false00016517210001651721us-gaap:WarrantMember2024-07-242024-07-2400016517212024-07-242024-07-240001651721us-gaap:CommonStockMember2024-07-242024-07-24

A

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2024

GENERATION INCOME PROPERTIES, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

Maryland |

|

001-40771 |

|

47-4427295 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

401 East Jackson Street, Suite 3300 Tampa, Florida |

|

33602 |

|

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (813)-448-1234

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

GIPR |

|

The Nasdaq Stock Market LLC |

Warrants to purchase Common Stock |

|

GIPRW |

|

The Nasdaq Stock Market LLC |

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4859-6899-9379.2

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4859-6899-9379.2

Item 1.01. Entry into a Material Definitive Agreement.

Agreements with LMB Owenton I LLC

On July 24, 2024, Generation Income Properties L.P. (the “Operating Partnership”), the operating partnership of Generation Income Properties, Inc. (the “Company”), entered into a Fifth Amendment to the Amended and Restated Limited Partnership Agreement of the Operating Partnership (the “LPA Amendment”), pursuant to which the Company, as the general partner of the Operating Partnership, issued partnership interests to LMB Owenton I LLC (“Contributor”) in the form of Series B-1 Preferred Units (the “Series B-1 Preferred Units”). The LPA Amendment sets forth the designations, rights, powers, preferences and duties and other terms of the newly designated class of Series B-1 Preferred Units. The Series B-1 Preferred Units were issued in exchange for Common Units of the Operating Partnership pursuant to a Contribution Agreement (as defined below).

Also on July 24, 2024, the Operating Partnership and the Contributor entered into a Contribution and Exchange Agreement (the “Contribution Agreement”) pursuant to which the Contributor contributed 155,185 Common Units in exchange for 155,185 Series B-1 Preferred Units. If and when determined by the Company, as general partner of the Operating Partnership, in its sole discretion, holders of the Series B-1 Preferred Units will be paid cash distributions in the amount of $0.117 per Series B-1 Preferred Unit per quarter, subject to prior payment of any preferred return on senior preferred units of the Operating Partnership. The Contributor will have the right to cause the Operating Partnership to redeem the Series B-1 Preferred Units after two (2) years for either (i) cash in an amount equal to $7.15 per Series B-1 Preferred Unit or (ii) a number of shares of common stock of the Company equal to the number of Series B-1 Preferred Units being redeemed multiplied by 1.00, plus, in each case, an amount equal to all dividends accrued and unpaid thereon.

The foregoing descriptions of the above-referenced LPA Amendment and Contribution Agreement do not purport to be complete and are subject to, and qualified in their entirety by reference to, the full text of the LPA Amendment and Contribution Agreement, copies of which are filed herewith as Exhibit 4.1 and Exhibit 10.1, respectively, and are incorporated herein by reference.

Amendments to Norfolk Virginia Properties Limited Liability Company Agreements

On July 25, 2024, the Operating Partnership entered into First Amendments to the Second Amended and Restated Limited Liability Company Agreements, dated as of February 8, 2023, for each of the Norfolk, Virginia properties, GIPVA 2510 Walmer Ave, LLC and GIPVA 130 Corporate Blvd, LLC to revise the redemption date of Brown Family Enterprises, LLC membership interests from February 8, 2025 to February 8, 2027.

Item 3.02. Unregistered Sales of Equity Securities.

The information set forth under the heading “Agreements with LMB Owenton I LLC” in Item 1.01 above is incorporated herein by reference. The Series B-1 Preferred Units issued to the Contributor (together with the common stock of the Company, if any, issuable upon the redemption of the Series B-1 Preferred Units) will be issued, solely to “accredited investors,” as such term is defined in the Securities Act of 1933, as amended (the “Securities Act”) and in reliance on the exemption from registration afforded by Section 4(a)(2) and Regulation D (Rule 506) under the Securities Act and corresponding provisions of state securities laws. Accordingly, the issuance of such securities was not and is not registered under the Securities Act, and until registered, these securities may not be offered or sold in the United States absent registration or availability of an applicable exemption from registration.

|

|

|

10.1 |

|

Contribution and Exchange Agreement, dated July 24, 2024, by and between Generation Income Properties, L.P. and LMB Owenton I LLC. |

10.2 |

|

First Amendment to Second Amended and Restated Limited Liability Company Agreement of GIPVA 2510 Walmer Ave, LLC, dated July 25, 2024, by and between Generation Income Properties, L.P. and Brown Family Enterprises, LLC. |

|

|

|

10.3 |

|

First Amendment to Second Amended and Restated Limited Liability Company Agreement of GIPVA 130 Corporate Blvd, LLC, dated July 25, 2024, by and between Generation Income Properties, L.P. and Brown Family Enterprises, LLC. |

