false00016517210001651721us-gaap:WarrantMember2024-01-312024-01-3100016517212024-01-312024-01-310001651721us-gaap:CommonStockMember2024-01-312024-01-31

A

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2024

GENERATION INCOME PROPERTIES, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

Maryland |

|

001-40771 |

|

47-4427295 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

401 East Jackson Street, Suite 3300 Tampa, Florida |

|

33602 |

|

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (813)-448-1234

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

GIPR |

|

The Nasdaq Stock Market LLC |

Warrants to purchase Common Stock |

|

GIPRW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On January 31, 2024, Generation Income Properties, Inc. (the “Company”), issued 2,794,597 shares of its common stock (the “Redemption Shares”) in redemption of all 2,400,000 issued and outstanding shares of its Series A Redeemable Preferred Stock, par value $0.01 per share (“Series A Preferred Stock”), pursuant to the optional redemption right set forth in Section 5(b) of the Articles Supplementary for the Series A Preferred Stock (“Articles Supplementary”).

The Redemption Shares were issued to the sole former holder of the Company’s Series A Preferred Stock upon the redemption thereof pursuant to an exemption from registration provided by Section 3(a)(9) of the Securities Act of 1933, as amended, and upon similar exemptions under applicable state laws. This exemption is available to the Company because the Redemption Shares were exchanged by the Company with its existing security holder in accordance with the terms of the Articles Supplementary governing the Series A Preferred Stock with no commission or other remuneration being paid or given for soliciting such an exchange.

Item 7.01. Regulation FD Disclosure.

On January 31, 2024, the Company issued a press release announcing the issuance of 2,794,587 shares of its common stock pursuant to the redemption of its issued and outstanding shares of Series A Preferred Stock. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 7.01 and the related information in Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act or the Exchange Act except as set forth by specific reference in such filing.

|

|

Item 9.01. |

Financial Statements and Exhibits. |

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

GENERATION INCOME PROPERTIES, INC. |

|

|

|

Date: January 31, 2024 |

|

By: |

|

/s/ Ron Cook |

|

|

|

|

Ron Cook |

|

|

|

|

Chief Financial Officer |

2

FOR IMMEDIATE RELEASE

January 31, 2024

Generation Income Properties (Nasdaq: GIPR) Issues 2,794,597 Shares of Its Common Stock

TAMPA, FLORIDA - Generation Income Properties, Inc. (NASDAQ: GIPR) (“GIP” or the “Company”) issued 2,794,597 shares of its common stock in redemption of all 2,400,000 issued and outstanding shares of its Series A Preferred Stock (the “Redemption”). The shares of the Company’s common stock issued in the Redemption were issued to the sole former holder of the Company’s Series A Preferred Stock, Modiv Operating Partnership, L.P. (“Modiv OP”). The Company issued shares of its Series A Preferred Stock to Modiv OP in connection with its earlier disclosed portfolio acquisition from Modiv Industrial (NYSE:MDV) (“Modiv”). As previously announced by Modiv, on December 29, 2023, Modiv declared a stock distribution of the Company’s shares to be issued pursuant to the Redemption on the Modiv common stock and the Modiv OP Class C units issued and outstanding as of January 17, 2024, with an estimated distribution date of January 31, 2024.

"As a result of the distribution by Modiv, we are thrilled to welcome approximately 4,500 new Shareholders to GIPR and expand our investor base. I’d like to personally greet everyone that is now an owner of both Modiv Industrial and GIPR, and assure you that we are highly committed to being a valuable investment for you and your families. As our name suggests, we take our responsibility of carrying a generational outlook very seriously, and we look forward to continuing that legacy growth” said David Sobelman, CEO of GIPR.

About Generation Income Properties

Generation Income Properties, Inc., located in Tampa, Florida, is an internally managed real estate investment trust focused on acquiring and managing income-producing retail, industrial and office properties net leased to high-quality tenants in densely populated submarkets throughout the United States. Additional information about Generation Income Properties, Inc. can be found at the Company's corporate website: www.gipreit.com.

Forward-Looking Statements:

This press release, whether or not expressly stated, may contain "forward-looking" statements as defined in the Private Securities Litigation Reform Act of 1995. The words "believe," "intend," "expect," "plan," “estimate,” "should," "will," "would," and similar expressions and all statements, which are not historical facts, are intended to identify forward-looking statements. These statements reflect the Company's expectations regarding future events and economic performance and are forward-looking in nature and, accordingly, are subject to risks and uncertainties. Such forward-looking statements include risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such forward-looking statements which are, in some cases, beyond the Company's control and which could have a material adverse effect on the Company's business, financial condition, and results of operations. These risks and uncertainties include the risk that the distribution of the Company’s shares issued pursuant to the Redemption will not occur when

anticipated, or at all, as well as risks relating to general economic conditions, market conditions, interest rates, and other risks and uncertainties that are identified from time to in the Company’s SEC filings, including those identified in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which are available at www.sec.gov. The occurrence of any of these risks and uncertainties could have a material adverse effect on the Company's business, financial condition, and results of operations. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Any forward-looking statement made by us herein speaks only as of the date on which it is made. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof, except as may be required by law.

Contact Details

Investor Relations

ir@gipreit.com

813-448-1234

2

v3.24.0.1

Document and Entity Information

|

Jan. 31, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 31, 2024

|

| Entity Registrant Name |

GENERATION INCOME PROPERTIES, INC.

|

| Entity Central Index Key |

0001651721

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity File Number |

001-40771

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Tax Identification Number |

47-4427295

|

| Entity Address, Address Line One |

401 East Jackson Street

|

| Entity Address, Address Line Two |

Suite 3300

|

| Entity Address, City or Town |

Tampa

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33602

|

| City Area Code |

(813)

|

| Local Phone Number |

448-1234

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

GIPR

|

| Security Exchange Name |

NASDAQ

|

| Warrants |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase Common Stock

|

| Trading Symbol |

GIPRW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

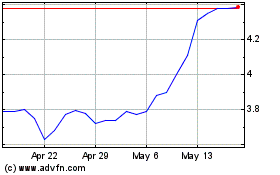

Generation Income Proper... (NASDAQ:GIPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Generation Income Proper... (NASDAQ:GIPR)

Historical Stock Chart

From Nov 2023 to Nov 2024