UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

Fastenal Company

(Exact name of the registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Minnesota | | | | 0-16125 |

(State or other jurisdiction

of incorporation or organization) | | | (Commission

File Number) |

| | | | |

| | | | |

| 2001 Theurer Boulevard, Winona, Minnesota | | 55987-1500 |

| (Address of principal executive offices) | | | Zip Code |

| | | | |

| | | | |

| Ellen Stolts | Vice President of Accounting and Finance | (507) 313-7282 |

| (Name and telephone number, including area code, of the person to contact in connection with this report.) |

Check the appropriate box to indicate the rule pursuant to which this form is being filed:

| | | | | | | | |

| X | | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023. |

| | |

| | Rule 13q-1 under the Securities Exchange Act (17 CFR 240.13q-1) for the fiscal year ended __________. |

Section 1 – Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Fastenal Company (hereinafter referred to as 'Fastenal' or by terms such as 'we', 'our', or 'us') has filed a Conflict Minerals Report for the reporting period from January 1, 2023 to December 31, 2023 (the 2023 Conflict Minerals Report), which is referenced in Item 1.02 below, filed as an exhibit to this Form SD and also publicly available on our website at https://investor.fastenal.com/ under the "Investor Resources" tab.

Item 1.02 Exhibit

A copy of our 2023 Conflict Minerals Report is filed as Exhibit 1.01 attached to this Form SD.

Section 2 – Resource Extraction Issuer Disclosure

Item 2.01 Resource Extraction Issuer Disclosure and Report

Not applicable.

Section 3 – Exhibits

Item 3.01 Exhibits

The following exhibit is filed as part of this report.

Exhibit 1.01 – Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form SD.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| | | | | | | | |

| | Fastenal Company |

| | (Registrant) |

| | |

| May 16, 2024 | | /s/ SHERYL A. LISOWSKI |

| (Date) | | Sheryl A. Lisowski |

| | Executive Vice President - Chief Accounting Officer and Treasurer |

| | | | | | | | |

| Exhibit Index | |

| 1.01 | Conflict Minerals Report | Electronically Filed |

Fastenal Company

Conflict Mineral Report

For the Year Ended December 31, 2023

This report for the year ended December 31, 2023 is presented to comply with Rule 13p-1 under the Securities Exchange Act of 1934 (the Rule). The Rule was adopted by the Securities and Exchange Commission (SEC) to implement reporting and disclosure requirements related to conflict minerals as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The Rule imposes certain reporting obligations on SEC registrants whose manufactured products contain conflict minerals which are necessary to the functionality of production of their products. Conflict minerals are defined as cassiterite, columbite-tantalite, gold, wolframite, and their derivatives, which are limited to tin, tantalum, tungsten, and gold (3TG). The covered countries for the purposes of the Rule and this report are the Democratic Republic of the Congo (the DRC), the Republic of the Congo, the Central African Republic, South Sudan, Uganda, Rwanda, Burundi, Tanzania, Zambia, and Angola (the Covered Countries).

1. Company Overview and Covered Products

This report has been prepared by our management. The information includes the activities of all subsidiaries that are required to be consolidated.

Fastenal is a North American leader in the wholesale distribution of industrial and construction supplies. We distribute these supplies through a network of more than 3,400 in-market locations. Most of our customers are in the manufacturing and non-residential construction markets. Our principal products include Fasteners, Tools, Cutting Tools, Hydraulics & Pneumatics, Material Handling, Janitorial Supplies, Electrical Supplies, Welding Supplies, and Safety Supplies. Each product line may contain multiple product categories.

In 2023, approximately 96% of our consolidated net sales were attributable to products manufactured by other companies to industry standards or to customer specific requirements. The remaining 4% related to products manufactured, modified, or repaired by our manufacturing businesses or our support services, consisting primarily of non-standard sizes of threaded fasteners and hardware made to customers' specifications, or standard sizes manufactured under our Holo-Krome®, Cardinal Fasteners®, and Spensall® product lines (the Covered Products). Products modified or repaired by our manufacturing business or support services are not in scope because we do not manufacture or contract to manufacture such products. In addition to our manufactured items are the Fastenal Brands listed below, which include applicable sub-brands, that we may be deemed to contract to manufacture. Since we may be deemed to contract to manufacture some of the products consisting of Fastenal Brands, a portion of our products manufactured by others are also included as Covered Products.