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Forward-Looking Statements

This Current Report on Form 8-K may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainty. Words such as “anticipate,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Such statements are based on management’s current expectations and are subject to a number of risks and uncertainties, many of which are beyond management’s control, that could cause actual results to differ materially from those described in the forward-looking statements, as well as risks relating to general economic conditions, market conditions, interest rates, and other factors. Investors are cautioned that there can be no assurance actual results or business conditions will not differ materially from those projected or suggested in such forward-looking statements as a result of various factors. Please refer to the risks detailed from time to time in the reports we file with the SEC, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC, as well as other filings on Form 10-Q and periodic filings on Form 8-K, for additional factors that could cause actual results to differ materially from those stated or implied by such forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

GENERATION INCOME PROPERTIES, INC. |

|

|

|

Date: July 29, 2024 |

|

By: |

|

/s/ David Sobelman |

|

|

|

|

David Sobelman |

|

|

|

|

Chief Executive Officer |

FIFTH AMENDMENT

TO THE

AMENDED AND RESTATED

LIMITED PARTNERSHIP AGREEMENT

OF

GENERATION INCOME PROPERTIES, L.P.

Dated as of July 24, 2024

This Fifth Amendment (this “ Amendment ”) to the Amended and Restated Limited Partnership Agreement, dated March 23, 2018, of Generation Income Properties, L.P., a Delaware limited partnership (the “ Partnership”), as amended by that certain First Amendment to the Amended and Restated Limited Partnership Agreement, dated May 21, 2019, that certain Second Amendment to the Amended and Restated Limited Partnership Agreement, dated October 12, 2020, that certain Third Amendment to the Amended and Restated limited Partnership Agreement, dated August 10, 2023, and that certain Fourth Amendment to the Amended and Restated Limited Partnership Agreement, dated June 27, 2024 (as amended, the “Partnership Agreement”), is entered into effective as of the date first written above in accordance with Section 4.02(a)(i) and Section 11.01 of the Partnership Agreement. Capitalized terms used but not defined herein are used as defined in the Partnership Agreement.

R E C I T A L S

WHEREAS, the General Partner is the sole general partner of the Partnership;

WHEREAS, Section 4.02 of the Partnership Agreement authorizes the General Partner to cause the Partnership to issue such additional Partnership Interests, in the form of Partnership Units, for any Partnership purpose at any time or from time to time to the Partners (including the General Partner) or to other Persons for such consideration and on such terms and conditions as shall be established by the General Partner in its sole and absolute discretion, all without the approval of any Limited Partners, which additional Partnership Interests may be issued in one or more classes, or one or more series of any of such classes, with such designations, preferences and relative, participating, optional or other special rights, powers and duties, including rights, powers and duties senior to the then-outstanding Partnership Units held by the Limited Partners, all as shall be determined by the General Partner in its sole and absolute discretion and without the approval of any Limited Partner, subject to Delaware law that cannot be preempted by the terms of the Partnership Agreement (including this Amendment) and as set forth in a written document hereafter attached to and made an exhibit to the Partnership Agreement;

WHEREAS, LMB Owenton I LLC, a Kentucky limited liability company (“Contributor”) holds 155,185 Common Units of the Partnership (the “Contributed Units”) that were received in connection with Contributor’s contribution of certain Property to the Partnership pursuant to that certain Contribution and Subscription Agreement dated October 11, 2021, which was amended effective as of February 7, 2023 (as amended, the “Contribution Agreement”);

WHEREAS, the Contributor desires to contribute all of the Contributed Units to the Partnership in exchange for 155,185 Series B-1 Preferred Units of the Partnership in a contribution and exchange transaction intended to qualify as a tax-free transaction under Section 721 of the Internal Revenue Code of 1986, as amended;

WHEREAS, the General Partner has authorized the issuance and sale (the “Contribution and Exchange Transaction”) of 155,185 Series B-1 Preferred Units in exchange for the contribution of the Contributed Units, as more specifically described in that certain Contribution and Exchange Agreement between the Partnership and the Contributor, dated July 24, 2024;

WHEREAS, in connection with the Contribution and Exchange Transaction and pursuant to the authority granted to the General Partner pursuant to Section 4.02 and Section 11.01 of the Partnership Agreement, and as authorized by the unanimous written consent, dated as of July 23, 2024, of the Board of Directors of the General Partner, the General Partner desires to amend the Partnership Agreement to (i) set forth the designations, rights, powers, preferences and duties and other terms of a newly designated class of Series B-1 Preferred Units and (ii) issue the Series B-1 Preferred Units in the Contribution and Exchange Transaction.

