of principal executive offices) |

(Zip code) |

|

| Subordinated Debt Securities |

| (Title of the indenture securities) |

| 1. | General information. Furnish the following information as to the trustee: |

| (a) | Name and address of each examining or supervising authority to which it is subject. |

| Name | |

Address |

| Comptroller of the Currency | |

Washington, DC 20219 |

| United States Department of the | |

|

| Treasury | |

|

| | |

|

| Federal Reserve Bank | |

San Francisco, CA 94105 |

| | |

|

| Federal Deposit Insurance Corporation | |

Washington, DC 20429 |

| (b) | Whether it is authorized to exercise corporate trust powers. |

Yes.

| 2. | Affiliations with Obligor. |

If the obligor is an affiliate of

the trustee, describe each such affiliation.

None.

Exhibits identified in parentheses

below, on file with the Commission, are incorporated herein by reference as an exhibit hereto, pursuant to Rule 7a-29 under the Trust

Indenture Act of 1939 (the "Act").

| 1. | A copy of the articles of association of The Bank of New York Mellon Trust Company, N.A., formerly known

as The Bank of New York Trust Company, N.A. (Exhibit 1 to Form T-1 filed with Registration Statement No. 333-121948 and Exhibit 1 to Form

T-1 filed with Registration Statement No. 333-152875). |

| 2. | A copy of certificate of authority of the trustee to commence business. (Exhibit 2 to Form T-1 filed with

Registration Statement No. 333-121948). |

| 3. | A copy of the authorization of the trustee to exercise corporate trust powers (Exhibit 3 to Form T-1 filed

with Registration Statement No. 333-152875). |

| 4. | A copy of the existing by-laws of the trustee (Exhibit 4 to Form T-1 filed with Registration Statement

No. 333-229762). |

| 6. | The consent of the trustee required by Section 321(b) of the Act (Exhibit 6 to Form T-1 filed with Registration

Statement No. 333-152875). |

SIGNATURE

Pursuant to the requirements

of the Act, the trustee. The Bank of New York Mellon Trust Company, N.A., a banking association organized and existing under the laws

of the United States of America, has duly caused this statement of eligibility to be signed on its behalf by the undersigned, thereunto

duly authorized, all in the City of Chicago, and State of Illinois, on the 6th day of February, 2025.

| |

THE BANK OF NEW YORK MELLON |

| |

TRUST COMPANY, N.A. |

| |

|

| |

By: |

/s/ Ann M, Dolezar |

| |

|

Name: |

Ann M, Dolezar |

| |

|

Title: |

Vice President |

EXHIBIT 7

Consolidated Report of Condition

of

THE BANK OF NEW YORK MELLON TRUST

COMPANY, N.A.

of 333 South Hope Street, Suite 2525, Los Angeles, CA 90071

At the close of business December 31,

2024, published in accordance with Federal regulatory authority instructions.

| ASSETS | |

Dollar amounts

in thousands | |

| Cash and balances due from depository institutions: | |

| |

| Noninterest-bearing balances and currency and coin | |

| 30,948 | |

| Interest-bearing balances | |

| 200,909 | |

| Securities: | |

| | |

| Held-to-maturity securities | |

| 0 | |

| Available-for-sale debt securities | |

| 98,676 | |

| Equity securities with readily determinable fair values not held for trading | |

| 0 | |

| Federal funds sold and securities purchased under agreements to resell: | |

| | |

| Federal funds sold in domestic offices | |

| 0 | |

| Securities purchased under agreements to resell | |

| 0 | |

| Loans and lease financing receivables: | |

| | |

| Loans and leases held for sale | |

| 0 | |

| Loans and leases held for investment | |

| 0 | |

| LESS: Allowance for credit losses on loans and leases | |

| 0 | |

| Loans and leases held for investment, net of

allowance | |

| 0 | |

| Trading assets | |

| 0 | |

| Premises and fixed assets (including right-of-use assets) | |

| 9,955 | |

| Other real estate owned | |

| 0 | |

| Investments in unconsolidated subsidiaries and associated companies | |

| 0 | |

| Direct and indirect investments in real estate ventures | |

| 0 | |

| Intangible assets | |

| 856,313 | |

| Other assets | |

| 105,148 | |

| | |

| | |

| Total assets | |

$ | 1,301,949 | |

LIABILITIES

| Deposits: | |

| |

| In domestic offices | |

| 967 | |

| Noninterest-bearing | |

| 967 | |

| Interest-bearing | |

| 0 | |

| | |

| | |

| Federal funds purchased and securities sold under agreements to repurchase: | |

| | |

| Federal funds purchased in domestic offices | |

| 0 | |

| Securities sold under agreements to repurchase | |

| 0 | |

| Trading liabilities | |

| 0 | |

| Other borrowed money: | |

| | |

| (includes mortgage indebtedness) | |

| 0 | |

| Not applicable | |

| | |

| Not applicable | |

| | |

| Subordinated notes and debentures | |

| 0 | |

| Other liabilities | |

| 264,082 | |

| Total liabilities | |

| 265,049 | |

| Not applicable | |

| | |

EQUITY CAPITAL

| Perpetual preferred stock and related surplus | |

| 0 | |

| Common stock | |

| 1,000 | |

| Surplus (exclude all surplus related to preferred stock) | |

| 107,246 | |

| Not available | |

| | |

| Retained earnings | |

| 928,635 | |

| Accumulated other comprehensive income | |

| 19 | |

| Other equity capital components | |

| 0 | |

| Not available | |

| | |

| Total bank equity capital | |

| 1,036,900 | |

| Noncontrolling (minority) interests in consolidated subsidiaries | |

| 0 | |

| Total equity capital | |

| 1,036,900 | |

| Total liabilities and equity capital | |

| 1,301,949 | |

I, Shana Quinn, CFO of the above-named

bank do hereby declare that the Reports of Condition and Income (including the supporting schedules) for this report date have been prepared

in conformance with the instructions issued by the appropriate Federal regulatory authority and are true to the best of my knowledge and

belief.

We, the undersigned directors (trustees), attest

to the correctness of the Report of Condition (including the supporting schedules) for this report date and declare that it has been examined

by us and to the best of our knowledge and belief has been prepared in conformance with the instructions issued by the appropriate Federal

regulatory authority and is true and correct.

| Kevin C. Weeks, President |

) |

|

| Cathleen Sokolowski, Managing Director |

) |

Directors (Trustees) |

| Jon M. Pocchia, Senior Director |

) |

|

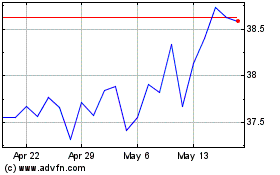

Exelon (NASDAQ:EXC)

Historical Stock Chart

From Jan 2025 to Feb 2025

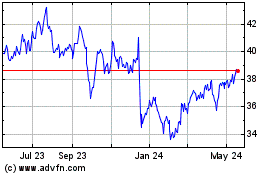

Exelon (NASDAQ:EXC)

Historical Stock Chart

From Feb 2024 to Feb 2025