| | | | | |

| Fastenal Brand | Product Type |

Agent® | Safety Non-Personal Protective Equipment (PPE) |

Aspect® | Office Supplies |

Blackstone® | Abrasives & Welding Supplies |

Body Guard® | Safety PPE |

Clean Choice® | Janitorial Supplies |

DynaFlo® | Fluid, Power, and Lubrication Supplies |

EquipRite® | Lifting and Rigging & Material Handling |

Fastenal Performance Anchoring Systems® | Anchoring Fasteners |

FMT® | Metalworking & Cutting Tools |

FNL® & EcoGuard® | Fasteners |

Northway® | Fleet & Automotive Supplies |

ORMADUS® | Global Exclusive Brand (1) |

Power Phase® | Electrical Supplies |

ProFitter® | HVAC & Plumbing Supplies |

Regiment® | Hardware Supplies |

Rock River® | Construction Supplies |

Stronghold® | Power Transmission Supplies |

Talon® | Chemicals & Greases |

Tritan® | Measuring Tools |

(1) In 2023, we consolidated our North American legacy brands to provide the Fastenal Brand value proposition on a global scale.

Fastenal has actively engaged with its customers and suppliers for several years with respect to the use of conflict minerals. We adopted a conflict minerals policy articulating the conflict minerals supply chain due diligence process and our commitments to reporting obligations regarding conflict minerals. The policy is available online and can be found at www.fastenal.com/fast/services-and-solutions/engineering/material-declarations-conflict. We have contributed to industry efforts to address conflict minerals as a member of the Responsible Minerals Initiative (RMI). This engagement and the contributions made have helped develop standards, best practices, and tools that benefit all companies working to stop sourcing 3TG from conflict areas in the DRC and adjoining countries.

2. Reasonable Country of Origin Inquiry (RCOI) Survey

A targeted risk-based approach was utilized by Fastenal to ensure we included suppliers of products that were more likely to contain 3TG, either due to the nature of the component or the location of the supplier and its manufacturing facilities. We assessed our industry as well as other companies and confirmed that this risk-based approach is consistent with how many peer companies are approaching the Rule.

Fastenal retained Assent Inc. (Assent), a third-party service provider, to assist in reviewing the supply chain and identifying risks. We provided a list of suppliers and parts associated with the in-scope products to Assent for upload to the Assent Compliance Manager. To trace materials, and demonstrate transparency procured by the supply chain, we utilized the Conflict Minerals Reporting Template (CMRT) Version 6.2 or higher to conduct a survey of all in-scope suppliers. During the supplier survey, we contacted suppliers via a software-as-a-service (SaaS) platform provided by Assent that enables users to complete and track supplier communications, and allows suppliers to upload completed CMRTs directly to the platform for validation, assessment, and management. The platform meets the Organization for Economic Co-operation and Development (OECD) Guidance process expectations by evaluating the quality of each supplier response and assigning a health score based on the supplier's declaration of process engagement. Additionally, the metrics provided in this report, as well as the step-by-step process for supplier engagement and upstream due diligence investigations, are managed through this platform. Working with our service provider, we requested that all suppliers complete a CMRT. Training and education to guide suppliers on best practices and the use of this template was included. Assent monitored and tracked all communications for future reporting and transparency. We directly contacted suppliers that were unresponsive to Assent's communications during the diligence process and requested these suppliers complete the CMRT and submit it to Assent.

Fastenal's program continues to include automated data validation on all submitted CMRTs. The goal of data validation is to increase the accuracy of submissions and identify any contradictory answers in the CMRT. This data validation is based on questions within the declaration tab of the CMRT, which helps identify areas that require further classification or risk assessment, as well as understand the due diligence efforts of Tier 1 suppliers. The results of this data validation contribute to the program's health assessment and are shared with the suppliers to ensure they understand areas that require clarification or improvement.

All submitted declaration forms are accepted so that data is retained, but they are classified as valid or invalid based on a set criteria of validation errors (see Appendix A for CMRT validation criteria). Suppliers are contacted regarding invalid forms and are encouraged to correct validated errors to resubmit a valid form. Suppliers are provided with guidance on how to correct these validation errors in the form of feedback to their CMRT submission, training courses, and direct engagement help through Assent's multilingual Supplier Experience team. Since some suppliers may remain unresponsive to feedback, Fastenal tracks program gaps to account for future improvement opportunities.