A G R E E M E N T

NOW, THEREFORE, in consideration of good and valuable consideration, the receipt and sufficiency of which hereby are acknowledged, the General Partner hereby amends the Partnership Agreement as follows:

1.The Partnership Agreement is hereby amended by the addition of a new exhibit thereto, entitled “EXHIBIT G,” in the form attached hereto as EXHIBIT G, which sets forth the designations, allocations, preferences, conversion or other special rights, powers and duties of the Series B-1 Preferred Units, which exhibit shall be attached to and made a part of, and shall be an exhibit to, the Partnership Agreement.

2.The foregoing recitals are incorporated in and are made a part of this Amendment.

3.This Amendment has been authorized by the General Partner pursuant to Section 4.02, Section 5.01(i), and Section 11.01 of the Partnership Agreement and does not require execution by any Limited Partner or any other Person.

4.Except as modified herein, all terms and conditions of the Partnership Agreement shall remain in full force and effect, which terms and conditions the General Partner hereby ratifies and confirms.

5.This Amendment shall be construed in accordance with and governed by the laws of the State of Delaware.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the undersigned has executed this Amendment as of the date first set forth above.

|

|

|

|

GENERAL PARTNER: |

|

|

|

|

GENERATION INCOME PROPERTIES, INC. |

|

|

|

|

|

|

By: |

/s/ David Sobelman |

|

|

Name: David Sobelman |

|

|

Title: Chief Executive Officer |

[Signature Page to Fifth Amendment to Amended and Restated Limited Partnership Agreement]

EXHIBIT G

DESIGNATION OF THE SERIES B-1 PREFERRED UNITS

OF

GENERATION INCOME PROPERTIES, L.P.

1.Designation and Number. A series of Preferred Units (as defined below) of Generation Income Properties, L.P., a Delaware limited partnership (the “Partnership”), designated the Series B-1 Redeemable Preferred Units” (the “Series B-1 Preferred Units”), is hereby established. The number of authorized Series B-1 Preferred Units shall be 155,185.

2.Defined Terms. Capitalized terms used herein and not otherwise defined shall have the meanings given to such terms in the Amended and Restated Limited Partnership Agreement of Generation Income Properties, L.P. (as now or hereafter amended, restated, modified, supplemented or replaced, the “Partnership Agreement”). The following defined terms used herein shall have the meanings specified below:

“Business Day” shall mean any day other than a Saturday, Sunday or a day on which state or federally chartered banking institutions in New York, New York are not required to be open.

“Distribution Event” shall mean the Partnership’s failure to declare and pay distributions pursuant to Section 5(a) for a period of three consecutive months.

“Distribution Record Date” shall have the meaning provided in Section 5(a).

“Exchange” shall mean the Nasdaq Stock Market or such other national securities exchange or automated quotation system on which the REIT Shares are then listed or admitted to trading.

“Junior Preferred Units” shall have the meaning provided in Section 4.

“Nasdaq” shall mean the Nasdaq Stock Market or any successor that is a national securities exchange registered under Section 6 of the Exchange Act.

“Parity Preferred Units” shall have the meaning provided in Section 4.

“Partnership” shall have the meaning provided in Section 1.

“Partnership Agreement” shall have the meaning provided in Section 2.

“Preferred Units” means all Partnership Units designated as preferred units by the General Partner from time to time in accordance with Section 4.02 of the Partnership Agreement.

“Senior Preferred Units” shall have the meaning provided in Section 4.

“Series B-1 Preferred Return” shall have the meaning provided in Section 5(a).

“Series B-1 Preferred Unit Distribution Payment Date” shall have the meaning provided in Section 5(a).

“Series B-1 Preferred Units” shall have the meaning provided in Section 1.

“Specified Redemption Date” shall have the meaning provided in Section 6(c).

“Trading Day” shall mean (i) if the REIT Shares are listed or admitted to trading on Nasdaq, a day on which Nasdaq is open for the transaction of business, (ii) if the REIT Shares are not listed or admitted to trading on Nasdaq but are listed or admitted to trading on another national securities exchange or automated quotation system, a day on which such national securities exchange or automated quotation system, as the case may be, on which the REIT Shares

are listed or admitted to trading is open for the transaction of business, or (iii) if the REIT Shares are not listed or admitted to trading on any national securities exchange or automated quotation system, any day other than a Saturday, a Sunday or a day on which banking institutions in the State of New York are authorized or obligated by law or executive order to close.

3.Maturity. The Series B-1 Preferred Units have no stated maturity and will not be subject to any sinking fund or mandatory redemption.

4.Rank. In respect of rights to the distribution of assets in the event of any voluntary or involuntary liquidation, dissolution or winding up of the Partnership, the Series B-1 Preferred Units shall rank on parity with all classes or series of Common Units and LTIP Units. In addition, as to rights to the distribution of assets in the event of any voluntary or involuntary liquidation, dissolution or winding up of the Partnership, any class or series of Partnership Units which by its terms specifies that it shall rank junior to, on parity with, or senior to the Common Units shall also rank junior to, on parity with, or senior to, as the case may be, the Series B-1 Preferred Units. The term “Preferred Units” does not include convertible or exchangeable debt securities of the Partnership, including convertible or exchangeable debt securities which will rank senior to the Series B-1 Preferred Units prior to the conversion or exchange. The Series B-1 Preferred Units will also rank junior in right or payment to the Partnership’s existing and future indebtedness. All of the Series B-1 Preferred Units shall rank equally with one another and shall be identical in all respects.