3. Due Diligence

3.1 Framework Design

To determine the source and chain of custody of 3TG necessary to the functionality and/or production of our products, we conducted due diligence on our supply chain. Our due diligence measures were developed to ascertain whether the 3TG in our products originated in the Covered Countries. Our due diligence measures have been designed to conform, in all material respects, with the framework in the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (OECD Guidance) and the related Supplements for gold, tin, tantalum, and tungsten. As detailed in the following sections, our due diligence process has been designed to comply with the following five steps of the OECD Guidance:

1.Establishment of strong company management systems;

2.Identification and assessment of risks in our supply chain;

3.Implementation of a strategy to respond to identified risks;

4.Audit of supply chain due diligence; and

5.Reporting on supply chain due diligence annually.

3.2 Due Diligence Performed

Due diligence measures performed to advance the efforts described above included:

a.Continued membership in the Responsible Minerals Initiative (RMI);

b.Compared smelters and refiners identified by suppliers to RMI lists of validated conflict free and verified facilities and the US Department of Commerce "Reporting Requirements Under Section 1502(d)(3)(C) of the Dodd-Frank Act World-Wide Conflict Mineral Processing Facilities", and conducted our own supplemental research on smelters and refiners;

c.Contacted smelters identified with an audit status of "outreach required", "communication suspended", "non-conformant", "RMI due diligence review", or "RMI due diligence vetting process" in addition to the suppliers correlated to those smelters, promoting certification with RMI;

d.Escalated communication with unresponsive suppliers to the stakeholder(s) in charge of the business relationship;

e.Validated questionable supplier responses by reviewing bill of material reports for existence of 3TG in the Covered Products;

f.Requested product level CMRTs when supplier responses indicated 3TG existed within the supplier's full product offering to ensure applicability to the Covered Products;

g.Challenged and returned outdated supplier disclosures to obtain updated responses; and

h.Screened the responses with a screening software to alert us if any materials or components provided to us may have originated in any country that may be subject to sanctions or other various governmental watchlists related to human rights violations or if any of the smelters or refiners identified are subject to sanctions or may be on other various government watchlists related to human rights violations.

4. Overview of Fastenal's Conflict Minerals Program

Supply Chain and Developing Strong Company Management System

Due to the breadth and volume of suppliers with which Fastenal conducts business, we are continuing outreach and finalizing review of responses from our suppliers. We rely on our direct suppliers to provide information regarding the origin of any 3TG conflict minerals contained in components and materials supplied to us, including sources of 3TG that are supplied to our direct suppliers from lower tier suppliers. Our Conflict Minerals Policy, Contract terms, and Supplier Code of Conduct have been made available to all suppliers. Internal systems have been created and improved upon to allow for product level reporting capabilities to better manage due diligence on the Covered Products.

Fastenal has established a management system for conflict minerals. Our management team includes the Senior Executive Vice President and Chief Financial Officer, Vice President - General Counsel, and Vice President of Product Development. The President and Chief Executive Officer and other executive-level representatives provide direct oversight of the management team. Also, subject matter experts from relevant functions such as Supply Chain Compliance, Trade Compliance, Engineering, Quality Control, Manufacturing, Procurement, and Product Development have assisted and supported the management team with implementing processes and procedures to reach the objectives of our program. The Director of Supply Chain Compliance acts as the conflict minerals program manager. Continued involvement with industry groups keeps us informed of changes and solutions surrounding supply chain transparency within the industry.

If a Fastenal employee suspects that someone may have violated the Standards of Conduct, Supplier Code of Conduct, or is in doubt about the best course of action in a particular circumstance, the employee should promptly contact his or her direct supervisor, any member of management, the legal department, the Audit Committee, or the Chair of the Board. Violations or grievances at the industry level can be reported to the RMI directly at www.responsiblemineralsinitiative.org/responsible-minerals-assurance-process/grievance-mechanism/.

Fastenal has adopted to retain relevant documentation for a period of five years. Through Assent, a document retention policy to retain conflict minerals related documents, including supplier responses to CMRTs and the sources identified within each reporting period, has been implemented. We store all of our information and findings from this process in a database that can be audited by internal or external parties.

Identify and Assess Risk in Supply Chain

Risks associated with Tier 1 suppliers' due diligence processes were assessed by their declaration responses on a CMRT, which the Assent Compliance Manager identifies automatically based on established criteria. These risks are addressed by Assent staff and members of Fastenal's internal Conflict Minerals Team, as noted previously in this report, who engage with suppliers to gather pertinent data and ask for corrective actions if needed, performing an overall assessment of the supplier's conformity status, which is referred to as "conflict minerals status."