(a)Subject to the preferential rights of holders of any class or series of Senior Preferred Units of the Partnership, the holders of Series B-1 Preferred Units will be entitled to receive cash distributions at the rate of $0.117 per unit per quarter (as equitably adjusted in the General Partner’s sole discretion for any split, reverse split, dividend or similar recapitalization event), subject and pursuant to the terms and conditions in Section 5.02 of the Partnership Agreement, applied and interpreted as if such Series B-1 Preferred Units were Common Units, mutatis mutandis and as modified herein (the “Series B-1 Preferred Return”). For the avoidance of doubt, the holders of Series B-1 Units will be entitled to receive the Series B-1 Preferred Return, when, as and if authorized by the General Partner in its sole and absolute discretion and declared by the Partnership, out of assets of the Partnership legally available for payment of distributions. Unless expressly stated otherwise herein, the distribution procedures and limitations of the Partnership Agreement shall govern any cash distributions on the Series B-1 Preferred Units pursuant to this Section 5(a), applied and interpreted as if such Series B-1 Preferred Units were Common Units. All calculations under this Section 5 shall be made by rounding to the nearest cent.

(b)No distributions on the Series B-1 Preferred Units shall be authorized by the General Partner or paid or declared and set apart for payment by the Partnership at such time as the terms and conditions of any agreement of the General Partner or the Partnership, including any agreement relating to the indebtedness of any of them, prohibits such authorization, payment or setting apart for payment or provides that such authorization, payment or setting apart for payment would constitute a breach thereof, or a default thereunder, or if such authorization, payment or setting apart for payment shall be restricted or prohibited by law.

6.Holder Redemption Right.

(a) Beginning on the second (2nd) anniversary of the issuance of the Series B-1 Preferred Units, the holders of Series B-1 Preferred Units will have the option to require the Partnership to redeem, subject and pursuant to the redemption procedures of the Partnership Agreement, applied and interpreted as if such Series B-1 Preferred Units were Common Units subject to redemption, mutatis mutandis and as modified herein, all or a portion of its Series B-1 Preferred Units for a Cash Amount (within the meaning of the Partnership Agreement) equal to $7.15 per Series B-1 Preferred Unit (as equitably adjusted in the General Partner’s discretion for any split, reverse split, dividend

or similar recapitalization event ) plus an amount equal to all dividends accrued and unpaid thereon, to, but not including, the date fixed for redemption, without interest, in which event such amount as may be adjusted shall be deemed to be the “Cash Amount” for purposes of the Partnership Agreement. Unless expressly stated otherwise herein, the redemption procedures and limitations of the Partnership Agreement shall govern any redemption of Series B-1 Preferred Units pursuant to this Section 6(b), applied and interpreted as if such Series B-1 Preferred Units were Common Units. All calculations under this Section 6 shall be made by rounding to the nearest cent.

(b) Beginning on the second (2nd) anniversary of the issuance of the Series B-1 Preferred Units, the holders of Series B-1 Preferred Units will have the option to require the Partnership to redeem, subject and pursuant to the redemption procedures of the Partnership Agreement, applied and interpreted as if such Series B-1 Preferred Units were Common Units subject to redemption, mutatis mutandis and as modified herein, all or a portion of its Series B-1 Preferred Units in exchange for that number of REIT Shares (within the meaning of the Partnership Agreement) equal to the number of Series B-1 Preferred Units being redeemed multiplied by 1.0 (as equitably adjusted in the General Partner’s discretion for any split, reverse split, dividend or similar recapitalization event) (such number of REIT Shares shall be the “REIT Shares Amount” for purposes of the Partnership Agreement) plus an amount equal to all dividends accrued and unpaid thereon, to, but not including, the date fixed for redemption, without interest. Unless expressly stated otherwise herein, the redemption procedures and limitations of the Partnership Agreement shall govern any redemption of Series B-1 Preferred Units pursuant to this Section 6, applied and interpreted as if such Series B-1 Preferred Units were Common Units. All calculations under this Section 6 shall be made by rounding to the nearest 1/100th of a share.

(c) Notwithstanding anything to the contrary in the Partnership Agreement, for purposes of this Section 6, “Specified Redemption Date” shall mean the first business day of the month that is at least 180 business days after the receipt by the General Partner of a Notice of Redemption.

7.Voting Rights. Holders of the Series B-1 Preferred Units will not have any voting rights.

8.Conversion. The Series B-1 Preferred Units are not convertible or exchangeable for any other property or securities, except as provided herein.

***

CONTRIBUTION AND EXCHANGE AGREEMENT

July 24, 2024

This Contribution and Exchange Agreement (this “Agreement”) is entered by and between Generation Income Properties, L.P., a Delaware limited partnership (“GIPLP”) and LMB Owenton I LLC, a Kentucky limited liability company (“Contributor”)(collectively, GIPLP and the Contributor are referred to herein as the “Parties”), as of the date first written above (the “Effective Date”). Capitalized terms used but not defined herein have the meaning ascribed to them in that certain Amended and Restated Agreement of Limited Partnership of GIPLP, as amended (the “Partnership Agreement”).

R E C I T A L S

WHEREAS, the Contributor holds 155,185 Common Units of GIPLP (the “Contributed Units”) that were received in connection with Contributor’s contribution of certain Property to GIPLP pursuant to that certain Contribution and Subscription Agreement dated October 11, 2021, which was amended effective as of February 7, 2023 (as amended, the “Contribution Agreement”);

WHEREAS, the Parties desire that the Contributor contribute all of the Contributed Units to GIPLP as of the Effective Date in exchange for 155,185 Series B-1 Preferred Units of GIPLP (the “Preferred Units”) in a contribution and exchange transaction (the “Transaction”) intended to qualify as a tax-free transaction under Section 721 of the Internal Revenue Code of 1986, as amended (the “Code”);

A G R E E M E N T

NOW, THEREFORE, for and in consideration of the premises, the mutual covenants and agreements hereinafter set forth, and for other good and valuable consideration, the receipt, adequacy, and sufficiency of which are hereby acknowledged by the Parties hereto, the Parties hereto hereby covenant and agree as follows:

Article I

TRANSFER OF CONTRIBUTED UNITS

1.1Contribution and Exchange of Units. Effective as of the Effective Date, the Contributor hereby irrevocably contributes, conveys, grants, transfers and delivers to GIPLP, and GIPLP hereby irrevocably accepts and takes delivery from Contributor of the Contributed Units, free and clear of any liens. In exchange for and in full consideration of the contribution of the Contributed Units to GIPLP by Contributor, GIPLP irrevocably issues to Contributor the Preferred Units as of the Effective Date. The General Partner of GIPLP expressly consents to and approves of the transfer of Common Units contemplated herein.

Article II

REPRESENTATIONS

AND WARRANTIES OF CONTRIBUTOR

Contributor represents and warrants to GIPLP that the following statements are true and correct.

2.1Authority and Capacity. The Contributor has full legal capacity, power, and authority to execute and deliver this Agreement and to perform the Contributor’s obligations hereunder. This Agreement has been duly executed and delivered by the Contributor and is the legal, valid and binding obligation of the Contributor, enforceable against the Contributor in accordance with its terms (except as enforceability may be limited by principles of public policy, applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or other similar laws affecting the enforcement of creditors’ rights and remedies generally or general principles of equity (regardless of whether considered and applied in a proceeding at law or in equity)(collectively, the “Bankruptcy and Equity Exceptions”)).

2.2No Conflicts. The execution, delivery and performance of this Agreement by Contributor do not and will not (with or without notice or lapse of time or both) conflict with, breach, violate or cause a default under any contract, agreement, instrument, order, judgment or decree to which Contributor is a party or by which it is bound.

2.3Ownership. Contributor is the sole beneficial and record holder of, and has good and marketable title to, all of the Contributed Units, free and clear of all liens.

2.4Investment Intent. Contributor acknowledges that the Preferred Units have not been registered under the Securities Act of 1933, as amended (the “Securities Act”). Contributor is an “accredited investor” as defined in Regulation D promulgated under the Securities Act and possesses such knowledge and experience in financial and business matters that it is capable of evaluating the merits and risks of Contributor’s investments hereunder. Contributor is in a financial position to hold the Preferred Units for an indefinite period of time and is able to bear the economic risk and withstand a complete loss of Contributor’s investment therein. Contributor recognizes that Contributor’s investment involves a high degree of risk. Contributor is acquiring the Preferred Units for Contributor’s own account, for investment purposes only and not with a view to the distribution thereof in violation of applicable Law. Contributor agrees that the Preferred Units are subject to transfer restrictions pursuant to the Partnership Agreement. Contributor acknowledges that the Preferred Units will not be sold, transferred, offered for sale, pledged, hypothecated or otherwise disposed of without registration under the Securities Act, except in compliance with the Securities Act and applicable state securities laws. Contributor acknowledges that the offering and sale of the Preferred Units is intended to be exempt from registration under the Securities Act, by virtue of Section 4(a)(2) of the Securities Act and the provisions of Regulation D promulgated thereunder and the securities laws of the state of Contributor’s residence and understands that no securities commission or regulatory authority has approved, passed upon, or endorsed the merits of the offer and sale of the Preferred Units, nor is it intended that any such agency will do so because of the nature and limited number of persons solicited and the private aspects of the offering. Contributor is a resident and domiciliary (not a temporary or transient resident) of the jurisdiction listed after Contributor’s name on Contributor’s signature page hereto, has no present intention to become a resident of any other jurisdiction, and all

communications, written or oral, concerning the Preferred Units have been directed to Contributor in and received by Contributor in such jurisdiction.