Risks at the supplier level may include non-responsive suppliers or incomplete CMRTs. In cases where a company-level CMRT is submitted, such as when a company declares their broad product offering contains 3TGs, we are unable to determine if 3TGs are present in specific products supplied to Fastenal, nor if the specified smelters/refiners were used in those products. Assent's supplier risk assessment (flagging suppliers' risk as high, medium, or low) identifies problematic suppliers in a company's supply chain. The risk assessment is derived from the smelter validation process, which establishes risk at the smelter level via an analysis that takes into account multiple conflict minerals factors. Other supply chain risks were identified by assessing the due diligence practices and audit status of smelters/refiners identified in the supply chain by upstream suppliers that listed mineral processing facilities on their CMRT declarations. Assent's Smelter validation program compared listed facilities to the list of smelters/refiners consolidated by the RMI to ensure that the facilities met the recognized definition of a 3TG processing facility that was operational during the 2023 calendar year. Assent determined if the smelter had been audited against a standard in conformance with the OECD Guidance, such as the Responsible Minerals Assurance Process (RMAP). We do not have a direct relationship with smelters/refiners, and do not perform direct audits of these entities within their pre-supply chain. Smelters that are conformant to RMAP audit standards are considered to have their sourcing validated as "conflict free or responsibly sourced." In cases where the smelter/refiner's due diligence practices have not been audited against the RMAP standard or they are considered non-conformant by RMAP, further due diligence steps are followed to notify suppliers reporting these facilities. Smelters/refiners are actively monitored to proactively identify other risks pertaining to conflict minerals.

Each facility that meets the definition of a smelter or refiner of a 3TG mineral is assessed according to red-flag indicators defined in the OECD Guidance. Assent uses numerous factors to determine the level of risk that each smelter poses to the supply chain by identifying red flags. These factors include:

•Geographic proximity to Conflict-Affected and High-Risk Areas;

•Known mineral source country of origin;

•RMAP audit status;

•Credible evidence of unethical or conflict sourcing;

•Peer assessments conducted by credible third-party sources; and

•Sanctions and other human rights risks.

Risk mitigation activities are initiated whenever a supplier's CMRT reports facilities of concern. Through Assent, suppliers with submissions that included any smelters of concern were immediately provided with feedback instructing suppliers to take their own independent risk mitigation actions. Examples include the submission of a product-specific CMRT to better identify the connection to products that they supply to Fastenal. Additional escalation may have also been necessary to address any continued sourcing from these smelters of concern. Suppliers are given clear performance objectives within reasonable timeframes with the ultimate goal of progressive elimination of these smelters of concern from the supply chain.

In addition, suppliers are guided to the educational materials on mitigating the risks identified through the data collection process. Suppliers are also evaluated on program strength, which assists in making key risk mitigation decisions as the program progresses. The criteria used to evaluate the strength of the program is based on certain questions in the CMRT related to the suppliers' conflict minerals practices and policies.

Design and Implement Strategy to Respond to Risks

Together with Assent, Fastenal developed processes to assess and respond to the risks identified in the supply chain. We have a risk management plan, through which the conflict minerals program is implemented, managed, and monitored. As the program progresses, escalations are sent to non-responsive suppliers to outline the importance of a response via CMRTs and to outline the required cooperation for compliance to the conflict minerals rules and our expectations.

Feedback on supplier submissions is given directly to suppliers and educational resources are provided to assist suppliers in corrective action methods or to improve their internal programs. In cases where suppliers have continuously been non-responsive or are not committed to corrective action plans, we will assess if replacing that supplier is feasible. The results of the program and risk assessment are shared with the Conflict Minerals Team and our Leadership Team to ensure transparency within Fastenal as we work towards a conflict-free supply chain.

Audit of Supply Chain Due Diligence

In April 2014, the Securities and Exchange Commission provided written guidance that explained that only companies who elect to claim their products are "Conflict Free" are subject to an independent private sector audit. Fastenal is not making such claim. Consequently, this report presented herein was not audited. In addition, we do not have a direct relationship with any 3TG smelters/refiners and do not perform or direct audits of these entities within the supply chain. Instead, we rely on third-party audits of smelters/refiners (industry recognized audit/assessment programs). As an example, RMAP uses independent private-sector auditors, and audits the source, including the mines of origin, and the chain of custody of the conflict minerals used by smelters/refiners that agree to participate in the program.

Assent directly engages smelters/refiners that are not currently enrolled in an industry recognized audit/assessment program to encourage their participation and for those smelters/refiners already conformant to the corresponding program's standards, Assent thanks them for their efforts on behalf of its compliance partners. We are a signatory of these communications in accordance with the requirements of downstream companies detailed in the OECD Guidance.