2.5Independent Investigation. Contributor has had the opportunity to consult Contributor’s own independent legal, tax, accounting and other advisors with respect to Contributor’s rights, benefits, and obligations under this Agreement and the Partnership Agreement and the tax and other economic consequences to the Contributor of the acquisition, receipt or ownership of the Preferred Units, including the tax consequences under federal, state, local, and other income tax laws of the United States or any other country and the possible effects of changes in such tax laws. Contributor is not relying on GIPLP or any of its affiliates or any of their respective employees, agents, representatives, or advisors with respect to the legal, tax, economic and related considerations of an investment in the Preferred Units.

Article III

REPRESENTATIONS AND WARRANTIES OF GIPLP

3.1Organization, Good Standing, Authority. GIPLP is duly formed, validly existing and in good standing under the laws of the State of Delaware and has all requisite power and authority to carry on its business as presently conducted and as proposed to be conducted and to execute, deliver and perform this Agreement, and each other agreement, instrument, document or certificate to be executed and delivered by GIPLP, to perform its obligations herein and therein and to consummate the transactions contemplated herein and therein.

3.2Authorization. All action required to be taken in order to authorize GIPLP to enter into this Agreement and each other document, instrument or agreement to be executed and delivered by GIPLP in connection herewith, to perform its obligations herein or therein, and to issue the Preferred Units, has been taken. All action on the part of the officers of GIPLP necessary for the execution and delivery of this Agreement and each other document, instrument or agreement to be executed and delivered by GIPLP in connection herewith, the performance of all obligations of GIPLP under this Agreement and each other document, instrument or agreement to be executed and delivered by GIPLP in connection herewith, has been taken.

3.3Enforceability. This Agreement has been, and each other document, instrument or agreement to be executed and delivered by GIPLP in connection herewith will upon such delivery be, duly executed and delivered by GIPLP, and constitutes, or will upon such delivery constitute, the legal, valid and binding obligation of GIPLP, enforceable in accordance with its terms, except as such enforcement may be limited by the Bankruptcy and Equity Exceptions.

3.4Valid Issuance of Preferred Units. The Preferred Units, when issued and delivered in accordance with the terms and for the consideration set forth in this Agreement will be duly and validly issued and fully paid.

3.5No Conflicts. The execution, delivery and performance of this Agreement by GIPLP do not and will not (with or without notice or lapse of time or both), conflict with, breach, violate or cause a default under any contract, agreement, instrument, order, judgment or decree to

which Contributor is a party or by which it is bound or agreement to which GIPLP is a party or is bound.

Article IV

COVENANTS AND AGREEMENTS

4.1Further Assurances. From and after the date of this Agreement, GIPLP and Contributor shall execute any and all further documents, agreements and instruments and take all further actions that may be required under applicable law or that any party may reasonably request in order to effectuate the transactions contemplated by this Agreement.

4.2Joinder to Partnership Agreement. The Contributor expressly acknowledges that the Contributor is, and remains, bound to the Partnership Agreement, which shall apply to the Preferred Units received pursuant to the Transaction.

4.3Tax Treatment. The Parties acknowledge and agree, for U.S. federal income tax purposes (and for purposes of any applicable state or local income tax law), to treat the Transaction as a contribution/exchange transaction qualifying for nonrecognition of gain under Section 721(a) of the Code (the “Agreed Tax Treatment”). The Parties shall not take any position on any Tax Return or in any administrative or judicial proceedings inconsistent with the Agreed Tax Treatment, unless otherwise required by a “determination” within the meaning of Section 1313(a) of the Code. To the extent Transaction is deemed to be a taxable event by any administrative or judicial proceedings, GIPLP shall indemnify the Contributor for any taxable liability and for reasonable attorneys’ and accountants’ fees incurred in relation to such proceedings.

5.1Entire Agreement. This Agreement contains the complete agreement between the Parties hereto and supersede any prior understandings or agreements by or between the Parties hereto, written or oral, which may have related to the subject matter hereof in any way.

5.2Amendment and Waiver. Except as provided herein, any provision of this Agreement may be amended or waived only in a writing signed by Contributor and GIPLP.