Through Fastenal's membership with the RMI, smelters/refiners have been encouraged to participate in the RMAP. Any smelters/refiners that were reported by suppliers who were not part of the RMAP were also contacted directly by Assent to encourage them to participate in the RMAP as stated earlier.

Reporting on Efforts

In accordance with the OECD Guidance and the Rule, this report is available on our website at https://investor.fastenal.com under the "Investor Resources" tab.

5. Results of Due Diligence

5.1 Survey Responses

Identifying the Covered Products that contain 3TG has been a key part of reviews to date and supply chain outreach is required to identify the upstream sources of origin of tin, tantalum, tungsten, and gold. Suppliers included in the review process either manufacture Fastenal Brand "private label" products or are tied to our manufacturing supply chain and had purchase activity in 2023. Unresponsive and pending reviews will continue throughout 2024.

Following the industry standard process, CMRTs are sent to and requested from Tier 1 suppliers, who are expected to follow this process until the smelter and refiner sources are identified. The outreach conducted by Fastenal for the 2023 reporting year started with 316 suppliers and ended with 314 suppliers. Certain suppliers were deemed out of scope due to various reasons including, no purchase order (PO) actually placed with the supplier in the reporting year, product identified that did not meet our scoping definition, and various other reasons. The total response rate was 84.4%. Many suppliers continue to provide only company level information. We compared the information provided by our suppliers to the RMI list of smelters and refiners. While the sourcing status for some of these smelters and refiners remains unknown, the sourcing status for some of these smelters and refiners was available from information that we received as a RMI member. We have no way of knowing whether these smelters actually processed our Covered Products, since many suppliers continue to provide us with company level information and not product level information. We will continue working with these suppliers to obtain product level data specific to the Covered Products and encourage suppliers to source from RMAP conformant smelters and refiners. If we identify sanctions risk as part of the screening process described above, then we will work with the relevant suppliers to evaluate and remediate such risks in a manner consistent with applicable sanctions-program requirements, including, where appropriate, requesting that suppliers remove sanctioned smelters and refiners from their supply chain.

5.2 Product Determination

In light of the developing information from suppliers detailed above, we are unable to determine whether any of our Covered Products originated in Covered Countries. Supplier programs will need to mature more to comfortably provide this information.

5.3 Steps to Be Taken to Mitigate Risk

Fastenal has taken the following steps to improve the due diligence conducted to further mitigate any risk that the necessary 3TGs in our products could originate from Conflict-Affected and High-Risk Areas:

•Continue to evaluate upstream sources through a broader set of tools to evaluate risk. These include, but are not limited to:

–Using a comprehensive smelter and refiner library with detailed status and notes for each entity;

–Scanning for verifiable media sources on each smelter and refiner to flag risk issues; and

–Comparing the list of smelters/refiners against government watch and denied parties lists.

•Engage with suppliers more closely, and provide more information and training resources regarding responsible sourcing of 3TGs.

•Encourage suppliers to have due diligence procedures in place for their supply chains to improve the content of the responses from such suppliers.

•Continue to include a conflict minerals flow-down clause in new or renewed supplier contracts, as well as included in the terms and conditions of each PO issued.

•Following the OECD Guidance process, increase the emphasis on clean and validated smelter and refiner information from the supply chain through feedback and detailed smelter analysis.

Appendix A

CMRT Declaration Rejection/Approval Criteria

Assent Sustainability Platform Logic Structure

The following table maps the Assent Sustainability Platform's status outputs and CMRT logic structure when determining supplier conflict mineral statuses as displayed on the dashboard. Using this table, and referencing the CMRT questions listed above, users will be able to determine what answers were provided by their suppliers to earn their conflict minerals statuses.

Dashboard Supplier Response Statuses

| | | | | |

| Supplier Status | Description |

| Not Submitted | A CMRT has not been submitted by the supplier. |

| Complete | A CMRT has been submitted, and is valid and complete. |

| Incomplete | A supplier with parts associated to them has submitted a partially completed Product-Level or User-Defined CMRT. |

| Invalid Submission | A CMRT has been submitted and deemed invalid based on contradicting responses in the template. |

| Out of Scope | The supplier is out of scope for conflict minerals and does not need to be contacted. |

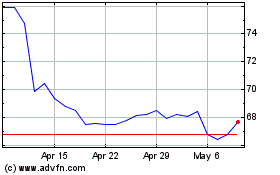

Fastenal (NASDAQ:FAST)

Historical Stock Chart

From May 2024 to Jun 2024

Fastenal (NASDAQ:FAST)

Historical Stock Chart

From Jun 2023 to Jun 2024