5.3Counterparts. This Agreement may be executed in two or more counterparts all of which shall constitute one and the same instrument. Any such counterpart, to the extent delivered by .pdf, .tif, .gif, .jpeg or similar attachment to electronic mail shall be treated in all manner and respects as an original executed counterpart and shall be considered to have the same binding legal effect as if it were the original signed version thereof delivered in person.

5.4Applicable Law. This Agreement shall be governed by the laws of the State of Delaware, without regard to the conflicts of law provisions hereof.

5.5Assignment. This Agreement and the provisions hereof shall be binding upon and inure to the benefit of the Parties hereto and their respective successors and permitted assigns, except that neither this Agreement nor any of the rights, interests or obligations hereunder may be

assigned by either Contributor (except in connection with a permitted transfer of the Preferred Units pursuant to the Partnership Agreement) or GIPLP without the prior written consent of the other.

[Remainder of Page Intentionally Blank – Signature Page Follows]

IN WITNESS WHEREOF, Contributor and GIPLP have executed this Agreement effective as of the date set forth above.

CONTRIBUTOR:

LMB OWENTON I LLC, a Kentucky limited liability company

By: /s/ Lloyd Bernstein

Name: Lloyd Bernstein

Title:

Contributor Address:

369 Montezuma Ave. 661, Santa Fe, NM __________________________________________

__________________________________________

GIPLP:

GENERATION INCOME PROPERTIES, L.P.,

a Delaware limited partnership

By:/s/ David Sobelman

David Sobelman

Authorized Representative

FIRST AMENDMENT TO

Second AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT OF

LIMITED LIABILITY COMPANY AGREEMENT OF

GIPVA 2510 Walmer ave, LLC

Dated as of July 25, 2024

This FIRST AMENDEMENT TO THE SECOND AMENDED AND RESTATED LIMITED LIABILITY COMPANY AGREEMENT (the “First Amendment”) of GIPVA 2510 WALMER AVE, LLC (the “Company”), a Delaware limited liability company, is entered into as of the date first set forth above, by Generation Income Properties, L.P., a Delaware limited partnership, as managing member (“GIPLP”, “Common Member”, or “Manager”), and Brown Family Enterprises, LLC, a Florida limited liability company (“Brown Family”, or “Preferred Member”). GIPLP and Brown Family are each a Member.

RECITALS:

WHEREAS, the Company and the Members entered into that certain Second Amended and Restated Limited Liability Company Agreement, dated effective as of February 8, 2023, (the “Prior Agreement”);

WHEREAS, Section 9.03 of the Prior Agreement provides that the Prior Agreement may be amended with the consent and approval of all Members and the consent and approval of the Manager;

WHEREAS, the Members and the Manger desire to amend the Prior Agreement as provided herein;

NOW, THEREFORE, in consideration of the mutual promises of the parties hereto and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties, intending to be legally bound, hereby agree as follows:

AGREEMENT:

1.Amendment. Exhibit A of the Prior Agreement shall be amended as follows:

(a)The definition of the defined term “Redemption Date” is hereby deleted in its entity and the following is substituted in lieu thereof:

“Redemption Date” means February 8, 2027.

2.Miscellaneous Provisions.

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4890-4924-8467.1

(a) This First Amendment, along with the Prior Agreement, constitute the entire agreement of the parties with respect to the subject matter hereof, and this First Amendment shall not be modified or amended in any respect except by a written instrument executed by all the parties. Should any provision of this First Amendment conflict with the provisions of the Prior Agreement, the provisions of this First Amendment shall control.

(b) This First Amendment shall be construed and enforced in accordance with the internal laws of the State of Delaware. If any provision of this Amendment is determined by any court of competent jurisdiction or arbitrator to be invalid, illegal or unenforceable to any extent, that provision shall, if possible, be construed as though more narrowly drawn, if a narrower construction would avoid such invalidity, illegality or unenforceability or, if that is not possible, such provision shall, to the extent of such invalidity, illegality or unenforceability, be severed, and the remaining provisions of this First Amendment shall remain in effect.

(c) This Amendment shall be binding on and inure to the benefit of the parties and their heirs, personal representatives, successors and permitted assigns.

(d) The Members and the Manager represent and warrant that the Members and the Manager have the capacity and authority to enter into this First Amendment.

(e) This First Amendment may be executed in one or more counterparts, each of which shall be deemed and original, and such counterparts together shall constitute one instrument.

[Signature Page Follows]

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4890-4924-8467.1

[Signature Page to the First Amendment to the Second Amended & Restated Limited Liability Company Agreement of GIPVA 2510 WALMER AVE, LLC]

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4890-4924-8467.1

IN WITNESS WHEREOF, the undersigned hereto have caused this First Amendment to the Second Amended and Restated Limited Liability Company Agreement to be executed as of the date first set forth above.

MANAGER:

Generation Income Properties, L.P.

/s/ David Sobelman

By: David Sobelman

Authorized Representative

MEMBER:

Brown Family Enterprises, LLC, a Florida limited liability company

/s/ Christian Brown

By: Christian Brown, Manager

MEMBER:

/s/ David Sobelman

By: David Sobelman

Authorized Representative

[Signature Page to the First Amendment to the Second Amended & Restated Limited Liability Company Agreement of GIPVA 2510 WALMER AVE, LLC]

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4890-4924-8467.1

FIRST AMENDMENT TO

Second AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT OF

LIMITED LIABILITY COMPANY AGREEMENT OF

GIPVA 130 CORPORATE BLVD, LLC

Dated as of July 25, 2024

This FIRST AMENDEMENT TO THE SECOND AMENDED AND RESTATED LIMITED LIABILITY COMPANY AGREEMENT (the “First Amendment”) of GIPVA 130 CORPORATE BLVD, LLC (the “Company”), a Delaware limited liability company, is entered into as of the date first set forth above, by Generation Income Properties, L.P., a Delaware limited partnership, as managing member (“GIPLP”, “Common Member”, or “Manager”), and Brown Family Enterprises, LLC, a Florida limited liability company (“Brown Family”, or “Preferred Member”). GIPLP and Brown Family are each a Member.

RECITALS:

WHEREAS, the Company and the Members entered into that certain Second Amended and Restated Limited Liability Company Agreement, dated effective as of February 8, 2023, (the “Prior Agreement”);

WHEREAS, Section 9.03 of the Prior Agreement provides that the Prior Agreement may be amended with the consent and approval of all Members and the consent and approval of the Manager;

WHEREAS, the Members and the Manger desire to amend the Prior Agreement as provided herein;

NOW, THEREFORE, in consideration of the mutual promises of the parties hereto and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties, intending to be legally bound, hereby agree as follows:

AGREEMENT:

1.Amendment. Exhibit A of the Prior Agreement shall be amended as follows:

(a)The definition of the defined term “Redemption Date” is hereby deleted in its entity and the following is substituted in lieu thereof:

“Redemption Date” means February 8, 2027.

2.Miscellaneous Provisions.

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4869-1369-2627.1

(a) This First Amendment, along with the Prior Agreement, constitute the entire agreement of the parties with respect to the subject matter hereof, and this First Amendment shall not be modified or amended in any respect except by a written instrument executed by all the parties. Should any provision of this First Amendment conflict with the provisions of the Prior Agreement, the provisions of this First Amendment shall control.

(b) This First Amendment shall be construed and enforced in accordance with the internal laws of the State of Delaware. If any provision of this Amendment is determined by any court of competent jurisdiction or arbitrator to be invalid, illegal or unenforceable to any extent, that provision shall, if possible, be construed as though more narrowly drawn, if a narrower construction would avoid such invalidity, illegality or unenforceability or, if that is not possible, such provision shall, to the extent of such invalidity, illegality or unenforceability, be severed, and the remaining provisions of this First Amendment shall remain in effect.

(c) This Amendment shall be binding on and inure to the benefit of the parties and their heirs, personal representatives, successors and permitted assigns.

(d) The Members and the Manager represent and warrant that the Members and the Manager have the capacity and authority to enter into this First Amendment.

(e) This First Amendment may be executed in one or more counterparts, each of which shall be deemed and original, and such counterparts together shall constitute one instrument.

[Signature Page Follows]

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4869-1369-2627.1

[Signature Page to the First Amendment to the Second Amended & Restated Limited Liability Company Agreement of GIPVA 130 CORPORATE BLVD, LLC]

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4869-1369-2627.1

IN WITNESS WHEREOF, the undersigned hereto have caused this First Amendment to the Second Amended and Restated Limited Liability Company Agreement to be executed as of the date first set forth above.

MANAGER:

Generation Income Properties, L.P.

/s/ David Sobelman

By: David Sobelman

Authorized Representative

MEMBER:

Brown Family Enterprises, LLC, a Florida limited liability company

/s/ Christian Brown

By: Christian Brown, Manager

MEMBER:

/s/ David Sobelman

By: David Sobelman

Authorized Representative

[Signature Page to the First Amendment to the Second Amended & Restated Limited Liability Company Agreement of GIPVA 130 CORPORATE BLVD, LLC]

DOCPROPERTY DOCXDOCID DMS=NetDocuments Format=<<ID>>.<<VER>> * MERGEFORMAT 4869-1369-2627.1

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

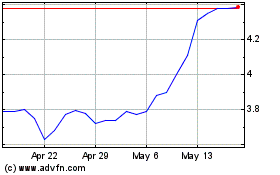

Generation Income Proper... (NASDAQ:GIPR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Generation Income Proper... (NASDAQ:GIPR)

Historical Stock Chart

From Nov 2023 to Nov 2024